Realty Income: Bullish On This Income Play

Summary

- Realty Income's financial results for Q2 2023 showed improvement year over year, with increased guidance for asset purchases.

- Revenue increased by 25.8% compared to the previous year, driven by rental revenue and acquisitions.

- The company plans to allocate $6 billion towards asset purchases this year, and continues to issue debt and equity to fund growth.

- Prices aren't cheap, but they are appealing enough to warrant cash flows when you consider the quality of the business.

- Looking for a helping hand in the market? Members of Crude Value Insights get exclusive ideas and guidance to navigate any climate. Learn More »

Dragon Claws

Earlier this month, the management team at Realty Income (NYSE:O), a REIT the focus is largely on the ownership and leasing out of single client properties for a wide variety of businesses, announced financial results covering the second quarter of the company's 2023 fiscal year. More important than the actual results relative to expectations is the fact that most of the metrics that matter really showed improvement year over year. On top of that, management increased their guidance for the 2023 fiscal year from an asset purchase perspective. That should only fuel the business to grow further and faster. Of course, this does not change the fact that the stock does trade at a premium to some of its peers. But as I stated previously in an article that I wrote about the company earlier this year, the growth that management is capturing justifies that premium.

Some really bullish changes taking place

Back when I wrote my last bullish article on Realty Income stock in May of this year, I called the company ‘strong’ because of its business model, valuation, and continued growth. Even though I tend to shy away from stocks that trade at what I believe to be a premium, I could not help myself but to rate the business a ‘buy’ because of these factors. Unfortunately, the market has not exactly agreed with me since then. Shares have generated upside for investors following the publication of that article of only about 1%. That compares to the 7.4% seen by the S&P 500.

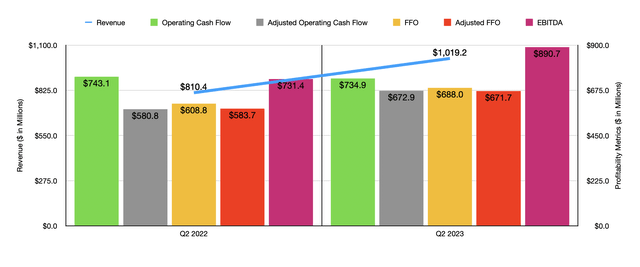

Looking at this return disparity, you might think that there was some problem with Realty Income from a fundamental perspective. But that is simply not the case. Consider, for instance, how the company reported for the second quarter of its 2023 fiscal year. These results were just announced on August 2nd and, frankly, they look rather bullish to me. Revenue for that time totaled $1.02 billion. That represents an increase of 25.8% over the $810.4 million the company reported one year earlier.

We can really break this up into three separate categories of sales. One of these involves rental revenue that is reimbursable to the company. In this kind of arrangement, the company is entitled to reimbursements from its clients for recoverable real estate taxes and operating expenses. During the quarter, revenue associated with this came in at $87.7 million. That's up from the roughly $41 million reported one year earlier. The second source of revenue is the ‘other’ category, which increased from $9.7 million to $23.9 million. This relates largely to interest income on financing receivables for certain leases that have above market terms to them. And the increase was driven largely by a greater number of leases that fell under this category thanks to recent acquisitions that management completed.

The heavy lifter for the firm, however, would be the rental revenue that does not include reimbursable terms. Sales here spiked from $759.8 million to $907.6 million. You really can break this up into multiple subcategories. But the largest chunk of the sales increase came from properties acquired either in 2022 or so far in 2023. Revenue spiked from $28.2 million to $186.7 million during this time. And that is thanks to the acquisition of 2,203 different properties. If this sounds like a lot, consider that during the first half of 2023 as a whole, Realty Income allocated $4.8 billion toward buying 997 properties, including those that are under development or undergoing expansions. $3.1 billion worth of these purchases occurred in the second quarter alone, with the company picking up 710 properties as a result. Meanwhile, same store rental revenue grew from $704.9 million to $718.8 million. And that, according to management, was driven largely by price escalators on the firm’s leases.

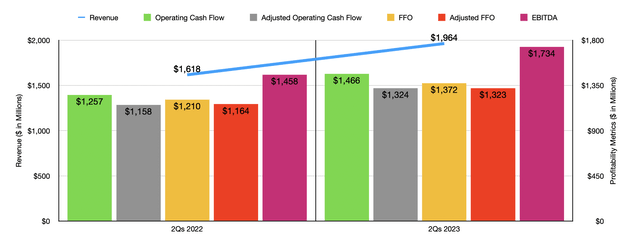

The increase in sales for Realty Income resulted in most of the company's profitability metrics improving. It is true that operating cash flow dropped from $743.1 million to $734.9 million. But if you adjust for changes in working capital, you would see this increase from $580.8 million to $672.9 million. There are, of course, other important profitability metrics to take into consideration. FFO, or funds from operations, would be one. This metric grew from $608.8 million to $688 million. On an adjusted basis, it expanded from $583.7 million to $671.7 million. And finally, EBITDA for the company grew from $731.4 million to $890.7 million. The second quarter was not a one-time event. In fact, if you look at the chart above, you can see a similar trend for the first half of 2023 relative to the same time of 2022.

The historical data provided by management is great. However, management seems set on continuing to grow the business further. When the company announced financial results covering the first quarter of this year, it was stated that the enterprise would allocate around $5 billion toward asset purchases this year. That number has now been increased to $6 billion. This is remarkable considering that the company has 13,118 properties in its portfolio already. Unfortunately, growth does require capital. So management has been hitting at whatever opportunity that it can. Three different times this year, management issued debt to the market. This included $1.1 billion in January and $1 billion in April. It also included €1.10 billion in July. The euro denominated debt had a weighted average interest rate of 5%. The rest of the debt, meanwhile, had a weighted average interest rate of 4.88%. Considering the interest rate environment that we are in right now, that's quite impressive.

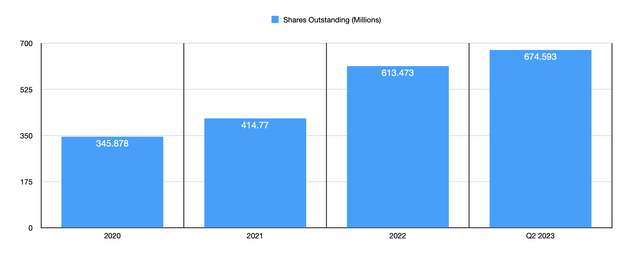

Another way that the company is funding its growth is by means of issuing additional equity. From 2021 to 2022, for instance, the business increased its share count by 47.9%. From the end of last year until the end of the second quarter, this number grew by another 10%. In the second quarter alone, management raised $2.2 billion by issuing stock, with those issuances coming out to 4.9 million shares in all. For the first six months as a whole, this number was just under $3 billion. And this month, the company also launched a program to sell up to 120 million shares to market participants. That would dilute shareholders significantly. But as long as the company can continue to grow nicely, that may not be much of an issue.

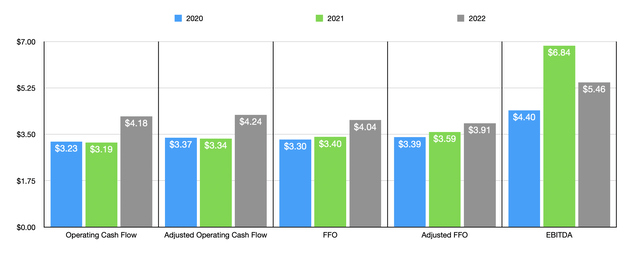

Of course, it is one thing if the business experiences a decrease in cash flows per share as a result of issuing too many units relative to the growth that it achieves with its purchases. But as you can see in the chart below, the cash flows per share for the business have largely increased from one year to the next from 2020 through 2023. This is definitely encouraging to see, but investors would be wise to continue to monitor it in case the trend shifts.

In terms of what the future holds, management is forecasting normalized FFO per share of between $4.05 and $4.15 for the 2023 fiscal year. That should be around $2.72 billion. Adjusted FFO per share should be between $3.94 and $4.03. That should be roughly $2.64 billion. It is worth noting that my numbers are probably too low. I say this because I'm using the firms share count as of the end of the second quarter. And if the company does continue to issue stock, especially doing so without decreasing guidance, we could see cash flows grow even more. Unfortunately, estimates have not been provided when it comes to other profitability metrics. But if we assume they will grow at the same rate as adjusted FFO, we would get operating cash flow of $2.82 billion, adjusted operating cash flow of $2.86 billion, and EBITDA of $3.69 billion.

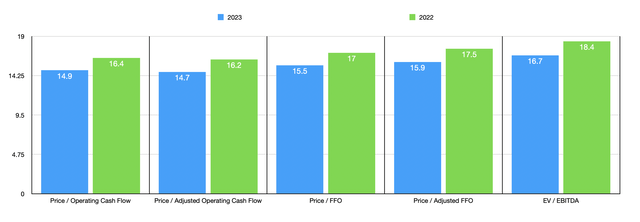

Using these figures, you can see how the stock is priced on both a forward basis and using data from 2022. These are both visible in the chart above. In the table below, meanwhile, you can see how shares are priced relative to similar firms. Using the more conservative 2022 figures, I found that four of the five companies are cheaper than Realty Income on a price to operating cash flow basis. Using the EV to EBITDA approach would result in our prospect being the most expensive of the group. Even if we use the more aggressive forward estimates, the ranking for the company drops down by only one for each of the valuation categories.

| Company | Price / Operating Cash Flow | EV / EBITDA |

| Realty Income (for 2022) | 16.2 | 18.4 |

| Realty Income (for 2023) | 14.7 | 16.7 |

| Simon Property Group (SPG) | 10.2 | 13.7 |

| Kimco Realty (KIM) | 12.2 | 16.1 |

| Regency Centers (REG) | 17.2 | 17.8 |

| Federal Realty Investment Trust (FRT) | 15.4 | 15.2 |

| NNN REIT (NNN) | 12.1 | 15.2 |

Takeaway

There is no doubt in my mind that Realty Income should still be classified as trading at a premium compared to other firms in the space. But on the whole, we have a quality operator that continues to grow nicely. The increase in guidance for acquisitions this year is most certainly encouraging, and I suspect that this overall trend will continue. I don't think that shares are likely to make you rich. But I do think that, for somebody who wants attractive upside with fairly limited risk, this is definitely a prospect to consider. This is especially true when you consider the 5.2% yield the business boasts.

Crude Value Insights offers you an investing service and community focused on oil and natural gas. We focus on cash flow and the companies that generate it, leading to value and growth prospects with real potential.

Subscribers get to use a 50+ stock model account, in-depth cash flow analyses of E&P firms, and live chat discussion of the sector.

Sign up today for your two-week free trial and get a new lease on oil & gas!

This article was written by

Daniel is an avid and active professional investor. He runs Crude Value Insights, a value-oriented newsletter aimed at analyzing the cash flows and assessing the value of companies in the oil and gas space. His primary focus is on finding businesses that are trading at a significant discount to their intrinsic value by employing a combination of Benjamin Graham's investment philosophy and a contrarian approach to the market and the securities therein.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Recommended For You

Comments (3)