Plug Power: Execution And Margin Issues Continue To Escalate

Summary

- Last week, Plug Power reported another set of abysmal quarterly results with escalating execution and margin issues while the remaining liquidity is depleting quickly.

- The company's much-touted electrolyzer segment suffered a major setback with sales declining by over 80% and backlog decreasing by more than 20% on a sequential basis.

- Performance of the core material handling operations continues to deteriorate with renewed GenDrive reliability issues and a very weak Fueling segment performance pressuring consolidated gross margin.

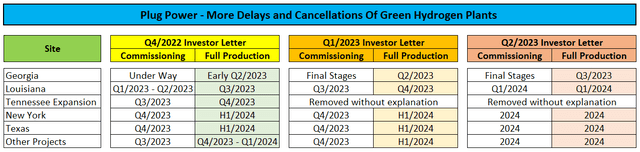

- Construction of additional hydrogen plants is delayed by at least six months. Despite a number of delays, the Georgia plant has not yet commenced liquid green hydrogen production.

- Given ongoing execution issues, overly aggressive financial projections, and deteriorating liquidity, investors should remain on the sidelines until management lines up new financing and finally starts delivering upon its ambitious targets.

audioundwerbung

Note:

I have covered Plug Power Inc. (NASDAQ:PLUG) previously, so investors should view this as an update to my earlier articles on the company.

After the close of Wednesday's regular session, Plug Power reported another set of abysmal quarterly results. While revenues came in ahead of consensus expectations, execution and margin issues continued to escalate with remaining liquidity deteriorating quickly.

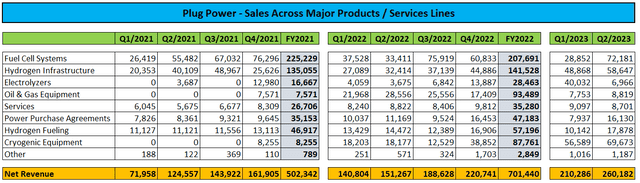

Following a host of acquisitions over in recent years, Plug Power's financial reporting has become more nontransparent than ever before with the company now lumping together sales of fuel cell systems, hydrogen infrastructure, electrolyzers, engineered oil and gas equipment as well as cryogenic equipment now lumped together under product sales without the company providing sufficient color on the individual performance of these offerings.

Electrolyzers - Weak Quarter And Misleading Statements

Plug Power's much-touted electrolyzer business saw sales declining by more than 80% on a sequential basis to just 7.0 million. The company's quarterly report on form 10-Q states the cost of revenue for the electrolyzer business at $9.0 million for the quarter thus resulting in a negative segment gross margin of almost 30%, very much in contrast to statements made by CFO Paul Middleton on the conference call:

Electrolyzers is the early phase of what we're doing there. As I mentioned, we're going to do 4 times the sales in the second half. But it's already in the 20s and we'll quickly grow up to that 30% plus.

In addition, even with electrolyzer sales expected to quadruple in the second half, full-year segment sales would come in more than 40% below previous guidance as provided by management on the Q4/2022 conference call:

By the end of 2023 we aim to generate $1.4 billion in revenue, commission more than 200 tonnes of liquid green hydrogen plant and become the largest global player, exceed $400 million in electrolyzer sales, deploy 30 megawatts of stationary power products, which will serve as a substantial source of recurring revenue for Plug and finally clearly demonstrate the path to profitability for all our investors.

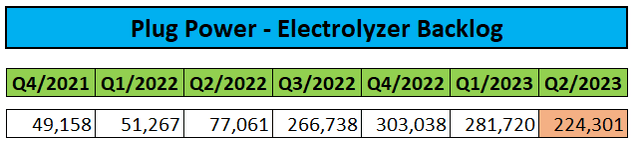

In addition, Plug Power's quarterly investor letter contains misleading statements regarding the company's electrolyzer backlog (emphasis added by author):

In tandem, our existing backlog exceeds 2 GW, encompassing both largescale projects and agile 1-5 MW containerized solutions. This fortified position is a testament to our strategic growth trajectory and underscores our commitment to pioneering solutions in the electrolyzer landscape.

Please note that during the first half of this year, the company has sold 66 MW of electrolyzers for aggregate proceeds of $47 million thus calculating to an average sales price per MW of $712,000.

Even when cautiously assuming the average selling price per MW of contracts in backlog being approximately 30% lower, the company's stated 2+GW electrolyzer order book would translate to at least $1 billion in revenue backlog.

However, a closer look at the company's quarterly report on form 10-Q is showing electrolyzer backlog of just $224.3 million:

Apparently, management's stated 2+GW number includes projects that are still subject to final investment decision like the 1GW Esbjerg green hydrogen plant.

Adding insult to injury, the number was down by more than 20% sequentially which might be due to the reported loss of a large-scale project in Egypt, order cancellations by other customers or even substantial price concessions for existing orders.

Material Handling - Unmitigated Disaster

Despite strong customer site additions resulting in meaningful revenue growth for the quarter, the business remains an unmitigated disaster, particularly when considering the fact that first quarter results were negatively impacted by substantial warrant charges. In contrast, overall warrant impact in Q2 was immaterial.

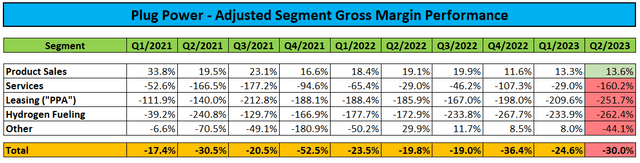

As a result, the company's adjusted gross margin was down quite meaningfully on a quarter-over-quarter and year-over-year basis:

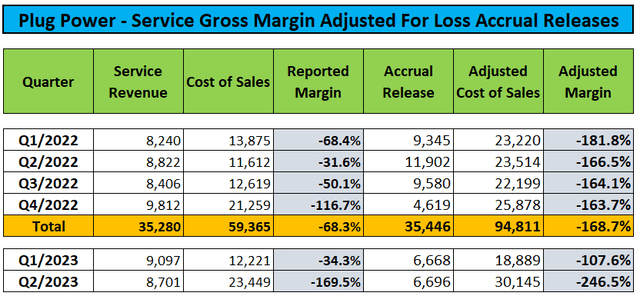

Further adjusting for releases from a previously established loss accrual for unprofitable service contracts, consolidated gross margin would have been negative 32.5%.

In fact, the company's service business recorded one of its worst performances in recent years. Adjusted for releases from the above-discussed loss accrual, Q2 service gross margins were negative an eye-catching 246.5%.

After being poked on the issue by an analyst on the conference call, management hesitantly admitted to ongoing reliability issues within the company's fleet of GenDrive units deployed at customer sites.

Please note also that due to unfavorable fixed-price service contracts with key customers, Plug Power is required to add to the loss accrual with each additional site deployed with these customers while releasing the accrual over the life time of the respective contracts with a resulting benefit to reported service gross margins.

However, management claimed approximately $45 million in "costs primarily associated with multiple scale up related activities". Deducting this amount from cost of sales would result in consolidated adjusted gross margin improving to negative 12.7% but after more than a decade of overpromise and overdeliver, I am hesitant to give management the benefit of the doubt, particularly after CFO Paul Middleton projected negative consolidated gross margin "in the low teens" for the current quarter.

Assuming no meaningful "costs primarily associated with multiple scale up related activities" in the current quarter, Q3 gross margins would be largely unchanged based on the adjusted number claimed by management for Q2.

With the above-discussed reliability issues also impacting the company's leased fleet, adjusted segment gross margin for the so-called "Power Purchase Agreement" segment deteriorated to new all-time lows.

In contrast to management's expectations, performance of the hydrogen fueling segment deteriorated on a quarter-over-quarter basis and despite much lower natural gas prices came in just shy of the all-time low recorded in Q4/2022.

Besides persistently high third-party hydrogen supply costs, the 10-Q also states "inefficiencies in fueling systems" as a key contributor to the segment's disappointing quarterly performance.

With commencement of liquid hydrogen production further delayed at the company's much-touted green hydrogen plant in Georgia, Q3 fueling margins are likely to remain under pressure.

Hydrogen Plants - More Delays

In fact, Plug Power perplexed market participants by delaying all of their remaining hydrogen projects by at least six months but given ongoing lack of execution, I would expect management to move the goalposts even further next year.

While the company reaffirmed previous projections for hydrogen generation capacity to reach 500 tons per day by the end of 2025, ongoing delays are likely to result in this target being missed by a wide margin again.

Undoubtedly, the delays will have an impact on the company's fueling margin trajectory as third party hydrogen supply will be required considerably longer than previously anticipated.

Given the abysmal operating performance and ongoing hydrogen plant delays, it is hardly a surprise that management abstained from reiterating previous expectations for full-year consolidated gross margin of up to 10%.

That said, the company affirmed full-year revenue guidance of between $1.2 billion and $1.4 billion.

Liquidity Depleting Quickly - New Capital Required Soon

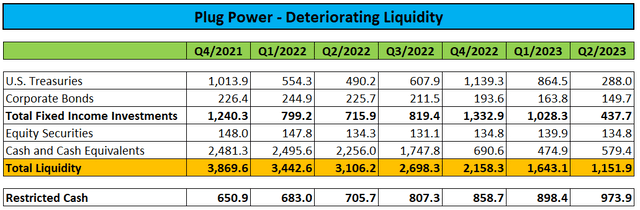

Negative free cash flow of $506.8 million for the quarter represented a new all-time high.

As a result, remaining liquidity deteriorated to $1.15 billion:

At the current pace of cash usage and to avoid going concern language in the annual report on form 10-K, Plug Power will have to raise a material amount of capital in the second half of this year.

As stated in the investor letter, the company still has a number of levers to pull:

Plug is evaluating multiple sources of capital, as it continues to build out a global green hydrogen generation network. Currently, Plug is completing the second stage of due diligence with the DOE Loan Program Office. Concurrently, we are evaluating a range of corporate debt facilities from major banks and alternative infrastructure project funding, and ITC project financing solutions. Plug continues to receive interest from corporates and infrastructure funds to partner in our next generation of hydrogen plant development. Financing decisions around these opportunities will likely be made in the second half of this year

On the conference call, CFO Paul Middleton pointed to a potential $1 billion loan guarantee approval by the Department of Energy ("DoE") by "mid-November to early December".

Quite frankly, with the DoE apparently still in the process of conducting due diligence and considering the company's abysmal track record, I wouldn't bet the farm on an approval, particularly not until year-end.

According to statements made on the conference call, management expects to raise up to $1.5 billion in debt capital over the next 18 months.

But considering Plug Power's rate of cash usage and the dismal state of the company's operations as well as the lack of sufficient collateral, securing debt financing at acceptable terms will likely prove difficult.

To be perfectly honest, I do not expect the company to raise sufficient near-term funds without reverting to offering equity-linked securities or even outright selling new shares.

Quite frankly, I wouldn't be surprised to see Plug Power coming to market with a large convertible notes offering or entering into a massive at-the-market equity distribution facility with leading investment banks in the not-too-distant future.

The company has made use of both financing options in the past. Given the ongoing volatility in the shares, a convertible notes offering would likely attract meaningful interest from institutional investors employing convertible arbitrage strategies.

In fact, convertible debt looks like the best available option to the company at this point for a number of reasons.

- Securities could be marketed within rather short notice

- No need to provide collateral

- Low coupon

Assuming sufficient investor interest, capital raised from a potential convertible notes offering could easily exceed $1 billion.

However, at the current rate of cash burn, even $1 billion would only be sufficient to cover two quarters of cash outflows but according to CFO Paul Middleton, the company expects to generate cash from substantially lower working capital requirements in the second half of the year.

In addition, projected margin improvement should also reduce cash burn going forward.

On the flip side, the company is still facing massive capital expenditures for the construction of its hydrogen plants.

Bottom Line

Things are only getting worse at Plug Power with new product reliability issues in the core material handling operations, an ugly setback in the electrolyzer business and further construction delays to the company's hydrogen plants.

Adding insult to injury, the company will be required to raise a substantial amount of new capital in not-too-distant future and with the much-touted $1 billion DoE loan guarantee anything but a given, I wouldn't be surprised to see the company coming to market with a large convertible debt offering before the end of this year.

Going forward, much will depend on Plug Power's Q3 performance given management's stated expectations for substantial improvements in margins and cash usage.

However, the condition of the core material handling business is not likely to improve meaningfully in Q3 and capital expenditures are likely to remain at elevated levels.

Given ongoing execution issues, overly aggressive financial projections and deteriorating liquidity, investors should remain on the sidelines until management lines up new financing and finally starts delivering upon its ambitious targets.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Recommended For You

Comments (4)

The cost of the facility. The cost of the electrolyzers . The cost of the hydrogen.A lot of early interest will quickly disappear if Hydrogen retails for $12.00 -$20.00 per kg.