StoneCo Became Cheap Before Its Q2 Release

Summary

- StoneCo is a $4.3-billion market cap Brazilian company operating in financial services and software segments, with a focus on MSMBs.

- StoneCo plans to expand its reach into lower-tier SMBs and capitalize on market opportunities by cross-selling financial services to software clients.

- STNE's qualitative growth strategy, coupled with strong operating leverage, positions it to improve margins, potentially yielding an upside of 28.4% from the current price.

- The risks are also in place. But despite them, STNE is a "Buy" to me.

- I do much more than just articles at Beyond the Wall Investing: Members get access to model portfolios, regular updates, a chat room, and more. Learn More »

I going to make a greatest artwork as I can, by my head, my hand and by my mind.

The Company

StoneCo Ltd. (NASDAQ:STNE) is a 4.3-billion market cap Brazillian company that operates in 2 business segments:

- Financial services [85.2% of total sales]: offers payment processing, digital banking, and credit solutions to Micro, Small, and Medium Businesses (MSMBs).

- Software [14.8%]: supplies Point of Sale (POS) and Enterprise Resource Planning (ERP) solutions tailored to various retail and services sectors, along with an array of tools encompassing CRM, e-commerce, and omnichannel integration.

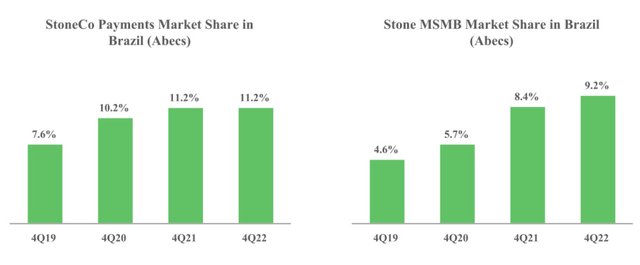

According to the latest 20-F statement, in its Financial Services business unit, the company held a market share of 11.2% in the Brazilian merchant acquiring industry's total processed volume (TPV) by the end of FY2022. Notably, their focus on MSMBs led to an increase in market share within this segment, rising from 8.4% in Q4 2021 to 9.2% in Q4 2022. However, their presence in newer offerings like digital banking and credit remains relatively small at less than 1% market share.

Regarding Software, following the acquisition of Linx in 2021, the company established itself as the primary retail management software provider in Brazil. They estimate their penetration in the software market's SAM to be ~13%, contributing to a revenue total of R$11 billion.

Unfortunately, I haven't found any more recent data on how STNE's market share changed in the first quarter of fiscal 2023, but from the Q&A during the Q1 earnings call, we could grasp that the company continues to gain market share from various competitors across different client tiers and in various geographies.

In Q1 2023, the company exceeded growth expectations with a 31% YoY revenue increase [+29.50% YoY in US dollars] and an adjusted EBT of R$324 million [vs. negative last year], surpassing guidance by 22%. This resulted in a record adjusted net income of R$237 million. Their efficiency-focused approach generated strong cash flows, raising adjusted net cash to R$4 billion.

In Financial Services, revenue grew by 36% YoY, driven by MSMB client success. The company added 2.8 million MSMB active payments clients, achieving an impressive 25% YoY TPV growth. Banking solutions, including Super Conta Ton for micro clients, expanded the banking active client base and showed promise in credit solutions.

Yet, the Software segment faced challenges, with 10% YoY revenue growth due to reduced ad spending from large enterprise accounts. But it contributes ~15% to total sales, so the relative weakness here didn't stop the overall top-line appreciation.

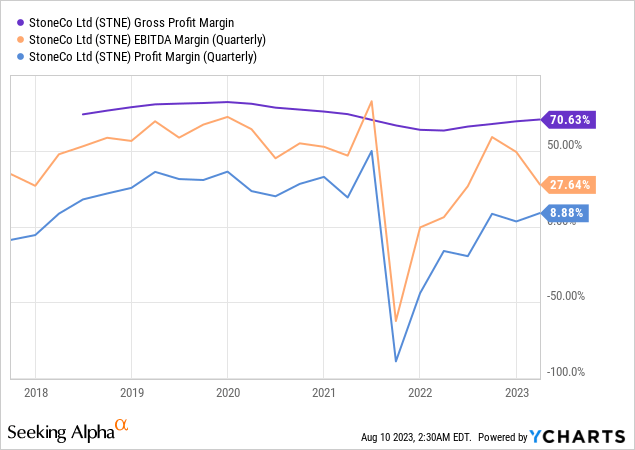

I love how STNE is performing in terms of its key margins - in Q1 FY2023 the firm continued to turn around from the major losses it had due to challenges related to the Brazilian faulty registry system:

Amid a global economic slowdown, Brazil's economy remains resilient, reporting strong annual GDP growth of 5% in 2021 and 2.9% in 2022, with continued momentum in 2023, achieving 1.9% QoQ growth in Q1. This growth is bolstered by decreasing inflation, which dropped from 12% to 3.94%, offering favorable conditions for sustained economic expansion. This positive backdrop bodes well for StoneCo, as the company's performance is closely tied to Brazil's economic health. Additionally, recent data from Goldman Sachs [August 9, 2023 - proprietary source] highlights robust retail sales in Brazil, with core/control retail sales holding steady at 0.0% mom sa and broad retail sales surging by 1.2% mom sa in June, surpassing market expectations.

Goldman Sachs [August 9, 2023 - proprietary source]![Goldman Sachs [August 9, 2023 - proprietary source]](https://static.seekingalpha.com/uploads/2023/8/10/49513514-16916560957051587.png)

The retail sector benefits from fiscal stimulus, rising labor income, and diminishing inflation (although potential challenges like fading reopening effects and tight monetary conditions may impact retail and services activity ahead).

As Nordsten Capital, an investment partnership for accredited investors, wrote in its memo to partners, the Central Bank of Brazil may be under political pressure to start lowering interest rates following the recent drop in inflation, which would lower STNE’s funding costs. So the overall macro backdrop for StoneCo is looking exceptionally good, in my view.

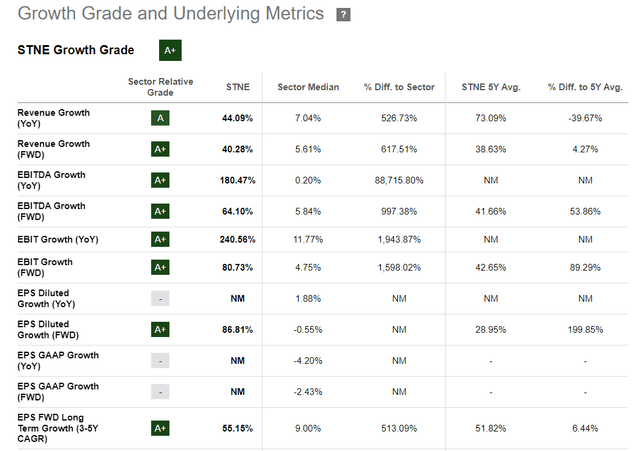

To further capitalize on the market opportunity, STNE's management plans to expand its reach into lower-tier SMBs. They see potential synergies in cross-selling financial services to software clients and using software to enhance their SMB market. That's why I believe it's highly likely that STNE's growth rates we see today will keep on surpassing those of the broader industry, primarily driven by a combination of expanding market share and the overall growth of the total addressable market.

Seeking Alpha, STNE's Valuation

But how cheap is the stock today? Let's approach this question together.

Q2 Report Preview And Valuation

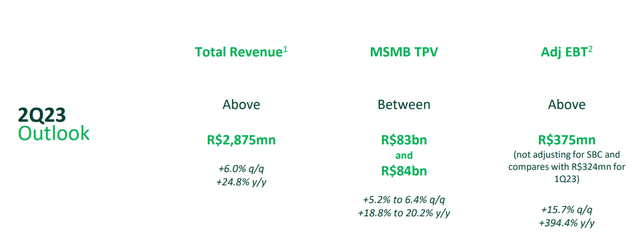

According to Seeking Alpha, the company is set to report Q2 FY2023 on August 16. Last quarter, the management gave a forecast that revenue growth of 24.8% YoY, while adjusted EBT is expected to increase nearly 400% YoY:

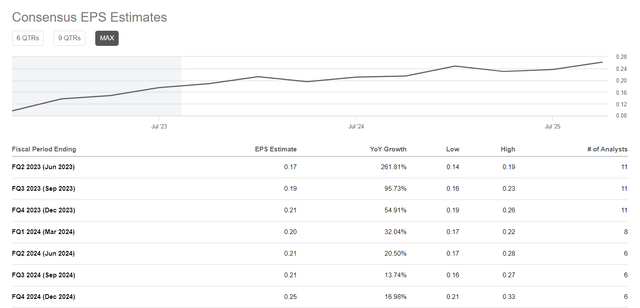

At the same time, the market expects STNE's Q2 EPS to be $0.17 (consensus), well below EBT growth guidance.

Seeking Alpha, STNE's Earnings Estimates

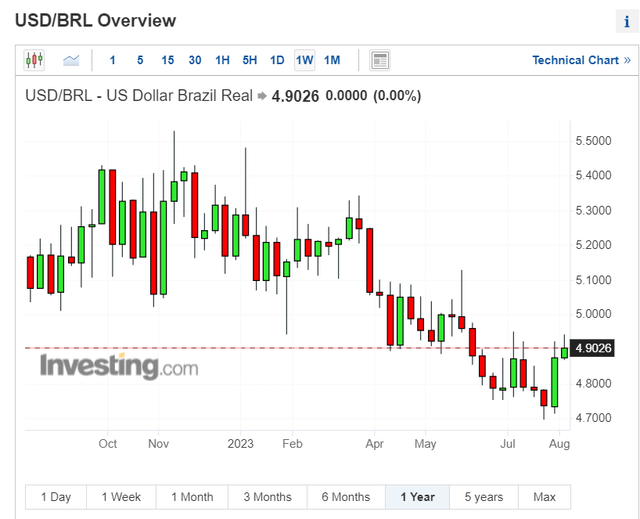

Here I see 2 reasons for the above-noted discrepancy: Taxes and the USDBRL exchange rate, which has weakened a lot over the last year:

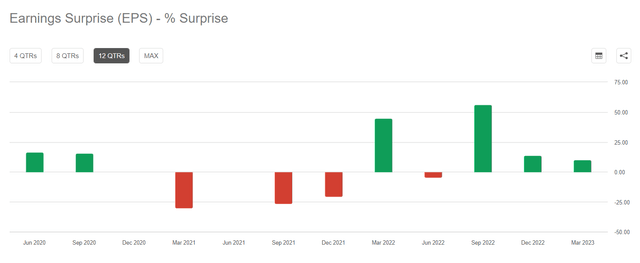

However, such high forecasts do not bother me - in my opinion, STNE is in its recovery cycle and has therefore managed not only to meet but even to exceed the high expectations in the last 3 quarters:

I cannot write with confidence that STNE will beat analysts' forecasts. However, if it does not do so in Q2, I do not think the margin of safety for the next quarters will disappear. That's because the market is factoring in EPS growth of ~16% CAGR from FY2023 in its forecasts, and at the same time, STNE's implied price-to-earnings ratio is expected to fall to just 12x by FY2025, which I think is too low for such a fast-growing story.

Seeking Alpha, STNE's Earnings Estimates [author's notes]![Seeking Alpha, STNE's Earnings Estimates [author's notes]](https://static.seekingalpha.com/uploads/2023/8/10/49513514-1691658007662714.png)

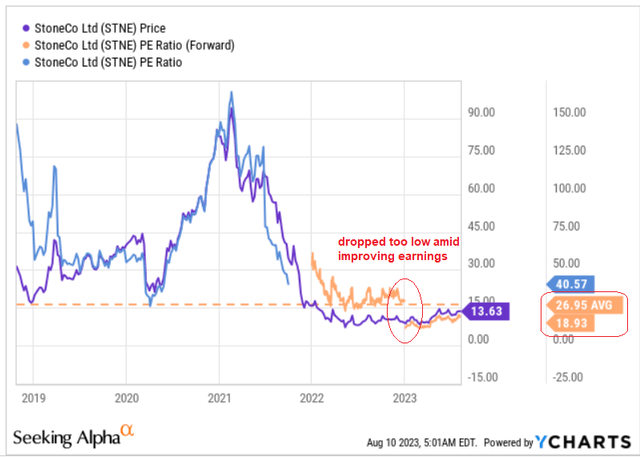

The valuation of any company is a subjective thing. But in my opinion, the P/E ratio for the next year that STNE is currently trading at, contracted too deep at the very beginning of 2023 (compared to its own average and the industry's multiple expansion trend we've been seeing for the past few months).

Even if STNE's EPS for fiscal 2023 is $0.7/sh rather than $0.73 as currently priced in, then with the multiple expansion to 25x [slightly below historical average], StoneCo becomes a $17.5 stock, implying an upside of 28.4% from the current price.

The Bottom Line

There are certain risk factors to consider when investing in StoneCo stock. Although Brazil offers growth opportunities and diversification potential, fluctuations in the Brazilian real due to currency instability could impact StoneCo's financial position. The company's revenue growth rates exhibit notable cyclicality, making it difficult to predict future growth rates. In addition, StoneCo's accounting adjustments, such as the inclusion of stock-based compensation and bond costs, have raised concerns that they may mask the company's underlying cyclical trends, SA fellow Michael Wiggins De Oliveira noted in his recent Neutral article on STNE.

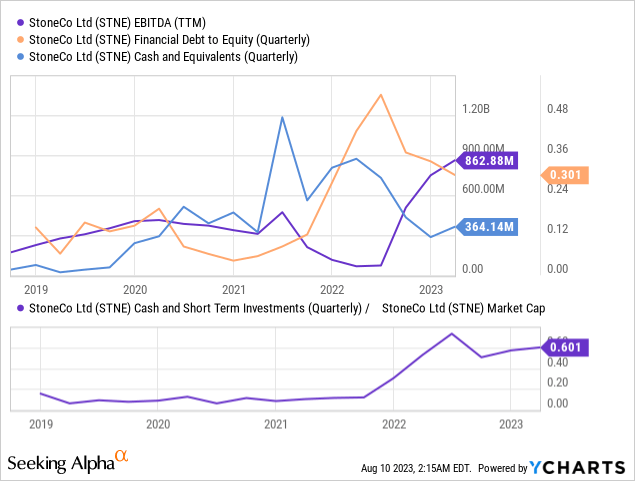

But despite all the risks, it seems to me that there are many more opportunities with StoneCo - the risk-reward ratio here is on the side of the buyers. Judge for yourself:

- The Brazilian economy is doing much better than previously thought, creating a favorable environment for the development of small and medium enterprises. The TAM opportunity for STNE here is obvious to me.

- StoneCo continues to develop and grow, doing it qualitatively. In my opinion, the company has enough operating leverage to keep on turning the margins in its favor.

- The stock is cheap. If the margin expansion does continue, the valuation multiples should theoretically get to where I've indicated previously ( PE of >20-25x, to say the least) amid the business and market share growth.

That is why, despite all the risks, StoneCo stock is a Buy today, in my view.

Hold On! Can't find the equity research you've been looking for?

Now you can get access to the latest and highest-quality analysis of recent Wall Street buying and selling ideas with just one subscription to Beyond the Wall Investing! There is a free trial and a special discount of 10% for you. Join us today!

This article was written by

The chief investment analyst in a small family office registered in Singapore, responsible for developing investment ideas in equities, setting parameters for investment portfolio allocation, and analyzing potential venture capital investments.

A generalist in nature, common sense investing approach. BS in Finance. The thesis description can be found in this article.

During the heyday of the IPO market, I developed an AI model [in the R statistical language] that returned an alpha of around 24% over the IPO market's return in 2021. Currently, I focus on medium-term investment ideas based on cycle analysis and fundamental analysis of individual companies and industries.

Get a free 7-day trial +25% off for up to 12 months on TrendSpider with the coupon code: DS25

**Disclaimer: Associated with Oakoff Investments, another Seeking Alpha Contributor

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in STNE over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.