Orion Office REIT: An Upgrade Is Warranted

Summary

- Orion Office REIT Inc. has seen a decline in occupancy, annual base rent, and weighted average lease term in Q2-2023.

- The company has struggled to lease enough space even in this latest quarter.

- We are upgrading the stock rating based on Orion's ownership of single-tenant office buildings in a struggling commercial real estate market, along with a price close to NAV and low debt to EBITDA.

- I do much more than just articles at Conservative Income Portfolio: Members get access to model portfolios, regular updates, a chat room, and more. Learn More »

FangXiaNuo

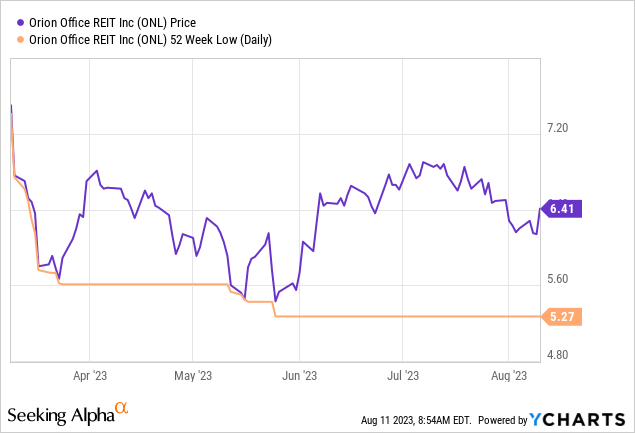

When we last covered Orion Office REIT Inc. (NYSE:ONL) we doubled down on our bearish stance, despite the stock actually hitting our downside target of $7.00 per share. We lowered our price target and stayed the course.

Normally we would upgrade this at the current point to a "hold" rating. But we don't think the damage is done. The relatively low lease renewals done in the quarter and the asset sales should keep bulls on the defensive. We think we will see $6.00 at some point in 2023 and are maintaining a sell rating.

Source: Orion Office Hits Our Fair Value Target, Here Is What Comes Next

The stock did dive further and hit a low of $5.27 per share. It has since rebounded and got some life after the Q2-2023 results.

We look at the numbers to see if we are past the point of peak pain.

Q2-2023

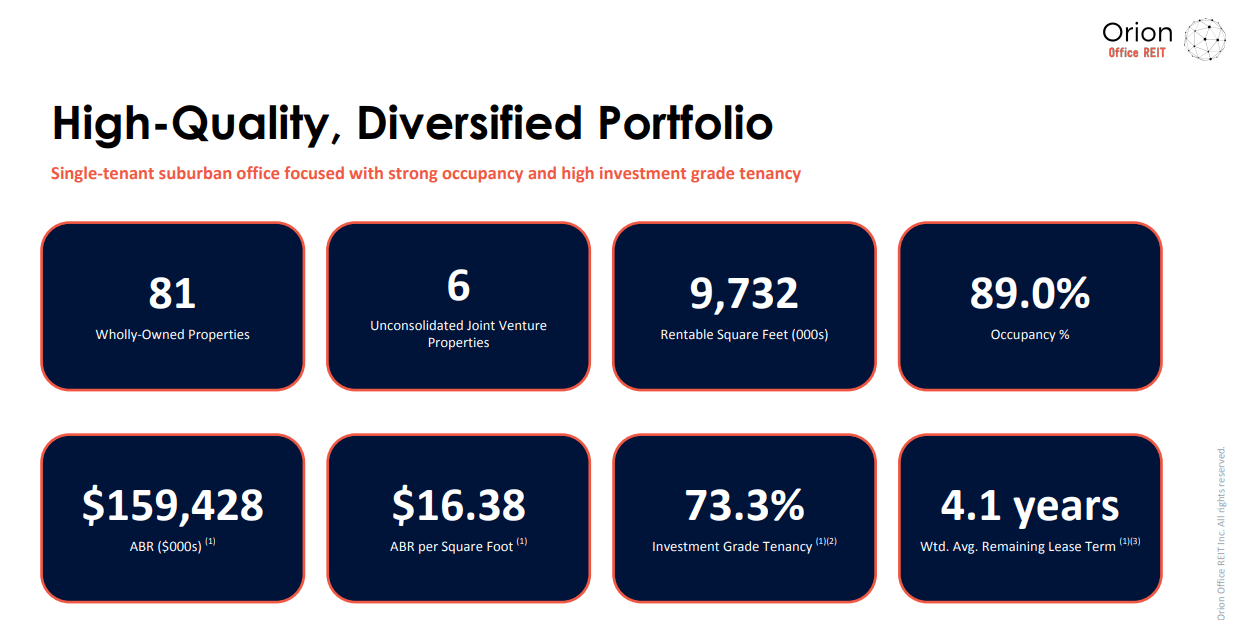

At the end of Q2-2023, Orion had 81 fully owned properties with an occupancy rate of 86.5%. The annual base rent was $15.77 per square foot and the weighted average lease term was 3.9 years.

As is extremely important when the theory is that of a melting ice-cube, we need to see how things are trending. So here are the numbers below from 2 quarters back.

Orion Q4-2022 Presentation

What do you see when you compare the Q4-2022 numbers to the present day?

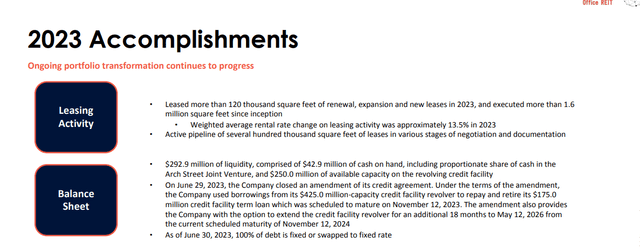

Occupancy is lower (86.5% vs 89%). Annual base rent per square foot is lower ($15.77 vs $16.38). Weighted average lease term is lower (3.9 years vs 4.1 years). In 2023, Orion has leased about 120,000 square feet of space via renewals or new leases. Therein lies the problem. The company has about 9.7 million square feet of space and about 15% was coming due for renewal in 2023. So ideally it should have found a way to lease 1.45 million square feet during 2023 to keep occupancy stable. At the half-time report, we should have done 730,000 square feet. Our current trajectory is less than 20% of the required run rate. Hence, occupancy continues to fall. One has to note below in the press release that the leasing rate in Q2-2023 was even below that for Q1-2023.

During the quarter ended June 30, 2023, the Company entered into one 5.0-year lease renewal for 44,000 square feet at the Company's property in Redding, California, leased 100% to the United States Government. The Company also entered into one new 3.0-year lease for 3,000 square feet at its multi-tenant property in The Woodlands, Texas. Additionally, Orion is in various stages of negotiation and documentation for new leases and renewals at multiple properties.

Source: Q2-2023 Press Release

So the half year metrics we used might be understating the problems the REIT is facing. Now, you might see a tick up in occupancy. That comes from the sale of another property early in Q3-2023. Note the price per square foot of that property and even the 8 Walgreens Boots Alliance (WBA) properties.

Shortly after quarter end, Orion closed the sale of a 227,000 square foot vacant property in Berkeley, Missouri, for a gross sales price of approximately $9.7 million. The Company also has agreements currently in place to sell eight additional properties, representing approximately 631,000 square feet, for an aggregate sale price of $41.0 million, including the six property Walgreens campus in Deerfield, IL.

Source: Q2-2023 Press Release

Outlook

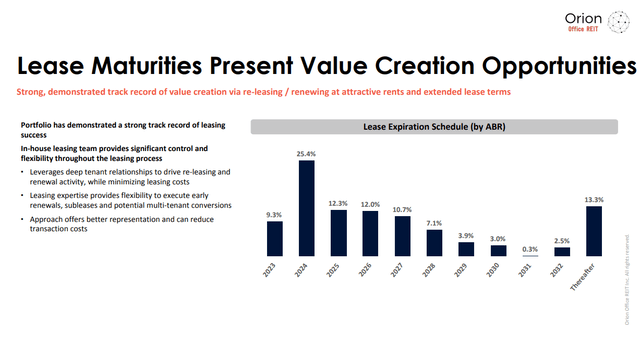

The asset sales in progress have to be weighed against the upcoming lease maturities. While 2023 was tough, 2024 will be back breaker. A full 25% of the portfolio is coming up for renewal in an incredibly challenging market.

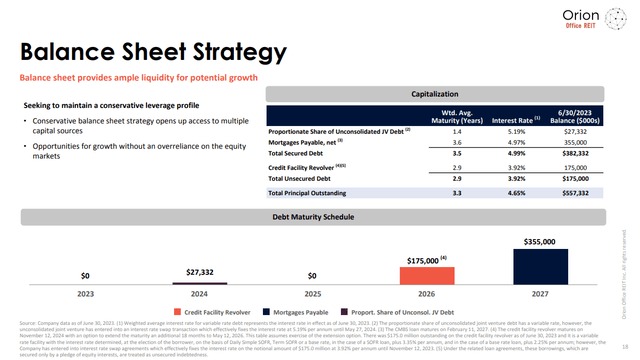

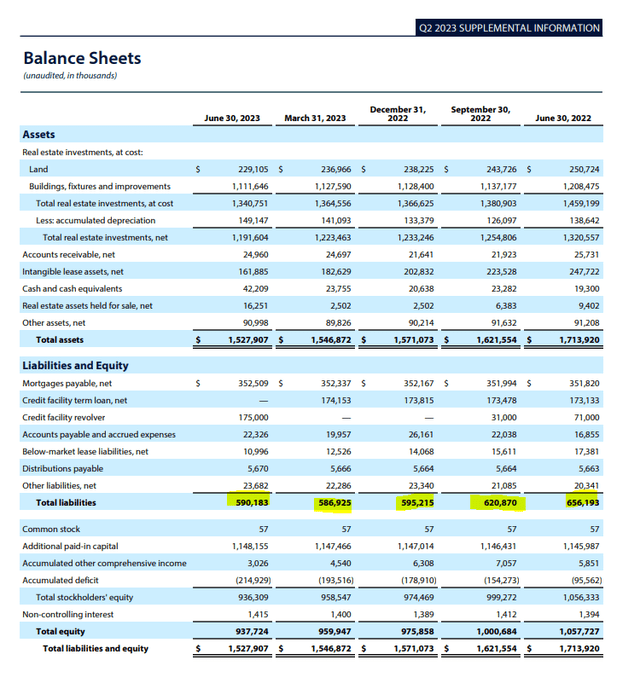

The one good aspect of Orion's extremely low dividend payout ratio is that it took the opportunity to reduce its debt slightly. Nearby debt maturities are modest and all debt is fixed rate.

Liquidity is adequate, and the company has zero existential risks.

The one issue here is finding out what is the long term steady state. If you extrapolate some of the vacant asset sales ( see our previous coverage for more on this), to the entire portfolio, even the total liabilities won't be covered.

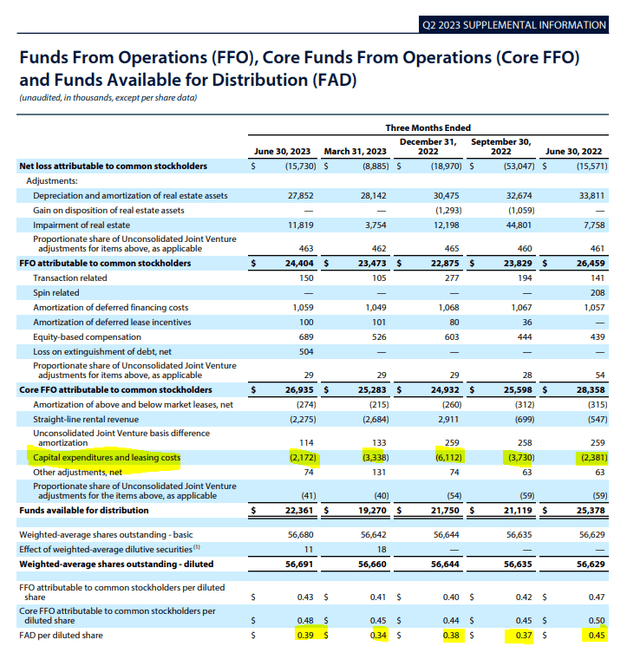

The excitement this quarter came from the small beat and we were surprised as well. But at least on the funds available for distribution front, the higher number is because the REIT has not been successful in leasing assets. Capital expenditures and leasing costs should rise meaningfully in quarters where leasing is strong (see Q4-2022 for example).

Verdict

The verdict comes from balancing three forces that go into the thesis. The first being that Orion owns single tenant office buildings, possibly the worst asset class in a tortured commercial real estate market. That pretty much rules out a "buy" rating. The second aspect is the price in relation to the liquidation value or NAV. This one is pretty hard to figure out; this is very close to the current price, possibly a bit more. Buttressing this is the relatively low debt to EBITDA that Orion has. Some office REITs like Vornado Realty Trust (VNO) carry almost twice the debt to EBITDA compared to Orion, so the lower leverage works to offset a negative opinion. Finally, what is the net present value of the cash flows 10 years out. One could argue that this is same as the NAV but here we are trying to see if in the worst case situation the stock can earn its market cap primarily from existing leases. The stock is trading for 4X funds from operations (FFO) so again downside bias is low. Weighing all the evidence so far, we see no reason to change our earlier price target of $6.00 per share. However, since the stock is so much closer to our target than when we last wrote on it, this time we go with a "hold" rating.

Please note that this is not financial advice. It may seem like it, sound like it, but surprisingly, it is not. Investors are expected to do their own due diligence and consult with a professional who knows their objectives and constraints.

Are you looking for Real Yields which reduce portfolio volatility? Conservative Income Portfolio targets the best value stocks with the highest margins of safety. The volatility of these investments is further lowered using the best priced options. Our Enhanced Equity Income Solutions Portfolio is designed to reduce volatility while generating 7-9% yields.

Give us a try and as a bonus check out our Fixed Income Portfolios.

Explore our method & why options may be right for your retirement goals.

This article was written by

Conservative Income Portfolio is designed for investors who want reliable income with the lowest volatility.

High Valuations have distorted the investing landscape and investors are poised for exceptionally low forward returns. Using cash secured puts and covered calls to harvest income off value income stocks is the best way forward. We "lock-in" high yields when volatility is high and capture multiple years of dividends in advance to reach the goal of producing 7-9% yields with the lowest volatility.

Preferred Stock Trader is Comanager of Conservative Income Portfolio and shares research and resources with author. He manages our fixed income side looking for opportunistic investments with 12% plus potential returns.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Recommended For You

Comments (2)