Palantir: Its Golden Moment Is Here (Rating Downgrade)

Summary

- PLTR demonstrated impressive capital management by generating robust interest income through the elevated interest rate environment.

- It also appears that the company has finally reached a sustainable operating scale, thanks to the expanding top-line and stable operating expenses.

- PLTR has also focused on short-term contracts, expanding its remaining performance obligations despite the ongoing capex optimization from the uncertain macroeconomic outlook.

- Then again, its announcement of a $1B share repurchase program seems untimely since the stock's valuations are now overly stretched, with its price near its 52-week highs.

- Therefore, given the mixed prospects, remains to be seen if PLTR is able to sustain its premium valuations and inflated stock prices, with profit taking already happening.

Andreas Rentz

PLTR's AI Investment Thesis Remains Robust

We previously covered Palantir Technologies Inc. (NYSE:PLTR) in May 2023, discussing its exciting forward prospects, due to the opportunistic launch of its conversational AI tool, AIP.

The CEO had believed that the new tool would be able "constructively extract value across the latter's proprietary and external data, while automating workflow and decision-making processes layered with conversational AI tools."

He also recognized the functional use case of AI in the defense and intelligence sector, as discussed in the New York Times article, Our Oppenheimer Moment: The Creation of A.I. Weapons.

For now, PLTR has achieved another quarter of positive profit margins, sustaining the trend from the previous quarter and nearer to the management's target for "FY2023 to be its first full year of GAAP profitability."

If we are to break down its performance in FQ2'23, the company generates an impressive $10.07M in operating income and $30.31M in interest income, compared to FQ1'23 levels of $4.11M/ $20.85M and FQ2'22 levels of -$41.75M/ $1.47M, respectively.

Much of the tailwind is probably attributed to the company finally reaching its sustainable operating scale, thanks to the expanding top-line of $533.31M (+1.5% QoQ/ +12.7% YoY) and stable operating expenses of $416.31M (+0.7% QoQ/ +0.9% YoY) in the latest quarter.

This is further aided by the management's intensified short-term investments of $2.04B (+25.1% QoQ), thanks to the elevated interest rate environment through the Fed's sustained rate hike since March 2022.

This is a highly strategic capital management, in our opinion, since it demonstrates the PLTR management's excellent use of the FQ2'23 balance sheet of $3.09B (+6.9% QoQ/ +17.9% YoY), contributing to the company's overall GAAP profitability.

For now, PLTR's prospects seem bright enough, with expanding Government revenues of $302M (+4.4% QoQ/ +14.8% YoY) and Commercial revenues of $232M (-1.6% QoQ/ +10.4% YoY) in FQ2'23, suggesting minimal demand headwinds despite the peak recessionary fears.

This is on top of the decent short-term remaining performance obligations of $558M (+5.4% QoQ/ +6.4% YoY), with its long-term backlog of $410M spread over the next 36 months.

Therefore, while PLTR's top and bottom line growth has decelerated compared to the hyper-pandemic period, we are not overly concerned, since it is mostly attributed to ongoing capex optimization from the uncertain macroeconomic outlook, one that has been similarly reported by other SaaS/ Cloud providers.

We are highly convinced about PLTR's head start in the AI race as well, since the management has managed to introduce multiple AI-powered tools and software, which have been designed in-house over the past twenty years, similar to CrowdStrike (CRWD).

This is compared to other players' acquisition strategies, such as Alphabet's (GOOG) DeepMind, Microsoft's (MSFT) backed OpenAI, and Meta's (META) Meta and AI.Reverie.

PLTR's superior end-to-end AI expertise/ engineering capability and the seamless/ highly integrated user experience has also allowed the recently introduced AIP be directly integrated with the existing Foundry and Gotham platforms with minimal time and operating lag.

Therefore, the stickiness of its product offerings are not surprising indeed, as seen with its increasing 421 consumers (+7.6% QoQ/ +38.4% YoY) by the latest quarter.

We are also highly encouraged that PLTR has raised its FY2023 guidance moderately to at least $2.212B in revenues (+16.4% YoY) and $576M in adj operating incomes (+37.7% YoY), compared to the previous lower-end guidance of $2.185B and $506M, respectively.

The $1B Share Repurchase Program Seems Untimely

Then again, PLTR's announcement of a $1B share repurchase program seems untimely, since the stock's valuations are now overly stretched, with its price near its 52 weeks highs.

In addition, if the management use its existing balance sheet to buy back shares, its eventual GAAP profitability may be impacted due to the reduced interest income.

Therefore, while the PLTR management may think that its current share prices are cheap and thereby warranting a buyback, we are not convinced for now.

Furthermore, based on its current market capitalization of $38B and 2.27B in shares outstanding, the eventual impact seems underwhelming, especially given the $456.8M (inline QoQ/ -21.6% YoY) of annualized share based compensation in the latest quarter.

Only time may tell, since there is no mandated end date for the share repurchase program.

So, Is PLTR Stock A Buy, Sell, or Hold?

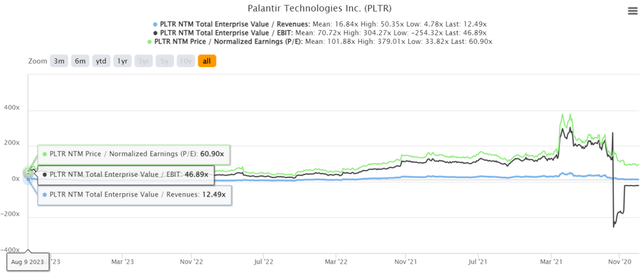

PLTR 3Y EV/Revenue, EV/ EBIT, and P/E Valuations

Therefore, due to the nascency of the generative AI market, it is unsurprising that the PLTR stock has been rewarded with inflated valuations, at NTM EV/ Revenues of 12.49x, NTM EV/ EBIT of 46.89x, and NTM P/E of 60.90x, against its 1Y mean of 8.08x/ 38.49x/ 55.11x, respectively.

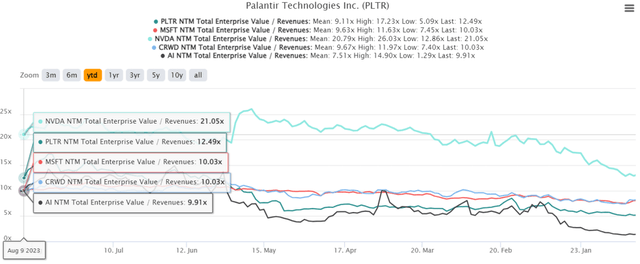

PLTR, MSFT, NVDA, CRWD, & AI YTD EV/Revenue Valuations

The same exuberance has also been observed with its AI SaaS peers, such as MSFT, Nvidia (NVDA), CRWD, and C3.ai (AI), with elevated NTM EV/ Revenue valuations compared to their 1Y means, thanks to the robust demand thus far.

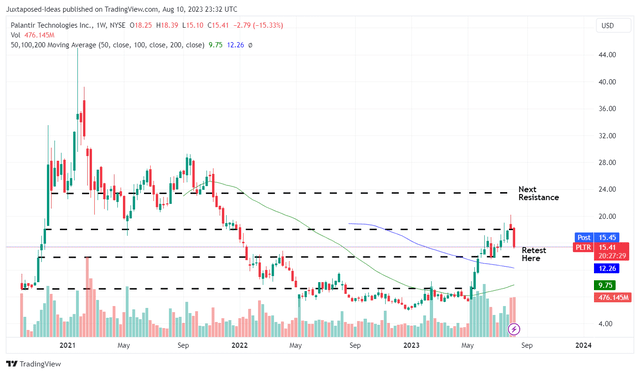

PLTR 3Y Stock Price

However, PLTR has also more than doubled from the May 2023 bottom of $7.38, retesting its Q4'21 support levels. Due to the overly fast/ furious rally, we are also not surprised by the rapid profit taking over the past few days.

Due to the potential volatility and the elevated short interest of 6.90% at the time of writing, we prefer to rate PLTR as a Hold here.

It may be more prudent to monitor PLTR's movement for a little longer, since it remains to be seen if the stock is able to sustain its current premium valuations.

This article was written by

Analyst’s Disclosure: I/we have a beneficial long position in the shares of PLTR, MSFT, META, GOOG either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The analysis is provided exclusively for informational purposes and should not be considered professional investment advice. Before investing, please conduct personal in-depth research and utmost due diligence, as there are many risks associated with the trade, including capital loss.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.