Emeth Value Capital - DICK'S Sporting Goods: A Case Study In Public Market Volatility

Summary

- DICK'S Sporting Goods is the largest sporting goods retailer in the US, with over 800 locations and $12 billion in revenue.

- The company has consistently grown its revenue and returned cash to shareholders, but its valuation has fluctuated significantly in the public market.

- Despite market volatility, DICK'S has maintained positive same-store sales and has seen increased strength during the pandemic.

Spencer Platt/Getty Images News

The following segment was excerpted from this fund letter.

DICK'S Sporting Goods (NYSE:DKS)

DICK'S is the largest sporting goods retailer in the United States, a position that it has held for nearly two decades. DICK'S was founded in 1948 when Richard "Dick" Stack, the father of Ed Stack, opened his original bait and tackle store in Binghamton, New York. Since assuming control of the then two store chains in 1984, Ed Stack has grown the family business into a full-line sporting goods store with more than eight hundred locations nationwide.

The company went public in 2002 and has since increased its total revenue by 10x, from $1.2 billion to $12 billion, while also returning over $5 billion in cash to shareholders. In its forty-year history, DICK'S has never had a period where comparable store sales, measured over rolling three-year intervals, were negative. Turning back to our discussion, let's consider a hypothetical investment made in DICK'S Sporting Goods in 2012.

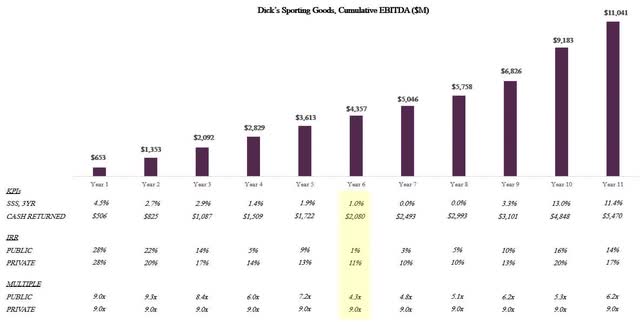

The graphic above details the progression of cash flows and how the theoretical private marks would differ from the actual public marks observed over this timeframe. At year zero, DICK'S Sporting Goods had no debt and was available for purchase for $5 billion, or 9.0x EBITDA. During the initial three years, the marks follow a similar trajectory. However, the consistency is short-lived. In years four through six, after having risen to a $6.2 billion valuation with over $1 billion in cash distributed back to shareholders, the public marks successively adjust the valuation down by $1.8 billion, up by $1.3 billion, and then down by $2.5 billion.

During these same years, company cash flows remained nearly identical at $750 million per year, and a further $1 billion in cash was returned back to shareholders. And so, six years into this investment, after cash flows had grown thirty-four percent in aggregate and $2 billion had been returned to shareholders, Mr. Market felt that this business now warranted half the multiple it did only a few years earlier, or 4.3x EBITDA. This is despite one of DICK'S largest competitors, Sport's Authority, filing for Chapter 7 bankruptcy in year five, which ceded several percentage points of market share to the remaining retailers, and US corporate tax rates falling in year six, which increased free cash flow conversion.

In short, the company was priced to disappear over the coming decade. The investment marked to market would have shown a one percent IRR, while constant multiples would have yielded an eleven percent IRR. Of course, the business has not disappeared. In fact, adjusted for the hunting and gun department, which DICK'S decided to remove from 500 of its stores, the business' same store sales have comped positive every year since year six.

An added bonus that no one could have foreseen was that the business would also strengthen materially as a result of the pandemic. Today, DICK'S generates $1.8 billion in EBITDA, and over the full course of the eleven-year investment the public and private marks have converged back to a mid-teens IRR.

So, what is the correct valuation? It is impossible to know with certainty. However, we can be reasonably confident that it is unlikely a business with stable cash flows is changing in value by one-third in either direction year to year, and it is unlikely that 4.0x is a proper multiple for a business with no debt and a thirty-year history of growing profits.

To paraphrase Christopher Schelling's article "Why Private Equity Gets Valuations Right," perhaps it is the short-term volatility of public markets, not the muted volatility of private markets, that's a bug, not a feature.

DisclosuresInvestment in Emeth Value Capital are subject to risk, including the risk of permanent loss. Emeth Value Capital's strategy may experience greater volatility and drawdowns than market indexes. An investment in Emeth Value Capital is not intended to be a complete investment program and is not intended for short term investment. Before investing, potential clients should carefully evaluate their financial situation and their ability to tolerate volatility. Emeth Value Capital, LLC believes the figures, calculations and statistics included in this letter to be correct but provides no warranty against errors in calculation or transcription. Emeth Value Capital, LLC is a Registered Investment Advisor. This communication does not constitute a recommendation to buy, sell, or hold any investment securities. Performance Notes Net performance figures are for a typical client under the standard fee arrangement. Returns for clients' capital accounts may vary depending on individual fee arrangements. Net performance figures for Emeth Value Capital, LLC are reported net of all trading expenses, management fees, and performance incentive fees. Reported returns prior to January 1st, 2021 reflect the personal account performance of Emeth Value Capital, LLC's sole managing member, and therefore represent related performance. All performance figures are unaudited and are subject to change. Contact Emeth Value Capital welcomes inquiries from clients and potential clients. Please visit our website at Emeth Value Capital or contact Andrew Carreon at acarreon@emethvaluecapital.com |

Editor's Note: The summary bullets for this article were chosen by Seeking Alpha editors.