Uber Technologies: Room For Drastic Growth

Summary

- Uber Technologies, a US-based company, dominates the ride-share market in North America. It also offers food and package delivery and freight transport services.

- Despite intense competition, Uber's financials indicate a shift toward profitability. The company also has the potential to expand further.

- Uber's future looks bright with the potential use of self-driving vehicles, which could drastically improve profit margins. The company's freight segment also shows potential for significant growth.

- Uber recently introduced a new partnership with Domino's and is working on expanding its car top advertising.

Editor's note: Seeking Alpha is proud to welcome Asetus Capital as a new contributor. It's easy to become a Seeking Alpha contributor and earn money for your best investment ideas. Active contributors also get free access to SA Premium. Click here to find out more »

Hollie Adams

Overview

I believe Uber Technologies (NYSE:UBER) is a buy, as it has promising growth prospects for its rideshare segment both in the US and internationally; its freights segment also has room for significant growth. Additionally, the company has ended their streak of losing money, removing a major concern that investors had. Uber has seen significant revenue growth rates recently; however, this growth does not seem like it will cool down soon. They have been slowly taking market share for their rideshare segment in the US and have established themselves worldwide more than any other rideshare company, placing them in a favorable position from the expansion of the rideshare industry. Segments like Uber Freights also have potential to meaningfully contribute to the company's revenue, as it has thus far had considerable success despite only being present in few locations. The development of self-driving cars could be an additional catalyst.

Business Model

Uber’s main source of revenue is its rideshare service and their second source of revenue is from their food delivery service. Uber does not hold any physical assets and generates revenue from commissions from the platform that they provide. Essentially, Uber are the middlemen between the supply side (drivers) and demand side (customers), facilitating the connection and taking a cut of the money. The company provides its users with convenience, allowing them to order a car anytime, anywhere, at the touch of their fingers, without having to look for the nearest taxi. They also provide convenience to their customers by delivering food to their homes, allowing them to receive the food they want without having to leave their home. They have few competitors in the rideshare industry, as they were the first to enter the market, and successfully held their position through their brand name and aggressive advertisement. In the food delivery market, they are performing worse, controlling only around 23% of the market whereas DoorDash (NYSE: DASH) is controlling 65%.

Key Financials

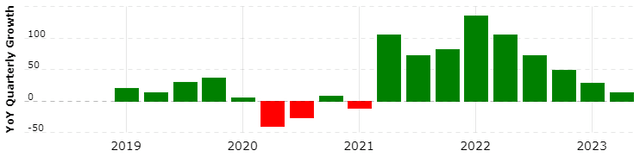

Uber’s financials further support the company’s strong buy case. In the second quarter of 2023, the company reported around $9.23 billion in revenue, representing an increase of around 14% YoY. The company's gross bookings also increased by 16% YoY, with the mobility segment experiencing growth of 25%. Despite Uber missing revenue projections by 1.16%, the company made up for this with its surprising EPS and profit. In the second quarter of 2022, Uber lost around $713 million, while in the second quarter of 2023 it reported its first profitable quarter, reporting $326 million in net income. I think that this quarter represents a significant shift for Uber, proving that the company can be profitable and making investment in the company even more favorable. Even though the company experienced strong growth (with the exception of the freight segment), it was still able to turn profit. A significant concern with investment in Uber was the ability's struggle with profitability, however that concern is no longer valid. I believe that this quarter proves that the company is able to establish itself as an industry leader without burning through billions to do so. In the case that the next few quarters have similar results, I think that Uber will continue to have great growth potential, however the risk associated with its instability will be greatly reduced.

A Bright Future

In the past few years, Uber has reported impressive revenue growth in the past few years, experiencing an 82.62% revenue growth from 2021 to 2022 and going from $13 billion to almost $32 billion in revenue from 2019 to 2022. The growth potential that rideshare services and food delivery have is phenomenal, and Uber have positioned themselves to be the main beneficiaries from this trend. In terms of Uber’s rideshare segment, their main competitor is Lyft (NASDAQ:LYFT). However, Uber’s scale does not compare to Lyft’s. In Q1 2023, Lyft’s revenue was around $1B, representing 14% growth YoY, while Uber’s revenue was $8.8 billion, representing 29% growth YoY. Uber has a 74% share of the rideshare market, almost 3 times Lyft’s 26%. Over the past few years, Uber has been slowly taking away market share from Lyft, making them by far the most dominant rideshare company in the US.

So, what does this dominant position mean for Uber? Simply put, Uber will be the company that will benefit the most from expansion in demand for rideshare and will make the barrier to entry almost impossible to overcome. The rideshare industry is valued at around $85 billion as of 2021, and it is expected to grow to around $185 billion by 2026, more than doubling in value in 5 years. Considering Uber’s position in US markets, I believe they will be the company that will mostly absorb this huge market expansion, allowing Uber to drastically improve its financials.

Another major reason I think that Uber has a bright future ahead is because of their desire to utilize self-driving vehicles. Uber and Google (NASDAQ: GOOGL) sister company Waymo recently announced a partnership, in which Uber could use Waymo’s self-driving cars for food delivery and rideshare services. Although self-driving cars are being used at a miniscule scale currently, a future where self-driving cars become more widespread would be extremely beneficial to Uber. If self-driving cars would become safe and practical, I believe Uber’s margins would drastically improve, removing Uber’s main source of COGS (employee costs). Especially for Uber’s rideshare service, most of the money goes to the driver (around 75%). With self-driving cars, Uber would be able to take a 100% cut of the transaction, a huge increase from its current cut. It is important to mention that new costs would be associated if there was no driver, such as car repairs and fuel/charge, however Uber would still be able to drastically increase their revenue and profit margin. If an advancement like this does occur, I would not be surprised if Uber’s valuation increased multiple fold over time. Uber would be able to multiply their revenue and eliminate their biggest cost, which would completely change the company’s financials for the better. Considering Uber’s dominance of the rideshare market and the fact that there will likely always exist a desire for rideshare services, I think this advancement does not need to happen soon to end up benefiting Uber.

I also believe that Uber’s freight segment has potential for significant growth. Uber Freight connects shippers and trucking companies, as a customer details what they want shipped and where, and the trucking company decides whether they want to ship or not, while Uber charges the customer. The segment has already grown at an impressive rate, going from $1 billion in revenue in 2020 to $7 billion in revenue in 2022. However, it is worth noting that Uber Freights is available in just a few states and countries. As Uber scales Uber Freights, covering all US states and expanding to economies like Europe and Asia, I think the segment could become much more crucial to the company. As of 2022, it accounts for nearly a fourth of Uber’s revenue, while only being present in a handful of areas. As Uber continues to introduce Uber Freights to new areas, revenue is bound to meaningfully grow for the company. It is also worth noting that Uber Freight has had positive EBITDA for most recent quarters.

As companies become larger, their rate of growth generally tends to slow down. At least for some time, I believe that Uber will be an exception to this trend. Uber has room for significant growth, both in North America and worldwide. As of now, Uber is drowning out its competitors, especially in the rideshare industry. Lyft has been slowly losing market share, and this appears to be a trend that will be nearly impossible to reverse. In addition to losing customers, Lyft stock has been performing poorly, lessening the companies’ resources and ability to fight Uber for market share. I believe that Uber will continue to take market share at a fast rate from struggling Lyft, accounting for considerable growth for the company. Uber Eats experienced 14% growth in revenue YoY, which is not growth as rapid as in Uber’s other segments, however it still shows that Uber is benefiting from the expansion of the food delivery market. Additionally, Uber’s strong financial position and brand name places the company in the perfect position to succeed worldwide the same way it is succeeding in the US. Being the rideshare company with the largest worldwide presence, it will absorb a significant portion of the rapid international growth that the rideshare industry will face. The company still has room to grow rapidly, as it still has a part of the US market to conquer, and it will be the main benefactor of worldwide increased demand for its services.

Partnership with Domino’s

After a long holdout, Domino’s (DPZ) has finally decided to sell its food on a third party platform. In July 2023, Domino’s announced its partnership with Uber, in which Domino’s agreed to make Uber the first and only third party platform where it is listed. I believe that this kind of partnership is extremely valuable for Uber, creating additional revenue, and further establishing the company as a leader in food delivery. Domino’s is the biggest pizza company in the US, and it generates billions in revenue, with a staggering 90% of over $4.5 billion coming from digital orders. I think that this type of partnership provides Uber with a sense of exclusivity, as customers that are stuck between choosing to mainly use Uber Eats or DoorDash, for example, might favor Uber because it lists restaurants that competitors do not. In order for impact to be maximized from exclusivity, I think Uber needs a few large companies that only partner with them, leaving customers no choice but to use Uber for orders to those restaurants, increasing the chance of those customers using Uber regularly. Additionally, this type of partnership provides Uber with additional revenue, bringing Domino’s enjoyers to the app and taking a share of the billions in digital revenue that Domino’s accumulates every year. I believe that Uber is headed in the right direction with this partnership.

Car top advertising

Uber is attempting to supplement revenue from its rideshare service by providing cars with car top advertising. Uber has been attempting to grow revenue from advertising, providing different forms of advertisements and aiming to reach a billion dollars from advertising in 2024. While I do not believe that there is anything inherently wrong with Uber’s car top advertising, it is a miniscule part of the business. Uber has to pay drivers high fees for them to install the ads, as well as additional payment for each week that they drive with the ads installed. This initiative has yet to fully expand, with Uber car top advertising being present at a small degree in only a handful of cities. Despite the low amount of revenue that this initiative is providing Uber, it is still a nearly risk free way of additional revenue, which has significant potential for expansion.

Valuation

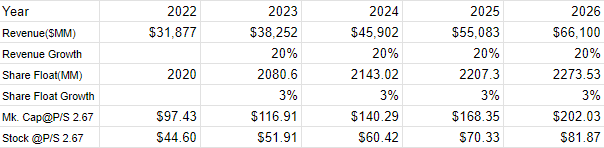

Due to Uber’s inconsistent free cash flow, a DCF valuation will not paint a complete picture, which is why it is best to utilize Uber’s price/sales ratio (P/S). Uber’s P/S is currently around 2.67, which is acquired by dividing Uber's stock price of $44.60 by Uber's Sales per Share of around $16.7. While Uber’s revenue growth fluctuates each quarter, it has recently been extremely high, with some quarters reporting growth rates over 100%. For Uber’s two most recent quarters, there was a growth rate of 29% and 14%. Considering Uber’s recent revenue growth, I am going to assume an annual growth rate of 25% of the company, which is not extremely conservative, but is also much less than recent growth (82% growth from 2021 to 2022). Another assumption I will make is that the company’s share float rate is going to be 3%, which roughly represents what the rate has recently been for the company.

Macrotrends

Seeking Alpha

Using Uber’s forward P/S ratio of 2.67, I came up with an intrinsic price of around $51.91 for the time that earnings come out for the year 2023. Using the forward P/S ratio of 2.67, I came up with a valuation of $81.87 for 2026.

ESG

In addition to having strong qualitative and quantitative reasons that make Uber a strong buy, the company is also a sustainable investment. The company has increasingly been making various ESG factors central to its business. So far in 2023, 77 million emission free trips have been taken through Uber. 31 million unique riders had the opportunity to drive electric cars and Uber increased the number of active EVs 3.5x YoY. Additionally, Uber Green, Uber Comfort Electric and/or Uber Planet are available in over 200 cities worldwide. Uber also fulfilled 11 different anti-racism commitments and there was a 1.5% increase in underrepresented people in leadership. Out of over 32 thousand employees, 84% are proud to work at Uber and are passionate about the company’s mission. Also, Uber’s board is made up of 40% females whereas the average S&P 500 company’s board is made up of 32% females and their 30% of their board members are minorities whereas the average for a S&P 500 company is only 22%. Uber has supported its employees during difficult times, with 74% of Uber’s employees reporting that they used income from Uber as a supplement to cover their necessities.

Risks

The biggest risk that Uber faces is fierce competition. Although they have established a more dominant position in the rideshare market, at least in the US, the food delivery and freight markets are still very competitive. In order to improve their position in the two markets, I think Uber will likely have to continue to invest much more, which will make it harder for the company to continue turning profits. If Uber is unable to obtain a better position in the two markets, it will likely upset shareholders by having to continuously dedicate billions to competition, worsening the financial health of the company.

Debt

Uber has around $9.2 billion in long-term debt, which comes with some risk, however it is manageable considering the company's solid balance sheet. It is worth noting that Uber has around $6.4 billion in cash, which leaves only around $2.8 billion in net debt. However, Uber's biggest problem with its debt is likely the high interest rate attached to it. Uber's effective interest rate on its debt is 5.48%, a figure much higher than its competitors. Uber currently has $1.433 billion in debt due in 2025, leaving the company little time to pay off this part of its debt.

As inflation has drastically fallen, reaching just 3% in June, interest rates are also expected to soon follow. Interest rates are expected to have peaked, or at least be very near to the peak, and are expected to begin to drop, most noticeably during 2024. With this in mind, I see Uber waiting for interest rates to eventually drop before refinancing the debt it owes in 2025. Most of Uber's other debt is due a long time from now, with its next due date being in 2027, leaving the company more time to refinance the debt during a more desirable time period.

Conclusion

In my view, Uber is a solid company with a bright future ahead. Ever since its IPO, the company has grown in valuation over 4 times and has consistently increased its revenue drastically. In the US, it controls a majority of the rideshare market, owning almost 3x the market share of its biggest(and virtually only) competitor. It is expected that the rideshare market is bound to experience drastic growth, much of which will be absorbed by Uber, as it is the rideshare company with the biggest worldwide presence. Additionally, the possibility of utilizing self-driving vehicles can be revolutionary for Uber. The company would be able to multiply its revenue from this change, making it significantly more profitable and overall successful. It is also worth noting that its freight segment has potential for massive growth, further improving the company’s financials. For the reasons stated above, I believe that Uber stock is a buy.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Recommended For You

Comments (1)