Robinhood: Rebounding Alongside The Markets

Summary

- Robinhood is making a strong comeback in 2023, with rebounding market values and higher interest rates fueling profitability.

- The company is attracting new users and experiencing healthy net deposits, despite a dip in trading frequency.

- It crossed the GAAP profitability threshold for the first time in Q2.

- New features like 24 Hour Market are designed to appeal to frequent day traders and hopefully boost transactional income alongside higher net interest income.

Spencer Platt

Once the frenzied trading activity of the pandemic was over, a lot of investors assumed that Robinhood would be left for dead. After all, what was Robinhood (NASDAQ:HOOD) if not the province of retail investors, meme-stock chasers and day traders?

And yes, while Robinhood did suffer throughout most of 2022 as equities fell and interest in cryptocurrencies sharply waned, the millennial-oriented brokerage firm is showcasing a strong comeback in 2023. Alongside rebounding market values and higher interest rates fueling juicy net interest income, Robinhood has also pared down its cost structure, allowing the company to generate levels of profitability it hasn't reached before.

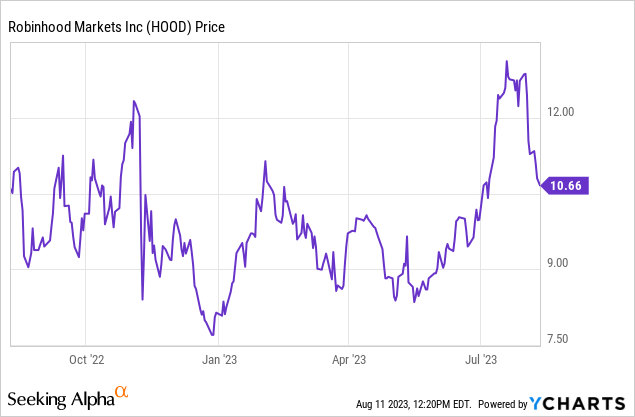

Though investors panned Robinhood's latest Q2 earnings print, I think the company showed fantastic progress toward recovering its revenue base and showcasing the heft of its bottom line. Year to date, Robinhood stock is still up more than 30%, and I think there's plenty of steam left to go in this rebound.

I continue to be bullish on Robinhood and recommend adding more to your position on dips. I'm encouraged by the fact that Robinhood continues to add new users, and net deposits are on a healthy trend as well. Though trading frequency has dipped (especially in the cryptocurrency segment where Robinhood historically earned very high spreads), the lost transactional revenue is being made up for by high net interest income as well as sturdy options activity. Long term, I continue to see Robinhood taking market share from legacy brokerages - especially as its clean, simple UI and gamified aspects make it easier for beginner investors to wade into the markets.

As a refresher for investors who are newer to Robinhood, here is what I see as the core bullish drivers for the company:

- Robinhood is dominating in the millennial/Gen Z demographics that will soon overtake the bulk of worldwide wealth. Traditional brokerages are still catching up to Robinhood's popularity. Market cycles have always occurred and will continue to occur; there will be periods of frenzied trading and there will be periods of calm. But over the arc of time, Robinhood's share of market activity will grow.

- Product innovation never stops. Part of what makes Robinhood so appealing is that it's often first-to-market (or at least, first to popularize) many new key features. Crypto trading, cash advances, and easy access to low-cost margin were some of Robinhood's key defining advantages. Retirement accounts will help to attract an even wider pool of assets to Robinhood.

- Diversified revenue streams. When interest rates were low and cash was cheap, Robinhood benefited from buoyant market activity. But now, as interest rates have shot up and put a chill over trading volumes, Robinhood is benefiting from higher interest spreads. Put in other words, Robinhood has now navigated through a recessionary cycle and has proven itself capable of sustaining.

- Profitability in mind. When trading volumes were high in 2021, Robinhood generated positive adjusted EBITDA every quarter. Amid the current trading crunch, the company is making targeted structural adjustments to its workforce to enable it to maintain profitability going forward. While the down cycle in the markets won't last forever, the belt-tightening and operational discipline that Robinhood is exercising now will certainly sustain. The company has crossed into the GAAP profitability threshold.

In my view, the post-earnings dip is a great time to build up or add to a position in Robinhood. The trends that we've seen play out in Q2 - building net deposits, higher interest income, the first signs of GAAP profitability - will continue to be tailwinds for Robinhood in Q3 and beyond, providing ample catalysts to stage a comeback.

Q2 download

Let's now go through Robinhood's most recent trends in the second quarter in greater detail.

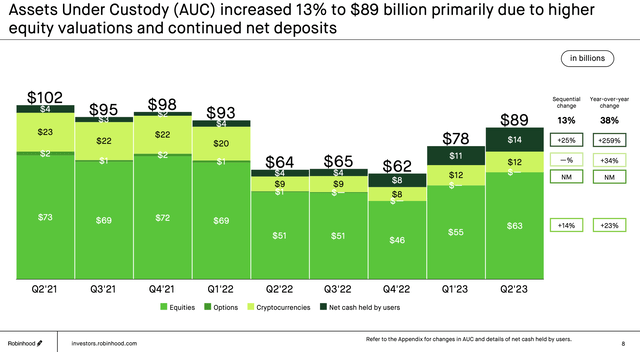

First: it's worth noting that Robinhood's assets under custody has continued to grow after bottoming out in 2022. Total AUC grew 13% sequentially and 38% y/y to $89 billion:

Robinhood AUC (Robinhood Q2 earnings deck)

Higher market valuations, of course, are the key driver behind the 23% y/y growth in equities. But it's also worth noting that Robinhood users are also holding much higher cash than they have historically, up to $14 billion (+259% y/y). Net deposits in the quarter were $4.1 billion, up 21% y/y, and the company also added 70k net-new funded accounts in the quarter to end at 23.2 million.

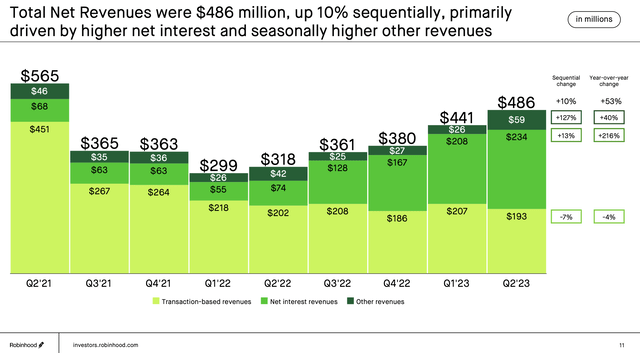

Revenue, in turn, grew 10% sequentially and up 53% y/y (albeit against a very weak first half of 2022). Transactional revenue declined, but net interest revenue soared more than 3x y/y and 13% sequentially to $234 million, nearly half of Robinhood's overall revenue base.

Robinhood revenue trends (Robinhood Q2 earnings deck)

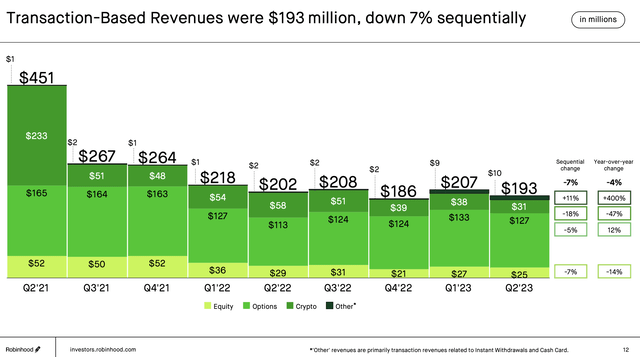

In the transactional revenue space, which is now worth less than net interest income (hence the growing importance of Robinhood's ability to attract deposits and new accounts), options activity was the standout, growing 12% y/y - while equity trading, never a big revenue contributor, declined -14% y/y.

Robinhood transactional revenue detail (Robinhood Q2 earnings deck)

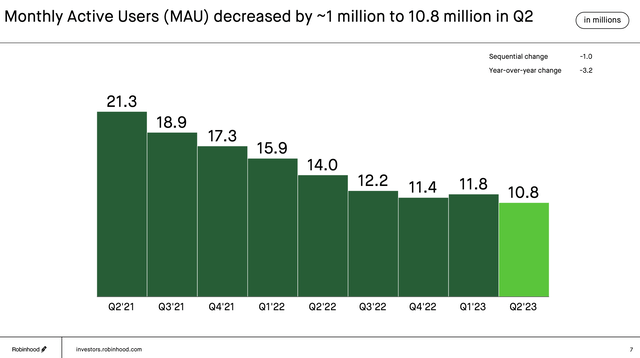

In a telling sign of how day trading activity has weakened significantly since the pandemic, the company's MAUs dropped to a multi-year low of 10.8 million in the quarter, 1 million less than in Q1:

Robinhood MAU trends (Robinhood Q2 earnings deck)

Here is commentary from CEO Vlad Tenev's prepared remarks on the Q2 earnings call, detailing how the company is working to rebuild its active trader base:

Now let's discuss active traders. As you know, over the past year, we continue to aggressively ship products and features to make Robinhood the best destination for active traders. These include advanced charts, cash accounts, strategy builder, stock screeners and, most recently, Robinhood 24 Hour Market.

With 24 hour market, we are the first US retail brokerage to offer 24/5 trading of single name stocks. We finished the rollout to 100% of our customers in July and we love the early uptake we see. We've seen strong volumes in our extended hours offering, particularly during earnings season, and Robinhood 24 Hour Market makes it even easier for customers to trade whenever they want. We're excited to continue to expand the selection of names we offer, and we will be adding nine more tickets quite soon, bringing our total to 52.

As we continue to enhance the experience for active traders, we're seeing our market share of retail trading grow. Last quarter, I mentioned that we were happy with the trajectory that our options trading product was on. We were starting to turn more of our attention to our core equities business.

In addition to 24 hour market, we shipped several tools and enhancements for our active equities traders, including longer chart history, returns comparison tools, and our awesome new screeners and scanners. And just a few hours ago, we rolled out instant deposits and cash accounts to all users.

Customers love these improvements, and we're seeing that in our market share. In Q2, equity market share was up 15% from a year ago, and our options market share was up over 20% from a year ago. So far in Q3, our market share continues to move higher in both equities and options. And we're working on many more improvements that we can't wait to share with customers."

This being said, given the fortunate circumstance of high interest rates, Robinhood is relying less and less on frequent trading activity to generate revenue.

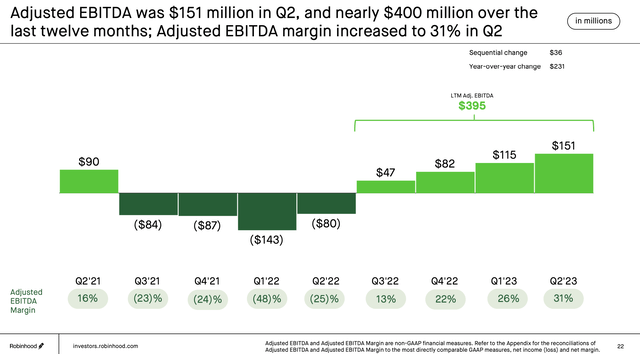

Net interest income strength has also cascaded nicely into the bottom line, where Robinhood hit a $151 million adjusted EBITDA (31% margin) in the second quarter, a 56 point margin improvement year over year and five points of margin accretion sequentially.

Robinhood adjusted EBITDA (Robinhood Q2 earnings deck)

It's equally worth noting that Robinhood hit its first-ever GAAP profit of $25 million ($0.03 EPS) in the quarter, substantially beating Wall Street's expectations of -$0.01 EPS.

Key takeaways

With soaring interest rates fueling net interest income and profitability, and Robinhood continuing to draw in more net deposits and roll out features to appeal to frequent traders, there are plenty of catalysts for the company to rely on for a sustained rally. Stay long here and buy the recent dip.

This article was written by

Analyst’s Disclosure: I/we have a beneficial long position in the shares of HOOD either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.