Warner Bros. Discovery: A Shareholder Aligned Media Powerhouse

Summary

- Warner Bros Discovery has likely recovered from peak spin-off selling pressure, but still offers a good risk/reward profile trading at a discount to our estimate of a $26/share fair value.

- The marketing power behind the release of the Barbie movie showcased the synergistic power of WBD's media assets, with over $1 billion of global box office sales in 3 weeks.

- WBD's executive team appears to be well aligned with shareholders, with significant stock holding requirements and majority performance-based compensation.

Gareth Cattermole

Executive Thesis

Warner Bros Discovery (NASDAQ:WBD) has been having some growing pains. As many spin-offs do, it has experienced immense selling pressure from its initial trading price of around $25/share and traded as low as $9.50 in December 2022. This rapid decline was likely from AT&T (T) investors who were primarily interested in dividends, discarding the stock. Despite the more recent recovery, I believe the current stock price still provides an interesting risk/reward profile and estimate the shares to be worth approximately $26 using what I believe to be a conservative DCF model. The company appears to be well aligned with shareholders and is just starting to show the synergistic power of its media assets with the summer of Barbie.

Marketing Power

It sounds a little bit ridiculous on paper, but the marketing power surrounding the release of the Barbie movie pushed me over the edge into purchasing shares of WBD. I have been on the fence here, as also owning shares of Paramount (PARA) puts me at risk of being overweight media companies. On the most recent earnings call, Zaslav discussed the combined company's marketing power with the promotion of the movie, as shown below:

Over the last 6 months, every area of the company has played a part in promoting this great film. From the 4-part series, Barbie Dreamhouse Challenge on HGTV which premiered in the U.S. to 4 million viewers and was then broadcast across 146 countries to Food Networks' Barbie-themed Summer Baking Championship, to Turner Sports' sneak peek of the film during the NBA Eastern Conference finals, it has truly been a one-company effort.

Also on the call, Zaslav insists that the marketing effort actually didn't cost the company much money. It became a movement, and as it spread, other companies wanted to join in on the summer of Barbie, no extra marketing spend required. In 3 weeks, Barbie was able to gross over $1 billion at the box office, which is quite an impressive feat. I'm impressed how the company has been able to wield the combined assets of Warner Bros and Discovery so far, and am looking forward to the next Barbie type marketing effort.

Spin-Off Shareholder Alignment

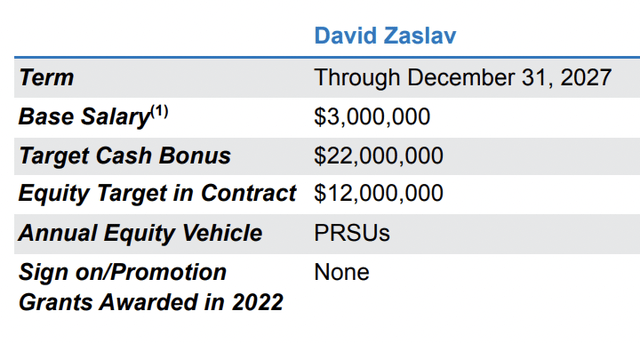

When Zaslav was running Discovery prior to the Time Warner merger, he was in the news for being one of the most generously compensated CEOs, with a package that totaled $246 million in 2021. Luckily for shareholders, this no longer is his current compensation, and the executive team appears to be aligned with shareholders based on their last schedule 14A.

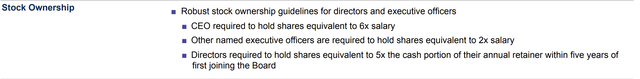

All executive officers and directors are required to hold a significant amount of WBD stock, with Zaslav having the largest requirement at 6x his salary. It's usually a good sign when executives are required to eat their own cooking. This is demonstrated below:

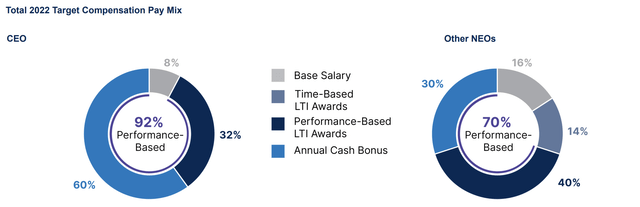

Also of note, the majority of executive pay is performance based, with Zaslav's portion being the most strict at 92% of compensation. The performance pay is based on shareholder accretive metrics including adjusted free cash flow, adjusted EBITDA, number of DTC subscribers at year-end and net revenue.

WBD 2022 Schedule 14A WBD 2022 Schedule 14A

Valuation

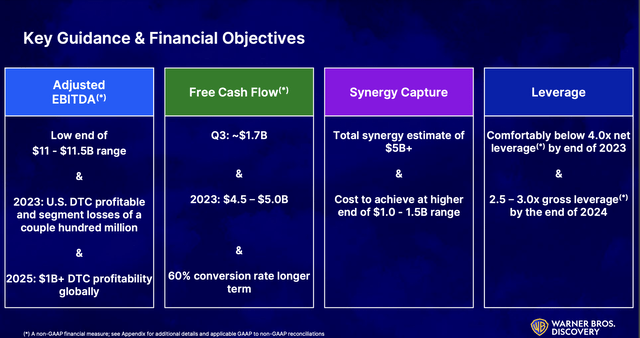

Below, you can see management's key guidance and financial targets over the next few years, as presented in its most recent earnings presentation.

WBD Q2 2023 Earnings Presentation

The company appears to be executing on its strategic goals by generating meaningful free cash flow and aggressively paying down debt. In Q2, $1.6 billion of debt was paid down, and the company also announced a tender offer for $2.7 billion worth of notes moving forward. As of Q2, the company had $47.8 billion in gross debt, and is anticipating a 2.5-3x gross leverage ratio by the end of 2024. If there are no changes in EBITDA, this would equate to $33 billion in gross debt.

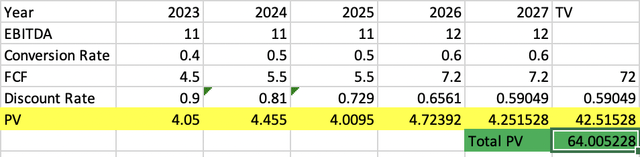

For my valuation model, I decided to make what I would consider relatively conservative estimates. I used a 10% discount rate, which is above the most recent reported average cost of debt of 4.7%. I assumed that the company would not be able to meaningfully grow EBITDA above $12 billion, and their FCF conversion rate would inch up to 60% by 2026. Since the company anticipates future DTC profitability and $5 billion in cost savings from merger synergies, hopefully these estimates are well below actual future performance. For terminal value, I also assumed no growth. These estimates can be visualized below, giving WBD an estimated value of $64 billion, or around $26 dollars per share.

WBD DCF ($B) (This Writer Estimates)

Of note, when studying the company, I also found it interesting that when AT&T acquired Time Warner in June 2018, it paid $108 billion when including net debt assumed from the merger. I think it's pretty compelling that the combined assets of Time Warner and Discovery can currently be purchased at an enterprise value of around $80 billion, or $28 billion less than what it cost AT&T for Time Warner alone. Granted, we are in a different interest rate environment and linear TV is in secular decline, this could still be argued to add to the margin of safety.

Risks

Debt

The company has significant gross leverage of $47.8 billion, with 23% of it or approximately $11 billion reportedly maturing in less than 3 years. This could significantly reduce shareholder returns over the years, as free cash flow will have to be used to aggressively pay down debt. Additionally, there is no guarantee the company will be able to service it moving forward. On the flip side, as the company pays down debt, shareholders' proportional interest in the likely valuable media assets of Time Warner and Discovery increases.

Lack of DTC Profitability

The DTC segment is not yet profitable, and has no guarantee of being profitable in the future. It also may not be as much of a cash cow as linear television was, so could fail to compensate for the decline. It is worth noting, though, that DTC has been trending in the right direction, with breakeven EBITDA reported for the segment in Q2 2023 compared to losing $600 million a year ago.

Sector Problems

It is not just WBD which is losing money on DTC, major competitors like Paramount and Disney (DIS) have been burning cash on a transformation, with the former cash flow negative and the latter with significant declines in free cash flow. The sector would benefit from either further consolidation which has no guarantee of achieving regulatory approval, or further bundling of DTC services like what was done with legacy media.

Writer's and Actor's Strike

The writer's and now actor's strike shows no clear signs of stopping, and the company will not be able to create content if this continues. The likely effect of this strike will also be increased costs for the company, which could further eat into shareholder returns. Interestingly, though, WBD reported a $100 million free cash flow benefit for the quarter from the cost saving. Hopefully, the strikes will allow the media competitors to discuss and reassess if it makes sense to spend as much as they were on content creation.

Conclusion

Though there is a fair amount of uncertainty surrounding the transformation to DTC, I believe the current depressed price of WBD stock provides a buying opportunity for long term shareholders interested in acquiring valuable cash generating media assets. With an estimated fair value of $26/ share using what I believe to be conservative estimates, I decided to purchase a position despite already owning WBD's competitor, PARA. I believe the success of advertising the summer of Barbie is a nice preview to the power of this recently combined media conglomerate. It also appears that executives are well aligned with shareholders, with the majority of pay being performance based and with requirements for holding multiples of salary in stock. I am hopeful that the DTC media sector will be able to find a path forward that is profitable to shareholders, whether that be through further consolidation, increased bundling of services, or reduced content spending.

This article was written by

Analyst’s Disclosure: I/we have a beneficial long position in the shares of WBD, PARA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Recommended For You

Comments (1)

If you really believe that is the way to think, then you need to go down this road also:You are estimating PV of all future FCF to be worth 64B. But all the money goes to both equity owners and debt owners. If you really want to do your DCF like that, then you have to pay the PV of the debt payment out of the FCF.

And we know the fair value of the senior notes are around 41.2B.

So the market says the PV of all debt is currently around 43B.

So your true estimate of the value of the equity of WBD is 64B-43B (the debt needs to be repaid out of FCF) = 21B

So your share price estimate is 21B/2.43B shares = 8.64.

So you are estimating the intrinsic value of the share to be 40 % lower than currect share price. Very inconsistent analysis. And not very smart to be long if you are believing your own estimates.