iShares Preferred And Income ETF: Long-Term Loser On Income And Price

Summary

- Preferred stocks offer higher dividend yields than common stocks, with yields of 4%, 6%, or even higher.

- The iShares Preferred and Income Securities ETF provides monthly dividend payouts, but its performance and dividend income have declined over time.

- Investing in PFF may not be a successful option for growth or income, especially for retirees on a fixed income.

designer491

Passive income gives freedom. Most investors start out with a small trickle of dividends. They have a few hundred or a few thousand in a retirement account or an investment account, and the dividends might be $10 or $20 a month. Once a portfolio gets to five or six figures, those dividends will reach three and four figures every quarter. Over time, the snowball starts to grow, picking up more shares that produce more passive income.

The goal for income investors is frequently to replace working income, which will mean a need for tens of thousands in passive income. It will likely take decades to build that up with an S&P 500 fund (VOO) that has a yield of 1.5%. Therefore, some investors might be tempted to chase yield to juice the amount of overall investment needed to build up the passive income needed to slow down or quit work altogether.

Preferred Stocks

One option for increased dividend yields is preferred stock. These investments are a bit of a hybrid. They pay out a fixed amount of interest like a bond, but they provide a slice of ownership in the company like a common stock. They received preferred treatment when it comes to receiving dividends. The company has to pay out dividends to preferred shareholders before paying any dividends to common stockholders. To entice investors, companies will offer higher yields on preferred shares. It's not unusual to see yields of 4%, 6%, or even higher.

There are some income-focused investors who look at preferred stocks. I've owned a preferred ETF in the past--Invesco's Preferred ETF (PGX). That fund dropped in price, and the dividends slowly declined over the period I owned the shares. However, PGX is not the only dividend ETF out there. iShares also offers a Preferred and Income Securities ETF (NASDAQ:PFF) that currently offers a yield of 6.88%.

Does PFF Make Sense?

So, does PFF make sense for an investor concerned with income? It definitely throws off income. One thing that can benefit those looking for regular income is the monthly payout the iShares fund offers. Every month, right around the 7th of the month, investors in PFF will receive a dividend.

The iShares preferred fund currently holds 464 different stocks. Most of the top holdings are made up of issues from financial companies that include JPMorgan (JPM) and Citigroup (C). Indeed, some of the shares held come from different preferred issues from the same company. Currently, 72.14% of the fund is made up of preferred stocks from the financial sector. Industrial offerings make up 15.24% of the fund, while preferred offered by utility companies make up 11.94% (as of August 9, 2023). Those three sectors make up more than 99% of the fund's holdings, which means that the fund could perform really badly if a replay of the financial crisis from 2008 and 2009 played out.

The fund charges investors a management fee of 0.46% annually. This is quite a bit higher than some of the index funds like those offered by low-cost brokers like Fidelity or Vanguard.

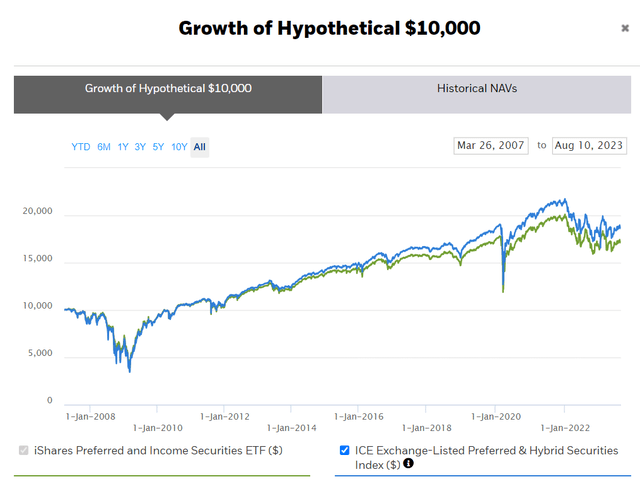

Since the fund's inception date, a $10,000 investment has grown to $17,240 (as of August 2). This is a positive return, but it's taken about 16 years to reach this total return of 74%, as the fund dates to April 2007. This is an average annual return of 3.39% since inception. This return trails the benchmark, which sits at $18,757. The benchmark the fund tries to mimic is the ICE Exchange-Listed Preferred and Hybrid Securities Index.

Growth of PFF Since Inception (iShares PFF Home Page)

While there has been some growth of PFF shown in this graph, the image supposes the investor reinvested all dividends. The goal of income-focused investors is usually to replace working income. Therefore, an investor who wanted to see a positive return would have to avoid spending the income their shares throw off each month.

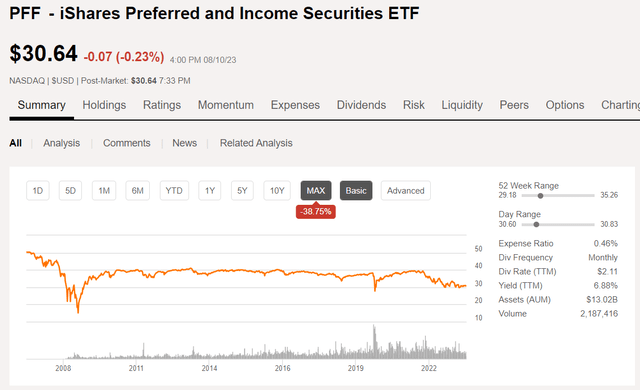

Without dividend reinvestment, the share price of PFF has actually lost money over the past 10 years, dropping by 18% over that period. Since inception, shares have lost 38.75% of their value.

Price Drop of PFF Since Inception (Seeking Alpha)

This price drop might be acceptable if there was dividend growth. However, the dividend has actually dropped over the entirety of the fund's existence. Despite a few increases over the past 16 years, the general trendline is downward.

Most of the payments in the 2007 and 2008 time frame were in the $0.21 to $0.23 range (although there was some variation). Some monthly payouts in 2009 and 2010 exceeded $0.30 per share per month. (Please note that a couple of December payments were well in excess of this range, but they were major outliers). Over the past couple of years, with one exception (again in December 2022), the payouts have been less than $0.20 per share, with the lowest monthly dividend coming in at just $0.11 per share.

Looking Forward

One of the main reasons investors will purchase is income. Over the past year, the Federal Reserve has rapidly increased the base interest rates. This means that banks have increased their rates for savings accounts and CDs. Some online savings options like PayPal (PYPL) and money market accounts like Vanguard's option (VMFXX) have yields that exceed 4%. In the case of the latter, the most recent 7-day average yield is 5.25%. Treasury I-Bonds currently yield 4.3%. These come with less risk than preferred stocks, which are traded on the open market, even though new preferred issues are likely to have higher rates as well.

If interest rates continue to stay at an elevated level (at least from a recent perspective), it's unlikely that the price of preferred stocks and funds like PFF will recover to higher levels. Indeed, if the Federal Reserve continues increasing interest rates, there will be increased downward pressure on preferred stocks. The most recent inflation report showed a slight uptick in the annual rate of inflation, which makes additional rate hikes more likely.

Conclusion

Those looking for monthly income will definitely get it from an investment in PFF. However, that dividend income is quite a bit lower than it was just a few years ago. This is not really a situation that retirees on a fixed income will want to find themselves in because purchasing power has dropped over time. PFF is not the only preferred income fund that's dropped. PGX, which has a history dating to early 2008, has dropped in price by 45% since its inception, although its 10-year return is slightly better than PFF's, coming in with a loss of 16.75% over that period (compared to a decline of about 18% for PFF).

Additionally, unless an investor reinvested most of their dividends, their investments would actually have lost money. This is generally the case for short-term and long-term investors, although the actual results would vary based upon when the investment was made. This seems to be a losing proposition on the growth front as well as the income front. Investors who want to limit volatility might make an investment in a fund like PFF, but otherwise, it's not been a successful option.

This article was written by

Analyst’s Disclosure: I/we have a beneficial long position in the shares of VOO either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

I am not an investment professional. The preceding is intended for informational and educational purposes. Please make sure to perform due diligence before investing in equities, as losses up to all capital invested can occur.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.