ZROZ: PIMCO Fund Is A Big Bet On A Deflationary Bust

Summary

- ZROZ from PIMCO is an ultra-long duration bond ETF.

- The fund has been battered with the rising interest rates.

- We look at whether this would be a good play today with interest rates far higher than they were 2 years back.

- Conservative Income Portfolio members get exclusive access to our real-world portfolio. See all our investments here »

m63085/iStock via Getty Images

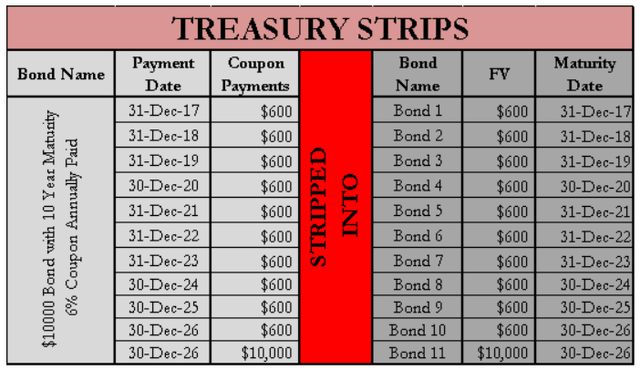

A US Treasury Bond pays interest at a fixed rate semi-annually and has a longer maturity period, unlike a Treasury Bill that matures in one year or less. When one of these bond issuances is broken down into individual securities by detaching the principal and the periodic interest payments, packaged and sold to investors, they are called "Separate Trading of Registered Interest and Principal of Securities" or STRIPS. These "mini-mes" of the US Treasury Bonds are sold to investors as zero coupon or discount bonds, with the par value only repaid at maturity. Interested parties have a wide selection of maturity dates to choose from for these STRIPS, enabling them to pick what suits their liquidity needs, akin to a bond ladder.

Being zero coupon, these securities are particularly vulnerable to interest rate risk as the bondholders gets the interest (in the form of appreciation in value to par) only at maturity. That exposes them to more gyrations in the bond value due to interest rate changes in the interim. On the other hand, they can sleep well at night with regards to reinvestment risk as they know the return that is locked in for the holding period. In case of a vanilla bond, an assumption is built into the yield to maturity or coupon that the periodic interest payments will be reinvested at the same rate, which rarely holds true. STRIPS are not subject to this uncertainty being zero coupon in nature.

Even though the interest is received on maturity on STRIPS, it is generally taxed when earned. Investors bypass this by holding these in a tax advantaged account. The government does not repackage the treasury bonds into STRIPS, so these are purchased from the financial institutions that does. Or, you could invest in a fund dedicated to these, like the one we will be discussing today, the PIMCO 25+ Year Zero Coupon U.S. Treasury Index Exchange-Traded Fund (NYSEARCA:ZROZ).

The Fund

ZROZ is a passive ETF that aims to match the performance of the BofA Merrill Lynch Long Treasury Principal STRIPS Index. The index is comprised of the STRIPS dedicated to the final principal repayment of the original government bond, and must have 25 years or more term remaining to maturity. At least 80% of the ETF's total assets are invested in the components of the index under normal market conditions, with the balance in cash or variety of securities achieve the same result, i.e. track the performance of the benchmark. These securities include investment grade, liquid short-term instruments, and derivatives such as options and futures, among others. ZROZ does not replicate the index, instead it applies representative sampling. PIMCO explains this method in its summary prospectus.

In using this strategy, PIMCO seeks to invest in a combination of Component Securities and other instruments, or in Component Securities but in different proportions as compared to the weighting of the Underlying Index, such that the portfolio effectively provides exposure to the Underlying Index.

Source: Summary Prospectus

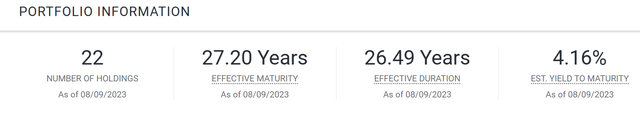

The most recent numbers show the ETF holding 22 securities with an effective maturity of 27.20 years at the portfolio level.

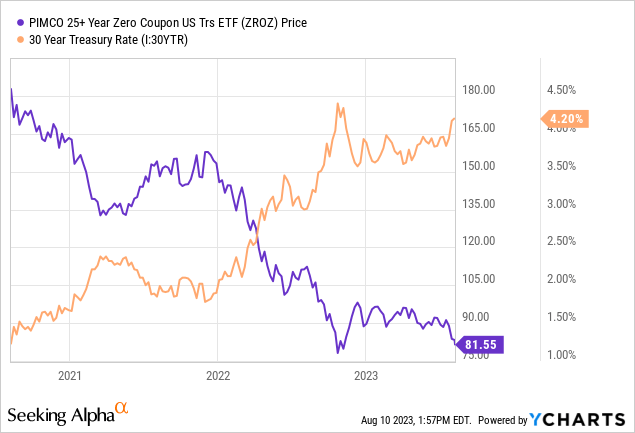

This metric takes into account the market value and maturity of each holding and weighs it in relation to the total value of the portfolio was is around $893 million. The effective maturity differs from the effective duration, which in ZROZ's case is 26.49 years. Duration represents the sensitivity of the portfolio to the changes in the interest rates. The two are inversely proportionate, that means in ZROZ's case, with the increase in 100 basis points in rates, the portfolio value would theoretically drop by 26.49%. The reverse would also apply. We have compared the price performance versus the changes in the 30-year rate below and the inverse relation is almost picture perfect.

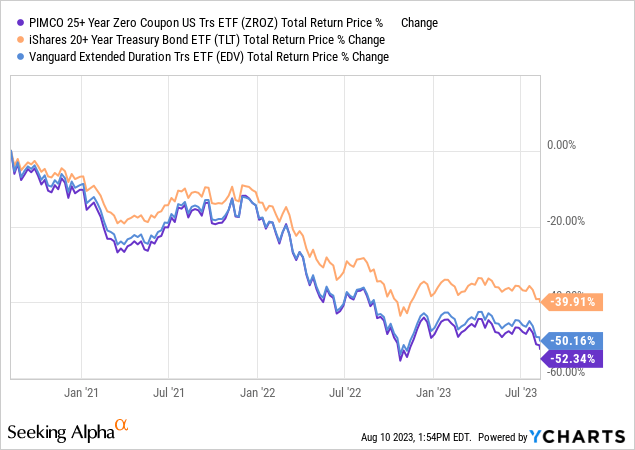

The relation between duration and price is not linear as we have factors such as convexity come into play. We can also see below that the total return of ZROZ has closely tracked the Vanguard Extended Duration Treasury ETF (EDV) which with an effective duration of 24.3 years is close to that of ZROZ.

Our protagonist is slightly more sensitive as it holds zero coupon bonds, and those have a higher exposure to interest rate risks as we noted earlier in this piece. We have also thrown in iShares 20+ Year Treasury Bond ETF (TLT) in this comparison mix to show the performance of a fund with a relatively lower duration. TLT's effective duration is 17 years.

Distributions

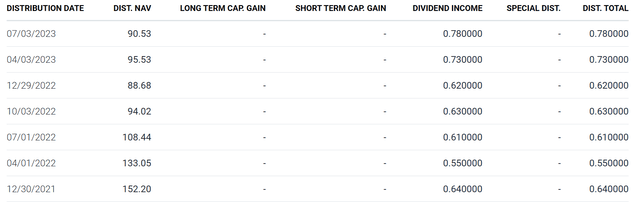

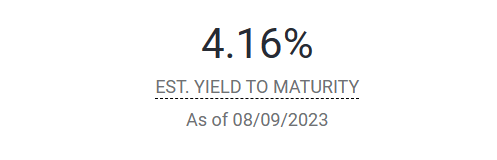

Collectively, ZROZ holdings have a yield to maturity of around 4.16%,

Fund Website

after taking into account the 0.15% in expenses, the ETF should be able to distribute around 4% to its unitholders. Based on its last quarterly distribution of 78 cents, it is yielding around 3.82%. So there is room to increase the payouts to its investors and we can see that from overall uptrend in the last few payments.

Verdict

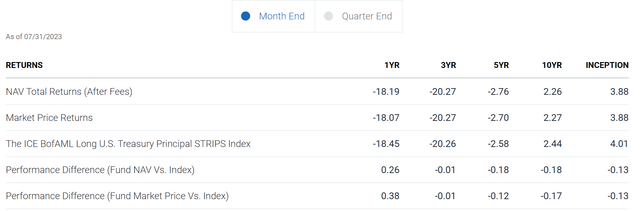

As noted previously, the annual expense charge of 0.15% is insignificant enough that it does not materially impact ZROZ from pursuing the returns of the benchmark. We can see that in the annualized performance available from the fund website.

Since inception, the difference between the benchmark and the fund performance has been about 13 basis points which would qualify as excellent tracking. So if you want the long bond exposure, this is a great fund for it. Now whether you want that exposure is a bigger question.

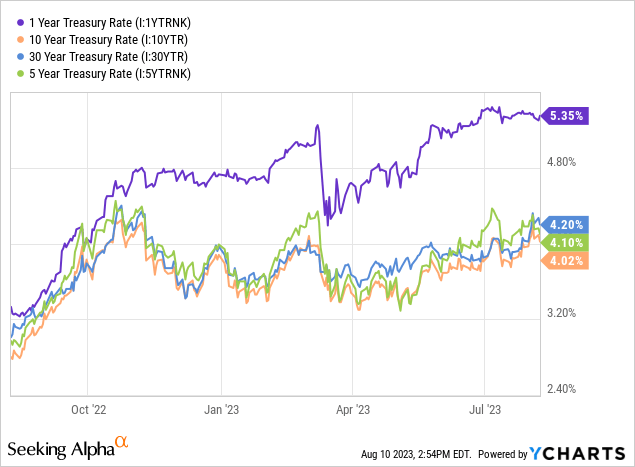

Sure, bond yields are higher today than what we saw in 2020 and 2021. But the big part of the story today is that you really have to give up a lot of current yield to lock-in those long term rates. For example, 1 year Treasuries yield 5.35%. So to dive into 30 year bonds, you have to immediately sacrifice 1.15% of yield.

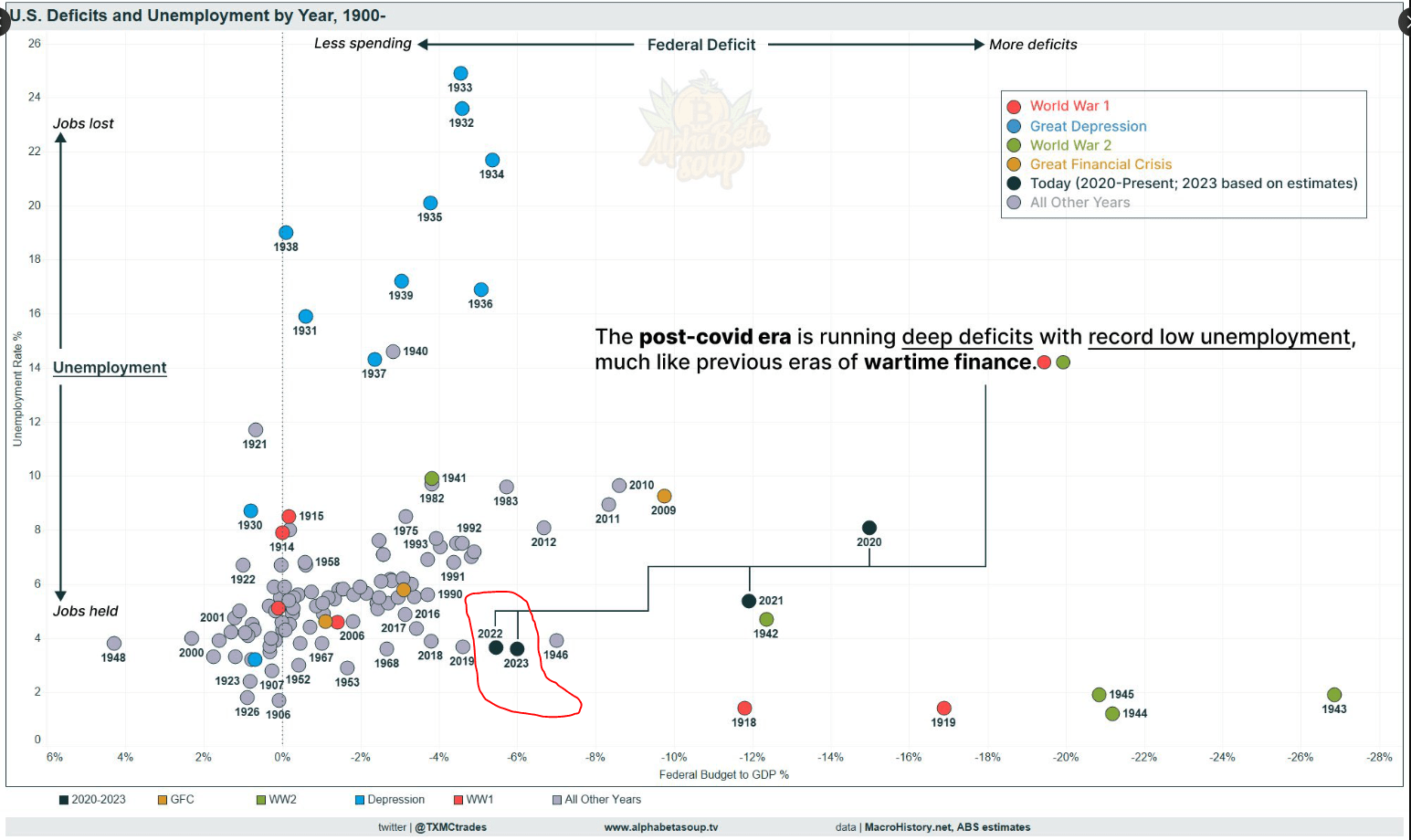

Yes, interest rates can be cut down the line and if we have a massive deflationary bust, the long-dated bonds would do well. The flip side is that we have never run such horrible deficits with unemployment so low.

Twitter

So there is an avalanche of supply of bonds and that supply will increase in a recession. Do you really want to lock-in 30 year rates near 4.2% with that dynamic? We know our answer, tell us yours in the comments.

Please note that this is not financial advice. It may seem like it, sound like it, but surprisingly, it is not. Investors are expected to do their own due diligence and consult with a professional who knows their objectives and constraints.

Are you looking for Real Yields which reduce portfolio volatility? Conservative Income Portfolio targets the best value stocks with the highest margins of safety. The volatility of these investments is further lowered using the best priced options. Our Enhanced Equity Income Solutions Portfolio is designed to reduce volatility while generating 7-9% yields.

Give us a try and as a bonus check out our Fixed Income Portfolios.

Explore our method & why options may be right for your retirement goals.

This article was written by

Conservative Income Portfolio is designed for investors who want reliable income with the lowest volatility.

High Valuations have distorted the investing landscape and investors are poised for exceptionally low forward returns. Using cash secured puts and covered calls to harvest income off value income stocks is the best way forward. We "lock-in" high yields when volatility is high and capture multiple years of dividends in advance to reach the goal of producing 7-9% yields with the lowest volatility.

Preferred Stock Trader is Comanager of Conservative Income Portfolio and shares research and resources with author. He manages our fixed income side looking for opportunistic investments with 12% plus potential returns.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.