BGR: Big Oil At A Discount

Summary

- BlackRock Energy & Resources Trust has put up a relatively better performance on a YTD basis compared to XLE due to its mostly flat performance.

- BGR employs a covered call strategy to dampen volatility, but energy is a cyclical sector and will lead to a volatile fund regardless.

- BGR offers exposure to big energy names and is currently trading at a discount, making it an enticing investment opportunity.

- This idea was discussed in more depth with members of my private investing community, CEF/ETF Income Laboratory. Learn More »

ipopba

Written by Nick Ackerman, co-produced by Stanford Chemist.

BlackRock Energy & Resources Trust (NYSE:BGR) is a closed-end fund that has been able to outpace its straight, passively managed peer, Energy Select Sector SPDR (XLE), on a YTD basis. A solid discount on a portfolio heavily weighted toward oil majors provides a compelling option for investors.

Energy has cooled off in 2023 after having a solid rebound from the Covid pandemic lows when the sector was crushed. Besides positioning differences between BGR and XLE, the fund also employs a covered call strategy on its underlying portfolio. That can help dampen a bit of volatility; however, energy being such a historically volatile sector means that it still wouldn't be appropriate to call this fund conservative by any means.

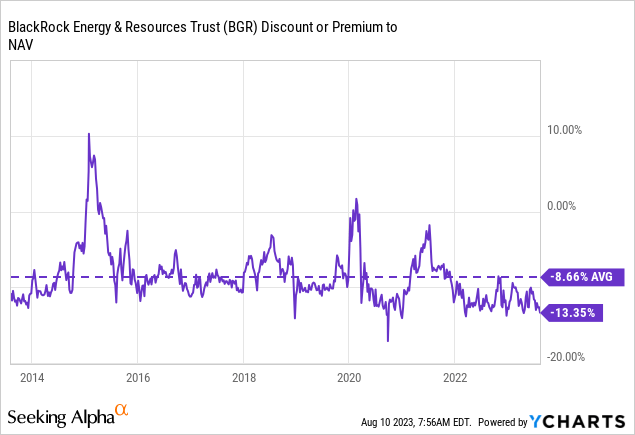

With that being said, this fund offers investors exposure to big energy names and currently offers an enticing discount. The discount on the CEF level is trading well below its historical discount.

Since our last update, the fund has underperformed the broader S&P 500 Index, and most of this has to do with energy itself being weaker overall.

BGR Performance Since Prior Update (Seeking Alpha)

The Basics

- 1-Year Z-score: -1.35

- Discount: -13.35%

- Distribution Yield: 5.94%

- Expense Ratio: 1.26%

- Leverage: N/A

- Managed Assets: $403.35 million

- Structure: Perpetual

BGR's investment objective is "to provide total return through a combination of current income, current gains and long-term capital appreciation." To achieve this, they will "under normal market conditions, invest at least 80% of its total assets in equity securities of energy and natural resources companies and equity derivatives with exposure to the energy and natural resources industry. The Trust may invest directly in such securities or synthetically through the use of derivatives. The Trust utilizes an option writing (selling) strategy to enhance dividend yield."

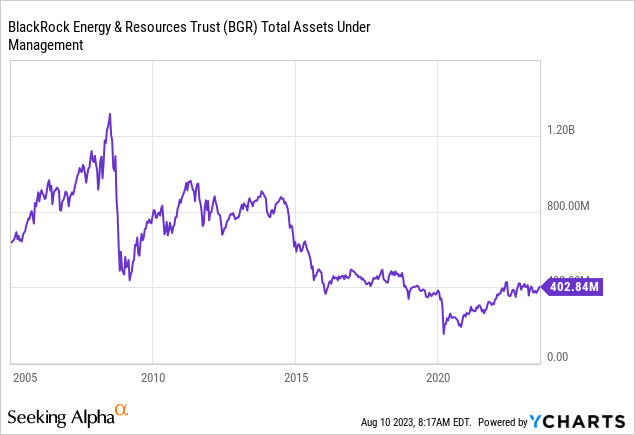

The fund is a decent size, and that was actually helped out with significant rebounding in the last two years in the energy space. However, it's still much smaller than it was when it initially started. This was driven by an incredibly tough period for energy while most everything else was rallying.

Ycharts

Performance - Attractive Discount

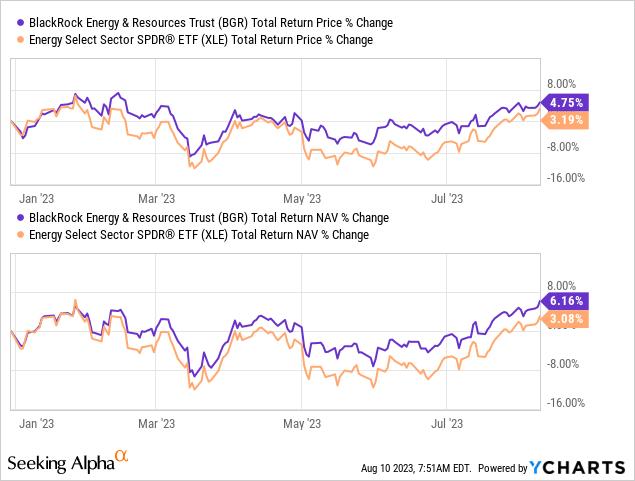

On a YTD basis, BGR has been able to outpace its straight, passively managed, vanilla ETF counterpart XLE. One of the reasons this can happen is due to the fund's options strategy generating additional option premiums that can soften a bit of downside or add to gains when a sector is fairly flat. For the most part, I'd say XLE has been mostly flat at this point though XLE was down fairly materially just a few months ago. Besides the additional covered call strategy, portfolio positioning will, of course, also play a strong role in the outcome of each fund, too.

Ycharts

As with anything in investing, though, there are pros and cons to each strategy. While BGR can deliver fairly solid results and even outperform in a flat or down year, during raging bull markets, BGR will underperform its XLE counterpart.

This is because XLE is unconstrained from the upside cap that can come from writing covered calls. If energy names are running higher, then chances are BGR could be writing calls that they'll either have to close for a loss, or they'll have just to let the position get called away at a price potentially less than the current market price.

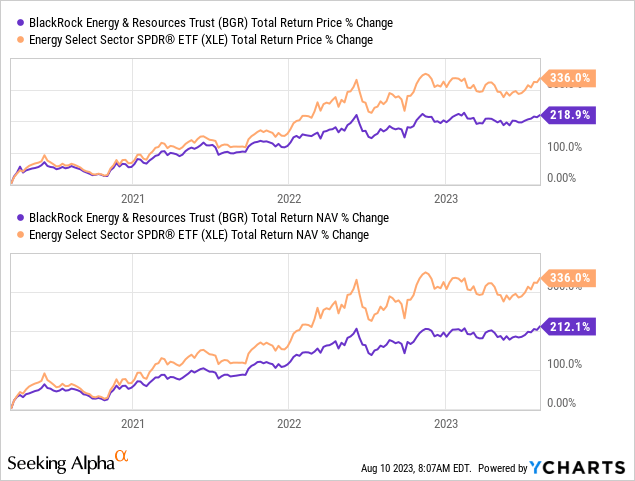

We can look at the period from March 23, 2020, to date. This period comparing BGR and XLE gives us a glaringly obvious example of the cons of this strategy.

Ycharts

For 2022 alone, when energy was up 65.7%, their written options resulted in a loss of around $20.4 million to the fund, or what was the equivalent of 6.5% of the fund's managed assets at the start of the year. What we don't know, though, is that the cost of closing these positions could have been offset by keeping the positions to continue their run higher.

As of the end of July 2023, the portfolio was overwritten by 32.48%. A higher overwrite could indicate more bearishness, as a lower overwrite of the portfolio could indicate more bullishness.

With all that being said, if one is incredibly bullish on the energy sector, BGR should actually be avoided. If you are more or less neutral on the sector or just uncertain in the short term, then BGR could be the more conservative play.

The other appealing part of this fund is the discount, though. The discount since our last update has narrowed a bit when it was at 14.35%. The fund's 1-year z-score has also narrowed from -2.18 to the latest -1.35. Of course, this happens when the fund's discount narrows. However, the fund's discount has been wider now in the last year than it had been previously. As the fund's discount stays wider, this would continue to push down the average discount in the last 1-year period.

The current discount still represents a fairly compelling argument that adding at this level could mean limited discount widening from here. Thus, that should provide some margin of safety when investing in this volatile space and lead to potential further discount narrowing for further potential upside.

Ycharts

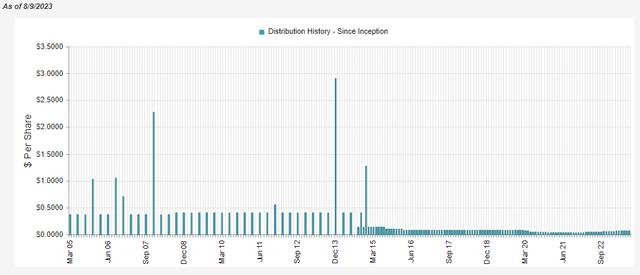

Distribution - Rebound Leads To Distribution Hikes

Similar to how the size of the fund has shrunk over time, the fund's distribution has also shrunk over time. However, that has also been reversing as energy has been a strong performer since the Covid collapse. They had also initially started out as a quarterly payer before going monthly around 2014.

BGR Distribution History (CEFConnect)

The fund would still have a long way to go before reaching pre-Covid distribution levels, and I suspect it never gets there. That being said, the fund's NAV distribution rate of 5.43% is quite low and, I believe, leaves plenty of capacity for further increases from here.

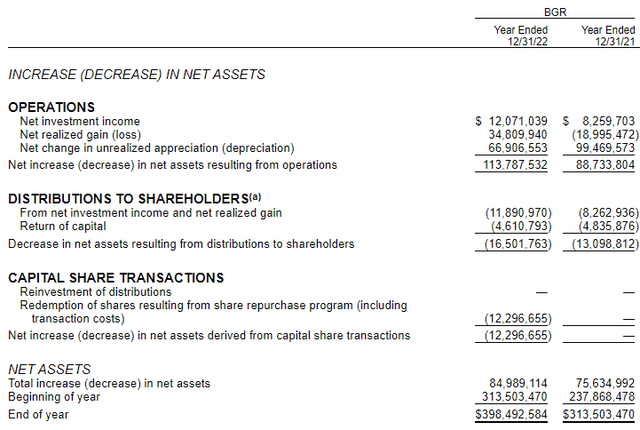

BGR, similar to other equity funds, will still require capital gains to fund their monthly distribution to shareholders. That is even though the actual NAV rate is low. That being said, the fund's net investment income did rise materially in the last year. This isn't a leveraged fund, so they haven't had to grapple with higher borrowing costs compared to its leveraged CEF peers.

BGR Annual Report (BlackRock)

The fund had plenty of realized gains and plenty of unrealized appreciation in its portfolio last year to fund its payout. That was despite the drag on realized gains when losing $20.4 million due to their options writing.

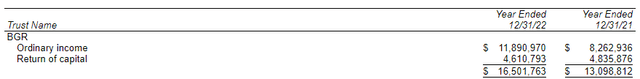

Despite the massive gains in the last year, the fund still had a portion of its distribution classified as return of capital.

BGR Distribution Tax Classification (BlackRock)

This brings up an excellent point of discussing why tax distribution classifications that show ROC shouldn't send an investor running for the hills immediately. It can indicate not earning its distribution, but that was clearly not the case for this fund at all in 2022. Even 2021 was an amazing year. And even if 2023 ends strong, as it has been trending now, we are very likely to see ROC still going forward.

The reason for this is not only because they hold some energy names that will distribute out their own ROC distributions that get passed through BGR to its own shareholders but because BGR is sitting on a pile of carryforward losses. At the end of 2022, BGR had a total of almost $240 million in non-expiring capital loss carryforwards.

These are due to the substantial losses experienced in the prior years that can be used to offset gains going forward. This is actually quite positive for current investors because ROC distributions defer tax obligations by reducing your cost basis rather than being taxed in the year received.

BGR's Portfolio

BGR was fairly active in the last year with a turnover of 76%, topping the 61% seen in 2021. These amounts were over the average of 51% turnover seen in the last five years. That doesn't always translate into meaningful changes in top positions for a CEF. This is mostly the case for BGR, as its top positions saw some natural portfolio gyrations, but there don't appear to have been any drastic changes in most of the largest positions.

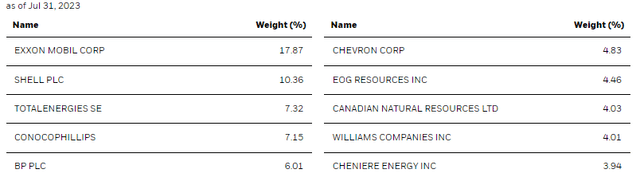

BGR Top Ten Holdings (BlackRock)

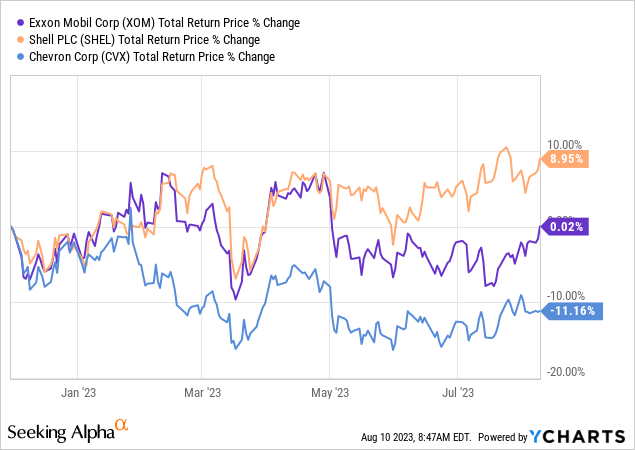

Exxon Mobil (XOM) still controls the top spot, and in fact, its weighting has further expanded since the 15.87% we saw previously. Shell (SHEL) has moved up to the second spot after expanding its weighting allocation from the 9.48% weighting, edging out Chevron (CVX), which was the second largest weighting previously. CVX saw its weight drop somewhat meaningfully from when it was at 9.62%.

SHEL overtaking CVX in terms of its weighting makes sense because, during the period since our last update, CVX has struggled while SHEL has blasted higher.

Ycharts

Interestingly, it would appear that XOM performed about flat during this period. This would suggest that the managers added to their position, which we see evidence of that occurring in the first quarter. At the end of 2022, BGR held 590,545 shares. By the N-PORT filing for the end of March 2023, the number of shares increased to 655,695. Unfortunately, BlackRock is not one of the fund sponsors that allows a full holding list that's more recent, showing a share count.

All this being said, the fund is relatively positioned similarly to how it was previously. The large integrated oil majors make up a major part of this portfolio. The top ten make up ~70% of the fund, with 24 total positions. The top five make ups nearly 50% of weighting alone.

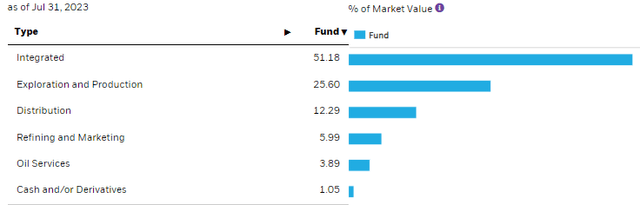

The large oil majors are relatively more conservative. At least, relatively speaking with what is a cyclical sector overall. E&P companies still make up a 25.6% weighting in the fund. Those names are relatively more volatile as they are more dependent on commodity prices directly.

BGR Energy Sub-sector Allocation (BlackRock)

Conclusion

BGR presents investors with a tempting discount while offering investors a solid portfolio of energy names. It is highly concentrated, but that isn't necessarily a negative if you are looking for exposure to mostly the largest integrated oil majors. They then apply a covered call writing strategy on the fund in an attempt to dampen volatility and produce options 'income.'

During strong bull markets, that can often lead to lagging results but can help provide returns even when the sector is flat or slightly lower. Thus, if you are highly bullish on the energy sector, BGR is not a good play. If you are moderately bullish or neutral, then BGR's discount and strategy could be a tempting play.

At the CEF/ETF Income Laboratory, we manage closed-end fund (CEF) and exchange-traded fund (ETF) portfolios targeting safe and reliable ~8% yields to make income investing easy for you. Check out what our members have to say about our service.

To see all that our exclusive membership has to offer, sign up for a free trial by clicking on the button below!

This article was written by

---------------------------------------------------------------------------------------------------------------

I provide my work regularly to CEF/ETF Income Laboratory with articles that have an exclusivity period, this is noted in such articles. CEF/ETF Income Laboratory is a Marketplace Service provided by Stanford Chemist, right here on Seeking Alpha.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of CVX either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Recommended For You

Comments (3)