UniCredit: Still A Buy Despite The Windfall Tax Hit

Summary

- The Italian government has decided to go ahead with a windfall tax on banks, causing shockwaves in the Italian banking sector as soon as the initial draft circulated.

- The draft is yet to sign into law, and the Finance Ministry has already been working on amendments. Based on the latest draft, the hit seems manageable.

- In the meantime, UniCredit has released a great 1H23 report, with profits significantly up YoY. Even after the windfall tax hit, the bank is still on track to outpace its profit guidance.

- At a 5.8x fwd P/E and 0.75x P/B, I rate UniCredit shares a buy.

RobsonPL

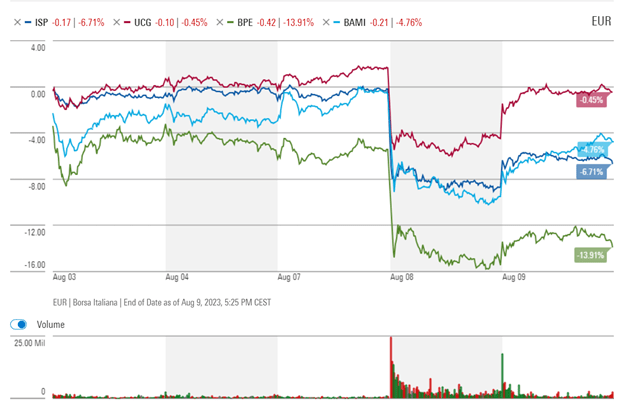

The date of August 8th will probably be one for the history books when it comes to Italian banking. In a seemingly extraordinary move, the center-right government of PM Giorgia Meloni approved a windfall tax on the country’s lenders, suddenly erasing about 10% from the market capitalizations of the listed ones on huge selling volumes. Even if UniCredit S.p.A. (OTCPK:UNCRY)(OTCPK:UNCFF) fared a bit better than other top banks Intesa Sanpaolo (OTCPK:ISNPY)(OTCPK:IITSF), BPER Banca (OTCPK:BPXXY) and Banco BPM (OTC:BNCZF)(OTCPK:BNNCY), none of them could be immune to the consequences of a new levy.

Morningstar

[Above graph shows corrections for the primary listings on the Italian Stock Exchange]

At the opening of the next trading day, however, all titles partially bounced back on the news that the Italian Finance Ministry was already working on amendments to the first draft, reducing the potential tax burden on the banks. But clumsy actions here obviously led to a market panic that, in my opinion, could have been partly avoided.

Here is why.

A foreseeable event

Those who follow me on Seeking Alpha and read my recent coverages of both UniCredit and Intesa Sanpaolo should have known that the government passing a windfall tax was likely. Pardon me for the vanity of quoting myself, but here is what I had to write on the matter in June and July:

[…] the risks remain elevated. In March, I discussed the possibility that the Italian government could implement a populistic measure like a mortgage payments jubilee to harm bank profits. While that particular risk seems very low now, Italian media has recently started reporting that discussions could be ongoing regarding levying potential surtaxes on bank profits (June 27th, 2023)

With Italian households holding up well to the increase in mortgage rates and banks showing record Q1 profits, Italian media is floating the idea that the government could instead impose a surtax on bank profits. (July 13th, 2023)

It is impossible to believe the sell-off came from the panic caused by this being a surprising event. Moreover, Italy was not the first country to go down this path. With Spain and Hungary already enacting similar laws, more countries in the EU could follow. In my view, the main problem was the irrationality of the initial government plans.

Tax what?

As divulged by the media, the initial plans looked at a 40% tax on extra profits reaped from higher net interest margins (NIM) in 2022 and 2023. The “extra profits” are defined as the yearly NIM increases exceeding 3% for 2022 and 6% for 2023 (subsequently revised at 5% and 10%). It is frankly worrisome how the Italian government seems at ease in deciding how much is a “normal” profit and how much is “extra” in a given year. What anchors such threshold of “exceptionality”? If the government wanted something done, I believe a simple raise of the statutory tax rate would have had far better optics.

The initial plan looked at capping the tax at “up to 25% of the book value of equity,” putting UniCredit and Intesa, the two biggest banks, (potentially) on the hook for over €10 billion each. In essence, there was no cap. Despite the Italian government claiming to be seeking to raise €2 - €3 billion, private sector experts quickly assessed the extra tax revenue would have been more than double that amount. According to JP Morgan (JPM) preliminary estimates, UniCredit could have ended up shelling out €0.8 billion relative to its FY23 results, and Intesa Sanpaolo €2.0 billion!

Fortunately, in the second circulated draft a few hours later, the cap methodology was revised to “0.1% of the net assets,” and a mini-rally followed. However, not all banks’ shares recouped the losses, with BPER bank suffering the worst consequences among the major names. Nevertheless, the new cap provides investors more clarity about the impact and a significant “discount” to the banks: the hit should not exceed €0.4 billion for UniCredit and €0.7 billion for Intesa. At the same time, under the revised limit, it would seem that the new tax could still raise the stated range of €2 - €3 billion.

Credibility at stake

Despite the (partial) U-turn, several of the most prominent Italian businesspeople quickly pointed out that the government is treading on thin ice with this measure, with the most critical ones, like Corrado Passera, CEO of Illimity Bank and former Italian Minister, openly questioning its credibility.

Indeed, the issue was also brought forward by Italian MP Alessandro Cattaneo, who commented that “Italy is at risk of losing all its [international] credibility” with this windfall tax.

Buy why did the government decide to come up with the tax? According to government sources, the tax’s primary purpose will be to fund relief measures for mortgage holders affected by the significant increase in variable interest rates. In other words, a bail-out for those who committed moral hazard in the first place. Italian banks have always offered fixed interest rates on mortgages, and only a few years back, prospective homeowners could lock in 20-30 years’ mortgages with a 1.5% fixed interest rate (or even less). But those who were opting for variable could pay less than 1%. The tide has turned, and those who bet on negative rates holding out forever lost. Game over? Not so fast, because the old socialist state mindset strikes again, putting the costs of reckless behavior on the collectivity.

While it is certainly within the prerogatives of any government to re-modulate its fiscal levers, I’d argue that to avoid spooking the markets, it is undoubtedly necessary to impose tributes that are not ill-conceived, are not set arbitrarily, and benefit those in need, rather than speculators who lost their bets.

How all this affects UniCredit

Against the challenging political backdrop, it is a real blessing that the private sector in Italy continues to thrive. More often than not, my first-hand experience with Italian companies showed me solid, well-run players, frequently superior in productivity to their EU peers. I often contemplate this might be economic Darwinism in action, these companies being survivors of a public system of bureaucratic oppression and fiscal persecution.

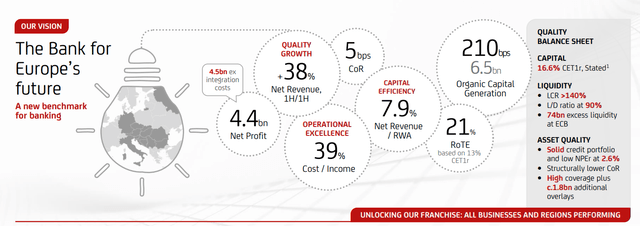

UniCredit is no exception. Under the leadership of Andrea Orcel, the bank has shifted gears and transformed itself into one of the best-performing financial institutions in Europe. The recent 1H23 numbers speak for themselves: 21% RoTE, 39% Cost / Income ratio, 16.6% CET1r, with low NPEr at 2.6% and ample liquidity coverage and loan/deposit ratios. These are undoubtedly strong numbers. To prove my point, let me compare them with foreign European banks (to some extent) operating in Italy. Dutch ING Group (ING) reported 1H23 Cost / Income of 54%, CET1r 14.9%, and RoTE 17.3%. French BNP Paribas (OTCQX:BNPQF)(OTCQX:BNPQY) 1H23 Cost / Income ratio stood at 64%, CET1r of 13.6%, and RoTE around 10%. Each bank has its own nuances, and three ratios are no substitute for a complete analysis. Still, there should be little doubt that UniCredit is firing on all cylinders and producing great operational results.

UniCredit 1H23 presentation

Exceptional 1H23 report, uncertain outlook

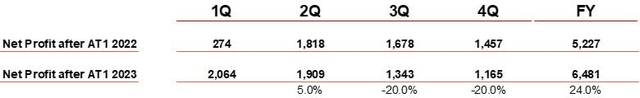

When I last covered UniCredit in June, the company still pointed investors to FY23 earnings of €6.5 billion. In my analysis, I tried to divide such results and suggested a potential quarterization that looked at a net profit of €1.9 billion in 2Q23 before a substantial drop in 2H23:

And Value For All - Jun23

At that time, I already knew the company was lowballing its guidance and explicitly said so, but I wanted to understand the implied YoY changes under such a scenario. After posting a Q2 profit of €2.3 billion, the net profit for 1H23 stands at €4.4 billion. UniCredit has modestly raised its FY outlook to “at least” 7.25 billion, implying H2 profits greater than €2.9 billion. With €3.1 billion posted in 2H22, the company seems again conservative by forecasting a YoY decrease-to-flat earnings in the back half of the year. Half of Q3 is already under the belt, and I believe UniCredit will once again post solid numbers vs. LY. The company earned €2.5 billion in NII in 3Q22, but I expect that figure to increase by at least €1 billion for the current year. That alone should be able to flow directly to the bottom line and boost 3Q23 earnings to €2.3 billion, roughly the same level as Q2.

The outlook remains, however, clouded for Q4: the EU manufacturing PMI readings aren’t great, with six consecutive declines already. Italy’s GDP decreased by 0.3% in Q2, and another negative quarter would officially signal a recession. UniCredit seems to be preparing to hit its guidance even in the face of an upcoming mild downturn, with the potential for higher provisions in Q4. Still, it would only need about €300 million in earnings to hit the guidance (LY: €1.5 billion even after new provisions for €0.5 billion).

Verdict: shares still relatively cheap

After running the numbers and modeling an additional €0.6 - €0.8 billion in provisions against non-performing loans and €0.44 billion for the windfall tax (the theoretical max cap as of today), I still expect the company to post 2H23 profits of about €3.2 – 3.3 billion. Anything short of a swift and deep recession, and I believe UniCredit will post FY23 net profits of about €7.5 billion, beating its latest guidance, even after the new windfall tax hit.

UniCredit is changing hands in Milan at (about) €22.5 per share (1 UNCRY ADS = 0.5 UCG) for a market cap of €43.5 billion. That equates to a fwd P/E multiple of approximately 5.8x. With TBVPS at the end of 1H23 slightly over €30 per share, shares trade at 0.75x P/B.

With top efficiency achieved, RoTE above 20%, and C/I below 40%, I see no reason for such a significant discount. Considering a potential downturn and earnings cyclicality, I am somewhat cautious about assigning high valuation multiples to UniCredit, but a 7x P/E and 0.9x P/B should do, pointing at approximately 20% upside to €27 per share. The company remains shareholder-friendly and plans to pay out most of the FY23 earnings through dividends and buybacks.

After a +130% one-year return, the days of UniCredit shares being an excellent bargain trading at less than 0.5x TBVPS are gone. As I warned in my previous analysis, investors should remain alert about the new earnings cycle approaching a peak. That said, I continue to see relative value in UniCredit. Shares are still cheap vs. EU peers. The already mentioned ING and BNP are trading at 7x and 8.3x fwd EPS, respectively.

Conclusion

Except for Mr. Passera, Italian bankers have refrained from comments on the windfall tax issue, which might be the wise thing to do at this stage. The Italian parliament is now closed for holidays for four/five weeks in August, and there is no telling when the tax will be signed into law. By the time the new tribute completes the legislative process, it could be amended further and look different from the drafts.

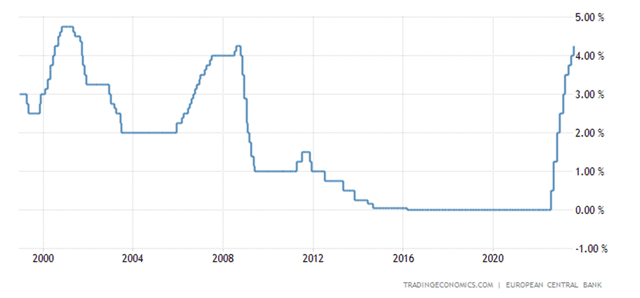

From the latest reads, the tax impact should be manageable. Hence, I see no reason to change my BUY recommendation for UniCredit. UniCredit is a well-run institution that has completed its turnaround and reached high levels of operational efficiency. Besides another hasty government intervention that criminalizes free enterprise and profits, the main bearish point seems to be a quick interest rate drop that would significantly reduce NII levels, an excellent historical example of this happening being 2008.

Tradingeconomics.com - ECB

However, with inflation remaining high in the Eurozone, the ECB seems to have little choice but to keep interest rates in place or raise them further for now. As long as the “higher of longer” fundamental assumption holds, so does the bull case for UniCredit.

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

This article was written by

Analyst’s Disclosure: I/we have a beneficial long position in the shares of ISNPY either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.