Simon Property Group: The Comeback Dividend

Summary

- The Simon Property Group, Inc. dividend is still recovering from the 2020 cut. But the dividend is not yet back to 2019 levels.

- Simon Property Group has a high debt rating and its diversification and superior locations have helped it bounce back better than competitors.

- The dividend yield is high and the payout ratio is historically low. This is a great bargain combination for investors. Dividend increases are expected to continue.

- This quality investment has unusually high appreciation potential as the stock recovers to historical valuation levels.

- Contrarian investment is often very hard to execute.

- This idea was discussed in more depth with members of my private investing community, Oil & Gas Value Research. Learn More »

CHUNYIP WONG

Simon Property Group, Inc. (NYSE:SPG) cut the dividend back in 2020 as a precaution. Investors can now benefit from that precaution.

Simon Property Group Dividend History (Simon Property Group Website August 10, 2023)

Obviously, the worst never happened even though fiscal year 2020 was pretty scary and challenging for the retail sector. Next came the threat of inflation with still another set of challenges. Management has been restoring the dividend, as shown above. But the business has made more progress than expected from the acquisition a few years back. As a result, that dividend will be heading past old levels into new territory. An investment at the current price is likely to have an uncharacteristically high yield in the future for such a quality company.

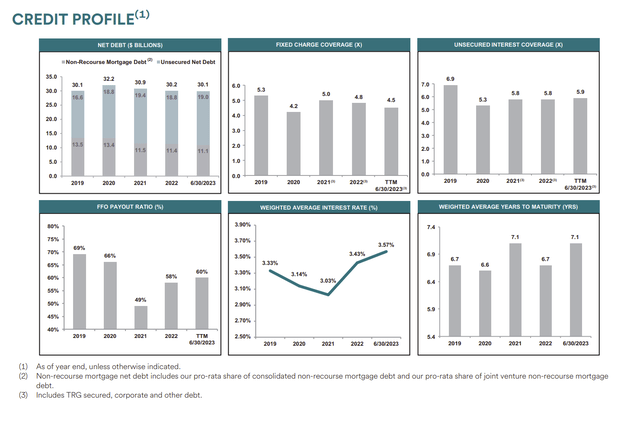

Simon Property Group Credit And Payout Measures (Simon Property Group Second Quarter 2023, Earnings Conference Call Slides)

Simon Property Group has one of the highest debt ratings of any company I follow in really any industry. As shown above, a lot of measures did get worse in fiscal year 2020. But they were still pretty comfortable by most measures. It was not a bad idea to cut the dividend because far worse could have happened and management would have had the cash to deal with the situation. The retail customers that rent or lease spaces in its malls certainly were stressed that year and a lot of landlords found themselves financially strained as a result.

This real estate investment trust ("REIT"), though, has a lot of diversification as the largest of its kind, and its locations are often superior. So, the bounce back, once the shutdown ended, was considerably better than many competitors. Fortunately, the shutdown did not happen during the very important Christmas season. Therefore, a lot of the financial damage was not quite as significant as it could have been had it happened during that important holiday season for retailers.

The end result of this is shown as a low payout ratio that has slowly been increasing as the company raises the dividend. As was shown first, these dividend raises are only to get back towards where the dividend level was before the pandemic. Now management is able to see its way to normalcy (relatively speaking). Therefore, dividend increases will at least continue relatively frequently. There is a good chance that the dividend will eventually exceed previous levels, as the business has been making progress.

Stock Price

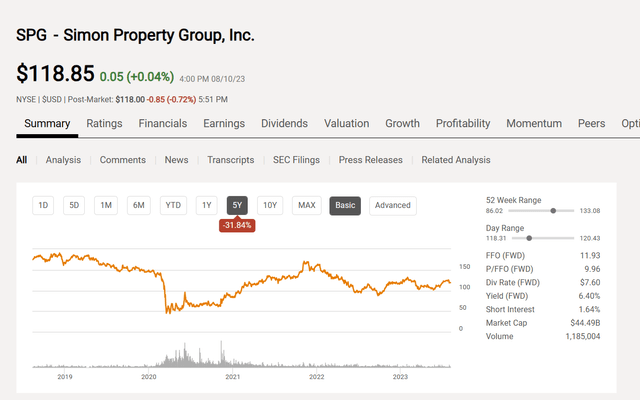

The stock price has yet to fully recover to pre-pandemic levels (similar to the dividend).

Simon Property Group Common Stock Price History And Key Valuation Measures (Seeking Alpha Website August 10, 2023)

Business appears to be good enough, with a bright enough future that the stock price should at least return to pre-pandemic levels above $150. That is an unusually large appreciation amount for a quality issue like this.

The dividend yield shown above is already historically high even though the dividend likewise has not gotten back to pre-pandemic levels and the payout ratio is uncharacteristically low. Clearly, the market expectation for this "best in class" company are nothing close to "the best." That provides an unusual cushion against downside possibilities and long-term loss of investment principal while allowing for the more likely upside potential.

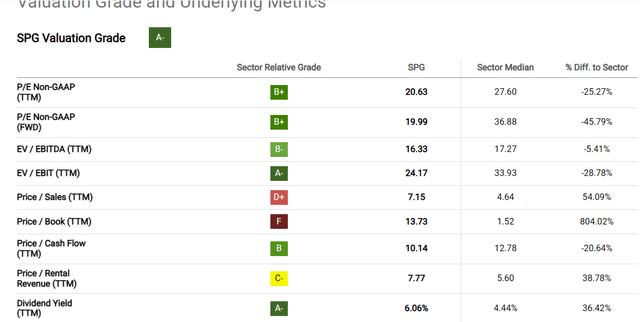

Simon Property Group Relative Valuations From The Seeking Alpha Quant System (Seeking Alpha Website August 10, 2023)

The Seeking Alpha Quant System likewise confirms that historically this stock is cheap. The key measures of price-earnings ratio, EV/EBITDA and Dividend Yield all score highly in the system. Further down, the funds from operations ("FFO") and AFFO (adjusted FFO) ratios (not shown) also have historically cheap ratios.

Since the business, as reported for the second quarter, pretty much met management's guidance, the valuations above in the quant system appear to signal a relative bargain for a high-quality issue. That high quality implies less than average investment risk for an above average return. That kind of situation is very rare.

This means that the average investor can get into a 6% yield that is most of the average 8% total return that many investors report long term while waiting for more dividend increases that are indicated by the low payout ratio shown earlier.

That dividend increase in the future will likely be accompanied by a higher stock price as the market realizes that this company was not flattened by the market worries. The "Buy straw hats in January" attitude is an important investment strategy that is extremely hard for most investors to execute.

Often times, these stocks do not appreciate when the investor expects. But they will return to historical valuations over time as this is one of the better managements in any industry I follow.

Most likely the future will entail some slow organic growth along with an occasional opportunistic acquisition. But the current stock price appears to anticipate none of the above.

Mr. Market is so worried about inflation that he does not realize that inflation would only make a lot of the properties owned more valuable. Eventually people still have to buy things. Those "things" are sold by the malls this company owns. Retail downturns rarely last long enough to be a total disaster. If fiscal year 2020 did not do the job (and it did not) then it is hard to imagine anything coming close to the fears of Mr. Market.

The Future

Even though the Simon Property Group, Inc. stock price often follows the perceived fortunes of the retail market, the business is much steadier than retail. Here, the ability to pay rent is the big concern. Many companies can easily pay their location fees even in a cyclical downturn. That is a big difference from reporting lower earnings to shareholders and owners.

There will be an industry cycle as there has been in the past. But the location advantages and low debt that have resulted in a sky-high debt rating should indicate to you that superior performance throughout the business cycle can be expected by an investor.

The stock has clearly risen from its recent lows. However, it is still a bargain as shown by the quant system. The debt rating ensures that refinancing debt or repaying debt is not an issue for the company. This company will have access to the debt markets when many others will be shut out because debt would be too expensive.

The unusual aspect of an investment in this quality company is that the stock probably has at least a 25% appreciation potential to recover to historical levels. That is likely to happen sooner rather than later as inflation fears fade. It is also likely to be accompanied by dividend increases as the payout ratio returns to historical levels. After that slow growth over the long-term is likely to resume.

Once the initial recovery potential is achieved, slow growth and slow dividend growth is likely to result in a combined return of the low teens. But when an investor opens a position in a stock like this at a bargain price (as is the case right now), the long-term return is on a lower price and hence will be considerably higher than what I am writing. That is what makes "buy straw hats in January" so important.

I analyze oil and gas companies, related companies, and Simon Property Group in my service, Oil & Gas Value Research, where I look for undervalued names in the oil and gas space. I break down everything you need to know about these companies -- the balance sheet, competitive position and development prospects. This article is an example of what I do. But for Oil & Gas Value Research members, they get it first and they get analysis on some companies that is not published on the free site. Interested? Sign up here for a free two-week trial.

This article was written by

Occassionally write articles for Rida Morwa''s High Dividend Opportunities https://seekingalpha.com/author/rida-morwa/research

Occassionally write articles on Tag Oil for the Panick High Yield Report

https://seekingalpha.com/account/research/subscribe?slug=richard-lejeune

Analyst’s Disclosure: I/we have a beneficial long position in the shares of SPG either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Disclaimer: I am not an investment advisor, and this article is not meant to be a recommendation for the purchase or sale of stock. Investors are advised to review all company documents and press releases to see if the company fits its own investment qualifications.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.