Parsons: Performance Is Good But Valuation Is Expensive

Summary

- PSN reported strong 2Q23 results, with revenue increasing by 23% YoY and beating consensus expectations.

- The company has a high win rate of 72% this year and has a qualified pipeline of $45 billion, indicating potential growth acceleration.

- While PSN's performance and growth prospects are positive, it's trading at a steep premium compared to historical levels and peers.

courtneyk

Investment Action

I recommended a hold rating for Parsons Corp. (NYSE:PSN) when I wrote about it the last time, as I wanted more concrete evidence that PSN was able to continue its momentum since 1Q23. Based on my current outlook and analysis of PSN, I recommend a hold rating. I expect the business to continue doing well and sustain its momentum. However, valuation is rich at this price, relative to history and peers.

Review

PSN's 2Q23 results were strong and better than expected. Now that things are picking up steam, I feel much more confident that PSN is headed in the right direction, business wise.

Revenue of $1.36 billion in 2Q23 was an increase of 23% year over year and 20% better than what consensus expected. Both Federal Solutions and Critical Infrastructure showed strength, with the former increasing by 20% and the latter by 25%. New and ongoing contract volumes increased, fueling growth across all segments. Given PSN's solid backlog performance, I anticipate the company's top-line growth to remain robust. Overall backlog increased by 8% to $8.9 billion thanks to PSN's net bookings of $1.9 billion during the quarter, a staggering 92% growth across both segments. About $5.8 billion (58%) of the total amount is committed. The book-to-bill ratio helps me make sense of this backlog number. Assuming all of the backlog is funded, PSN's book-to-bill ratio in 2Q23 was 1.4X, which equates to potential annual revenue of $6.4 billion ($8.9/1.4x). The degree to which management has insight into future revenue and the likelihood of meeting consensus estimates can be gauged using this method, which is not perfect but does provide useful information.

Management highlighted the fact that so far this year, the company has a win rate of about 72%, compared to the historical norm of 40-50%, and that it has won 11 programs this year alone worth more than $100 million. Indicative of PSN's forward motion and the market's acceptance of its solutions. The increase in victories is especially striking when compared to 2022, when PSN won just 10 program awards. I believe there is a clear path to growth acceleration at PSN's current rate of success, as evidenced by the $45 billion in qualified pipeline, $7 billion in bids awaiting notice, and $12 billion in ceiling unbooked value.

Adjusted EBITDA rose by 53% to $118 million, and the margin increased by 100bps to 8.7%, complementing the robust top line. New and existing contract volume, incentive fees for chemical weapon destruction programs, and Xator's contribution all played significant roles in this margin expansion. As PSN's revenue grows, I anticipate a corresponding increase in margin. Management plans to announce 20-30 bps of annual adj EBITDA margin expansion through 2025 at the Investor Day in March. Looking at PSN's historical operating history, in which margins expanded along with revenue, I think this is a realistic goal.

Management's goal of making two purchases per year on average (as stated at March's Investor Day) is supported by the company's strong FCF generation ability demonstrated at LTM. PSN's FCF of $191 million over the LTM was equivalent to 1.4 times the LTM's net income. If we hold this ratio the same for the next 3 years, using consensus estimates, PSN could generate a cumulative amount of $1 billion in FCF. This should help PSN fund future acquisitions, which will boost their bottom line. Since management's acquisitions typically involve the PSN supply chain, I believe they will have a positive effect on margins over the long term. These technologies include AI, autonomous vehicles, cloud computing, and the Internet of Things.

Valuation

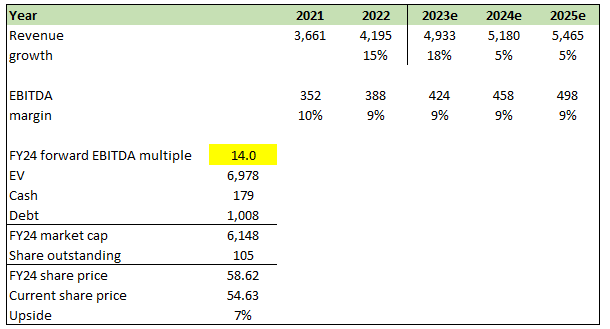

Author's work

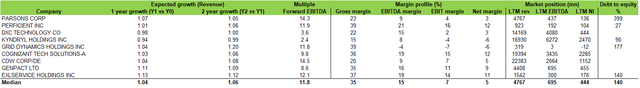

While I am positive about the business now, the issue with PSN is that its valuation is trading at a steep premium to history and peers.

Looking at PSN's historical trading range, it is currently trading at around a 22% premium to its average of 11.7x forward EBITDA (PSN trades at 14.3x today). The stock has traded in a very tight range in the past, between 10x and 13x.

When compared against peers, PSN is also trading at a premium of 30%. I am not sure if this premium is justified given that the growth profile is pretty similar and PSN's margin profile and market position are not pretty much in line with peers as well.

Nonetheless, I acknowledge that in the near term, valuation could be supported by the growth momentum so far. However, even assuming consensus numbers are right and that PSN continues to trade at 14x forward EBITDA, the stock is worth $58.62, which makes it fairly valued, in my opinion.

Final Thoughts

In conclusion, PSN performance has shown strength and momentum, evident in its robust 2Q23 results and impressive win rates. The company's strategic direction and backlog performance suggest a path for continued growth acceleration. While Adjusted EBITDA margin expansion and strong FCF generation are positive indicators, the issue lies in the steep valuation premium compared to historical levels and peers. Though short-term growth momentum could support valuation, the stock's potential worth of $58.62, assuming a 14x forward EBITDA, indicates fair valuation.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.