Municipal Bonds In Today's Market Place

Summary

- Treasuries are generally priced more attractively than AAA municipal bonds today.

- Municipal bonds offer better value at the long end of the yield curve.

- Many features of municipal bonds make them less attractive to real world investors.

- Municipal bond interest can increase Medicare insurance premiums and taxes on social security income.

Wirestock

The Federal Reserve has talked and acted tough with respect to inflation over the past 18 months. Interest rates have soared from the repressed levels that prevailed for the decade following the Great Recession. During those years, investors remained indifferent to the disposition of their short term investments as near zero interest rates were offered in a broad swath of bond markets.

That period of indifference has ended decisively. Our central bank has hiked the federal fund rate in 11 of its last 12 meetings. In fact, the Fed Funds futures rate hovers around 5.4% for the month of December. As bond prices have fallen, bond yields have increased to the point where their expected return beats inflation expectations.

Investors are now evaluating different segments of the fixed income market such as tax-exempt municipal bonds. Individual investors continue to hold the plurality of the $4.1 trillion municipal market, accounting for two fifths of the float through direct holdings. Of course, more is held through funds.

Break Even Tax Rates

The municipal market is skewed to the more credit worthy end of the ratings spectrum. About 85% of its issues are rated A or better. Cumulative default rates for investment-grade municipal bonds total 0.09% over ten-year periods, on average. This compares with 2.17% for the global corporate market—well over twenty times that of municipals according to Moody's data as of December 31, 2021. it's worth taking a closer look at the benefits of municipal bonds.

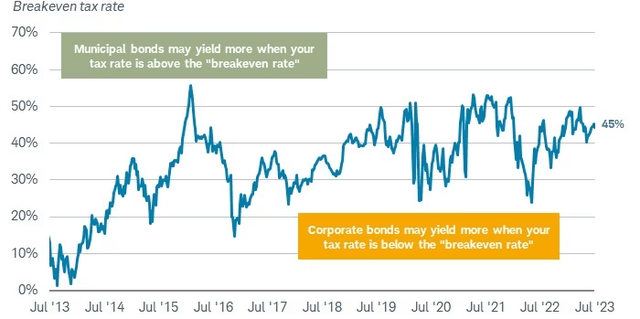

Both municipal and taxable yields have increased but which market is better for whom? One basic criteria for evaluation is to compare the breakeven tax rate for both issues. This comparison has produced varied results over the years.

In 2016, as an example, most investors in intermediate bonds would be better served by tax exempt offerings. Breakeven tax rates hovered around 20% while most investors were taxed at levels above 20% at the margin. Over the past 12 months, however, the breakeven rate has exceeded 40%. Very few investors pay taxes at that rate.

Bloomberg, weekly data as of 7/14/2023. Bloomberg Municipal Bond 7-year (6-8) Index (LM07TR Index) and Bloomberg U.S. Intermediate Corporate Bond Index (LD06TRUU Index)

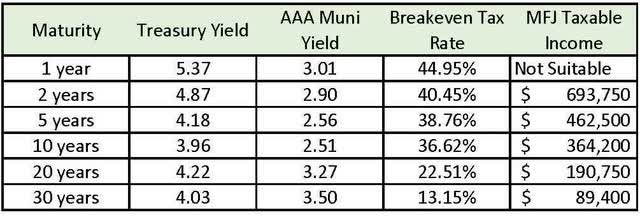

The relative attractiveness of munis varies across the maturity spectrum. Today's AAA bond market yields favor taxable issues at both the short and intermediate parts of the yield curve. The top federal income tax rate is 40.8% (including the Obamacare tax) As a practical matter, few investors pay this rate. Short and intermediate municipal bonds are favorable only to those investors at or near the top Federal tax rate. At the long end of the yield curve, however, municipal bonds suit a much wider array of investors. Breakeven tax rates fall below well into the income range of the middle class.

The table below describes the breakeven tax rate above which municipal bonds offer a better return. The rightmost column cross-references the income level at which a married couple pays tax above that rate at the margin.

Breakeven Tax Rates and Income Levels (Raymond James and the Tax Foundation, 07-31-23)

For example, A typical 1 year municipal bond yields only 55.05% of a comparable treasury. An investor would have to be taxed at a 44.95% tax rate to be indifferent to treasuries. That's higher than the top federal income tax rate.

At the 10 year maturity, it's a somewhat closer call as munis there offer yields roughly 65% of treasury securities. At 30 years, the yield ratio expands to 87%. Most taxable individuals can benefit from long dated municipal bonds on an after tax basis. Why?

Unlike the U.S. Treasury yield curve, the tax-exempt municipal curve remains upward-sloping, with 30-year muni yields almost 100 basis points higher than 5-year yields. In fact, 30 year high quality munis have yielded almost 90% of comparable maturity treasuries. They are priced attractively at the long end of the yield curve. In addition to potential return from spread compression, investors could benefit from price appreciation as longer-dated bonds “roll down” the relatively steep tax-exempt curve.

Deviating from the Simple Analysis

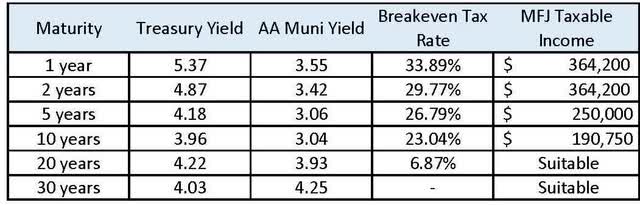

Historically, the default experience of Municipal bonds has been superior to corporate bonds, even adjusting for their credit rating. AA Munis almost never default. The 10-year average default rate for AAA rated munis is 0.00%, while AA rated bonds stand at 0.02%. A portfolio of AA municipal bonds suffers almost no degradation from default. Some consider them a reasonable credit proxy for Treasuries.

If AA Munis are essentially equal in credit quality to Treasuries, the breakeven tax and income levels fall. Consider the breakeven analysis against the AA muni yield curve.

Breakeven Tax Rates and Income Levels for the AA Muni Space (Raymond James and the Tax Foundation, 07-31-23)

The reality is that municipal bonds seldom perform this "cleanly". There are numerous practical problems with their tax advantage. One principal example is the state income tax. Interest on Treasuries is exempt from state income taxes while investors must pay state tax on bonds issued outside their state of residence. For residents in states such as New York and California, that's a material shortcoming of municipal bonds.

There are other exceptions. Interest rates have risen considerably. As such, many municipal bonds have been trading at a significant discount to their face value. The IRS taxes accretion of discounts as ordinary income. For years, this policy was irrelevant as falling interest rates pushed municipal bond prices above par. There were no discounts.

However, in 2022, the surge in interest rates cratered the municipal market. Many bond prices sunk well below par. Trading volume dried up in these issues as fund managers avoided them - for fear of generating taxes for their end investors. At best, these issues traded at an extra discount to compensate investors for their implied tax liability.

Municipal bonds have rallied a bit in 2023 thus depleting the ranks of municipal bonds with embedded tax liability. Nevertheless, it's a problem that looms over the tax-exempt market in the event of another surge in interest rates. New buyers of muni bonds must navigate the market and adjust their after tax calculations with the knowledge that some fraction of their total return will be taxed as ordinary income.

Muni bonds might also underperform if interest rates fall. Unlike Treasuries, over 85% of municipal bonds are callable. As an example, most long term municipal bonds allow the issuer to call the bond away at some price above par value (e.g. 105.00). In the event of a market rally, municipal bonds will underperform taxable product as their issuers have the option to call the bonds at a capped price.

The option-adjusted yield in a municipal bond suffers in a volatile fixed income market. Tax issues and call options impair on price performance as these bonds move away from par value. Here is a simple graphic example below.

Bond Performance as Interest Rates Change (Prepared by the Author)

Many kinds of municipal bonds are subject to the alternative minimum tax (AMT). Income from private activity municipal bonds, those that fund stadiums, airports or more businesslike enterprises—might be subject to AMT. If one has to pay AMT and hold such a bond, interest income would generally be taxed at an AMT rate of 26% or more. As an example, Vanguard's high yield muni bond fund (VWALX) paid almost one sixth of its interest last year from private activity bonds. This interest was subject to the AMT.

Retirees also face unique challenges holding municipal bonds. Income from such bonds is included in modified adjusted gross income (MAGI) when determining how much of one's Social Security benefit is taxable. If half of your Social Security benefit plus other income, including tax-exempt municipal bond interest, amounts to more than $44,000 for a joint return, up to 85% of your Social Security benefits may be taxable.

Monthly premiums on Medicare parts B and D are also scaled by income. Interest from municipal bonds may increase the amount paid for these insurance premiums. If you're married filing jointly and your MAGI is more than $194,000, you will be required to pay an additional amount for Medicare Part B and Medicare prescription drug coverage. Today, most retirees pay $165 monthly but this can increase to over $500 for higher income levels.

There are a lot of ifs, ands, or buts to the tax shelter properties of municipal bonds. Individual investors need to tread carefully.

Best Practices

While the municipal market has its pitfalls, professional municipal bond management is available to individual investors through a wide array of mutual funds and ETFs. The managers of these funds are in a position to steer away from the tax traps implicit in the municipal market. They can offer bonds exempt from the AMT and issued by a single state, as an example.

Individuals should avoid holding individual muni bonds. The tax-exempt bond market is less liquid than the US Treasury market - some individual bonds have bid/ask spreads of 1.0% or more.

Going forward, we are likely to see that some funds shy away from discounted issues as well. All this comes at a cost, however. Municipal markets are reasonably efficient. Bonds that avoid these tax pitfalls trade at higher prices in equilibrium and that negates some of their tax advantage.

It's difficult to assign precise values to the structural issues with the municipal market. Much of the drag on municipal securities depends on the specific situation of the investor. Moreover, the attractiveness of the overall municipal market itself are quite fluid. Our first chart indicated that basic breakeven tax rates vary considerably over time.

Are there some rules of thumb? Almost certainly. Investors in high tax states like New York and California should stay away from municipals unless they have access to home state muni bond funds. Similarly, retirees should consult with a tax advisor before investing in municipals. Interest income from these bonds can reduce the value of Social Security and Medicare benefits.

Asset location plays a major role in the size of a tax-exempt portfolio. Most investors considering municipal bonds are individuals. These folks already have tax-sheltered accounts such as 401ks and IRAs. Best practice suggests that taxable bonds be located in these accounts where tax on interest can be deferred. As taxable bonds almost always offer higher yields, the overall return to the investor is maximized by locating bonds here first.

To the extent that bonds must be held in taxable accounts, it makes sense to include municipal bonds representing the long end of the yield curve. In today's market, the advantage of tax-exempt fixed income is maximized at maturities in excess of ten years

Consider this example. John has a $1.2 million portfolio which consists of a $800,000 individual account and a $400,000 IRA. His expected marginal tax rate in 2023 is 30%. After consultation with a financial advisor, he agrees to a balanced asset allocation of 50% stocks and 50% bonds. We need to buy him $600,000 in bonds. For the sake of argument, we'll limit long term bond purchases of any kind to $100,000 due to concerns about interest rate movements.

Our first step is to build the bond portfolio by populating the IRA with short and intermediate term taxable bonds. That leaves $200,000 in bond purchases for the individual account. The relative value of the municipal market at the long end of the yield curve suggests that our long bonds should be tax-exempt. At shorter maturities, we'll continue to use taxable bonds for the rollout. The general strategy would look like this in graphic terms.

Sample Rollout of Muni Bonds (Prepared by Author)

Municipal bonds can play a constructive role in an individual's investment portfolio. Macroeconomic conditions do drive the basic suitability of tax-exempt issues. The tax-exempt yield curve today offers more value at longer maturities. That said, nuances in the taxation of muni bonds impact each investor differently. It's best to utilize professional management to implement a municipal bond strategy. The investor's personal situation plays an elevated role in the selection and sizing of his municipal bond holdings.

This article was written by

Analyst’s Disclosure: I/we have a beneficial long position in the shares of VWALX either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.