Ready To Set Sail With A.P. Møller - Mærsk A/S

Summary

- Maersk stock is currently depressed due to struggles the global economy faces and stagnant shipping freight rates.

- Economists have flip-flopped on their predictions of a recession perhaps creating an opening for positive thinking about Maersk shares.

- Maersk is well-positioned in the container shipping and logistics industry preparing for future challenges with green energy initiatives and AI integration.

Marina113

Shipping Moored To Economic Fortunes

Armies move on their stomachs. Container ships sustain modern world economies moving goods and energy from port to port. A.P. Møller - Mærsk A/S (OTCPK:AMKBY), commonly known as Maersk, is a Danish company founded in 1904. Maersk stock is depressed reflecting the struggles of the global economy and tumbling freight rates. We value it as a Hold expecting the stock to tick up when the global economies strengthen.

We consider Maersk a long-term opportunity for retail value investors. Management produced profits and shared them with healthy dividends. Their business plan laid out to shareholders this month appears sound for weathering the headwinds. The valuation metrics suggest the shares are a good value at $9.50.

Maersk shares sold for +$14.60 a year ago. We expect the share price to tick up on improving economic news. In the past week, economists changed their opinions flip-flopping on their predictions of a recession. Concomitantly, shipping business owners are on buying sprees of container shipping shares selling “at a significant discount,” observes FreightWaves.

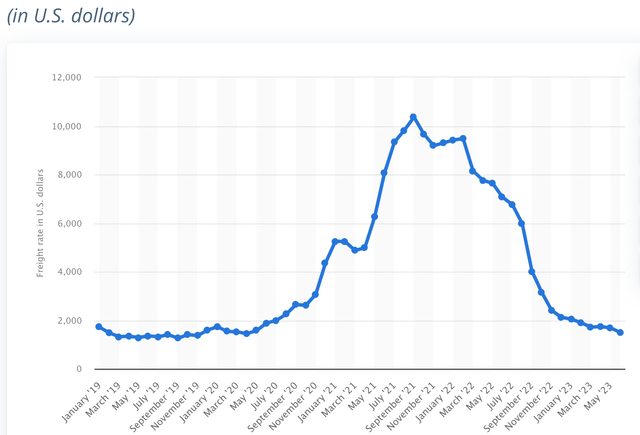

Freight rates have not yet turned around:

Global container freight rate index from January 2019 to June 2023

Global Container Shipping Rates (Statista)

For 25 years, Maersk ranked as the largest container shipping company in the world. Today it is number 2 following a decade of industry M&A consolidation. Economic growth is probably going to linger for a while longer and freight rates remain flat for another 12 months. That puts a damper on our bullish sentiment for Maersk.

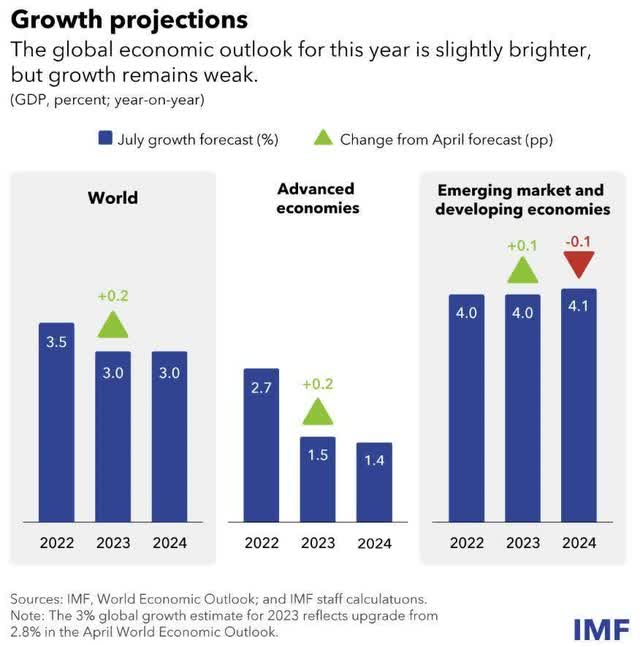

The OECD, IMF, and others issued warnings in July. The IMF projected global growth to fall from 3.5% in 2022 to 3% in both ’23 and ’24. Slowdowns might worsen for “advanced economies” exponentially affecting shipping and logistics companies’ cash and bottom lines. Just days ago, Maersk officials told the Financial Times a contraction in global trade is coming and it will be longer and deeper than feared.

Company analysts foresee a fall in global container demand between 1% and 4%. COVID-depleted inventories are replenished and overstocked businesses are struggling. In July ’23, China’s exports tumbled 14.5% and its imports fell 12.4%. Domestic consumption is flagging lessening demand for container shipping services.

Economic Growth Projections (Internat'l Monetary Fund)

Company Profile

Maersk is in the transport and logistics business. It operates more than 730 ships. It owns nearly 16% of the market share. Maersk has a $31.36B market cap. Its dividend yield forward is 33.39%. The downsides investors face start with the stock not being the bellwether for economic trends; there is a dearth of analysts tracking the stock, it is lightly traded and paid short shrift by the financial news media.

Maersk operates through several divisions. The Ocean division manages container shipping and terminal services under various brand names. It handles storage and sales of bunker oil. Logistics and Services manage integrated transportation matters for land, sea, and air shipping, supply chain management, and specialty needs. There is a Terminals division and a Towage and Marine division that services the energy industry and a slew of tug vessels. Maersk operations are in 65 terminals and in 130 countries. The company’s high priorities are diversifying into the green fuel energy arena and expanding its digital technology space, especially with AI.

Maersk Technology Plans (Maersk)

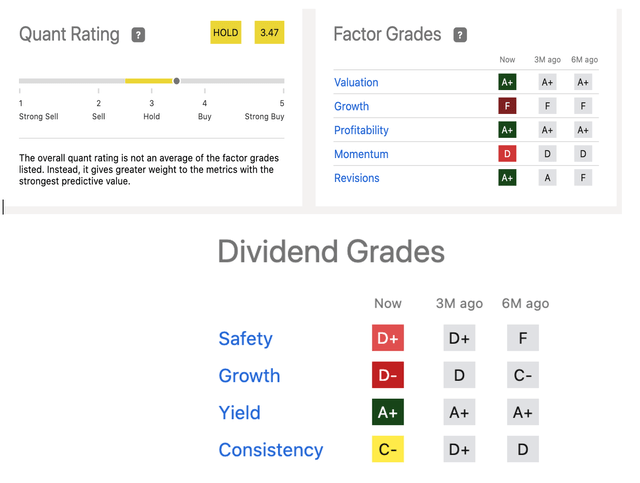

The good, bad, and ugly news seems factored into the current share price. It is down 32.4% for the year from its 52-week high. Despite the good news in a healthy Q2 ’23 earnings call on August 4, ‘23 the share price is -15% YTD. Except for growth and momentum, Maersk gets excellent Factor Grades from Seeking Alpha. To us, this suggests management is handling the macroeconomic situation with aplomb.

All the numbers in the Q2 ’23 earnings report fell from previous quarters. Yet, company earnings in the first half of 2023 adequately cover the generous dividend. In their Q2 ’23 earnings report shareholders were reassured that

Combined with low financial expenses net profit was strong at $1.5 billion… Cash generation was good as well, and we continue to return cash at $2.4 billion to shareholders this quarter, executing on our share buyback, including the payout of withholding tax on dividends.

Total revenue was $12.988B compared to $21.65B in Q2 ’22. Ocean division suffered the greatest loss of income. EBITDA was $2.9B compared to the previous year’s quarter over $10B. CAPEX fell in Q2 ’23 to $738M from over $1B a year earlier for the second quarter. Revenue and earnings for FY ’23 and ’24 is going to be significantly lower than in 2021 and 2022. The S A dividend grades are low; we sense a hint that the dividend yield might tumble perhaps into the teens as free cash flow fell to $2.02B for June 30, 2023.

Quant Ratings/Factor Grades (Seeking Alpha)

Management has not definitively addressed the future of the dividend. So far, earnings cover the dividend. The payout ratio has been 44% of adjusted earnings; we expect about a 75% reduction in dividends considering the drop in revenue and earnings expected over the next 2 years.

Sail Away

Now is not the best time for retail value investors to take a bullish position on Maersk shares but rating the share a worthwhile Hold or Moderate Buy is not too risky. The risks come with a stumbling global economy.

Maersk Analysis (Infront Analytics)

Container shipping and logistics is an essential industry in which Maersk seems well-positioned and prepared to prosper once the bear market sentiment in freight rates stabilizes. This year, shares of 22 shipping stocks are +8% and container shipping stocks are up ~21% on average, as talk about a recession fades. Maersk shares have a Beta under 1 and there are no downwind forces from short sellers. Against its peers, Maersk’s 10.89 PE seems to be a good value; its ratio is 1.8x compared to the peer average of 11.2x.

Keep in mind that in 2023 we are looking at a window in time. Over the last 10 years, the share price was +33%, and +37% during the last 5 years. Maersk’s Innovation Center is preparing for the next generation of challenges by prioritizing its green energy initiatives and readying for the impacts of AI including robotics and drones. The company feels like it is in a holding pattern for now but it is well-managed, has substantial income and cash flow and can weather rough seas longer. Shipping magnets see good times ahead so this is a stock to keep on watch.

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Recommended For You

Comments (1)