Monster Beverage: Strong Earnings Growth With No Debt Deserves A Valuation Premium

Summary

- Monster Beverage's 2Q23 results show strong earnings growth and increased revenue, with organic sales up 14.4%.

- The temporary slowdown in Latin America is not a cause for concern, as management expects a rebound and the US market continues to perform well.

- The company's entry into the alcohol segment and focus on innovation support its future growth prospects.

Jack Taylor

Summary

This post is to provide an update on my thoughts on Monster Beverage's (NASDAQ:MNST) recent performance and 2Q23 results. I recommend a buy rating for MNST as I expect earnings growth to remain strong in the low 20% range, supporting its valuation premium vs. peers.

Investment thesis

The 12.1% increase in revenue was just shy of the 12.8% increase expected by consensus, however, organic sales is up 14.4%. The company's gross margin increased by 541 basis points to 52.5% as a result of price increases and decreases in shipping and aluminum can costs, among other factors. MNST's 2Q23 EPS of $0.39 was in line with consensus expectations.

The major sequential slowdown in Latin America from 1Q23's 40.4% growth to 2Q23's 9.4% growth is the "red" flag I think needs to be addressed first this quarter. Due to the difficult comps caused by rapid growth since the introduction of COVID, product supply challenges, and distributor inventory de-stocking, I believe a three-year stack basis is the best lens through which to evaluate this growth. As such, the sequential growth comps are not as meaningful as they seem. What's more, the management's tone during the call convinced me there is nothing fundamentally wrong with this slowdown. They seemed confident that the slowdown would end as inventories are brought back up to par, and they stressed that the brand is still going strong in the region, as evidenced by its dominance in the market in many countries. I trust the statements of the management, especially given the robust performance of the US market (which is more developed). In the week preceding the release of the 2Q23 earnings call, the tracked channel growth was 13%, and there was still a steady growth of around 10% in the traditional energy sector.

“So if I talk about the energy category as such, and we started looking at the one-week data because the community looks at the one-week data. And the energy category is still growing in good double-digits, 13% in the last week. So we're seeing a good increase in the energy category.”

In the near-term, I anticipate MNST's growth momentum to maintain its robustness, as indicated by management's report of a 13.7% increase in gross sales excluding foreign exchange effects and encompassing alcohol brands. The strong performance of gross sales in July aligns well with the consensus estimate of a low-teens growth (13.9%) for 3Q23. Given MNST's track record of fostering innovation, I have confidence in the company's capacity to sustain an innovative culture and extend its growth prospects in the years ahead.

Illustrating this, in 2Q23, the sale of new alcohol brands contributed nearly 3pts of growth to the U.S. top-line, a remarkable feat especially considering that The Beast Unleashed [TUB] had not yet achieved nationwide distribution. With the imminent national distribution of TUB by the end of FY23, I anticipate further positive growth impact. Furthermore, Nasty Beast and NOS Zero Sugar, two new products, are expected to play a role in MNST's expansion in the near term. Particularly with the latter, my confidence is bolstered by MNST's proven success with its Monster Zero Sugar product.

Taking everything into consideration, based on my analysis of recent results, I am confident that the company is in a favorable position to sustain remarkable growth by means of remarkable innovation, advantageous mergers and acquisitions, and the exploration of the high-margin alcohol sector. In regards to the 2Q23, MNST reported yet another period of strong revenue growth, attributed to the positive impact of price hikes and a strong lineup of innovative products that are performing exceptionally well.

Valuation

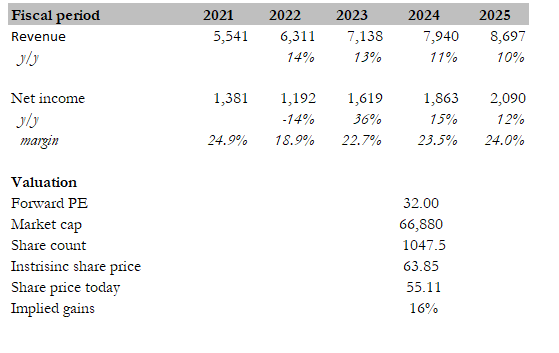

I believe the fair value for MNST based on my model is $63.85. My model assumptions are that MNST will continue to see strong and elevated earnings growth in the low-20% range, supported by low-double-digit top-line growth (consistent with recent trends) and its ability to innovate products to penetrate adjacent categories (alcohol, tea, etc.). Margins should expand naturally as the business enjoys high incremental margins from penetrating into new verticals as it leverages the same distribution network.

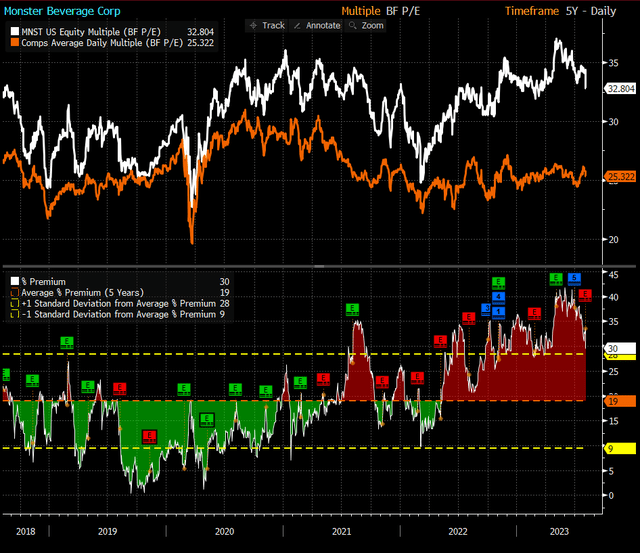

Peers include: PepsiCo (PEP), Coca-Cola (KO), Celsius (CELH), Keurig Dr Pepper (KDP), and National Beverage Corp. (FIZZ). The median forward PE multiple peers are trading at is 25x, the expected 1Y revenue growth rate is 5%, and the leverage ratio is 1.2x net debt to EBITDA. I expect MNST to continue trading at a premium to peers given its higher growth rate (14% expected 1 year growth) and its net cash position, which gives it ample flexibility to conduct M&A and drive innovation without worrying about liquidity issues.

Own calculation

Bloomberg

Risk

Given the commodity nature of beverages, my worry comes from increased competition from peers directly increasing investments in their own energy brands. I am positive that MNST can innovate and market well to defend its position, but consumer taste and preference can change easily and are impossible to track or know in advance.

Conclusion

To conclude, the upside for MNST is promising, supported by its robust earnings growth and absence of debt, warranting a higher valuation. The company's 2Q23 results demonstrated steady progress, with strong top-line expansion and enhanced margins attributed to strategic pricing actions. Despite a temporary slowdown in Latin America, management's confident outlook indicates a likely rebound, while the US market continues to perform well. The entry into the alcohol segment and innovation further fortify growth potential. Considering the positive track record, I recommend a buy rating for MNST.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.