Lightspeed Commerce Continues Unified System Rollout Amid High Operating Losses

Summary

- Lightspeed Commerce Inc. recently reported fiscal Q1 2024 financial results, beating revenue and EPS estimates.

- The company offers an omnichannel commerce platform for businesses worldwide.

- The mandatory adoption of its unified POS and payments system is expected to drive revenue growth in the medium term.

- Until we see improved revenue growth and a meaningful move toward operating breakeven, I'm Neutral [Hold] on Lightspeed Commerce Inc.

- Looking for more investing ideas like this one? Get them exclusively at IPO Edge. Learn More »

andresr/E+ via Getty Images

A Quick Take On Lightspeed Commerce

Lightspeed Commerce Inc. (NYSE:LSPD) reported its fiscal Q4 2023 financial results on August 3, 2023, beating revenue and EPS estimates.

The company provides a platform for omnichannel commerce for businesses worldwide.

I previously wrote about Lightspeed with a Hold outlook.

Management's approach to making its unified POS and payments system mandatory will likely be a tailwind to revenue growth in the medium term as increased transaction volumes add to revenue, but it will take time to see show up in the Lightspeed Commerce Inc. financials as customers migrate.

Until we see those results begin to manifest in its financials and the firm reduces its operating losses, I'm Neutral [Hold] on LSPD.

Lightspeed Overview And Market

Montreal, Canada-based Lightspeed was founded in 2005 to develop a commerce platform of various functions for small and medium companies worldwide.

The firm is headed by Jean Paul Chauvet, who previously held senior roles at Atex Group and Nstein Technologies.

The company's primary offerings include

Point of Sale.

Menu management.

Employee management.

Inventory management.

Analytics.

Payment processing.

Related hardware.

The firm acquires customers primarily in the retail, restaurant, and golf course industries directly as well as through reseller partners.

According to a 2018 market research report by Grand View Research, the global restaurant management software market is forecast to reach nearly $7 billion by 2025.

This represents a forecast CAGR of 14.6% from 2019 to 2025.

The main drivers for this expected growth are a growing awareness by restaurant operators of the benefits of increased efficiencies from software systems.

Also, the COVID-19 pandemic will bring forward significant demand for integrated restaurant management systems in order to streamline processes while providing restaurant services in a more omnichannel approach to customers.

Major competitive or other industry participants include:

Block.

TouchBistro.

Clover Network.

Toast.

Oracle/Micros.

NCR.

PAR Technology.

Heartland Payment Systems.

Shift4 Payments.

Fiserv.

FreedomPay.

Olo.

Others.

Lightspeed's Recent Financial Trends

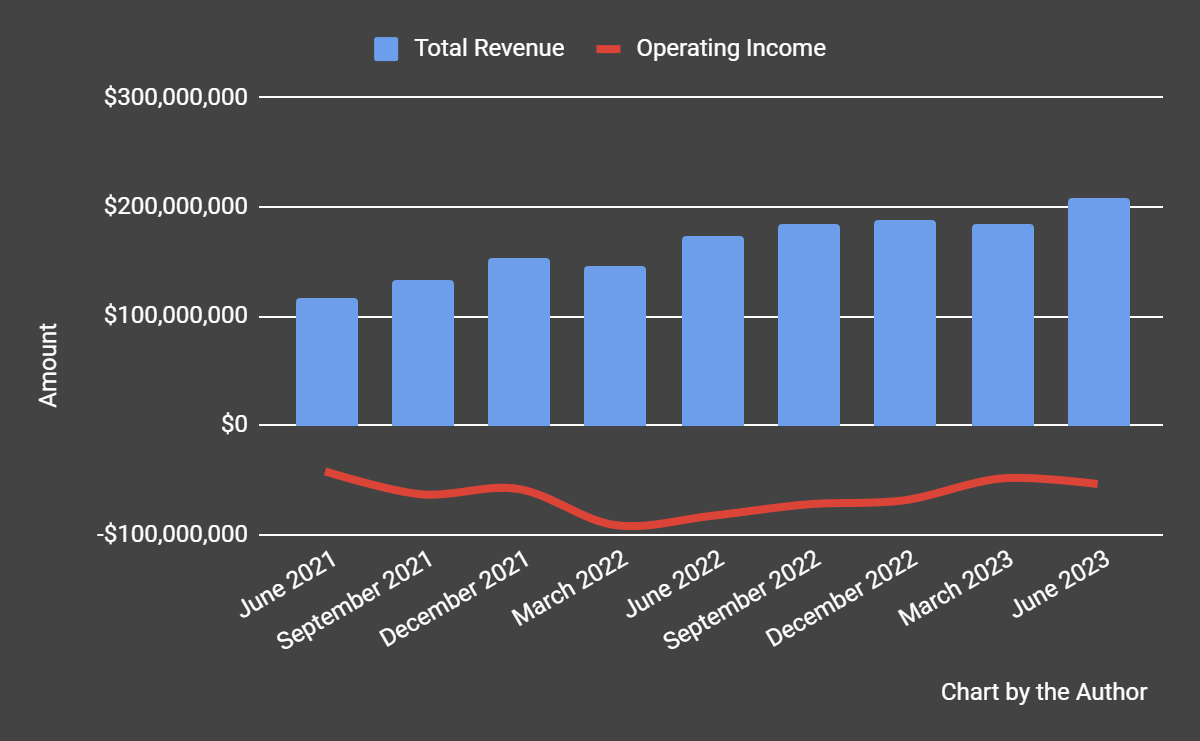

Total revenue by quarter has continued to grow; Operating income by quarter has remained substantially negative:

Total Revenue and Operating Income (Seeking Alpha)

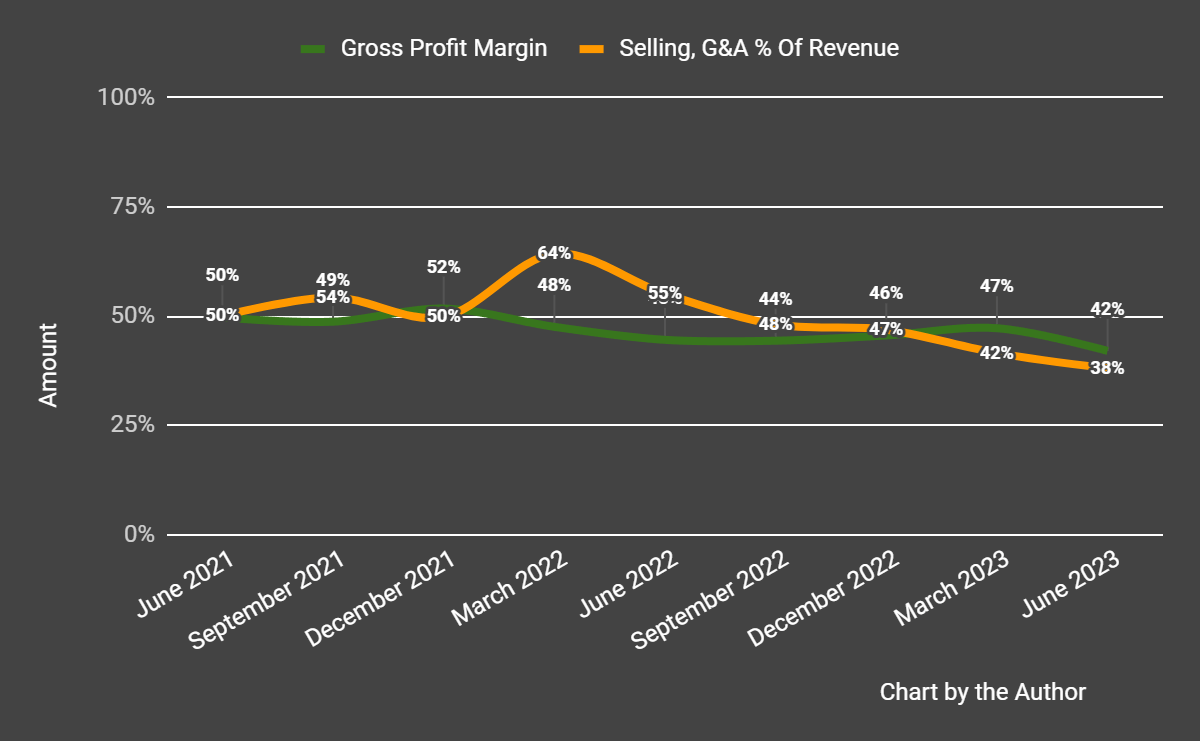

Gross profit margin by quarter has trended lower in recent quarters; Selling, G&A expenses as a percentage of total revenue by quarter have also moved lower more recently, indicating improved efficiency in this regard.

Gross Profit Margin and Selling, G&A % Of Revenue (Seeking Alpha)

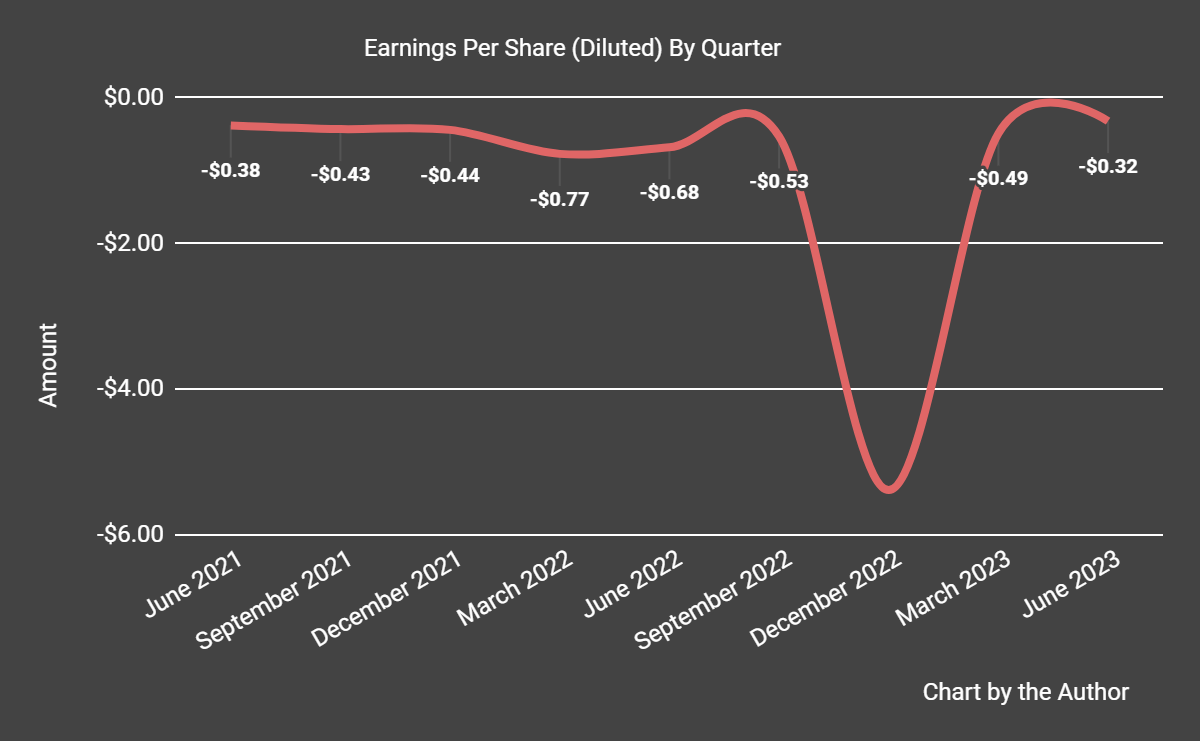

Earnings per share (Diluted) have remained heavily negative, as the chart shows below:

Earnings Per Share (Seeking Alpha)

(All data in the above charts is IFRS).

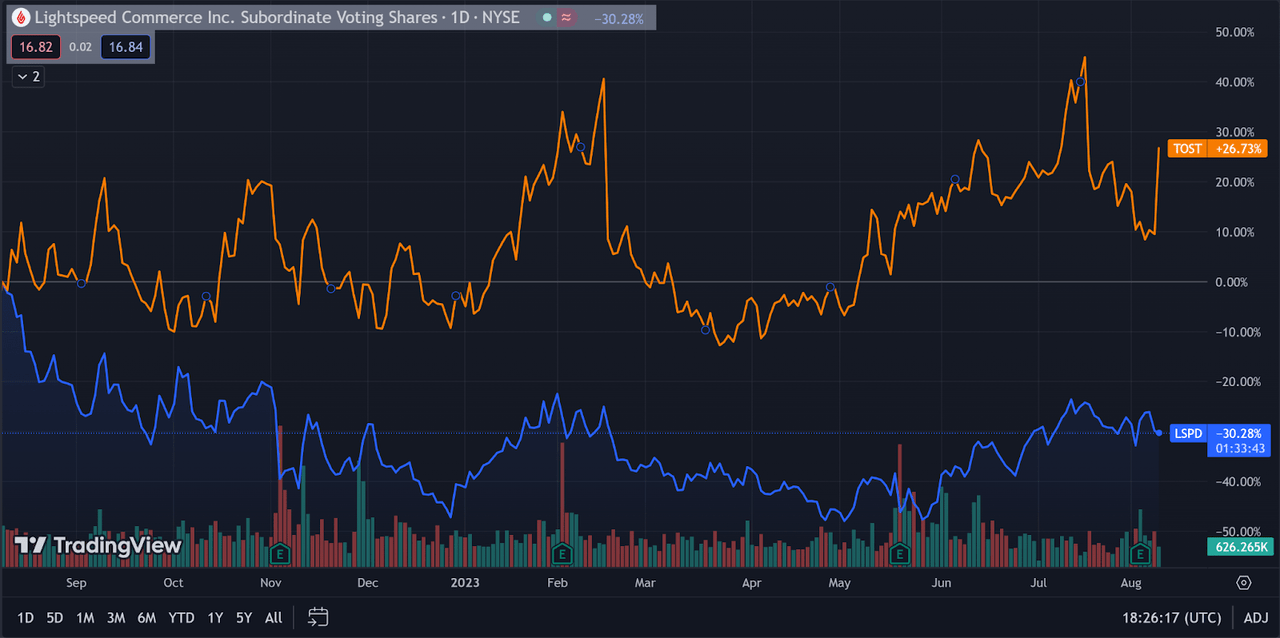

In the past 12 months, LSPD's stock price has fallen 30.28% vs. that of Toast's (TOST) rise of 26.73%, as the chart indicates below:

52-Week Stock Price Comparison (TradingView)

For the balance sheet, the firm ended the quarter with $780.3 million in cash and equivalents and no debt.

Over the trailing twelve months, free cash used was ($125.2 million), during which capital expenditures were $7.2 million. The company paid a hefty $108.5 million in stock-based compensation in the last four quarters.

Valuation And Other Metrics For Lightspeed

Below is a table of relevant capitalization and valuation figures for the company:

Measure [TTM] | Amount |

Enterprise Value / Sales | 2.6 |

Enterprise Value / EBITDA | NM |

Price / Sales | 3.5 |

Revenue Growth Rate | 26.3% |

Net Income Margin | -132.9% |

EBITDA % | -23.6% |

Net Debt To Annual EBITDA | 4.3 |

Market Capitalization | $2,710,000,000 |

Enterprise Value | $1,960,000,000 |

Operating Cash Flow | -$117,960,000 |

Earnings Per Share (Fully Diluted) | -$6.73 |

(Source - Seeking Alpha)

As a reference, a relevant partial public comparable would be Toast; shown below is a comparison of their primary valuation metrics:

Metric [TTM] | Toast | Lightspeed Commerce | Variance |

Enterprise Value / Sales | 3.3 | 2.6 | -22.4% |

Enterprise Value / EBITDA | NM | NM | --% |

Revenue Growth Rate | 54.0% | 26.3% | -51.3% |

Net Income Margin | -11.0% | -132.9% | --% |

Operating Cash Flow | -$164,000,000 | -$117,960,000 | --% |

(Source - Seeking Alpha)

The Rule of 40 is a software industry rule of thumb that says that as long as the combined revenue growth rate and EBITDA percentage rate equal or exceed 40%, the firm is on an acceptable growth/EBITDA trajectory.

LSPD's most recent unadjusted Rule of 40 calculation was only 2.7% as of FQ1 2024's results, so the firm has performed poorly in this regard, per the table below:

Rule of 40 Performance (Unadjusted) | FQ2 2023 | FQ1 2024 |

Revenue Growth % | 68.8% | 26.3% |

EBITDA % | -35.4% | -23.6% |

Total | 33.4% | 2.7% |

(Source - Seeking Alpha)

Commentary On Lightspeed

In its last earnings call (Source - Seeking Alpha), covering FQ1 2024's results, management highlighted its ARPU growth as a function of focusing its efforts on high-value customers and the launch of a unified payments and POS system.

Also, subscription revenue as a percentage of total revenue has dropped year-over-year, with higher transaction revenue producing a higher percentage of the company's revenue.

The firm has made its unified system mandatory for new customers and is rolling out the system to its existing customer base, first in North America and then in APAC and Europe.

Management didn't disclose any company, customer, or revenue retention rate metrics.

Total revenue for FQ1 2024 rose by 20.2% year-over-year and gross profit margin decreased by 2.5%.

Selling, G&A expenses as a percentage of revenue fell by 17% YoY and operating losses were reduced by 35.1%.

The company's financial position is strong, with ample liquidity, no debt but a large amount of free cash used of ~$125 million in the past 12 months.

LSPD's Rule of 40 performance has been poor and has worsened dramatically in the last several quarters.

Looking ahead, full fiscal year 2024 revenue is expected to grow by around 22.5% per consensus estimates.

If achieved, this would represent a drop in revenue growth versus FYE 2023's growth rate of 33.2% over FYE 2022, indicating a slowing growth rate.

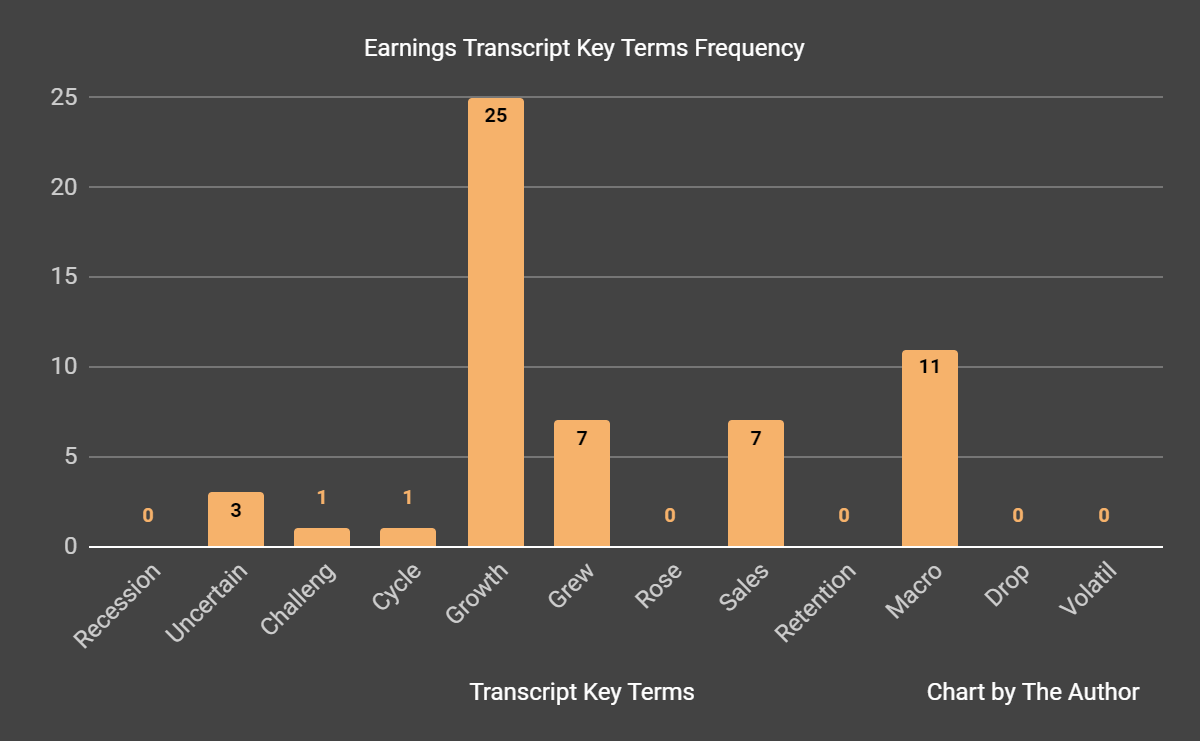

From management's most recent earnings call, I prepared a chart showing the frequency of key terms mentioned (or not) in the call, as shown below:

Earnings Transcript Key Terms Frequency (Seeking Alpha)

I'm most interested in the frequency of potentially negative terms, so management or analyst questions cited "Uncertain" three times, "Challeng[es][ing]" once, and "Macro" eleven times.

Analysts questioned company leadership about the first quarter beat no change in forward guidance. Management responded by saying that they are being conservative in the forward projections as they believe customers haven't felt the full effects of the recent interest rate rises.

Regarding valuation, the market is valuing LSPD at an EV/Sales multiple of around 2.6x on TTM revenue growth rate of 26.3% against a median Meritech SaaS Index implied ARR growth rate of 21% (Source).

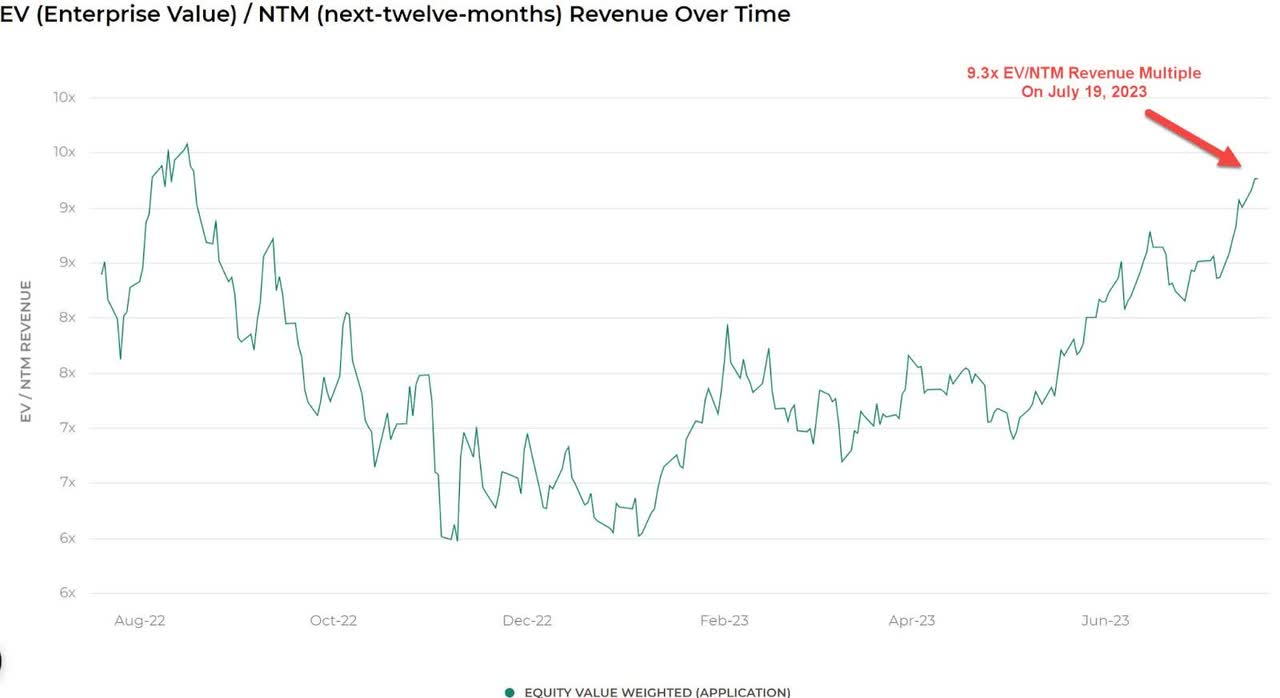

The Meritech Capital Index of publicly held SaaS application software companies showed an average forward EV/Revenue multiple of around 9.3x on July 19, 2023, as the chart shows here:

EV/Next 12 Months Multiple Index (Meritech Capital)

So, by comparison, LSPD is currently valued by the market at a substantial discount to the broader Meritech Capital SaaS Index, at least as of July 19, 2023.

Risks to the company's outlook include an economic slowdown that appears to be underway and reduced credit availability which may affect customer/prospect spending plans.

The firm's approach to making its unified POS and payments system mandatory will likely be a tailwind to revenue growth in the medium term as increased transaction volumes add to revenue, but it will take time to see show up in the financials as customers migrate.

Until we see those results begin to manifest in its financials and the firm reduces its operating losses, I'm Neutral [Hold] on Lightspeed Commerce Inc. stock.

Gain Insight and actionable information on U.S. IPOs with IPO Edge research.

Members of IPO Edge get the latest IPO research, news, and industry analysis.

Get started with a free trial!

This article was written by

I'm the founder of IPO Edge on Seeking Alpha, a research service for investors interested in IPOs on US markets. Subscribers receive access to my proprietary research, valuation, data, commentary, opinions, and chat on U.S. IPOs. Join now to get an insider's 'edge' on new issues coming to market, both before and after the IPO. Start with a 14-day Free Trial.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.