ChargePoint: On A Good Path, But Stuck In A Lackluster Industry

Summary

- ChargePoint Holdings, Inc. is well positioned to directly benefit from our currently increasing electric vehicle use.

- The company has been experiencing strong revenue growth and improving gross margins for the last several quarters.

- They have committed to reaching adjusted EBITDA positive by the end of 2024.

- Even though their industry faces sustained tailwinds, I do not believe charging companies will be attractive as long-term compounders.

- After looking over their financials and valuation, I currently rate CHPT a Hold.

robertcicchetti

Thesis

We are in the middle of a major transition in energy. As more electric and hydrogen powered vehicles enter use, the infrastructure needed to service them is also expected to grow. The passing of the Inflation Reduction Act has accelerated the pace of this shift and is providing sustained tailwinds for the affected industries.

ChargePoint Holdings, Inc. (NYSE:CHPT) is well positioned to directly benefit from this shift toward alternative fuel vehicles. The rise in electric vehicle sales is driving demand for their charging stations. The company enjoys excellent revenue growth and is working toward profitability. However, I have doubts about their industry being able to produce attractive returns once it's mature. After looking over their tailwinds, financials, and valuation, I presently rate ChargePoint as a Hold.

Company Background

ChargePoint is an electric vehicle infrastructure company. It offers hardware, software, and services for commercial, fleet, and residential customers. The company originally was founded in 2007 as Coulomb Technologies, and is currently based in Campbell, California.

CHPT Company Background (Investor Presentation, June 2023, Page 9)

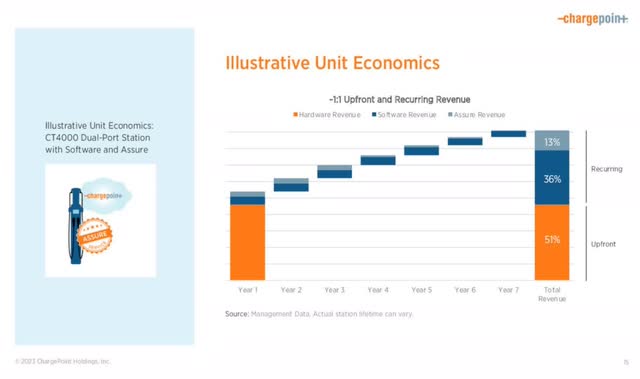

ChargePoint doesn't own their own charging stations; this lowers their cost of expansion. Instead of having to wait to recover the capital investment of manufacture, they can recapture it immediately after the installation. In addition to generating a relatively fast turnover rate, when they install new charging stations, they secure long-term contracts with their new owners. With this type of business, the margins on installations and hardware is traditionally quite low. However, the recurring revenue that installation later provides typically carries attractive margins.

CHPT Recurring Revenue (Investor Presentation, June 2023, Page 15)

Long-Term Trends

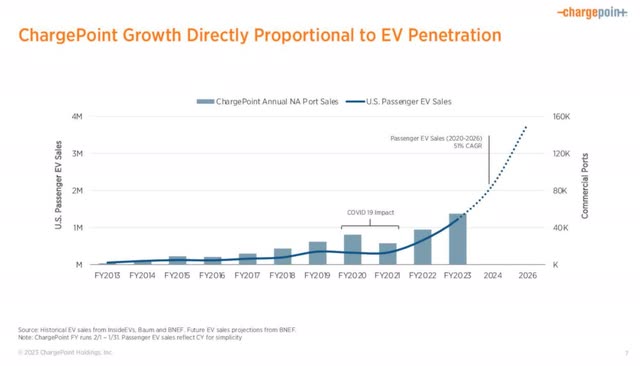

The global electric vehicle charging station market size is projected to have a CAGR of 30.26% through 2028. The global electric vehicles market is projected to maintain a CAGR of 10.07% through 2028. Within just the United States, the charging market is expected to experience a CAGR of 24% until 2028, while the electric vehicle market is projected to have a CAGR of 44.43%. ChargePoint has identified a strong correlation between EV sales, and demand for their charging stations.

CHPT Revenue Correlation (Investor Presentation, June 2023, Page 7)

Guidance

Their most recent earnings call revealed that they continue to expand their fast-charging availability. They increased their number of DC fast-chargers by about 2000 over the most recent quarter and are up to approximately 21,000 of the 243,000 ports in their network. Roughly one-third of their fast-charging ports are located in Europe, which continues to grow and now accounts for over 20% of ChargePoint's quarterly revenue. Their guidance for the second quarter of fiscal 2024, was that revenue would likely be $148M to $158M. They stated they are committed to being adjusted EBITDA positive in Q4 of calendar 2024.

Financials

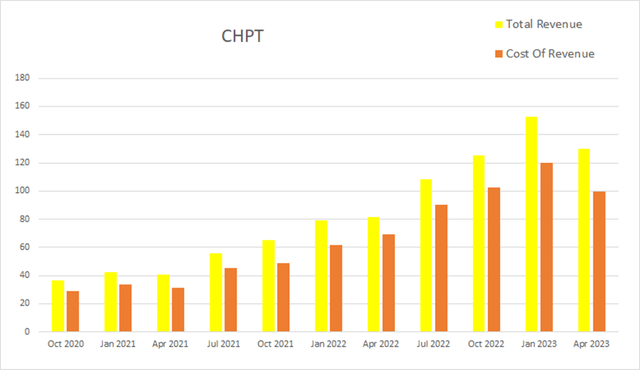

ChargePoint is affected by seasonality. They typically experience lower than average revenue every Q2. Eight quarters ago they had a quarterly revenue of $40.5M. Four quarters ago that had grown to $81.6M; by this most recent quarter that had risen further to $130M. This represents a total two year increase of 220.99% at an average quarterly rate of 27.62%.

CHPT Quarterly Revenue (By Author)

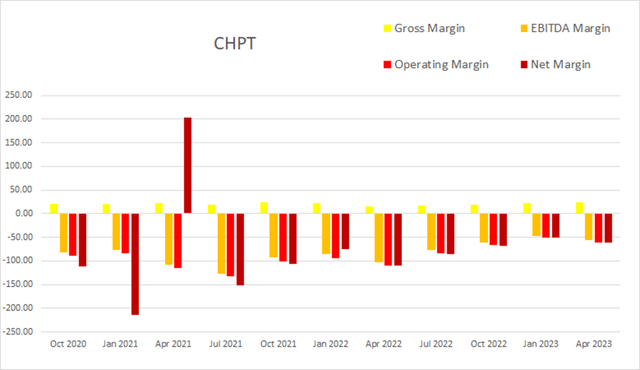

Gross margins were maintaining a range between 19.25% and 24.8% until they dipped in 2022. In April of 2022, gross margins reached a low of 14.83%. They have been steadily improving every quarter since then. As of the most recent quarter, gross margins were 23.46%, EBITDA margins were -56.08%, operating margins were -61.46%, and net margins were -61.08%.

CHPT Quarterly Margins (By Author)

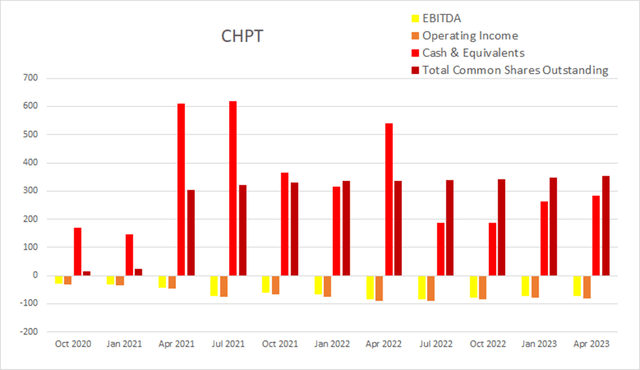

ChargePoint experienced a significant rise in share count from January 2021 to October 2021. Dilution has settled into a fairly stable rate since then. In October 2021, total common shares outstanding was at 331M. As of the most recent quarter, that had risen 353.1M. This represents a total growth of 6.68% over those six quarters of changes, at an average non-compounded rate of 1.11% per quarter.

CHPT Quarterly Share Count vs. Cash vs. Income (By Author)

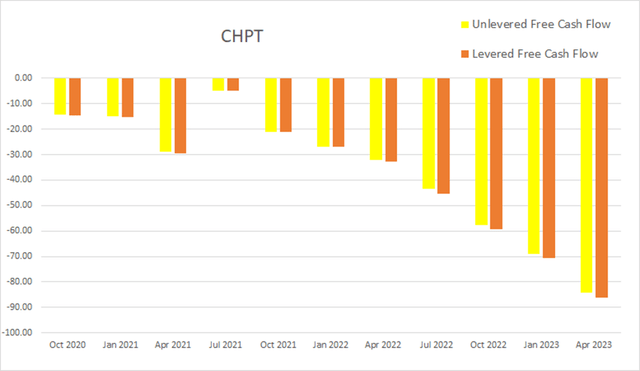

I believe most of this is likely the result of rapid expansion; ChargePoint has been experiencing steadily increasing losses for the last two years. This most recent quarter cash and equivalents was $283M, quarterly operating income was -$80M, EBITDA was -$72.9M, net income was -$79.4M, unlevered free cash flow was -$84.40M, and levered free cash flow was -$86.2M.

CHPT Quarterly Cash Flow (By Author)

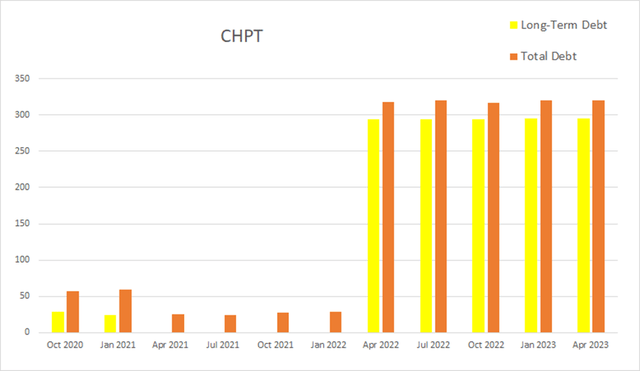

In addition to their regular quarterly debt obligation being quite low, they have recently been canceling most of it out with interest and investment income. As of the most recent quarterly report, ChargePoint only had -$0.5M in net interest expense, total debt was $320.2M, and long-term debt was $295.2M.

CHPT Quarterly Debt (By Author)

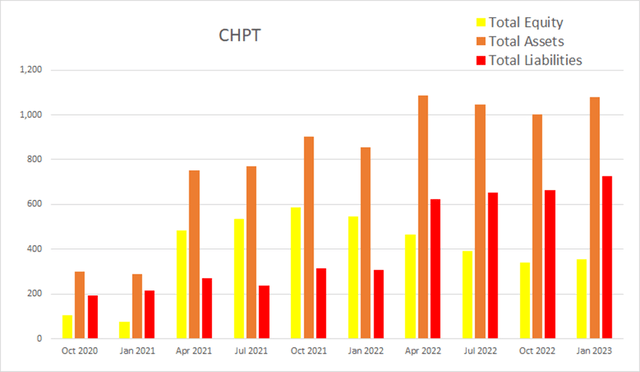

Their total equity rose significantly in 2021, but declined for most of 2022. Once they improve their cash flow situation, I expect their equity to begin rising.

CHPT Quarterly Total Equity (By Author)

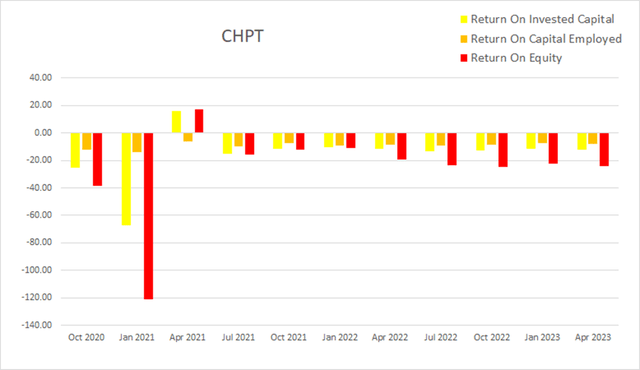

As they build out more infrastructure, more of their revenue will come from long-term service contracts. As this shift occurs, I expect the higher margin portion of their revenue to begin pushing returns toward positive territory. This most recent quarter had ROIC at -12.26%, ROCE was -7.72%, and ROE was -24.24%.

CHPT Quarterly Returns (By Author)

Valuation

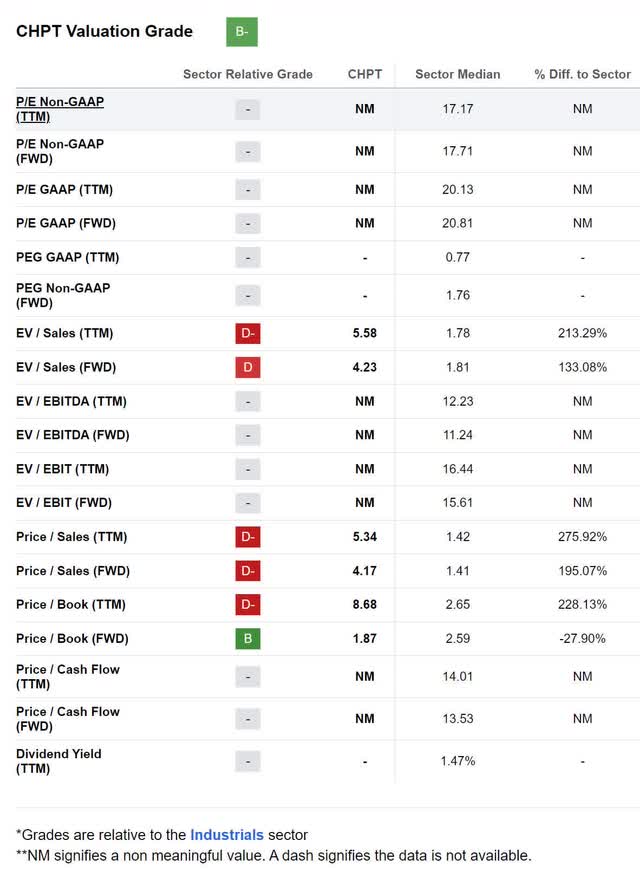

As of August 4th, 2023, ChargePoint had a market capitalization of $2.84B and traded for $8.05 per share. They are not profitable, so I cannot produce a PEGY estimate. However, they have been improving gross margins, and are giving guidance that they expect to reach positive Adjusted EBITDA in 2024. Also, they have a projected forward revenue growth of 62.42%.

Considering their presently unattractive financial situation, and the pace it is expected it to improve, I view their forward EV/Sales of 4.23x, Price/Sales of 4.17x, and Price/Book of 1.87x as showing the company is currently trading relatively close to fair value.

CHPT Valuation (Seeking Alpha)

Industry Drawbacks

My primary problem with investing into ChargePoint, or any of the other companies which provide charging services, is the lack of potential for value added in this industry. Not only is electricity fungible, the widespread adoption of a single charging connection standard now means the charging stations themselves are also fungible. While it's possible that companies find ways to improve the charging experience and so find themselves able to upcharge consumers, I don't see it happening.

Similar to gas stations, I believe the charging industry is stuck treating vehicle re-energization as a loss leader and has to try to find other ways to make money from customers. Gas stations typically sell gasoline, lottery tickets, and tobacco products as loss leaders and thrive off the junk food and other impulse buys customers make while they are in the store. Instead of merely holding their attention for a few minutes, charging station customers are typically stuck waiting for long enough that they may be willing to pay for entertainment while they wait. In addition to selling junk food and soda, they may also find they can charge customers for Wi-Fi or time on a desktop PC. More business-oriented customers may be willing to pay for a small quiet office they could work in while they wait. I have heard of several attempts to trailblaze this new business model and believe someone will eventually find the most efficient way to separate EV customers from their disposable income.

The problem with the scenario I just described is that it's one where the charging station owner-operators are able to find profits, but it still leaves the companies that manufacture, install, and service the actual chargers out of the value-added loop. My point is, for the same reason I would probably never invest into companies that manufacture gas pumps, I will probably never invest into the companies that make charging stations. Traditionally, the expected returns for most types of manufacturing is actually quite low. Even after ChargePoint reaches maturity, a significant portion of their business will still be busy installing or replacing hardware at a very low margin. I believe this portion of the business will always be capital intensive, so while I do think they will be able to achieve sustained positive annual returns, I don't believe they will be attractive enough.

Risks

ChargePoint has numerous competitors, recently most of the charging companies in North America have announced that are switching to the same charging standard. While this is fantastic for consumers, it immediately erodes any compatibility-based moats the charging companies have been building. While this is not exactly a risk, the potential catalyst of achieving compatibility-based dominance will no longer be available.

The fate of the charging industry is tied to the fate of electric vehicles. If the EV market does not grow as quickly as projected, the charging companies should also experience lower than expected demand. Also, EV's and the charging industry are currently receiving tailwinds from the inflation reduction act; while I think it's incredibly unlikely it is repealed or undermined, this is a possibility.

The company is not currently profitable and doesn't think they will be until at least the end of 2024. Although their cash supply is presently granting them several more quarters of runway, if their expected improvements to cash flow do not materialize, they may be forced to raise additional capital.

Catalysts

If EV sales beat expectations, then charging companies should experience stronger than expected tailwinds. It is also possible additional legislation is passed which provides further tailwinds for the EV industry.

ChargePoint is in the process of transitioning its inventory of chargers into the North American Charging Standard while also increasing their number of fast chargers. This represents a period of additional capital expenditure. Once the shift is complete, the company can look forward to lower expenses and better margins.

As the company continues to install new charging stations, they will eventually approach saturation. At some point, their pace of new infrastructure construction will slow, and a majority of their revenue will instead come from recurring service contracts. As this occurs, ChargePoint's margins and returns should experience improvements.

It is possible that their ability to turnover revenue quickly allows them to outgrow their competition by enough that they are eventually able to establish market share dominance with their industry. If they manage to become dominant enough, their name brand could carry enough weight that they would be able to begin shifting their pricing higher. I can think of several companies that have managed this. I have written articles about Apple (AAPL), Otis Worldwide Corporation (OTIS), and Tractor Supply Company (TSCO); all of which have managed to dominate their niche. If ChargePoint ever manages to dig this moat deep enough, it could give them supernormal returns.

Conclusions

Overall, this appears to be a success story in the making. The company is still in the process of leaving the introduction/start-up phase of their business life cycle as they shift into the growth phase. Although they do not appear to be in danger of running out of cash, their guidance is that they expect to reach positive Adjusted EBITDA around Q4 2024. This implies they don't expect to reach non-adjusted EBITDA profitability until sometime in 2025. This means anyone wanting to make a well-timed investment in ChargePoint, likely won't have to wait many more quarters.

As they cross the threshold into achieving profitability, they are likely to experience a significant valuation improvement. However, with them projecting profitability several quarters away, I believe we can expect to wait for at least another quarter or two before the share price will begin rising in anticipation. Forward guidance in future quarterly reports could change this. Valuation could always begin rising beforehand, so adopting this stance might mean having to buy at a higher price later.

While I believe ChargePoint is doing well, and on its path toward viability, I do not believe its industry is one which will ever be able to produce eye-popping returns. This means I also don't believe it's going to become attractive enough as a long-term compounder. I look for companies that are undervalued; high-growth, long-runway spawners. They need to have the potential to eventually develop into something that regularly produces annual return on invested capital values above 15%. To achieve that, companies need to have some sort of unfair competitive advantage. I don't see that here, at least not yet.

If ChargePoint were able to shift its business model or branch into new streams of high-margin revenue, this could easily change. ChargePoint is in an emerging industry, one ripe with opportunities for adaptation and innovation. Also, it's possible the income from recurring service contracts ends up being significantly more profitable than the drag from the installation side of the business, so their returns may become more attractive than I presently expect. Even if I don't believe they are attractive as a long-term compounder, I do believe in their ability to eventually find profitability, and the valuation improvement that should come with that. For these reasons, I believe ChargePoint is worth keeping an eye on.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.