Colgate And The Importance Of Sales Growth, Expectations Matter

Summary

- Colgate recently presented their Q2 2023 report, which first crashed the stock, but during the last week it has rebounded.

- My main takeaway from the report is that CL continues to achieve organic sales growth.

- With very conservative expectations build into its current stock price, an options play might be the right way to approach this stock.

Araya Doheny

Colgate-Palmolive (NYSE:CL) is a $63 billion market cap, global consumer goods company, producing oral care, personal care, home care, and pet nutrition products, with a widespread international presence in various markets worldwide.

Earnings call rebound

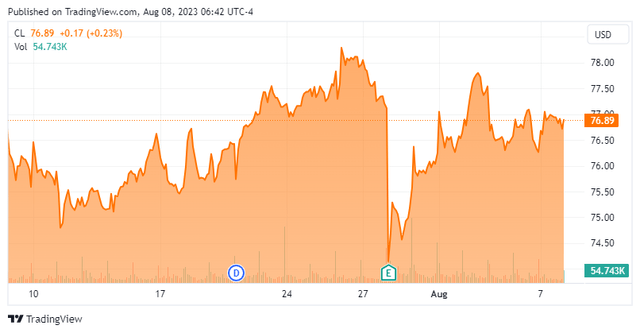

They recently presented their Q2 2023 report, which first crashed the stock but during the last week, it has rebounded to a similar level pre-earnings.

Seeking Alpha

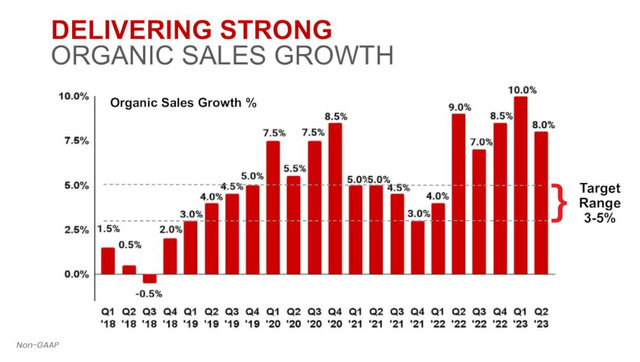

Given the contents of the earnings report, I was a bit surprised but afterward relieved by the market reaction. Since my main takeaway from the report is that CL continues to achieve organic sales growth.

CL Q2 2023 earnings presentation

This is very important since from a value creation standpoint, specifically to CL and similar companies, sales growth is king. From a general value creation analysis, an analyst can point out several factors that impact value, it can be sales growth, operating profit margin, cash tax rate, incremental investment rate, cost of capital, and forecast period (value creation horizon).

But when reviewing CL financials over the last five years all of these factors, with the exception of sales growth look rather stable. CL operating margin fluctuates in the 20-25% range, the up-tick in net working capital has been offset by improvements to their incremental investment rate (NWC as % of sales has increased from -2% five years ago to 1% LTM23, while PP&E and Intangibles as % sales have decreased from 36% to 34% over the same period).

Although CFROI (Cash-flow return on investment) has been decreasing during the last five years (from 50% to 30%) the current level is still so far above CL's WACC that any sales growth (given a stable operating margin) creates a lot of value for its shareholders. Basically, the company generates a return of 30% for each dollar invested compared to a financing cost of 6% (current estimated WACC).

To describe how extreme this effect is, if CL could sustain sales growth of 5% while keeping everything else as-is, using a standard discounted cash flow (DCF) model the stock should trade at least 2x than its current price of $77 per share.

Market expectations

So why is the stock currently not trading at $150 per share or higher? It's because the expectation of the market is that CL will not achieve this high level of sales growth. And I'm not talking about next year's sales estimates but I'm referring to CL's long-term 10-year plus sales growth outlook. If the market for any reason were to change its perception of CL's long-term sales outlook I see substantial upside in its stock price. This would most likely be driven by continued organic sales growth over the coming quarters and the implementation of innovations in the product offerings.

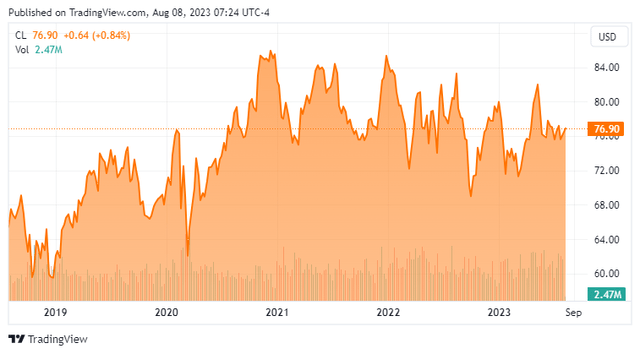

Looking at the downside I don't see much of it, using the same DCF model, with more bearish assumptions, negative sales growth of c. 3%, an operating margin of 20%, and higher investment needs, etc, the model indicates a value of $78 per share, which is very close to today's stock price and inline with CL's trading range over the last few years, as shown below.

Seeking Alpha

How to invest?

Since the stock has a low beta (0.5x to S&P 500) and in my opinion, very conservative expectations build into its current stock price an options play might be the right way to approach this stock. Either as an outright purchase of a LEAP (expiring January 17 2025) or selling put options on the stock while receiving coupons on T-bills held instead of the stock.

This article was written by

Analyst’s Disclosure: I/we have a beneficial long position in the shares of CL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.