Bausch + Lomb: Growth Should Accelerate As Supply Issues Ease

Summary

- I recommend a buy due to anticipated acceleration in growth in FY24 and upcoming product launches.

- Sales in 2Q23 exceeded expectations, with growth across all segments despite supply chain problems.

- The company's valuation should trade at a discount to peers due to its smaller scale and short history as a public company.

SolStock

Overview

My recommendation for Bausch + Lomb (NYSE:BLCO) is a buy rating, as I expect growth to accelerate in FY24 once the supply chain eases and is also supported by the upcoming product launches. However, its valuation should continue to trade at a discount to peers given its smaller scale and short history as a public company.

Business

BLCO operates as an eye health company. The Company offers eye care products, ophthalmic pharmaceuticals, contact lenses, lens care products, and ophthalmic surgical devices and instruments.

Recent results & updates

Sales of $1.035 billion for BLCO in 2Q23, up 10% y/y and 12% in constant currency, surpassing the consensus estimate of $964 million. Notably, despite supply chain problems, growth is widespread across all segments.

Growth remains strong in the Contact Lens segment with Daily SiHys growing 42%, SofLens growing 10%, while Biotrue ONEday grew by 3%. For Daily SiHys, I note that it is still in the growth (investment) stage. As such, even though it is already available in all major markets, it will take sometime to gain scale before it contribute meaningfully to the bottom line. In other words, the earnings profile today does not reflect BLCO mature margin profile, and we should see earnings grow faster than the top-line as these products mature. In addition, the new Lynchburg warehouse management facility's rocky rollout disrupted business operations, which impacted ULTRA in the quarter. Unlike the general supply chain issue, this was a self-inflicted one. As such, I expect management to fix this asap and get things back on track.

Meanwhile, Surgical sales grew by 7% in constant currency to $195 million, which is slightly lower than I had anticipated given the ongoing difficulty sourcing components for the surgical industry despite the 11% growth in consumables. As far I can I tell for Surgical, weakness in growth is not a demand issue, it is a supply issue. The supply chain issue should resolve itself eventually, and all the current “deferred” growth should return back to BLCO. However, until then, performance on this front may be erratic.

“In surgical, product demand remains strong, but component availability continues to be an issue impacting our supply chain. We're working with third parties to address these challenges while providing more options in a growth market. I highlighted our impressive company-wide launch calendar earlier, but it's worth pointing out surgical launch contributions well into 2024, including several new products in the high-margin premium IOL category” 2Q23 earnings

Finally, Ophthalmic Pharmaceutical, BLCO adeptly maneuvered through the supply chain landscape to secure a portion of the market from its rivals, resulting in reported sales of $194 million. The notable aspect here is International growth, which was widespread across major markets, including China. Specifically focusing on China, I hold a positive outlook for future growth due to the introduction of MIEBO in 3Q23. The management foresees a peak sales figure of $350 million eventually. However, it's important to note that establishing a new launch in the market typically takes around 18-24 months, so expecting a significant contribution in the short term might not be realistic.

Overall, I think the 2Q23 results point to a clear conclusion that demand for contact lenses remains strong, albeit offset by challenges in the supply chain. More importantly, the origin of growth from new products was not via cannibalization of own products; rather, management noted that it was from competitors.

“And with respect to the Daily SiHy or infused product line, obviously, I think what's most important is we have a very good product there. And we're seeing great support from ODs and patients to the lens. When you look at volume there, we see that about 60% is being sourced from new fits and the rest from switches. I do think that when we get deeper into the data, we see about a third of patients are switching from other modalities or other consumers coming into our infused products.” 2Q23 earnings call

Valuation and risk

Author's valuation model

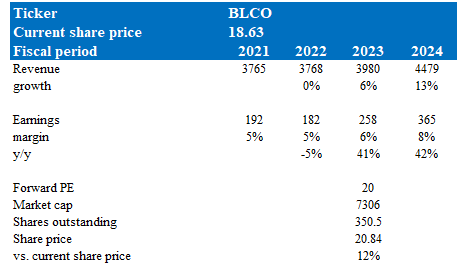

According to my model, BLCO is valued $20.84 in FY23E, representing a 12% increase over 4 months. This target price is based on my growth forecast of 6% in FY23 (guidance) and an acceleration in FY24 as supply chain issues resolve, removing the constraint to growth.

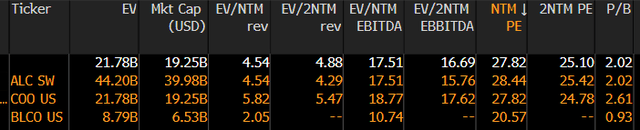

BLCO is now trading at 20x forward PE, which I think is a fair multiple when we compare it to its bigger peers like ALC and COO, which are trading in the high 20s. BLCO should trade at a discount given the much smaller scale it has relative to peers (hence the lower margin). Also, BLCO just got listed not long ago, so there might be some discount from that.

However, my expected upside may not come true if the supply chain situation persists longer than expected or, even worse, becomes worse than what it is today. No matter how "convinced" the market is that growth is constrained by supply issues and not demand, the report results would result in negative sentiment around the stock.

Summary

I recommend a buy rating for BLCO based on the anticipation of accelerated growth in FY24 as supply chain challenges ease and new product launches unfold. BLCO's recent performance showcases robust sales of $1.035 billion in 2Q23, fueled by strong demand for contact lenses. While hurdles like supply chain issues and operational disruptions persist, these headwinds should go away eventually. My valuation model estimates a target price of $20.84 for FY23E, reflecting a 12% increase over four months, contingent on the resolution of supply constraints.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.