Glencore's H1 Earnings: The Market's Not Impressed

Summary

- Glencore plc's first half earnings landed softer than most of its shareholders would've liked amid struggling commodity prices and regional obstacles.

- Although we think a period of stability is near, key indicators fail to suggest the miner is set for a steep recovery.

- Cash is being held back for the Teck Resources acquisition, which can be interpreted in numerous ways from a valuation perspective.

- Glencore's valuation, dividend profile, and stock buyback program communicates positivity.

- However, we think the company's fundamental variables must align before its stock realizes its implied value.

- Looking for a helping hand in the market? Members of The Factor Investing Hub get exclusive ideas and guidance to navigate any climate. Learn More »

thamerpic

Mining powerhouse, Glencore plc (OTCPK:GLCNF) released its first-half earnings results on Tuesday and delivered a few surprises by doing so. Although much of the firm's announcements were linear, the market's sentiment was mixed and matched as the stock was subject to a volatile morning of trading.

Let's discuss a few of Glencore's H1 earnings' salient features.

Earnings Review and Outlook

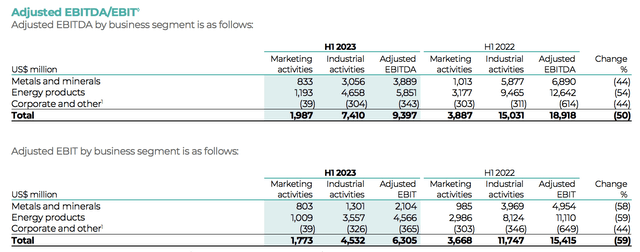

Glencore's first-half earnings dropped across the board since the same time last year. As visible in the diagram below, the company's EBIT across all of its segments was severely impacted, which we attribute to softer industrial demand coupled with higher costs.

Although Glencore's first-half earnings provide some illustration of the firm's trajectory, a forward-looking analysis is required to make sense of it all.

Let's traverse into a brief discussion about Glencore's most critical segments and their respective outlooks.

Copper

Glencore's flagship segment was among those that landed softly in H1. In fact, the firm's copper segment's EBITDA margin slumped to 45% from the 60% achieved a year ago.

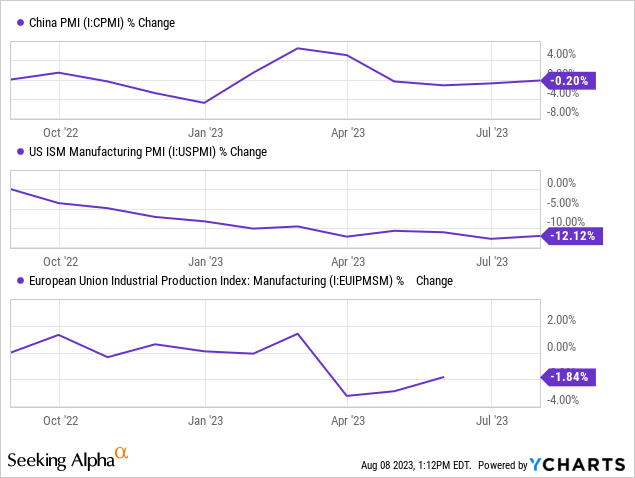

Unfortunately, cyclical demand from China hasn't been as strong as many believed it would be after the nation's re-openings. As such, the region's re-opening demand wasn't enough to supplement softening industrial production in areas such as the U.S. and EU during H1.

Although we believe copper has solid long-term prospects, we think cyclical demand will remain an issue until global interest rates settle lower and automatic stabilizers are put forth by governments (to ensure a soft economic landing). Moreover, Glencore itself admits that its Copper segment is struggling from aging assets and a sluggish pipeline; we see this as a significant risk as it might result in a heightened maintenance CapEx cycle and acquisitions above their fair values.

Glencore's copper results were mixed from an idiosyncratic point of view. The company's Collahuasi and Antamina assets coalesced and saw a 4% year-over-year decrease in production. The firm initially guided toward higher production from the assets after successful mine sequencing earlier in the year; however, Glencore's latest financial results indicate to us that the firm anticipated softer demand in recent months and thus reduced its output.

Furthermore, Glencore's cobalt (copper by-product) and copper marketing activities naturally declined amid softer upstream results for Copper. The firm's realized prices for Cobalt fell by 59% year-over-year, while its marketing division also suffered from industry-wide inventory liquidation induced by stockpile buildups during 2022's supply-chain disruptions.

Although Cobalt is a strategic metal with significant support from the electronic vehicles industry, we believe a cyclical crunch is set to resume until global industrial demand improves.

Zinc & Nickel

Glencore's own source produced Zinc settled at 434 700 tonnes for the half year, which is 10% lower than a year ago. Although softer demand-side factors played a role, the reduction in supply is partially attributable to the disposal of South American Zinc operations and the closure of Matagami in Quebec.

Furthermore, heavy Australian rainfall has continued to curtail operations at the company's Mount Isa and McArthur River. Although rainfall did have a material effect, we think related production decreases are non-core and will level out in time.

Lastly, for Zinc, Glencore expects lower unit costs across the segment and a ramp-up at its Zhairema asset. Although we concur, we still see soft industrial production as a significant issue for base metals, and Zinc is no different. Moreover, Glencore's Zinc marketing activities are struggling with over-anticipated demand from China and increased global smelting capacity, which is why we are worried about future price realization.

Glencore's industrial Nickel segment suffered from a 20% year-over-year decrease in production and a 74% year-over-year increase in cash costs.

As with most of its other segments, the division's struggles were uniform across the industry. Although we anticipate lower unit costs, we think global disinflation will result in pressure on the commodity's sustainable price level. Sure, a post-planned maintenance outlook for the firm's Murrin Murrin and Koniambo assets might spark a structural production spike; however, the general market for Nickel (specially lower-grade) seems oversupplied with unimpressive short-term demand prospects.

Energy

Glencore's energy segment also experienced setbacks in the past year, driven by lower prices, rainfall in Australia, and supply-chain issues in South Africa.

For the time being, we remain unsure about the price outlook for coal. On the one side, an approaching northern winter might support prices; however, sluggish industrial output and economic softening might lead to lower or at least flat coal prices.

During Glencore's past quarter, the firm's coal production decreased by 2% and sustained higher cash costs of approximately 2%. Although the Newlands mine might ramp up toward the end of the year (after a standstill in early 2023), we anticipate Glencore's South African coal endeavors to struggle amid renewed national strikes involving municipal workers and taxi unions, indicating unrest among the labor force.

Holding Back Capital For Teck Acquisition

Along with its H1 earnings, Glencore disclosed it would hold back $2 billion in cash, which it aims to attribute toward the acquisition of Teck Resources (TECK). The Teck deal is well known by now, and based on our observations, most anticipate the acquisition to materialize. However, we would like to outline the risk of "stranded capital," which might inflict delay costs. Moreover, prolonged negotiations and ancillary disputes might exacerbate the issue.

Nevertheless, we think if the deal commences swiftly, Glencore might benefit from synergies as Teck's steelmaking coal will suit Glencore's horizontally integrated business model greatly.

The Market's Reaction, Valuation, and Dividends

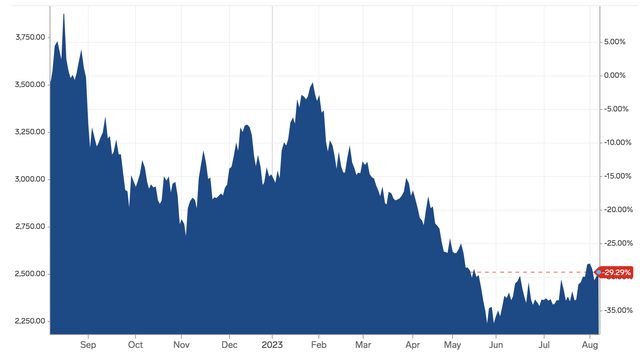

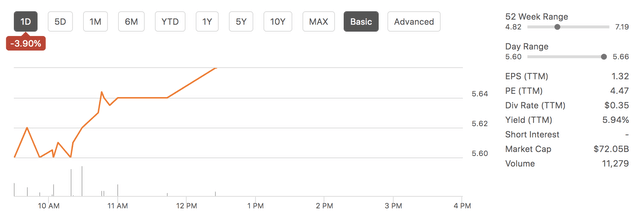

The stock market didn't react positively after Glencore's earnings release. This might've been due to various reasons; however, it is surprising that the market looked past the firm's shareholder compensation package, which included $5.2 billion in share buybacks and pending dividend distributions, a 139% year-over-year increase.

GLCNF Price Reaction (Seeking Alpha)

By considering Glencore's latest earnings-per-share number of $0.36, I computed a trailing EPS of $0.77, which translates into a price-to-earnings ratio of approximately 7.35x. Considering a sector average P/E of 15.59, we believe it can be reasonably concluded that the stock is relatively undervalued on an earnings basis.

Furthermore, Glencore has a 5-year average dividend yield on cost of 8.29%, which adds stealth to the company's overall return profile. As such, in isolation, we deem the stock's total return prospects favorable; however, we think the company's fundamental variables need to improve before its stock experiences robust returns.

Final Word

Glencore's first-half results landed softly, reflecting various systemic and idiosyncratic challenges experienced by the company. Although the firm's shareholder compensation, valuation, and dividend profile remain lucrative, we think its fundamental challenges are rife and need alignment before its stock captures its implied value.

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Looking for structured portfolio ideas? Members of The Factor Investing Hub receive access to advanced asset pricing models. Learn More >>>

This article was written by

Quantitative Fund & Research Firm with a Qualitative Overlay.

Coverage: Global Equities, Fixed Income, ETFs, and REITs.

Methods: Factor Analysis, Fundamental, Valuation, Street Gossip, and Common Sense.

Our work on Seeking Alpha consists of independent research and not financial advice.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.