Companhia Brasileira De Distribuicao: Unfolding Catalysts Reinforce The Bull Thesis

Summary

- Companhia Brasileira De Distribuicao, operating under GPA Brazil, has strategically shifted its focus towards convenience stores, its most profitable business segment.

- GPA Brazil's most recent financial results demonstrate sequential improvement, with notable growth in same-store sales, especially within the Pão de Açúcar banner.

- The company is currently undergoing strategic transformation, with a focus on spin-offs and divestments, which could potentially serve as significant catalysts.

Felipe Cruz/iStock Editorial via Getty Images

Companhia Brasileira De Distribuicao (NYSE:CBD), operating in Brazil under the GPA Brazil brand, is the controlling entity behind the supermarket chain Pão de Açúcar. Managed by the Casino Group, one of France's largest retail chains, GPA Brazil has a presence in Brazil and several other Latin American countries, including Colombia, Uruguay, and Argentina, through its association with the Éxito Group.

Since 2021, GPA Brazil has reached a pivotal turning point in its trajectory. Following the spin-off of its cash and carry wholesale arm, Assaí (Sendas Distribuidora S.A. (ASAI)), and the divestment of its hypermarket units, the retailer has strategically shifted its focus toward its most profitable business segment: convenience stores.

Investors in this Brazilian food retailer have experienced exceptional returns over the past year, with the company's shares appreciating by more than 40%. The decline in inflation in Brazil has triggered a reduction in interest rates. This, combined with factors like the approval of the tax reform, which includes eliminating tax rates for essential items, as well as positive developments related to divestments within the Latin American operations through Éxito and the potential independence from the financially-troubled controller, Casino, has contributed to this positive momentum.

Furthermore, the potential sale of GPA Brazil's stake in Cnova, a Brazilian e-commerce company, alongside the spin-off of the Éxito Group, could serve as catalysts to unlock value for the company, improving its operational leverage and valuation metrics. The company's latest financial results have shown significant improvements compared to previous quarters, particularly in specific areas.

Given the Brazilian macroeconomic context and its improving trends, there are solid reasons to anticipate positive developments for GPA Brazil as it navigates through the second half of this year.

Latest results: Q2 earnings

GPA Brazil's most recent financial results demonstrate a sequential improvement, even though its net losses have widened.

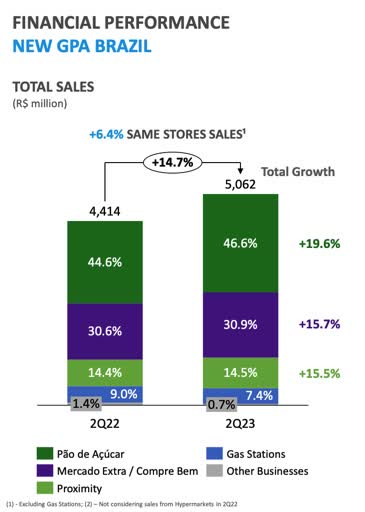

The food retailer displayed impressive Same-store sales (SSS) growth (excluding gas stations), which soared by 6.4% YoY. Notably, the Pão de Açúcar banner outperformed, achieving an 8.6% SSS growth, a noteworthy trend spanned five consecutive quarters—over two times the 4% food-at-home inflation rate in Brazil registered in June. Pão de Açúcar banner has been strategically increasing its exposure to fresh produce (Fruits, Vegetables, and Legumes - FLV) and butchery through its "refresh" project, bolstering its competitiveness.

GPA Brazil's IR

Second-quarter net revenue reached R$4.755 billion, signifying a 13.5% surge compared to the same period in 2022. This upward revenue trajectory reflects a discernible shift in Brazilian consumer behavior. Consumers have transitioned between premium supermarket formats and wholesalers in light of subsiding food prices and commodity declines. This trend has been buoyed by capturing new customers and a 0.8 percentage-point growth in the Premium & Valuable customer base. This growth is attributed to introduction of a new loyalty program and the resurgence of monthly shopping habits.

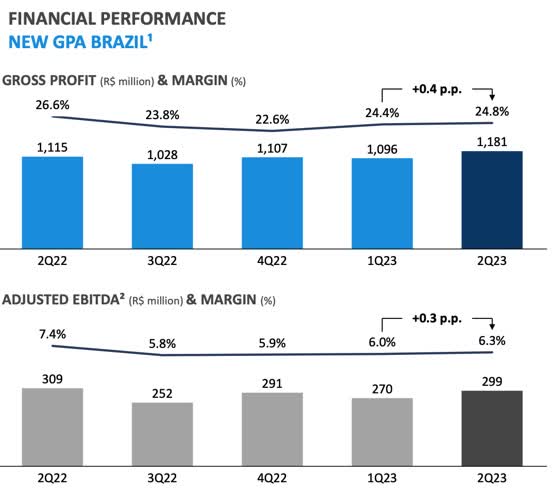

Gross profit reached R$1.181 billion, a 5.9% boost from 2022. However, the gross margin experienced a slight decrease of 1.8 percentage points compared to 2Q22, settling at 24.8%. Although this margin remains marginally below the previous quarter's 26.6%, there are indications of a shift in this trajectory, thanks to GPA Brazil's strategic efforts to revitalize the premium format of the Pão de Açúcar banner.

GPA Brazil's IR

The company has delineated its growth ambitions by expanding its Minuto Pão de Açúcar and Mini Extra stores, with a target of opening 100 units this year. In the second quarter, 23 new stores were launched, a 25% advancement compared to the previous year. This positions the company well to achieve its plan, contributing to a 15% revenue increase.

Selling, general, and administrative expenses in 2Q23 amounted to R$926 million, showing a slight dilution of 0.6 p.p. relative to net revenue compared to 2Q22. This dilution is predominantly concentrated in general and administrative expenses, which exhibited a 7.5% decrease compared to the previous year. This is attributed to restructuring efforts at the headquarters after the hypermarket sale and efficiencies captured in operating expenses.

GPA Brazil reported a 54% surge in net losses during the second quarter of 2023, compared to last year's period, escalating from R$213 million to R$330 million. The consolidated adjusted EBITDA reached R$299 million with margins at 6.3% versus 7.4% in Q2 2022. However, the adjusted EBITDA margin experienced a slight increase of 0.3 p.p. from the previous quarter. GPA Brazil's operating cash generation surged to R$245 million, marking a substantial 48.4% growth year-on-year.

As of June 30, 2023, the company's net debt stood at R$2.9 billion, a decrease of R$1.5 billion compared to 2Q22 and a reduction of R$100 million compared to 1Q23. The year-to-date investment amounted to R$363 million, a decline of 22.4% compared to the previous year. This reduction is primarily attributed to lower investments in renovations, conversions, and maintenance, which in 2022 were heavily focused on renovating Pão de Açúcar stores and converting hypermarkets into supermarkets.

Catalysts in sight

Asset sales currently influence GPA Brazil's shares, notably its subsidiary Éxito, and market actions orchestrated by its controlling entity, the French group Casino, Guichard-Perrachon (OTCPK:CGUIF), which trades on the Paris stock exchange.

The French company finds itself in a precarious financial situation, having accrued a net loss of 2.23 billion euros in the first half of this year, a substantial increase compared to the loss of 259 million euros reported during the same period last year. Casino's net debt surged to 6.1 billion euros at the close of June, rising from 5.1 billion euros at the end of March.

In response, Casino has entered into a preliminary agreement with a consortium to secure financial rescue as the company warned it might default on its revolving credit facility by the end of August. The definitive agreement is anticipated to be finalized in September, with implementation targeted for the first quarter 2024. This agreement entails Casino shareholders experiencing substantial dilution, ultimately leading to the loss of control by the current Casino controller, its CEO Jean-Charles Naouri.

This development bodes well for GPA Brazil's investors, given that the agreement guarantees the preservation of its present position, both directly and indirectly, encompassing 98% of the shares and voting capital in Cnova (a prominent online retailer in Brazil, of which GPA holds a 34% stake). Furthermore, the agreement includes divesting Casino's non-core assets, encompassing assets in the Latin American region, such as GPA Brazil.

Moreover, GPA Brazil received an offer from a billionaire tycoon to purchase a stake in Éxito for US$836 million, payable in cash. However, the offer was eventually declined by GPA Brazil, with the rationale being that the price did not align with "appropriate parameters of the financial rationale for a transaction of this nature and, consequently, does not serve the best interests of GPA and its shareholders."

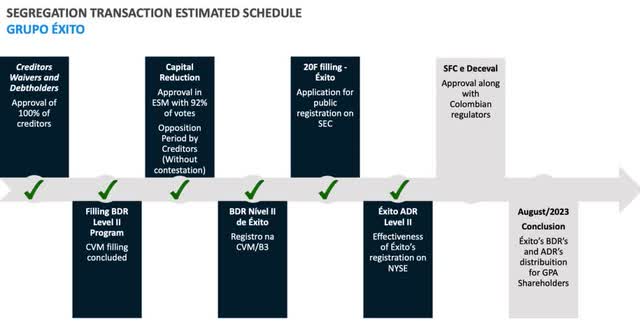

As the Brazilian food retailer indicated, the most probable course of action appears to be a spin-off of Éxito. However, this business separation is still in progress, subject to regulatory approval.

GPA Brazil's IR

The Bottom Line

GPA Brazil boasts an EV/EBITDA multiple of 28.4x, underscoring investors' willingness to pay a notable premium for the company's future earnings potential. However, I believe several catalysts related to GPA Brazil's asset divestitures could enhance these multiples and yield a more pronounced increase in its share value over the forthcoming months.

These catalysts encompass the finalization of the Éxito spin-off (or a potential sale to an interested group), the realization of operational leverage and margin optimization, the divestment of GPA Brazil's stake in Cnova, and the sale of the gas station operations.

According to the guidance outlined during the Investor Day, the company is targeting an EBITDA margin of 8%, an ambitious goal set for 2024 needing to improve by 1.7% in less than two years period. I believe this objective is audacious, but with the near-term prospect of the Éxito spin-off, it is plausible that this target might be attainable.

Considering GPA Brazil's current P/S multiple of 0.28x, it appears to be trading at a relatively low ratio with its total revenue. This could imply that the stock is potentially undervalued in its revenue generation. Anticipated significant revenue contributors for the new GPA Brazil are expected to be the "Proximity" (Minuto and Mini Extra) and "Premium" (Pão de Açúcar) formats. The relatively low multiple may reflect a heightened investor caution toward GPA Brazil shares.

While I perceive these catalysts as pivotal in constructing a bullish narrative for GPA Brazil, the timing of their occurrence remains plausible. Additionally, the second-quarter results indicate sequential improvement, further solidifying my positive outlook for the company.

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.