Datadog Earnings Surprise: The Peter Lynch Hypothesis In Action

Summary

- Datadog, Inc.'s Q2 results surprised me with a slowdown in revenue growth rates.

- Despite the growth slowdown, Datadog's underlying profitability is set to improve.

- I am cautious about Datadog's valuation and its ability to regain growth momentum in 2024.

- The company's downward revision of revenue projections raises questions about its future performance.

- What's the Peter Lynch Hypothesis? How this can be used on the long or short side.

- Looking for a helping hand in the market? Members of Deep Value Returns get exclusive ideas and guidance to navigate any climate. Learn More »

Carlos Barquero Perez

Investment Thesis

Datadog, Inc. (NASDAQ:DDOG) reported Q2 results that took investors by surprise. The biggest takeaway from this earnings result is the most obvious, that Datadog is no longer a growth company.

That being said, this earnings report wasn't all bad news, and in actuality, Datadog's underlying profitability is set to improve further.

However, given its valuation, I remain on the sidelines. Here's what you need to know.

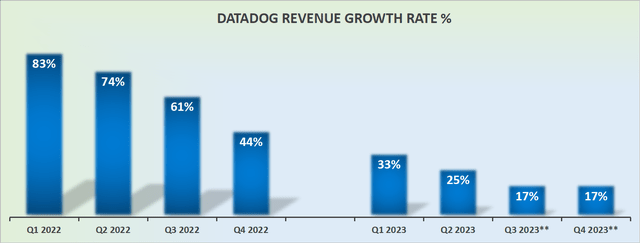

Revenue Growth Rates Hit the Breaks

Datadog provides monitoring, security, and analytics for cloud-scale applications and infrastructure.

This set of results not only took many investors by surprise, but it will also have ramifications for other IT and data analytics companies. The most obvious here is Snowflake (SNOW). But the impact will be felt over the whole sector, even with indirect peers such as Cloudflare (NET) and MongoDB (MDB) being impacted.

Datadog is guiding for a slowdown for the remainder of 2023. Datadog was a company that investors could count on to deliver rapidly growing revenues together with an attractive bottom line. Even though its bottom line continues to be attractive, investors were not attracted to Datadog for its profitability, which we'll soon discuss further.

Datadog was meant to be a growth stock. It was given a growth multiple on this contention. However, it turns out that Datadog's product suit was less in demand than many investors were led to believe.

Perhaps, what's even more challenging to grasp is that H1 2023 was the fastest half of the year. For me, this was the most surprising aspect.

Many investors have heard discussions throughout this earning season about how the back half of 2023 was ready for a reuptake in software demand after enterprises took a pause in their software infrastructure spend. You can read more on this from Microsoft (MSFT) or Amazon (AMZN) or Alphabet (GOOG, GOOGL) -- yes, I've provided analysis on all these names.

The Peter Lynch Hypothesis

I've termed the Peter Lynch hypothesis as being when a stock is changing its narrative, but the fundamentals haven't fully caught up the narrative. I've described to my followers how this can work on the long or the short side.

Allow me to explain. For Datadog, the big question is if 2023 will see Datadog exit with around 20% CAGR, what sort of growth rates can Datadog be expected to see in 2024?

Simply put, can we count on Datadog to accelerate its growth rates so that beyond H2 2023, it could re-accelerate back to an approximate 25% CAGR?

Here's the fact of the matter: growth companies don't downwards revise their growth rates in practically any condition. They can miss on the bottom line. They can become less profitable. But what they cannot do is downwards revise their revenues. And yet, albeit by a small margin, that's exactly what Datadog did.

This forces us to consider the following:

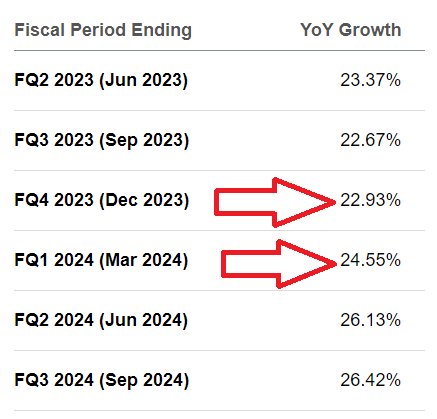

SA Premium

What you see above is that as we headed into the earnings results, analysts following Datadog had their consensus estimates for the company at around mid-20s% CAGR. But it now seems that analysts were too bullish. By extension, this means that in the coming days and weeks, we'll see analysts downwards revising their financial targets.

And that's how the Peter Lynch hypothesis starts to play out. When the fundamentals are starting to change and expectations start to move towards and align with the fundamentals.

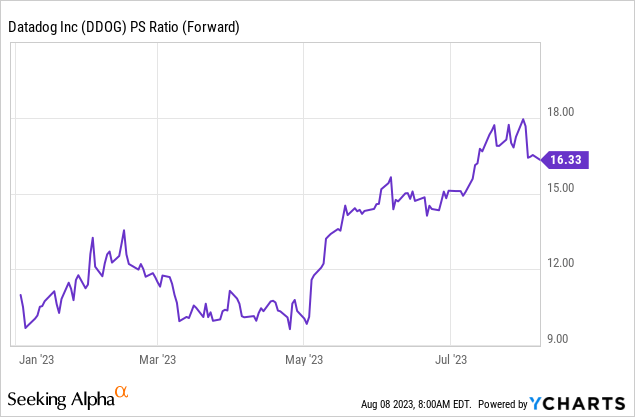

Since the start of 2023, Datadog's multiple has expanded from around 8x forward sales to 16x forward sales. A jump of 100% in multiple expansion in around half a year.

Accordingly, we can conclude that investor expectations were incredibly high. Even though Datadog was able to note that it was increasing its profitability by more than 10% to $400 million since its Q1 guidance was provided, investors were not willing to pay more than a $30 billion market cap for a $400 million adjusted operating profits. Investors were excited and hopeful to see Datadog delivering very rapid topline growth. And on this front, Datadog didn't live up to investors' expectations.

The Bottom Line

In this quarter's earnings report, I was taken by surprise as Datadog showed a slowdown in its revenue growth rates, indicating that it might no longer be a high-growth company.

While its underlying profitability is improving, the demand for Datadog's product suite seems to be weaker than I previously thought.

Now I wonder if Datadog can regain its growth momentum in 2024 after a slower H1 2023?

The fact that the company downwardly revised its revenue projections raises questions about its future performance.

As an investor, I'm cautious about Datadog, Inc.'s valuation and its ability to meet growth expectations. I'll stick to the sidelines.

Strong Investment Potential

My Marketplace highlights a portfolio of undervalued investment opportunities - stocks with rapid growth potential, driven by top quality management, while these stocks are cheaply valued.

I follow countless companies and select for you the most attractive investments. I do all the work of picking the most attractive stocks.

Investing Made EASY

As an experienced professional, I highlight the best stocks to grow your savings: stocks that deliver strong gains.

- Deep Value Returns' Marketplace continues to rapidly grow.

- Check out members' reviews.

- High-quality, actionable insightful stock picks.

- The place where value is everything.

This article was written by

Our Investment Group is focused on value investing as part of the Great Energy Transition. For example, did you know that AI uses thousands of megawatt hours for even small computing tasks? Join our Investment Group and invest in stocks that participate in this future growth trend.

I provide regular updates to our stock picks. Plus we hold a weekly webinar and a hand-holding service for new and experienced investors. Further, Deep Value Returns has an active, vibrant, and kind community. Join our lively community!

We are focused on the confluence of the Decarbonization of energy, Digitalization with AI, and Deglobalization.

As an experienced professional, I highlight the best stocks to grow your savings: stocks that deliver strong gains.

DEEP VALUE RETURNS: The only Investment Group with real performance. I provide a hand-holding service. Plus regular stock updates.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Recommended For You

Comments (7)