Deutsche Bank: It Is Now Time For Sewing And Co. To Give Back To Shareholders

Summary

- Deutsche Bank delivered a solid Q2 performance, beating analyst expectations for both topline and earnings.

- The bank is now (hopefully) shifting its focus towards returning capital to shareholders, with a dividend payment and share repurchase program announced.

- I believe DB management could and should do much more to finally reward shareholders who have been very patient with this bank.

MaxBaumann

Deutsche Bank (NYSE:DB) delivered a solid Q2 performance, beating analyst expectations with regards to both topline and earnings. During the period from April to end of June, the German banking house accumulated approximately EUR 1.4 billion of pre-tax profits. If this quarterly number were to be annualized, which I believe is reasonable, it is suggested that DB stock trades at a P/EBT of x3.8 -- a ridiculously low valuation, that clearly implies price appreciation upside.

As Deutsche Bank's multi-year restructuring efforts are slowly coming to an end, CEO Sewing and team are, hopefully, shifting their focus towards returning capital to shareholders. With that frame of reference, Deutsche Bank has already paid a EUR 0.3/ share dividend in June, and together with Q2 results management announced an approximate EUR 0.25/ share repurchase program to be completed within 2023. But still, this is not enough, in my view. In my opinion, DB management should do much more buybacks to finally reward shareholders, who have been very patient with this bank.

Deutsche Bank's Solid Q2 2023

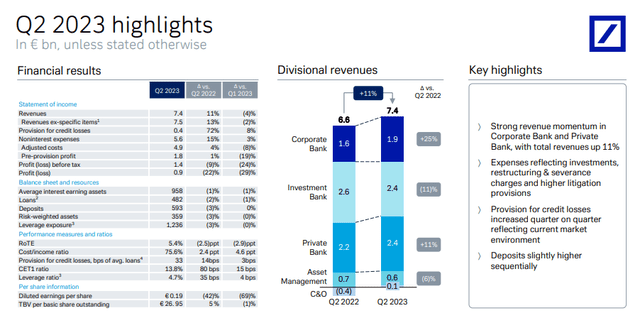

Deutsche Bank delivered a solid Q2 2023, beating analyst consensus estimates with regards to both topline and earnings. During the period from April to end of June, DB generated about EUR 7.4 billion of revenues, which compares to approximately EUR 6.65 billion for the same period one year earlier (11% YoY growth), and to EUR 7.1 billion estimated by analysts at consensus midpoint (EUR 320 million beat, according to data collected by Refintiv).

With regards to profitability, quarterly profit before taxes came in at EUR 1.4 billion, lower than the EUR 1.5 billion for the same period in 2022, 9% YoY contraction), but approximately EUR 200 million higher than what analysts estimated; net income after tax was reported at EUR 940 million.

The DB Q2 2023 number that received most media attention was the bank's 72% YoY jump in provision for credit losses, but undeservingly so, in my view. Investors should consider; firstly, that Deutsche Bank's Q2 2022 benchmark for bad loans was exceptionally stellar, with only EUR 233 million of writedowns; secondly, that Deutsche Bank's Q3 provision for credit losses was still close to management's FY 2023 guidance, between 25 to 30 basis points; and thirdly, Deutsche Bank's provision for loan losses are approximately in line with even to the most strongest names in Finance (see JPM's Q2, Morgan Stanley's Q2).

Deutsche Bank's overall profitability metric continue to trend towards 2025 targets: Adjusting for bank levies and non-operating expenses, DB's post-tax return on tangible equity for Q3 was 8.1%, and the cost-to-income ratio was 68%.

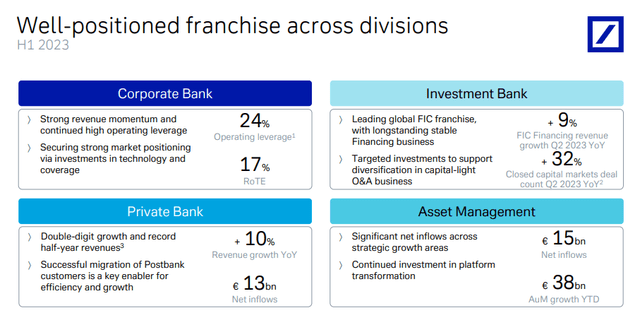

With regards to Deutsche Bank's four key segments, a few metrics stand out:

- The Corporate Bank recorded EUR 1.9 billion of revenue (up 25% YoY)

- The Investment Bank remained relatively resilient versus 2022, especially considering the numbers posted by Wall Street banks, generating revenue of approximately EUR 2.4 billion (down only 11% YoY

- Revenue from DB's Private Bank increased to EUR 2.4 billion (up 11% YoY), seeing EUR 28 billion of inflows (together with AM)

- The Asset Management generated EUR 0.6 billion of revenue (up 6% YoY, seeing EUR 28 billion of inflows (together with PM)

Sewing & Co Should Finally Give Back To Shareholders

In the conference call with analysts post-Q2 earnings release, Deutsche Bank's CEO, Christian Sewing and his CFO James von Moltke once again reiterated confidence that the bank is well on track to meet, if not surpass, its 2025 targets. As a reminder, these targets include achieving revenues close to EUR 30 billion, while maintaining a Cost-to-Income Ratio below 63%.

Doing the math, Sewing implies that Deutsche Bank is approaching a >EUR 10 billion pre-tax income, as compared to market capitalization of slightly more than EUR 20 billion. Needless to say, this is a ridiculous comparison, suggesting deep value. All the more I am surprised that Sewing and Co are only dabbling in share buybacks, and not going "all-in" with every cent of distributable capital.

In fact, investors should consider that Deutsche Bank generated about EUR 4.5 billion of adjusted pre-tax earnings for the trailing twelve month, but 2022 distributions are only expected at EUR 1 billion roughly, suggesting a payout of below 25%.

Reflecting on a decade of value destruction, followed by half a decade of restructuring, with respective disappointing share price performance, I think it is fair to say that shareholders have been very patient with this bank. And, in my view, the patience and -- even more so -- the persistent trust in the turnaround must finally be rewarded, as Sewing and team are in a position of doing so.

Now, while shareholders are waiting for their well-deserved payout, and this is even more frustrating, Deutsche Bank acquired Numis earlier this year for approximately EUR 470 million, paying a P/B of x2. Consider the following: Deutsche Bank is allocating capital to a P/B x2 opportunity, while the bank's own equity is priced below x0.3. How can market participants, who reference management decisions for value hints, believe that DB stock is a "Buy", if the bank's management would rather purchase non-DB equity at a considerable premium to book than DB equity at a steep discount?

I don't have a good answer for this question; but in any case, as a shareholder, I don't like the implied lack of shareholder-friendly management here.

Risks Associated With DB

Investing in banking remains a risky business; however, less so than the market often implies, in my view. Here is what DB investors should consider about risk: First, it is crucial to acknowledge the possibility of increased tail-risk exposure. If this risk materializes, it could result in a significant drop in Deutsche Bank's stock value. Secondly, bank profits show high economic sensitivity; because during economic downturns, borrowers may struggle to repay loans or show willingness to assume debt. Thirdly, I would like to highlight interest rate risk, as banks typically borrow funds at short-term rates and lend at long-term rates. Thus, changes in interest rates, as well as yield curve, can affect Deutsche Bank's profitability.

All that said, Deutsche Bank maintains a robust Common Equity Tier 1 (CET1) ratio of 13.8% as of Q2 2023, offering substantial protection against various market stress scenarios, even severe ones.

Conclusion

Deutsche Bank continues to write profits again, no question about it. And, the German lender is well on track for >10 EUR billion pre-tax operating profits by 2025. I think it is fair to say that the ship turned around. However, considering how well Deutsche Bank is doing now, I am surprised how "unrewarding" Sewing and Co are towards shareholders, especially considering the patience investors have shown over the past years.

Judged by fundamentals only, I continue to believe that DB stock should be valued around $37/share. My target price implies reasonable discount rates anchored on the belief of capable, shareholder-friendly management. Or in other words, I value Deutsche Bank as if earnings generated by the bank actually belong to the owners, the shareholders. So far, however, Sewing and Co have been reluctant to show agreement with this hypothesis; and thus, DB remains deeply discounted as compared to the bank's fundamental true value.

Concluding, I want to offer the following key considerations: If DB management starts to distribute >50% of earnings to shareholders through equity repurchases at <0.3 P/TBV, then buy DB stock with both hands. If, however, DB management even considers allocating earnings to more M&A, buying non-DB equity at >1 P/TBV , run. For now, I hope for the former, and continue to assign "Strong Buy" rating.

This article was written by

Analyst’s Disclosure: I/we have a beneficial long position in the shares of DB either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

not financial advise

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Recommended For You

Comments (4)