SPYI: Structurally Interesting Call Strategy With The Wrong Timing

Summary

- The Neos S&P 500 High Income ETF aims to provide high monthly income and potential upside appreciation in rising markets.

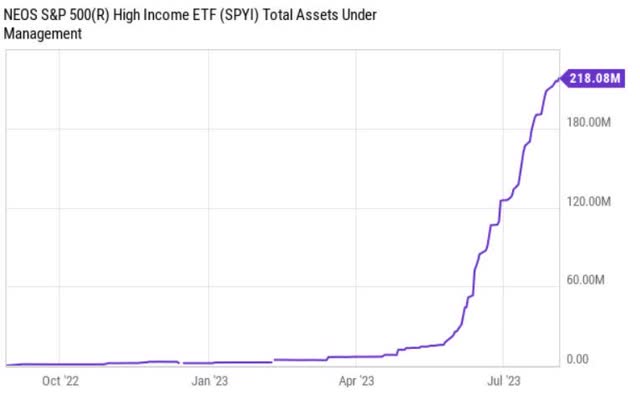

- The ETF has seen success with increasing assets under management and performance in line with the S&P 500.

- The ETF achieves its high yield through a call option strategy, but there may be limitations on potential upside and future yield due to depressed VIX.

- It is highly likely that there will be a search for yield through a more pronounced skew towards options with closer strike values to the underlying that should limit the upside potential if S&P 500 performs well.

monsitj

The Neos S&P 500 High Income ETF (BATS:SPYI) is a relatively recently established active ETF with an underlying exposure to the S&P 500 that is enhanced by a systematic call option strategy.

The overarching investment objective is to deliver high monthly income in a tax efficient manner, with the potential for upside appreciation in rising markets.

So far it has been a success story with the total assets under management figure on a constant rise.

Ycharts

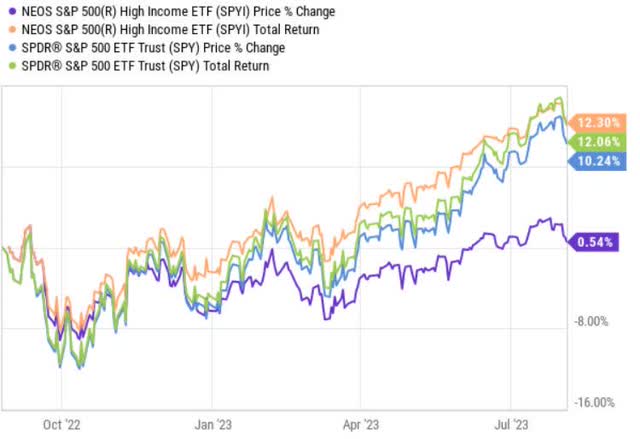

Since the inception the performance has been in line with that of the S&P 500 or the underlying benchmark of SPYI.

Ycharts

Yet, the key takeaway from the chart above is that SPYI has succeeded in its investment objective not only from the return perspective, but also through its juicy distributions.

In other words, one of the main benefits of investing in SPYI is that investors, who want to have an exposure to the returns of the S&P 500, but at the same time enjoy higher dividends than just ~2-3% offered by the conventional index, can achieve that through this ETF.

The dividend bias is enhanced with the tax loss harvesting opportunities that are made possible, when utilizing SPX Index options (classified as section 1256 contracts, which are subject to lower 60/40 tax rates).

Now, let me peel back the onion a bit and explain how double digit yield - currently offering ~11% on a TTM basis - is achieved.

As mentioned above, SPYI leverages call option strategy to pocket additional premiums on top of the long exposure to the S&P 500. This is done through mainly entering covered call positions, where the OTM options on the S&P 500 are sold in a manner which does not exceed the notional exposure to the underlying.

What this also does is it introduces a cap on the potential upside of the S&P 500. The more distant the cap is (or higher compared to the current price), the smaller premiums SPYI can source and thus distribute relatively lower dividends.

The opposite also holds true that if the option strikes are closer to the prevailing price of the S&P 500, the incremental yield potential stemming from the sold OTM calls is higher.

So there is an inherent tradeoff between maximizing dividend potential and not limiting the potential upside from a notable uptick in the S&P 500 value.

Ycharts

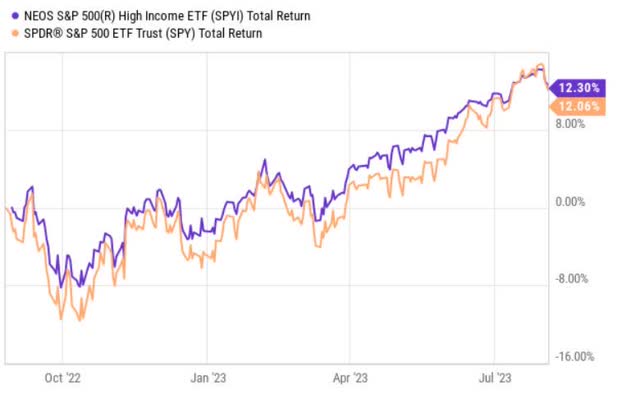

Interestingly, if we compare the total return performance of SPYI to that of the S&P 500, there is almost no divergence at all. What this could tell us is that the strikes on the sold options have been relatively far away from the prevailing S&P 500 prices, thus allowing SPYI to fully participate in the upswing.

Ycharts

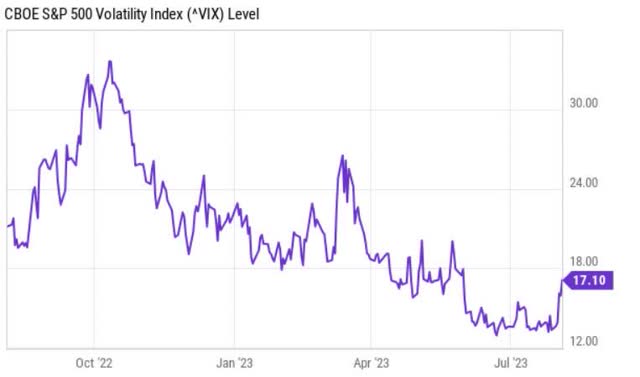

What is also interesting is that the VIX has gone down significantly, which, in turn, has increasingly limited SPYI's ability to pocket juicy premiums.

So the key driver of so similar performance (as it is hard to imagine that SPYI would sell options at so distant strikes or constantly be right on the short-term trades) has been the exposure to long-calls, which have provided a magnified long exposure to the S&P 500.

This in the context of SPYI's net-credit call option strategy, which means that the pocketed premiums from covered calls are greater than the cost of buying the long OTM calls, has benefited the Fund immensely.

The bottom line

Optically, SPYI seems as an attractive ETF for dividend-seeking investors who also want to retain some exposure to the world's most popular and one of the best performing indices - i.e., the S&P 500. The current dividend of ~11% and robust performance since the inception send comforting signals for a buy.

However, I am more in the front of avoiding SPYI for now due to the following reasons:

- The VIX is down considerably, which inherently creates an unfavorable base from which SPYI could extract meaningful yield going forward.

- As a result, I predict that the ETF will introduce a more pronounced skew towards covered calls with narrow spreads between the option strike and underlying index value; as this is the only way how to keep the yield-enhancement somewhat attractive when VIX is so low. This should, in turn, limit the S&P 500 upside capture significantly. The same conclusion (or my prediction) applies to the long calls, which will become less present due to SPYI's efforts to secure acceptable yield.

- Lastly, I would like to see first how SPYI reacts when the S&P 500 drops in a material manner and stays there at relatively depressed levels for a while. Since the inception the S&P 500 has gone up with temporary dips that in the context of both long and short call option strategies have come in handy.

SPYI is definitely on my watch list now.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Recommended For You

Comments (1)

Somebody should write a textbook based on what is actually going on in the market instead of theory that doesn’t really apply in the real world.