Distribution Solutions Group Q2: A 'Hold' In The Spotlight

Summary

- Distribution Solutions Group, Inc.'s Q2 earnings showed significant growth in sales and adjusted EBITDA, indicating a successful expansion strategy.

- The company's consolidated revenue increased by 17.6%, with a significant portion coming from acquisitions.

- Two segments within DSG's umbrella, Lawson's arm and Gexpro Services, performed well with strong sales growth and new client acquisitions.

LaylaBird

Thesis

Distribution Solutions Group's (NASDAQ:DSGR) second-quarter results provide a comprehensive view of the company's strategic trajectory. While the revenue of $377.98 million beat expectations by $18.53 million, the Non-GAAP EPS of $0.52 missed by $0.01. DSGR's growth is evident from its top line and bottom line dynamics, with sales increasing by 17.6% in total and 4.8% organically. However, despite pockets of positive performance, some red flags in valuation and certain segments' setbacks call for a cautious approach, leading to a "hold" rating on DSGR stock.

Company Profile

Distribution Solutions Group, Inc., headquartered in Chicago, serves markets not only in North America but also Europe, Asia, South America, and the Middle East by specializing in distribution solutions for the maintenance, repair, and operations (MRO) market.

Distribution Solutions Group Corporate Website

It operates via three main segments: Lawson, catering to diverse MRO sectors; TestEquity, targeting industries like technology and aerospace with specialized equipment; and Gexpro Services, offering supply chain solutions to manufacturing customers. Founded in 1952 as Lawson Products, Inc., the company rebranded in 2022, emphasizing its expanded distribution focus.

Distribution Solutions Group's Q2 Earnings Highlights

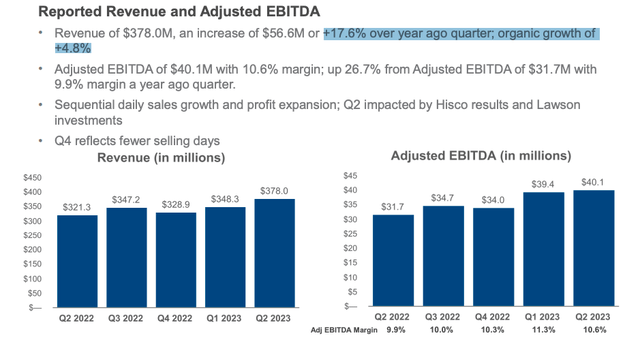

Distribution Solutions Group's second-quarter results give a layered insight into its strategic trajectory. From a broader perspective, its top line and bottom line dynamics hint at an evolving firm that has markedly bettered its previous year's accomplishments, with sales growing by 17.6% in total and a commendable 4.8% in organic terms.

DSGR'S Q2 2023 Consolidated Financial Highlights (DSGR's 2023 Q2 Earnings Presentation)

Unraveling this further, it becomes evident that a dual expansion strategy - encompassing both price and volume - has underpinned this growth.

Furthermore, from a GAAP lens, reported income metrics have burgeoned threefold. A standout figure that warrants attention is the adjusted EBITDA, which, for the first time since DSG's inception, has surpassed the $40 million mark. What this suggests is that the firm's strategic orientation towards ameliorating its working capital is bearing fruit, as reflected in the ensuing positive cash flow trends.

Peeling back the layers to delve into the specifics, the consolidated revenue of $378 million stands out showcasing an upward shift of 17.6% from the past year. Of particular note here is the component of this revenue that stems from acquisitions, amounting to roughly $43.4 million. The significant chunk, $28 million to be precise, came from Hisco's inclusion into DSG's portfolio.

The GAAP operating income presents another dimension: At $13.8 million, it's superior to the previous year's $4.1 million. Subtracting the variables of merger expenses, costs tied to acquisitions, stock-based incentives, severance, and other once-off items, the resultant adjusted EBITDA registers a growth of about 27%, amounting to $40.1 million.

Two segments within DSG's umbrella particularly caught my eye. First, Lawson's arm exhibited a commendable performance, raking in sales of $119.1 million for the said quarter. Here, organic growth was a pivotal driver, especially evident within niches like Kent Automotive and government sectors.

Gexpro Services, on the other hand, with its Q2 sales of $108.3 million, showcases a growth trajectory. The buoyancy in these figures is predominantly fueled by an influx of new clientele and broadening of extant customer relationships. Here, five of their six industry verticals have exhibited growth on a year-on-year basis, a trend that investors might not want to overlook.

Lastly, DSG's financial strategy appears to be one of consolidation and foresight. The Q2 reports highlighted an expansion in its credit facility - a leap from $500 million to $805 million. Furthermore, the additional stock issuance of $100 million to current stakeholders, even with its spree of acquisitions over a span of 15 months, appears to indicate the company is managing and maintaining its debt well with a leveraged ratio at 3.1x.

Performance

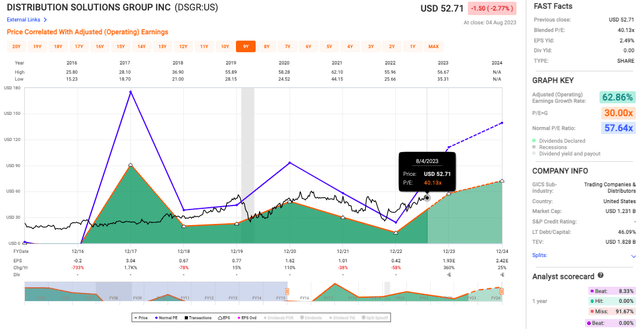

The following medium-term data indicates that DSGR has experienced a doubling of its share price, from USD $26.64 in January 2015 to USD $52.71 as of August 04, 2023. This translates to an annualized rate of return (ROR) without dividends of 8.27%. While this growth might look appealing, it's essential to notice that this performance is lower than the S&P 500 Index's (SP500) annualized ROR of 9.47%.

And when considering growth and dividends, DSGR's compound growth stands at 8.27%, while the S&P yields a more attractive return at 10.71%.

Valuation

The observed P/E ratio (see data below), which currently stands at 40.13x, compared with the historical normal of 57.64x, is notably lower. Such a deviation is often a signifier of potential undervaluation by the market. The interpretation of this might be seen as a buying opportunity for those investors with a conviction in the company's strategic direction. On the other hand, it could equally be perceived as an indication that market sentiment regarding the company's growth potential has become more conservative.

A further dimension to explore is that of growth. The company's adjusted (Operating) Earnings Growth Rate has reached an impressive 62.86%. This might be a reflection of DSGR's success in tapping into new market trends. Yet, a blended P/E ratio exceeding 40 invites questions concerning the durability of this growth rate.

Risks & Headwinds

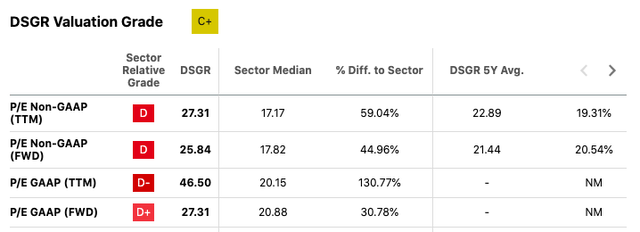

Starting with DSGR's Non-GAAP P/E ratios, both Trailing Twelve Months (TTM) and Forward (FWD) P/E ratios are significantly above the sector median, with differences of 59.04% and 44.96% respectively. It's also higher than its own 5-year average. With grades of D in these categories, these are typically red flags suggesting that DSGR might be overvalued compared to its peers.

The GAAP P/E ratios also paint a grim picture. A D- grade for the TTM ratio and a D+ for the FWD ratio with alarming differences to the sector median only add to the concerns.

Next, circling back to the Q2 results, the test equity segment presented some setbacks. With sales growing to $136.1 million, primarily driven by recent acquisitions, the storyline might appear exclusively promising at first glance. However, a deeper look reveals organic sales down 7% compared to a year ago, due to a decrease in test and measurement sales and a softening of the EPS sales. While these projects are delayed and not canceled, it still highlights a temporary obstacle in growth.

Lastly, within the strong performance of Lawson's segment, there were minor complexities as well: Adjusted EBITDA improved to $16.1 million, yet faced mix shift headwinds, and the very infrastructure investments that signify a focus on future growth (i.e., investments in new account managers and a new CRM tool) brought down the percentage slightly underscoring a delicate balancing act faced by many growing companies, that of aligning short-term profitability with the investments required to achieve long-term growth objectives.

Final Takeaway

Based on the information provided, I would rate Distribution Solutions Group, Inc. stock as a "hold." The company's Q2 2023 performance showcases pockets of growth and impressive strategic development, including increases in revenue and adjusted EBITDA. However, the valuation signals like higher P/E ratios compared to the sector median and some underlying complexities, such as a decrease in organic sales in certain segments, temper my enthusiasm. For now, this mixed picture suggests a cautious approach, justifying a hold position rather than a buy.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.