British American Tobacco: Consensus Bulls May Be Wrong Again

Summary

- The market has proved my earlier 'Strong Sell' rating correct. I maintain my stance as I am skeptical of the bullish arguments based on low-valuation and non-combustibles product growth:

- Combustibles still matter most above all else; more than new growth products, more than the new CEO and more than ESG.

- New categories do not move the needle; they are too small and growing too slowly to make a difference.

- The secular decline in combustibles may be stronger than it seems as volume declines continue even as alternative data shows inflationary pressures to have reduced.

- As expected earlier, the stock has de-rated even further. I believe it will continues to be a value trap unless there is a radical business diversification.

The contrarian view

welcomeinside

Performance Review

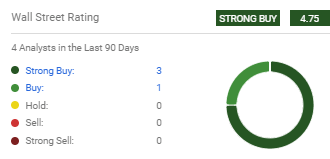

I had a "Strong Sell" on British American Tobacco (NYSE:BTI) (OTCPK:BTAFF) in my last article on this stock. Out of the last 41 Seeking Alpha articles on this company, I have been the only bear on the stock, compared to 20 "Strong Buys", 17 "Buys" and 3 "Holds". Wall St has also rated the stock bullish over the last 90 days:

Wall St Rating on British American Tobacco (Seeking Alpha's British American Tobacco Page)

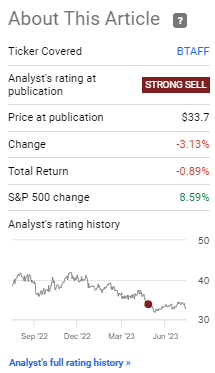

My stance has not only been very contrarian, but also rather controversial, as evidenced by the very lively comments discussion in my prior article. Luckily, sticking my neck out against the consensus has worked out as the market has so far ruled in my favor:

Performance of my last article on British American Tobacco (Hunting Alpha, Seeking Alpha)

Since publication of my last article, BTI has delivered a total shareholder return of -0.89% compared to the S&P500 (SPY) (SPX) (VOO)'s return of +8.59%. This corresponds to an alpha/outperformance of +9.48%.

The consensus bullish argument for BTI has been based upon low valuations and 'progress' on new growth products on the non-combustibles side. However, I do not see a compelling case for these arguments:

Thesis Update

After reviewing H1 FY23's results, my bearish thesis remains intact for the following reasons:

- Combustibles still matter most; don't let narratives outweigh the numbers

- New categories do not move the needle

- Secular decline may be stronger than it seems

- The stock continues to be a value trap

Combustibles still matter most; don't let narratives outweigh the numbers

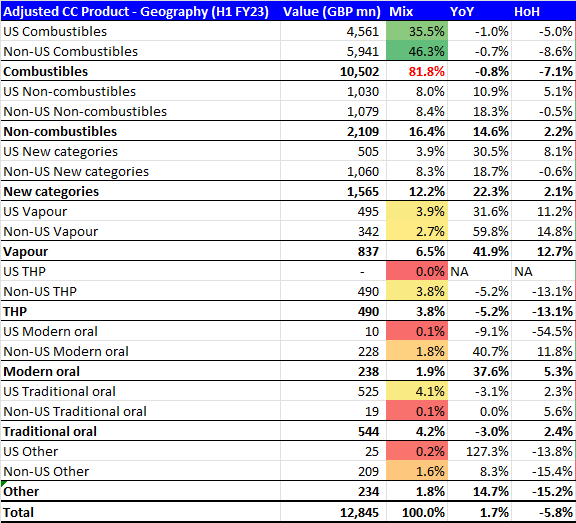

BTI reports a lot of granular data along with extensive commentary. In H1 FY23, we also saw some key events involving a CEO change following an earlier misconduct. However I think a lot of this is noise that does not matter. The stock's performance is still driven heavily by the Combustibles business' performance, which makes up almost 82% of total revenues. Here's the product and geography split:

British American Tobacco H1 FY23 Revenue Split (Company Filings, Author's Analysis)

Adjusted refers to the stripping away of inorganic parts to capture organic growth. CC stands for constant currency. Organic CC growth is a better measure to assess performance as it focuses on the core business, excluding the impact of external forces outside management's control such as FX movements

From a P&L contribution perspective, the New Categories segment is still unprofitable as it posted a GBP -12mn loss in H1 FY23. Hence the weightage of Combustibles matters even more the lower down we go towards earnings and cash flows.

New categories do not move the needle

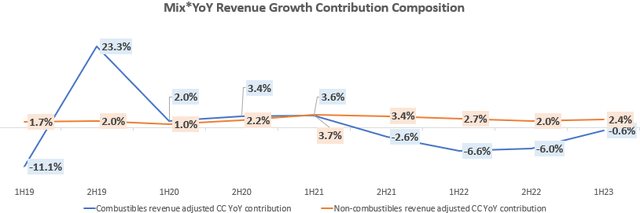

Some commenters in my last article pointed toward the growth in new categories as a reason to be bullish. This is certainly the narrative management tries to sell investors. However, even after accounting for its higher 14.6% YoY growth, the numbers prove that the impact is not large enough to really move the needle. To illustrate this, we can look at the weighted revenue contribution, which takes into account both the mix and the growth:

Mix*YoY Revenue Growth Contribution Composition (Company Filings, Author's Analysis)

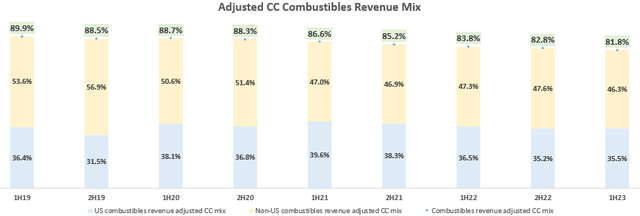

The non-combustibles contribution is still printing close to 2-3% here. Unless this materially accelerates, I believe the overall combustibles mix will continue to decline at a glacial pace of ~200bps every year:

Adjusted CC Combustibles Revenue Mix (Company Filings, Author's Analysis)

Note again that this analysis looks even worse for the non-combustibles segment at an earnings or cash flow level since the segment is still unprofitable.

Secular decline may be stronger than it seems

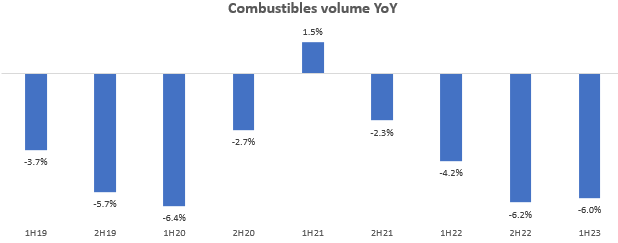

BTI's Combustibles segment continues to be a declining business, particularly on the volumes front:

BTI Combustibles Volume YoY (Company Filings, Author's Analysis)

Management attributed 26% of the overall industry's volume decline in the US to secular declines and 37% to "Consumer macro impacts", which includes inflationary impacts:

And at the same time with massive inflationary pressures that put a lot of pressure in terms of consumer purchase power.

- CEO Tadeu Marroco in the H1 FY23 earnings call

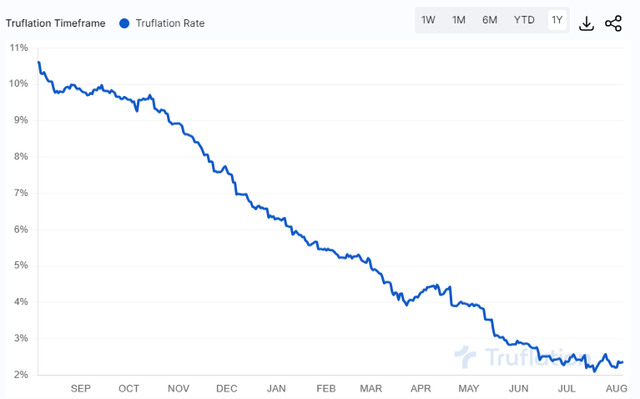

However, I suspect there is a greater proportion of secular decline to the story here than temporal macro drivers. Some evidence to support this view comes in when we look at the inflation data reported by Trueflation, which is arguably a more real-time measure of the inflation rate in the US economy:

Trueflation CPI (Trueflation)

According to Trueflation, inflation has reduced or at best, remained stable in the US economy. The latest data print shows 2.37%.

The stock continues to be a value trap

As I had anticipated, BTI has de-rated from its previous 1-yr fwd PE of 8.90x at the time of my earlier publication to 6.65x today:

British American Tobacco 1-yr fwd PE (Capital IQ, Author's Analysis)

The discount to the longer term 1-yr fwd PE multiple of 12.32x now stands at 46.1%. This may attract the interest of many value investors. However, I believe considering the gearing of the business to the secularly declining combustibles market, the stock continues to remain a value trap. Observe how the stock has continued to de-rate from previous 'discount' levels; when it was at a 10.00x 1-yr fwd PE, it traded at a ~20% discount to the long-term average. In my view, this is a classic example of the need for a genuine operational catalyst to trigger prudent value buys.

Key Monitorable

It is difficult to turnaround a business that is in secular decline. I believe the stock would be headed toward a more optimistic direction if and when it starts to diversify into new segments, ideally not highly regulatory-constrained, as that would expose the stock to the same regulations factor risk (in other words, cannabis diversification won't cut it). The Indian cigarettes leader ITC is a strong example of successful business diversification.

Perhaps the new CEO Tadeu Marroco will steer BTI along this path. This is the key thesis-changing monitorable I would wait for. Besides this, there may be some small periods of BTI outperformance over the market. However, I anticipate these to be temporary. I will update you all on the tactical changes in my stance, either in another article or via a pinned comment to this piece.

Takeaway

With a 'Strong Sell Rating', I have been the only bear on British American Tobacco since November 2022, which has not only been a contrarian position but also a controversial one as it looks like the stock garners the favor of many investors on Seeking Alpha.

I gain confidence in the results; British American Tobacco has underperformed the S&P500 by +9.48% since my last publication, even posting a negative total shareholder return of -0.89%.

The H1 FY23 results have renewed confidence in my thesis; combustibles still matter the most and they continue to be in (probably understated) secular decline, non-combustibles are not growing fast enough to move the needle, and the stock continues to de-rate as expected, remaining a value trap.

Thus, I will stick my neck out again and continue rating the stock a "Strong Sell".

How to interpret Hunting Alpha's ratings:

Strong Buy: Expect the company to outperform the S&P500 on a total shareholder return basis, with higher than usual confidence

Buy: Expect the company to outperform the S&P500 on a total shareholder return basis

Neutral/hold: Expect the company to perform in-line with the S&P500 on a total shareholder return basis

Sell: Expect the company to underperform the S&P500 on a total shareholder return basis

Strong Sell: Expect the company to underperform the S&P500 on a total shareholder return basis, with higher than usual confidence

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

This article was written by

Analyst’s Disclosure: I/we have a beneficial long position in the shares of VOO either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Recommended For You

Comments (26)

All that said, like many high dividend stocks, BTI is suffering in comparison to CDs and bonds. 18-24 months ago, many investors searching for yield had only one place to go, and BTI was one of the strong names. Fall and are coming, and so may a pause or reduction in rates. Then BTI (and many others) will likely get some interest. Just like 0%, 5% can't last forever.

In the meantime, investors like us need analysts like you to ferret out the potential issues in the names we hold. It's appreciated.

Earnings per share constant currency +5.3%

Operating Margin +0.4%How you get to your revenue growth rate I honestly don't know because I have the numbers from their half year statement and you don't disclose what you adjusted for. You should also mention that they exited Russia and Belarus which accounted for 2.9% of their total revenue. I doubt that they will have such an impact every year, so to adjust for that is totally reasonable and changes the picture of their combustible-business in AME (+6.0% revenue growth) and APMEA (+9.1%) completly. Perhaps you should mention what you excluded in your YoY comparison and not just present some shrinking numbers. Overall their combustible business grew 0.2% YoY (Constant currency) and not -0.8% or -7.1% (whatever number that is) because they managed to compensate the combustible volume decline with an increase in pricing (-511 pound volume change, + 548 pound price). Like they did since 10-20 years.But perhaps I'm old-school and a company takling 3-5% organic revenue and mid-single digit EPS growth on top of a safe 8% dividend yield is a shrinking buisness. At todays valuation they could reach the EPS growth target through buybacks alone with their cashflow after dividends because the deleveraging is completed and still pay a 8% dividend yield. But that is also an information you "accidently" forgot.

At least try to paint the whole picture and not just picking the negative numbers and forget the positive ones in an analysis. That is not honest.

You touch on a point that occurred to me while reading this article.

HA's arguments against BTI are applicable, for the most part, to all of Big Tobacco.

If you were to buy something today that paid a large safe dividend, what would you recommend?

I like Blackstone: seekingalpha.com/...Not as large a divvy yield, but I think it comes with outperformance over the S&P500.And I have to say: it's not a recommendation (please see Seeking Alpha disclosure at end of article).