LCI Industries: More Temporary Pain Likely To Be Seen In Q2 Earnings

Summary

- LCI Industries is expected to announce poor financial results for the second quarter of 2023, following a significant decline in sales in the first quarter.

- The decline in sales is attributed to a drop in demand for RVs due to inflationary pressures and higher interest rates.

- Analysts have low expectations for the company's second quarter, but the longer-term outlook for the company is likely to be positive.

- For now, however, investors would be wise to remain cautious because timing on a recovery is uncertain.

- Looking for a helping hand in the market? Members of Crude Value Insights get exclusive ideas and guidance to navigate any climate. Learn More »

Larry Crain

On August 8th, before the market opens, the management team at LCI Industries (NYSE:LCII) is expected to announce financial results covering the second quarter of the company's 2023 fiscal year. Those familiar with the company understand that it operates as a producer and seller of equipment that's used in the recreation and transportation markets, with most of its business dedicated to RVs, buses, trailers, and other similar vehicles. Objectively speaking, the first quarter of this year could only be described as a bloodbath for the company. More likely than not, that trend is set to continue for at least one additional quarter. But this doesn't necessarily mean that the company is one that investors should stay away from. While I am not optimistic enough to upgrade the company from a 'hold' to a 'buy' just yet, I do think that management has made clear that current troubles are short term in nature. And when you look at how shares are priced under the assumption that we will eventually see a full recovery, I do believe that it's only a matter of time before the business is worthy of an upgrade again.

Setting expectations

To be very clear, when I rate a company a 'hold', my view of that business is that shares should see upside or downside that more or less matches the broader market for the foreseeable future. I do this because, as an investor, my goal is not to match the market but to beat it. Since I last wrote about LCI Industries back in February of this year, an article in which I downgraded the company from a 'buy' to a 'hold', shares have actually performed better than I would have anticipated. While the S&P 500 is up 10.4%, units of LCI Industries have generated upside of 13.7%.

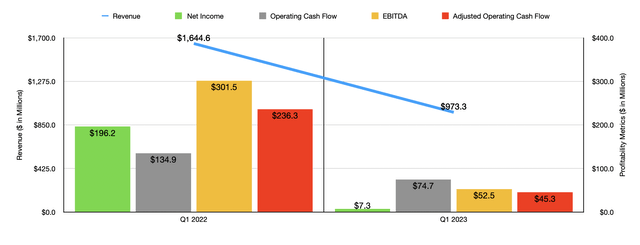

Looking at this outperformance, it's not difficult to imagine a scenario in which the upside was driven by strong fundamental results. Unfortunately, reality is quite a bit different. During the first quarter of the company's 2023 fiscal year, revenue totaled $973.3 million. That's 40.8% lower than the $1.64 billion the business reported the same time last year. This massive decline in sales was not unique to LCI Industries. The fact of the matter is that, for a couple of years, demand for RVs was incredibly high. The desire for social distancing, combined with low interest rates and economic stimulus, was responsible for that. But then inflationary pressures started to affect the industry. This was made worse by soaring interest rates aimed at combating said inflation. After all, if you are going to spend tens of thousands of dollars or hundreds of thousands of dollars on a recreational vehicle, it is highly probable that you will rely on some form of financing to do so.

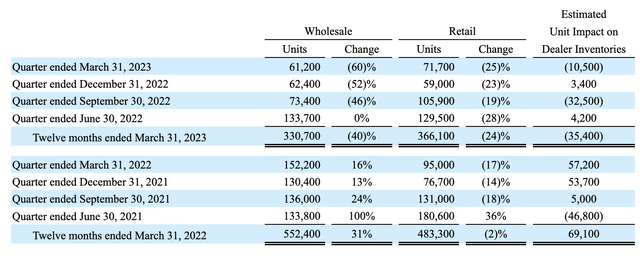

The end result, inevitably, had to be a decline in the number of RVs sold. In the 12-month window ending on March 31st of this year, total wholesale shipments of RVs, industry-wide for the US and Canada combined, came in at 330,700. That was down 40% compared to the 552,400 reported the same window of time one year earlier. Actual retail sales that came from the wholesale side dropped 24% from 483,300 to 366,100. The first quarter of this year was particularly painful, with wholesale shipments down 60% and retail sales, as measured by units, dropping 25%. The drop in revenue for the company also caused aftermarket sales to drop around 13% from $248 million to $215.1 million.

Naturally, any drop in revenue of this magnitude is sure to have a negative impact on the company's bottom line. Net profits went from $196.2 million to only $7.3 million. Operating cash flow was cut by nearly half, from $134.9 million to $74.7 million. If we adjust for changes in working capital, the decline was even worse, from $236.3 million to only $45.3 million. And finally, EBITDA for the business dropped from $301.5 million to $52.5 million.

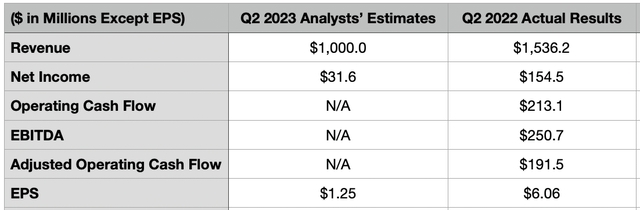

So far, when it comes to the second quarter of the year, analysts don't have high hopes. The current expectation is for the company to generate revenue of roughly $1 billion. Although higher than what the company achieved during the first quarter, this would represent a sizable decline from the $1.54 billion in sales generated in the second quarter of the 2022 fiscal year. Earnings per share, meanwhile, are expected to come in at around $1.25. That would represent a drop from the $6.06 per share reported one year earlier. This would take net income down from $154.5 million to only $31.6 million. Analysts have not provided guidance when it comes to other profitability metrics. But investors should also be paying attention to these when the company reports. For context, in the second quarter of last year, operating cash flow was $213.1 million, while the adjusted figure for it was $191.5 million. And finally, EBITDA for the company was $250.7 million.

If current estimates are correct, the picture for this year as a whole is not looking all that great. Management did say that they might start to see an increase in demand for the third quarter of the year. And investors should definitely pay attention to whether that is the case or not. Because, after all, we are now more than one month into that quarter. So management very likely will provide some details on that. We do know that when it comes to 2023 and its entirety, management said that wholesale shipments of RVs should be between 310,000 and 330,000. This would be down from the 421,700 units that were shipped last year. Retail sales are expected to come in stronger at between 340,000 and 360,000. That should cause dealer inventories to drop some on a year-over-year basis.

Even though this could indicate additional pain for shareholders from a fundamental perspective, it's likely that the company will recover either next year or the year after. Management also seemed unsure, specifying that a recovery should take place in either 2024 or 2025. But eventually, they expect a full recovery to translate to between 400,000 and 500,000 units sold each year. It is highly likely that if this comes to fruition, that results would go back to being similar to what they were last year.

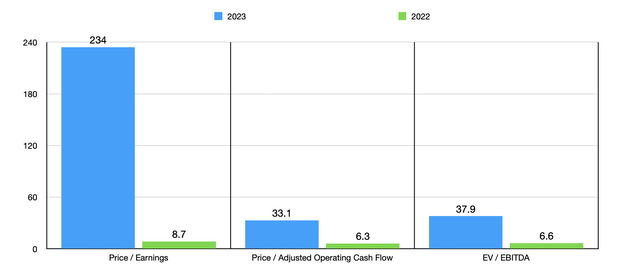

This is the reason why I remain neutral on the company. Obviously, we don't know what will happen until it does. But in the chart above, you can see how shares are priced using data from the 2022 fiscal year. I also put on that chart pricing for 2023 if we assume that financial results achieved in the first quarter of this year relative to the same time last year are indicative of how the rest of 2023 will play out. Clearly, in that case, units of the company are expensive. But if we assume a full recovery for the industry, the stock looks quite cheap on an absolute basis. I also, using those figures, compared LCI Industries to four similar firms in the table below. Using the price to earnings approach, our prospect was the cheapest of the group. It becomes the second cheapest if we look at the EV to EBITDA approach, and the third cheapest if we use the price to operating cash flow approach.

| Company | Price / Earnings | Price / Operating Cash Flow | EV / EBITDA |

| LCI Industries | 8.7 | 6.3 | 6.6 |

| Camping World Holdings (CWH) | 11.8 | 2.3 | 7.1 |

| Thor Industries (THO) | 10.9 | 7.5 | 6.9 |

| Winnebago Industries (WGO) | 8.9 | 7.4 | 6.0 |

| Patrick Industries (PATK) | 11.5 | 3.8 | 7.2 |

Takeaway

What all of this illustrates for me is that, despite all the pain occurring right now, the market is optimistic that a recovery will eventually take place. I also believe that this is the appropriate way to think about matters. But I am not optimistic enough to upgrade the company just yet. A soft landing for the economy is looking more likely by the day. But it would be a mistake to bet on that taking place before we see additional data. That's why I have decided to keep the company rated a 'hold' for now, but I very well could upgrade it if we start seeing some good upward momentum.

Crude Value Insights offers you an investing service and community focused on oil and natural gas. We focus on cash flow and the companies that generate it, leading to value and growth prospects with real potential.

Subscribers get to use a 50+ stock model account, in-depth cash flow analyses of E&P firms, and live chat discussion of the sector.

Sign up today for your two-week free trial and get a new lease on oil & gas!

This article was written by

Daniel is an avid and active professional investor. He runs Crude Value Insights, a value-oriented newsletter aimed at analyzing the cash flows and assessing the value of companies in the oil and gas space. His primary focus is on finding businesses that are trading at a significant discount to their intrinsic value by employing a combination of Benjamin Graham's investment philosophy and a contrarian approach to the market and the securities therein.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.