Air Products and Chemicals: Increasing Backlog Will Likely Drive EPS Growth

Summary

- Air Products and Chemicals' Q2 financial figures were supportive. The company increased its 2023 lower-end EPS.

- Here at the Lab, we particularly like APD's growth strategy focuses on large-scale mega-projects in hydrogen.

- Positive EPS trend with a double-digit growth also in 2024. Therefore, we decided to increase our target price.

schulzhattingen

Air Products and Chemicals (NYSE:APD) released its Q2 financial figures last week. We are surprised about the negative stock price reaction (in detail, at the Wall Street closing bell, the company declined by 5.85%). Here at the Lab, our long-standing buy rating is based on downside protection on APD's three industrial gas segments, with an upside on the green and blue hydrogen revolution that is currently pursuing (Fig 1). As mentioned, Air Products and Chemicals' growth strategy has always been to invest in the clean energy transition and is usually the first mover on worldwide large-scale mega-projects. In the past, we analyzed the CAPEX investments in infrastructure mission-critical energy projects (Fig 2). We commented on the latest $1 billion announcement with the Republic of Uzbekistan in May. Since then, APD has decided 1) to increase its exposure to Qatargas liquefied natural gas and 2) to invest in a capacity expansion on the Air Products manufacturing facility in Florida.

APD: Two-Pillar Growth Strategy

Fig 1

Mare Past Analysis

Fig 2

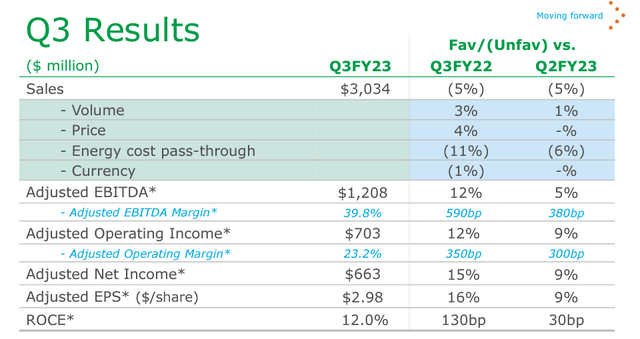

Q3 Results

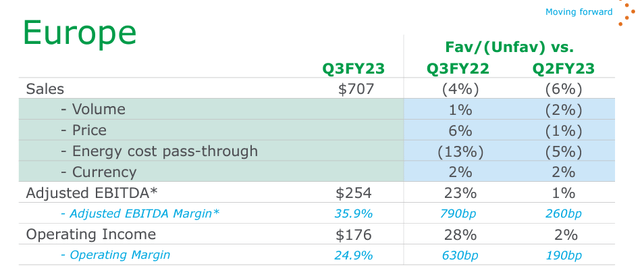

It is essential to analyze APD results by looking at its direct competitors. Here at the Lab, we have reviewed the quarterly financial performance of Linde's "Double-Digit EPS Growth, Buy Confirmed" and Air Liquide's "All Checked, Still A Buy." Starting with Wall Street consensus, we positively report that APD beat EPS estimates by 2%, reaching a reported June EPS of $2.98. On a yearly basis, EPS was up by 16%, thanks to volume and price growth by 3% and 4%, respectively. At the aggregate level, Linde recorded a harmful volume of 1%. Air Products and Chemicals recorded a core operating profit of $703 million (Fig 3); this was supported by Europe, the Americas, and the APAC regions up by 28%, 25%, and 14%, respectively. APD's EBIT was mainly driven by Americans and EU results which offer higher expenses due to corporate cost, given the company's project backlog and related investments. At the geographical level, APAC volumes were up by 8% yearly and were backed by new projects that are now operating. The Americas region recorded volume growth of 6% with supportive merchant pricing. Compared to Air Liquide, APD managed to grow its volume in the EU by up to 1% yearly (Fig 4).

Air Products and Chemicals Q3 Financials in a Snap

Fig 3

APD: EU volume growth

Fig 4

Mare Upside

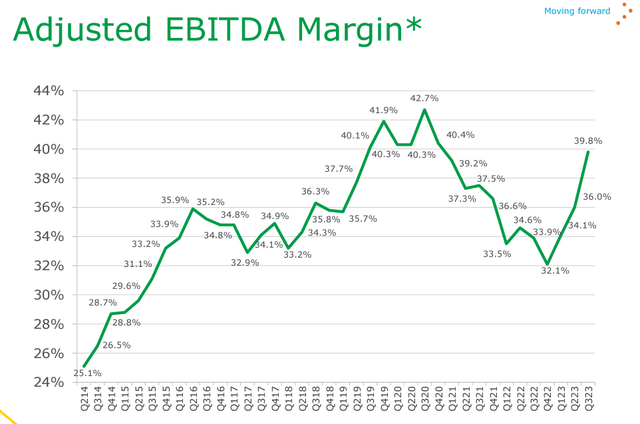

- APD achieved an adj. EBITDA of $1.2 billion, confirming a double-digit growth rate yearly, and thanks to the EU recovery, the adj. EBITDA margin reached 39.8% with an improvement of 590 basis points (Fig 5). Aside from the EU, pricing power and volume growth were drivers in all regional segments;

- Q4 EPS is guided up by 7/10% at the mid-point of APD guidance. After a few double-digit growth quarters, the EPS trajectory might seem disappointing. However, the company increased its 2023 lower end-guidance;

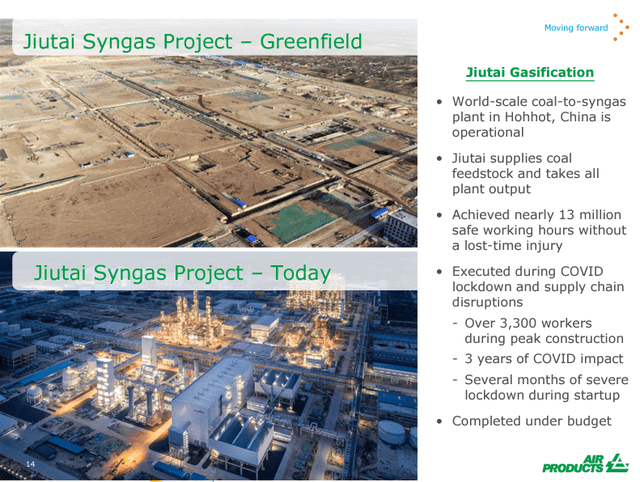

- The Chinese Jiutai project was completed (Fig 6). According to our estimates, this adds 5-7 cents per share to APS's EPS growth rate and 30 cents per share in a full run-rate development (scheduled in our numbers for next year);

- Here at the Lab, we forecast that the new projects should add $1.4 per share EPS growth over the next year, and we anticipate a 12% EPS growth in Fiscal Year 2024. This is derived by late 2023 start-ups projects coming online and a $3 billion backlog for 2024;

- The company's total project backlog is now at $14 billion and is expanding in the energy and decarbonization transition. SAF supports this, and we believe we should drive above-trend EPS growth.

APD: EBITDA growth

Fig 5

Jiutai project online

Fig 6

Conclusion and Valuation

Although the macroeconomics is still uncertain, here at the Lab, we believe the APD project backlog will likely be a strong growth driver over the medium-term horizon, with the specialty gas pricing power as a near-term upside. Our 2023 estimated CAPEX is also unchanged at APD's mid-point guidance ($5.25 billion). Including Q3 debt development, we arrived at a yearend debt of $8.1 billion, and including a $1.4 per share EPS growth, we marginally increased our EPS to $13.2. Applying an unchanged P/E multiple set at 25x, our target price increased from $320 to $330 per share. This valuation is also supported by its competitors' trading multiples (Linde 2024 P/E at 26x and AL 2024 P/E at 24x). Downside risks include 1) mega-project execution risks, especially with overexposure related to China, 2) unplanned plant outages, 3) raw material pricing pressure with the inability to offset margin compression, and 4) timing of new hydrogen applications.

This article was written by

Analyst’s Disclosure: I/we have a beneficial long position in the shares of APD either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.