High Growth Retirement Passive Income: SCHD Or DGRO?

Summary

- Investing in high dividend growth funds like SCHD and DGRO can provide a reliable source of passive income for retirees.

- These funds offer strong dividend growth rates, which can help protect against inflation and allow for a growing standard of living.

- We compare SCHD and DGRO side by side and offer our take on which is the better pick at the moment.

- Looking for a portfolio of ideas like this one? Members of High Yield Investor get exclusive access to our subscriber-only portfolios. Learn More »

designer491

Generating passive income by investing in high dividend growth funds like the Schwab U.S. Dividend Equity ETF (NYSEARCA:SCHD) and the iShares Core Dividend Growth ETF (NYSEARCA:DGRO) can be a great way to fund a retirement for the following reasons:

- The passive income makes it quite easy to budget for living expenses since dividend payout levels are far less volatile than returns generated by capital appreciation in the excessively volatile stock market. As a result, retirees can sleep well at night knowing that they have a sustainable plan to meet living expenses through their dividend income rather than fretting about whether or not a stock market crash may be right around the corner.

- The strong dividend growth generated by these funds alleviates another common worry: inflation. Even if inflation remains higher for longer, the double-digit dividend annualized growth rates generated by funds like SCHD and DGRO means that retiree's standard of living will likely continue to grow over time even in a high inflation environment.

- Their substantial diversification alleviates another common concern for retirees: dividend cuts. Even if some of the underlying holdings of these funds falls upon hard times and have to cut or even eliminate their dividends, the significant diversification of these funds mean that the overall dividend payout will still be quite safe and likely even continue to grow given the strong growth rates being generated by their underlying holdings in general.

- Last, but not least, the completely passive nature of these funds makes them ideal for retirees since they completely free them up to spend their time as they please without having to worry about digging into financial statements, earnings calls, macroeconomic news, and valuation models. Instead of staring at a computer screen with stress levels rising, retirees can relax while pursuing their favorite hobbies.

With these pros in mind, let's compare SCHD and DGRO side-by-side to determine which is the better passive income dividend growth machine for retirees.

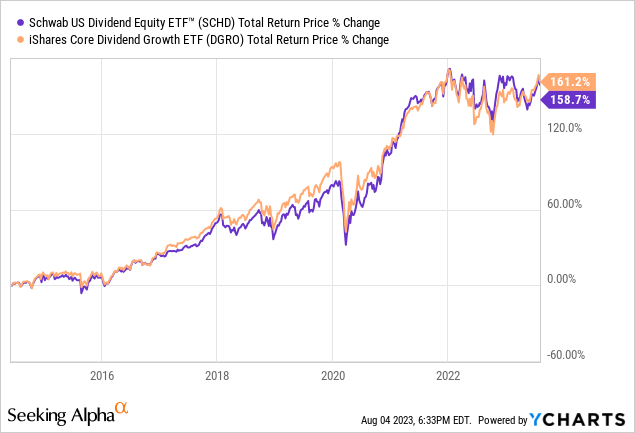

SCHD Vs. DGRO: Track Record

Over the long-term, these funds have delivered strikingly similar total returns with evident close correlation. SCHD has slightly edged out DGRO over that period:

When it comes to dividend growth, SCHD outpaces DGRO once again with a 13.92% five-year dividend per share CAGR compared to DGRO's 10.64% dividend per share CAGR over that same period and a 12.33% three-year dividend per share CAGR compared to DGRO's 7.82% dividend per share CAGR over that same period. That said, on a trailing twelve-month basis, DGRO has outpaced SCHD in dividend growth with a 17.53% dividend per share growth rate compared to SCHD's 7.13% dividend per share growth rate.

Overall, these funds appear to have very similar track records, though we would give a very slight edge to SCHD here.

SCHD Vs. DGRO: Constitution

DGRO and SCHD have fairly similar sector allocations. However, there are some notable differences. For example, DGRO has greater allocation to its top sectors, including a meaningfully greater exposure to sectors such as Health Care, Financials, and Technology compared to SCHD's exposure to those sectors. Moreover, DGRO has far greater exposure to Utilities than SCHD does.

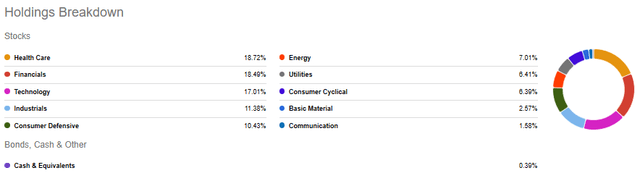

DGRO Sector Exposure (Seeking Alpha)

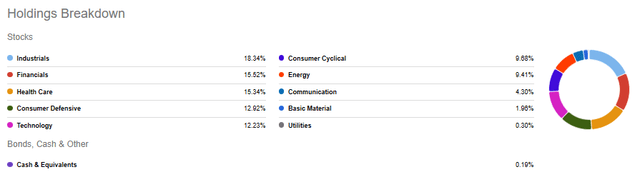

In contrast, SCHD has far greater exposure to Industrials and also has meaningfully more exposure to Consumer Defensive, Consumer Cyclical, and Energy stocks than DGRO does.

SCHD Sector Exposure (Seeking Alpha)

It is hard to draw too many conclusions from this analysis as far as how it pertains to sustainability of and future growth potential for dividends, but it is important to keep these differences in mind as a portfolio is filled out.

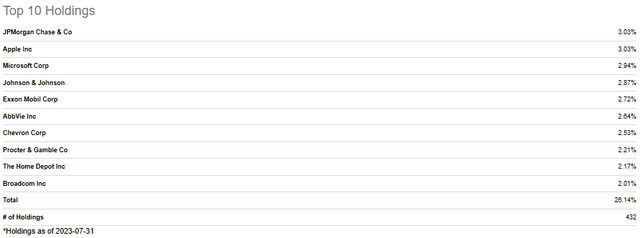

Another very important distinction is that DGRO is more than four times as diversified as SCHD is given that it has 432 total holdings compared to SCHD's 104 total holdings.

DGRO Top Holdings (Seeking Alpha)

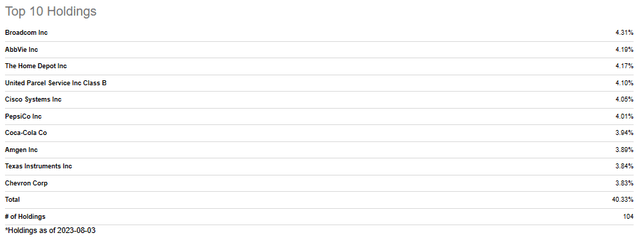

Moreover, its top 10 holdings comprise 26.10% of its total portfolio whereas SCHD's top 10 holdings comprise a whopping 40.33% of its portfolio:

SCHD Top Holdings (Seeking Alpha)

However, it is important to keep in mind that SCHD's portfolio is still fairly well diversified as 104 holdings is more than enough to mitigate the risks that come with too much concentration. Nevertheless, having its top 10 holdings concentrated in over 40% of its portfolio does imply that if one of those top holdings were to suddenly fall on hard times and have to slash or even eliminate its dividend that it would take a substantial bite out of the ETF's dividend growth rate. Fortunately, all of them are quite high-quality businesses with solid balance sheets, with the riskiest holdings likely being AbbVie (ABBV), Amgen (AMGN), and Chevron (CVX) as ABBV and AMGN have considerable regulatory and R&D risk and CVX has considerable commodity price volatility risk.

Moreover, DGRO has a considerable amount of exposure to dividend growth mega cap tech stocks like Apple (AAPL) and Microsoft (MSFT) compared to SCHD which has zero exposure to these stocks. While the case can be made that these stocks are currently overvalued, they also provide nice additional diversification to a portfolio as they often hold up better during bear markets than many other stocks due to their perceived safety.

Overall, we give DGRO the slight edge in this comparison given its significantly less concentration in its top 10 stocks along with its near 6% exposure to mega cap tech stocks.

SCHD Vs. DGRO: Yield

In the yield category comparison, SCHD wins hands down. SCHD's TTM yield is 3.51% compared to DGRO's TTM yield of 2.35%, giving it a substantial edge in terms of income generation capability. To illustrate the magnitude of the difference in yield between SCHD and DGRO, you would need to have ~50% more capital invested in DGRO than in SCHD to generate the same amount of current income. For retirees looking to live off of their dividend income, this is a huge difference and can make a dramatic difference in how soon someone can retire off of dividends.

SCHD Vs. DGRO: Investor Takeaway

While both SCHD and DGRO are very effective at delivering an attractive combination of long-term total returns and dividend growth, SCHD wins this comparison over which is better suited for retirees looking to live off of dividends.

This is because:

- SCHD's track record slightly outpaces DGRO's over the long-term in terms of both total returns and dividend growth.

- SCHD's TTM dividend yield is ~50% higher than DGRO's.

- SCHD's expense ratio is slightly lower than DGRO's (0.06% vs. 0.08%).

While DGRO does have a better diversified portfolio - including offering some exposure to mega cap tech stocks - for the purposes of a retiree, SCHD's portfolio is still sufficiently diversified while providing a much more compelling dividend yield.

If you want full access to our Portfolio and all our current Top Picks, feel free to join us at High Yield Investor for a 2-week free trial

We are the #1-rated high-yield investor community on Seeking Alpha with 1,500+ members on board and a perfect 5/5 rating from 150+ reviews:

You won't be charged a penny during the free trial, so you have nothing to lose and everything to gain.

Start Your 2-Week Free Trial Today!

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Recommended For You

Comments (12)

In 2013 we started simplifying our equity investments and chose SCHD as our primary vehicle. We have been periodically adding to our position and have no plans to sell it. The increasing dividends help finance our retirement lifestyle. Our average cost is $41,26 per share.

As Samuel noted the dividend growth has been superb and our compounded annual total return is 12.43%.