SGOV And USFR: Follow Warren Buffett And Buy Treasuries

Summary

- Fitch Ratings downgraded the United States' long-term sovereign credit rating from AAA to AA+ due to expected fiscal deterioration and high government debt burden.

- The U.S. government's deteriorating fiscal situation may push up long-term treasury yields, negatively impacting long-duration treasury bonds.

- Investors are recommended to shift their fixed income allocation to short-duration treasury bills like SGOV and USFR to earn the highest money market yields in a decade while retaining optionality.

LPETTET

The biggest news in the financial markets in the past few days has to be Fitch Ratings' surprise downgrade of the United States' long-term sovereign credit rating from AAA to AA+.

Fitch's rationale for downgrading the United States is 'the expected fiscal deterioration over the next three years, a high and growing general government debt burden, and the erosion of governance relative to 'AA' and 'AAA' rated peers over the last two decades that has manifested in repeated debt limit standoffs and last-minute resolutions.'

The credit downgrade drew stern rebuttals from the Biden administration, with Janet Yellen, the treasury secretary, calling the downgrade 'arbitrary' while press secretary Karine Jean Pierre said "it defies reality to downgrade the United States at a moment when President Biden has delivered the strongest recovery of any major economy in the world".

However, despite protests from government officials, I believe Fitch raises valid concerns that may have an impact on long-term bond yields in the long-run.

Going Over Fitch's concerns

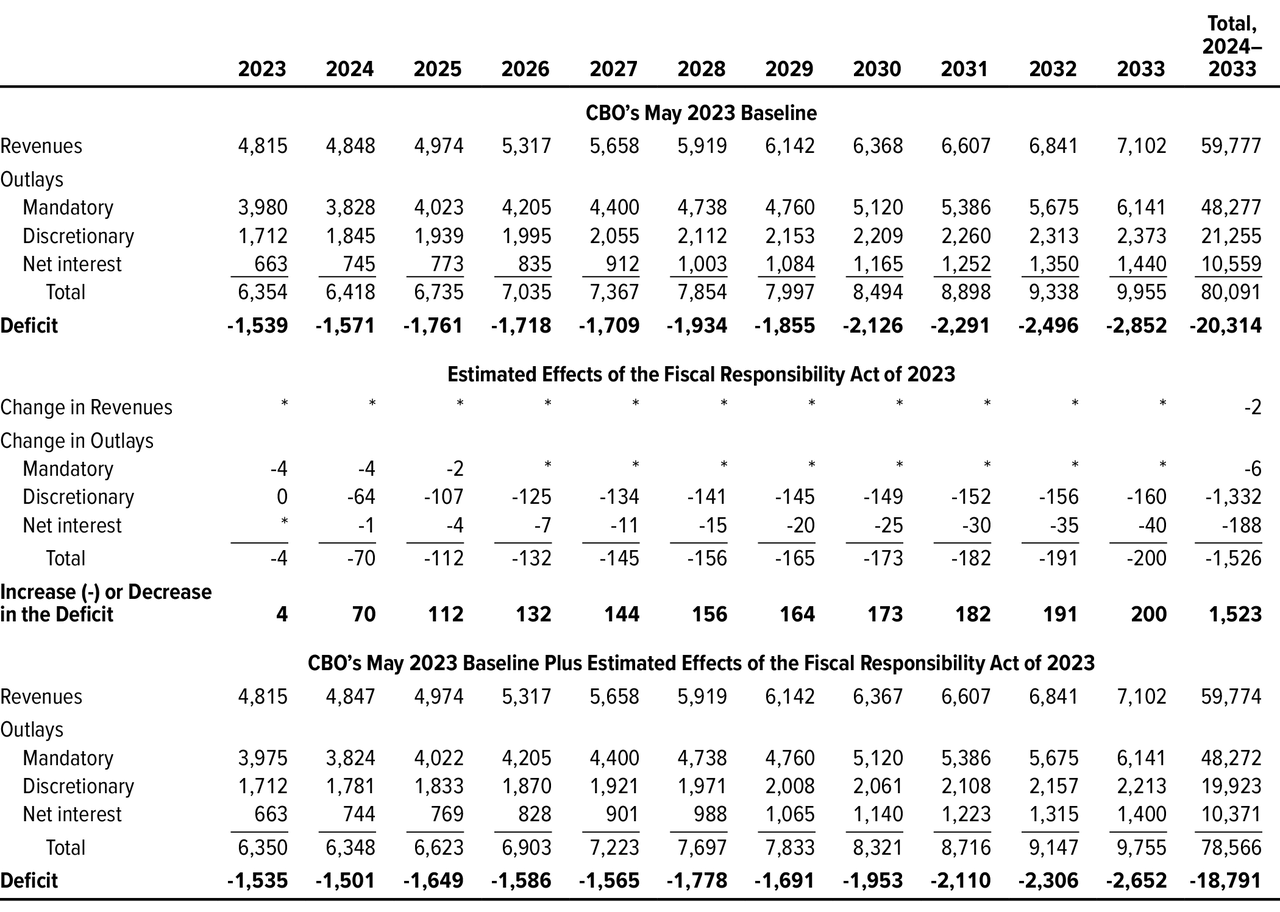

According to the Congressional Budget Office's latest baseline projections adjusted for the Fiscal Responsibility Act of 2023 ("FRA"), the U.S. government is expected to run large and expanding deficits for the foreseeable future, ranging from $1.5 trillion in 2023 to $2.7 trillion in 2033 (Figure 1).

Figure 1 - U.S. government is projected to run budget deficits for foreseeable future (CBO)

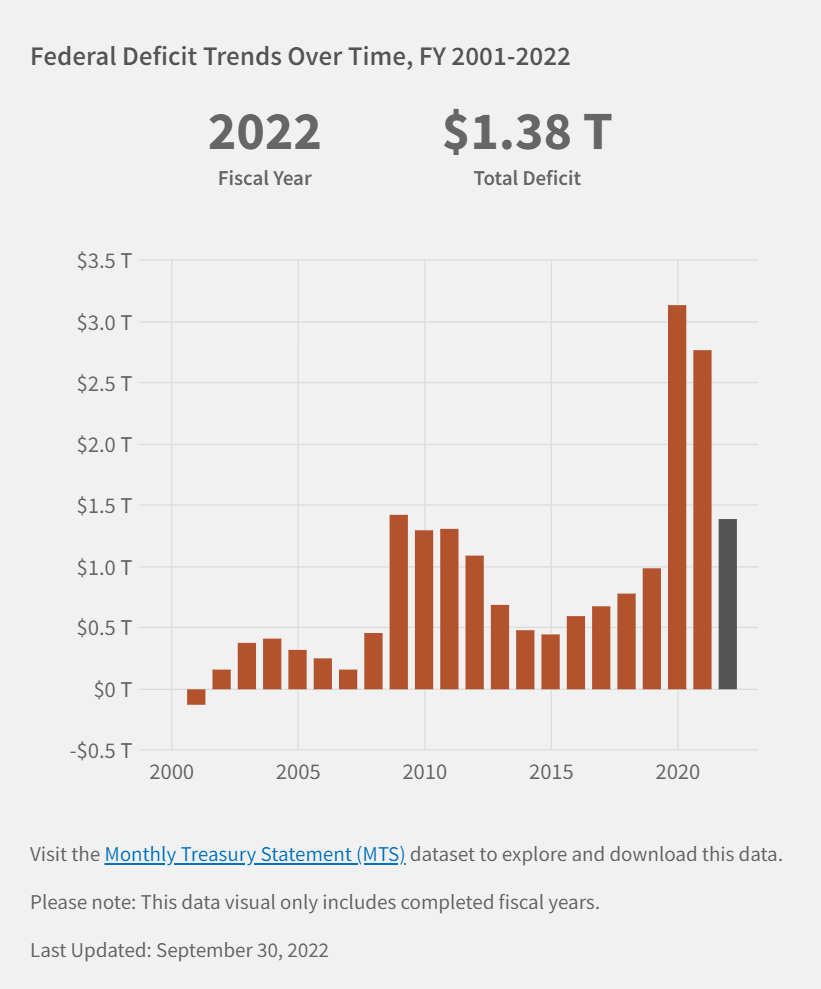

In fact, the U.S. government has not run a budget surplus since 2001, and the forecasted budget deficits in the coming decade are measured in the tens of trillions of dollars (Figure 2).

Figure 2 - U.S. government has not run a surplus since 2001 (CBO)

Government Spending Becoming Pro-Cyclical

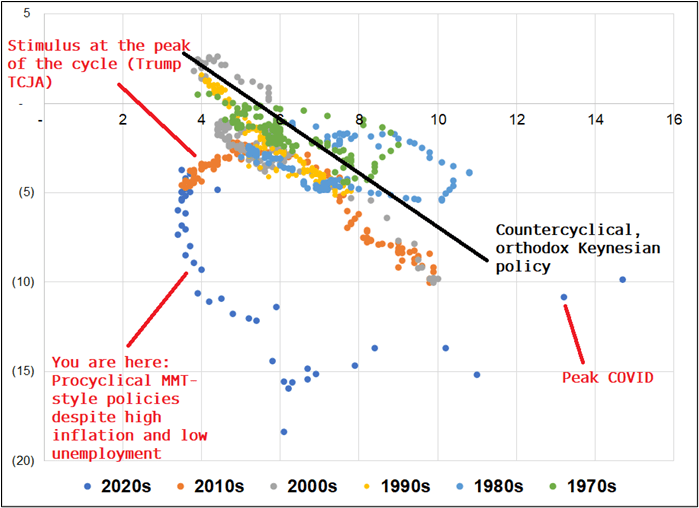

In introductory economics, students are taught that government spending should act as counter-cyclical stabilizers for the economy, stepping up during economic downturns like 2008 and 2020 to support the economy. However, judging by current fiscal policies and projections, the U.S. government appears to be on a pro-cyclical spending path, with the budget deficits actually expanding over the coming decade even as the economy is forecasted to continue to grow.

Current pro-cyclical fiscal policies may in fact be exacerbating the inflation problem that is plaguing the United States and other western economies. Figure 3 is a chart that I borrowed from Brent Donnelly, author of the am/FX newsletter. It shows historically, U.S. government deficits are high when the unemployment rate is high, as the U.S. government stimulates during tough economic times. When the unemployment rate is low, deficits are likewise low. However, in the past few years, budget deficits have been kept historically high despite high inflation and low unemployment, totally counter to the traditional nature of government spending.

Figure 3 - Deficits becoming pro-cyclical (Brent Donnelly via Twitter)

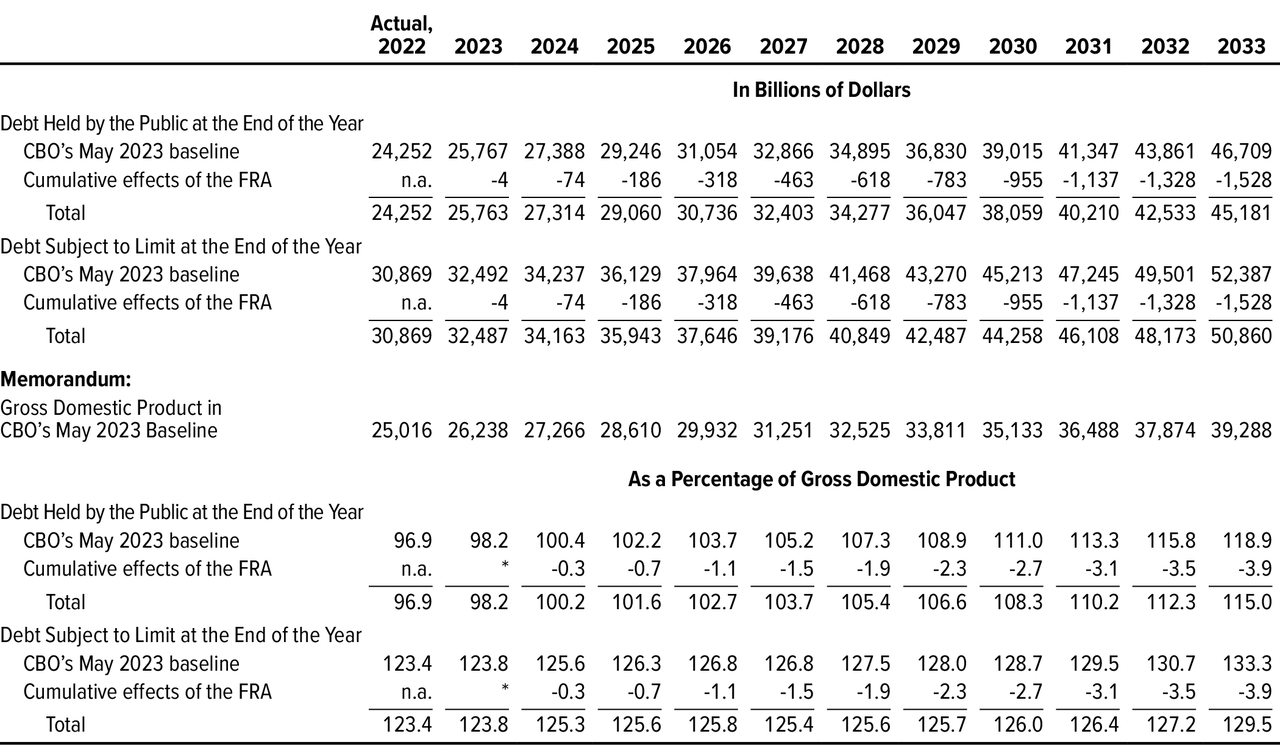

The out of control government spending is projected to lead to government debt surging from $32 trillion in 2023 to $51 trillion by 2033 (Figure 4).

Figure 4 - U.S. government debt is projected to surge to $51 trillion by 2033 (CBO)

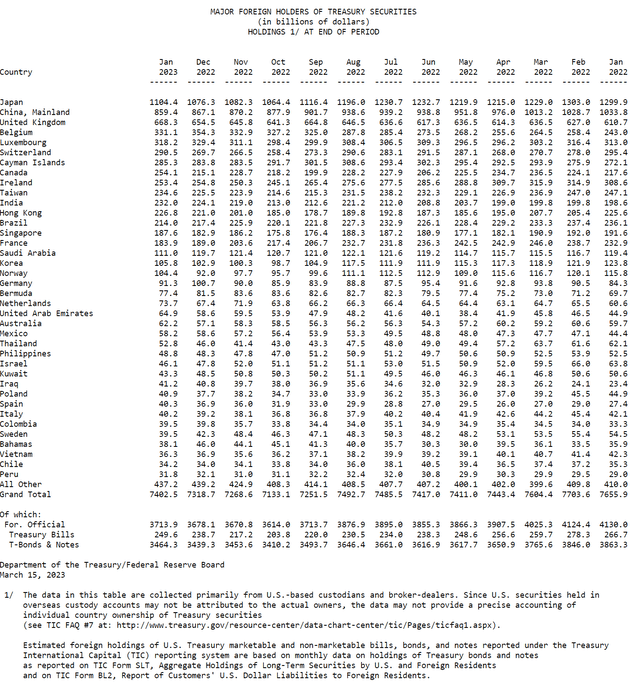

Simply put, who is going to fund the ~$2 trillion in net new debt per year that the U.S. government will be borrowing for the next decade? If we look at foreign holdings of U.S. debt, we can see top holders like Japan and China have been net sellers of U.S. treasuries in the past year (Figure 5).

Figure 5 - Foreign holdings of U.S. treasuries (U.S. Treasury Department)

Furthermore, foreign holdings are measured in hundreds of billions, but net issuance from the U.S. treasury will be in the trillions every year.

In the long-run, I believe the deteriorating U.S. fiscal situation may force up long-term interest rates, as investors must be compensated for the increased risk of a heavily indebted U.S. government running large and expanding deficits that will swamp demand for U.S. treasury securities. That is why I believe investors should be wary of investing in long-duration treasury bonds unless the fiscal situation improves.

Buffett Buying Treasuries

At the same time, we have Warren Buffett, the Oracle of Omaha, claiming his firm, Berkshire Hathaway “bought $10 billion in U.S. Treasuries last Monday and [we bought] $10 billion this Monday," in a vote of confidence for the U.S. government.

So what should investors do? Should they be wary of government bonds like I suggested, or should they follow Mr. Buffett and buy U.S. treasuries?

The answer is simple - follow Buffett! Mr. Buffett's actions are actually in agreement with my thesis to avoid long-duration government bonds. To understand why, we must look at what exactly Mr. Buffett is buying. Reading past the headline that Mr. Buffett is buying $10 billion of treasuries per week, we find that Berkshire is actually buying "treasury bills at the weekly government auctions of 3-month and 6-month bills".

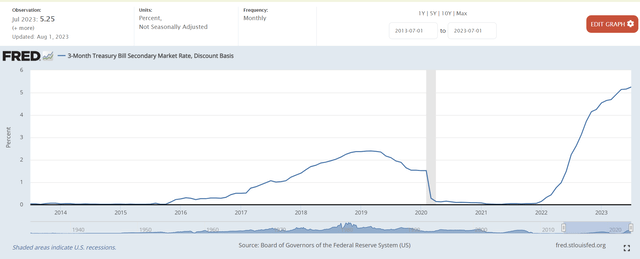

Mr. Buffett, the astute investor that he is, is not buying long-duration treasury bonds. Rather, he is buying tens of billions of treasury bills and earning the highest money market returns in years (Figure 6).

Figure 6 - 3 Month treasury bill yields highest in a decade (St. Louis Fed)

This is exactly my recommendation to investors looking at fixed income markets. Avoid long-duration treasury bonds and buy attractively yielding treasury bills. There are two reasons why buying treasury bills make sense.

First, if the Federal Reserve has indeed engineered a 'soft landing' in the economy with moderating inflation and robust economic growth, then the Federal Reserve will have political cover to maintain their tight monetary policies 'higher for longer'. This means that high money market yields may actually persist for months if not quarters.

On the other hand, if the economy eventually slows into a recession as many economists had been predicting, and the Federal Reserve is forced to cut interest rates to stimulate the economy, then holding treasury bills will come in handy for investors looking to buy bargains.

Despite long-term concerns regarding the U.S. government's fiscal situation mentioned above, in the short-term, there is absolutely nothing to be worried about with respect to U.S. treasury bills. The U.S. government remains the world's de-facto reserve currency and that fact will not change in the next few months or years.

Buy SGOV / USFR

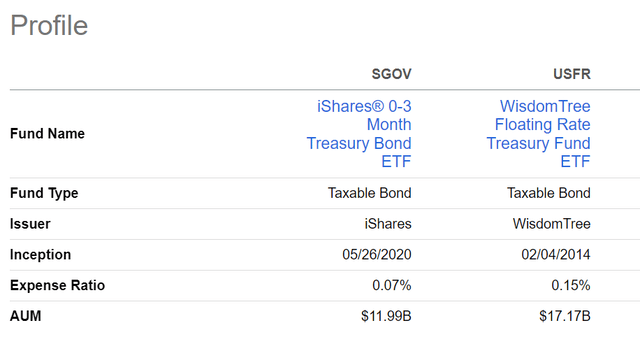

In terms of near-cash investments, I recommend investors consider the iShares 0-3 Month Treasury Bond ETF (NYSEARCA:SGOV) and the WisdomTree Floating Rate Treasury Fund ETF (NYSEARCA:USFR). both are low-cost ways to earn treasury bill yields (Figure 7). Investors should note SGOV's expense ratio is actually 0.13%, but some fees have been waived until June 2024 so its expense ratio shows as 0.07%.

Figure 7 - SGOV and USFR are low-cost ways to earn treasury bill yields (Seeking Alpha)

SGOV holds a portfolio of treasury securities with remaining maturity of 0 to 3 months. When treasury holdings mature, they are rolled onto new securities. On the other hand, the USFR ETF holds a portfolio of floating rate bonds issued by the U.S. government. These floating rate bonds have maturities of 1 to 2 years, but pay interest rates that are reset quarterly.

SGOV has a 30D SEC yield of 5.32% and its latest monthly distribution annualizes to 5.28%. USFR has a 30D SEC yield of 5.29% and its latest distribution annualizes to 5.36%. I last wrote about the SGOV ETF here, and the USFR ETF here.

Conclusion

Fitch's downgrade of the U.S. government due to a poor U.S. fiscal trajectory is serving as a wakeup call for long-duration bond investors. I believe long-duration bonds are poor investments at the moment, as out of control public spending are forcing up long-term treasury yields.

Instead, I recommend fixed income investors follow Warren Buffett and earn short-duration treasury bill yields via the SGOV ETF and the USFR ETF. Holding SGOV and USFR allows investors to earn the highest money market yields in the past decade while retaining the 'real option' to redeploy capital in case markets deteriorate and bargains become available.

This article was written by

Analyst’s Disclosure: I/we have a beneficial long position in the shares of USFR either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.