Marvell: AI Tailwinds Sustain, Growth Ahead, A Buy Into Earnings

Summary

- Marvell's Q2 earnings reports show solid bottom-line beat rate for S&P 500, but lower positive sales surprises and negative EPS outlooks are less impressive features.

- Marvell has high long-run EPS growth potential, low PEG ratio, and a positive technical outlook, making it a buy in my view.

- MRVL is a leading fabless supplier of high-performance standard and semi-custom products with a strong presence in AI and other markets.

- Ahead of Q2 earnings later this month, I highlight key price levels to watch.

Sundry Photography

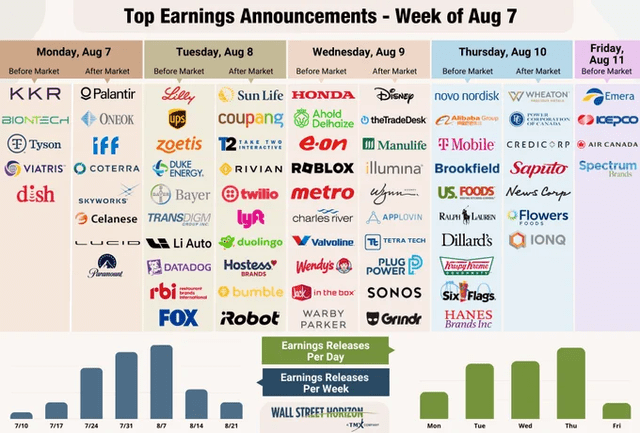

The bulk of Q2 earnings reports are in. The S&P 500's bottom-line beat rate is a solid 79%, though positive sales surprises have been less pervasive at just 65%. Guidance has also been an issue, with 49 S&P 500 firms having issued negative EPS outlooks and just 30 S&P 500 companies posting positive EPS guidance, according to FactSet. But we are not done yet. The retailers have yet to report, and a few key consumer and semiconductor stalwarts are on the earnings docket for the balance of the month.

I have a buy rating on shares of Marvell (NASDAQ:MRVL). While there are near-term growth headwinds, long-run EPS growth is high and normalized earnings suggest a somewhat low PEG ratio. Finally, the technical situation is encouraging with its strong momentum and a key pattern I noticed in the technical outlook.

Earnings on Deck

According to Bank of America Global Research, MRVL is a leading fabless supplier of high-performance standard and semi-custom products with a core strength in developing complex System-on-Chip architectures and integrating analog, mixed-signal, and digital signal processing functionality. Marvell's broad portfolio of IP spans computing, optics, networking, storage, and security and addresses the enterprise, cloud, telecom, auto, and industrial markets.

The Delaware-based $53.9 billion market cap Semiconductors industry company within the Information Technology sector has negative trailing 12-month GAAP earnings and has a small 0.4% forward 12-month dividend yield. Ahead of earnings later this month, the stock has a low 2.1% short interest and an implied volatility percentage of 55% as of August 4, 2023 - the at-the-money straddle expiring soonest after the reporting date has priced in an 8.2% share price swing. The firm has missed on EPS in two of the past three instances, and has traded lower post-earnings in seven of the past 11 events.

MRVL has gotten in on the AI hype. The stock jumped huge following its Q1 report, within which it said that AI-related sales would be at least double 2023 levels in its current fiscal year. Shares rallied 20% on the news, and MRVL has impressively held those gains for the most part this summer. That comes despite recent news that Taiwan Semiconductor (TSM) was lowering its 2023 revenue forecast. The global foundry company now sees a 10% year-on-year dip in sales, worse than its previous low-to-mid-single-digit decline guidance. Before that lackluster report, BofA had upgraded its price target on MRVL from $75 to $80 given broader industry tailwinds.

Of course, the big story of the year for Marvell was its blowout Q1 profit report. The firm posted per-share earnings of $0.31, topping estimates of just $0.29. The positive performance in Q1 is primarily attributed to growth in the non-core consumer segment, particularly in cloud and AI, offsetting declines in telco and enterprise networking. A weaker annual sales figure was more than offset by the AI-driven upside outlook, with particular strength seen in the back half of the current FY.

The outlook for Q2 (the quarter that just ended) was strong, with projected sales of $1.33 billion, modestly above the consensus estimate of $1.315 billion. What is also encouraging is that MRVL appears poised for margin expansion, with its gross margin ramping to 64% by the end of this FY, driven by robust data center business operations and better product mix trends, says BofA. The company's management team remains steadfast in its mission to reduce operating expenses to further increase EPS leverage while focusing investments on its core operations.

The big risk is the unknown of how much MRVL will be able to monetize AI - there is still a lot to prove here. What's more, it is still cloudy as to how well it generates sales and earnings from 5G going forward as the industry cycles ahead. Finally, the company has been on the dealmaking hunt, and there are always risks as to how those integrations go in a high-growth niche.

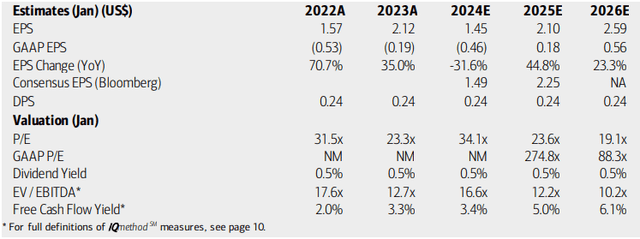

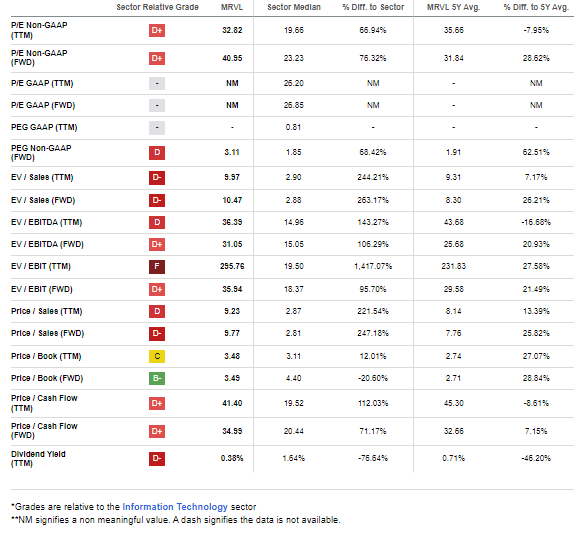

On valuation, earnings are seen falling sharply before EPS normalizes in the out years. The Bloomberg consensus outlook is slightly more sanguine compared to BofA's forecast, though dividends are expected to remain at just $0.24 over the coming quarters. With a non-GAAP price-to-earnings ratio north of 40 at the moment and a forward EV/EBITDA multiple more than twice that of the broad market, shares are not cheap. Moreover, the stock's current price-to-sales ratio of 9.8 on a next-12-month basis is stretched relative to the Information Technology sector median and the company's 5-year average. On the plus side, though, is that MRVL is free cash flow positive and is expected to grow its free cash flow per share over the years ahead.

Marvell: Earnings, Valuation, Free Cash Flow Forecasts

If we assume normalized EPS of $2.25 and assume 20% long-term EPS growth, then we are talking about a 28x operating P/E and a forward PEG ratio of just 1.4. Now, contrast that to the stock's 5-year average forward PEG of 1.9 and the industry median of 1.85 - shares are cheap when factoring in the growth trajectory. If we assume a 1.7 PEG, then the stock price should be near $75 based on those numbers.

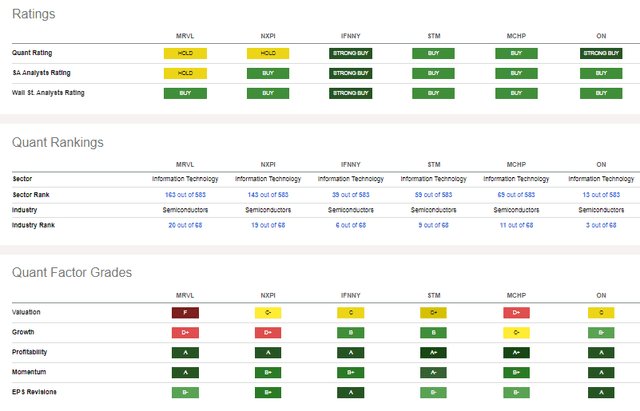

MRVL: Valuation Metrics Poor, But Growth In the Offing

Seeking Alpha

Compared to its competitors, you will see that there are fewer upbeat views on Marvell, both via the Seeking Alpha Quant Rankings and among other analysts. I assert, though, that the high valuation at first glance and short-term growth issues has caused that lackluster perspective.

Peer Analysis

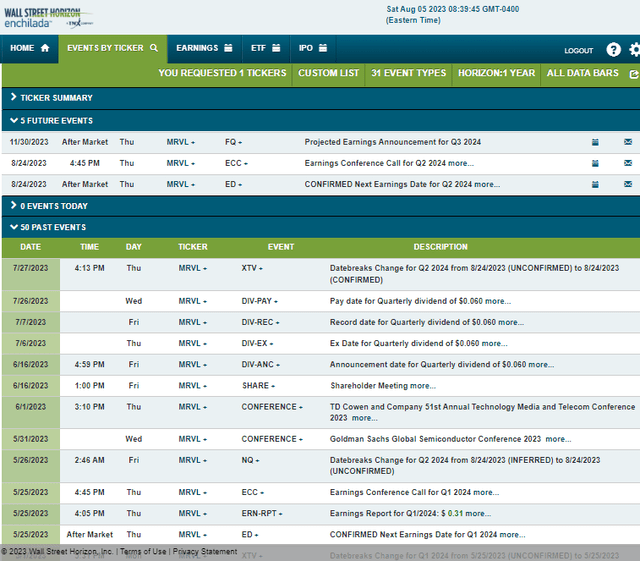

Looking ahead, corporate event data provided by Wall Street Horizon show a confirmed Q2 2024 earnings date of Thursday, August 24 AMC with a conference call immediately after the numbers cross the wires. You can listen live here.

Corporate Event Risk Calendar

The Technical Take

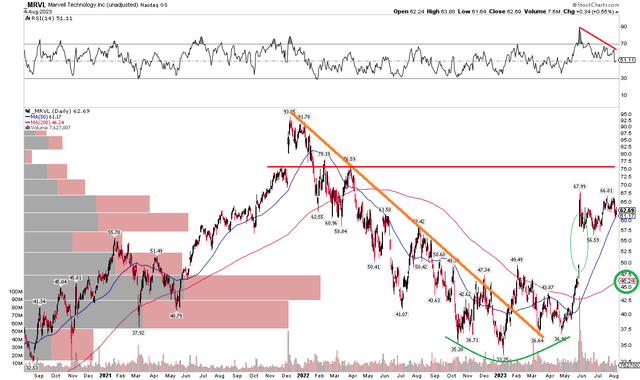

With solid growth prospects and a decent valuation, what does the chart say? Notice in the graph below that shares put in a bearish to bullish reversal pattern from late 2022 through the first half of this year. The highlight was a monster earnings-related thrust in late May that sent MRVL soaring and left the bears reeling. That gap has held - which I like to see. After a huge volume surge, the last two-plus months have seen a consolidation in price, momentum, and volume trends.

While bears might assert that the RSI divergence at the top of the chart is reason for concern, it is not a true negative divergence since price has not been inching up to new highs. Rather, I see the price formation as a bull flag, implying that the trend of larger degree is higher. And now, with a rising 200-day moving average helping to confirm the reversal, the bulls appear in control of the longer-run trend. I see resistance in the mid-$70s, about where my fundamental valuation is, while the all-time highs in the $90s might be a lot to ask for this year. Support is seen at the gap and February high, which come into play around $50 - that is also where the rising 200dma will soon approach.

Overall, the chart's rounded bottom reversal is encouraging ahead of Q4 earnings later this month.

MRVL: Bearish to Bullish Reversal

The Bottom Line

I have a buy rating on Marvell, with a price target into the mid-$70s. A robust growth trajectory and positive technicals outweigh near-term growth issues.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.