Cronos: Innovating Amidst Uncertainties

Summary

- Cronos strategically focuses on innovative products, gross margin improvement, cost efficiencies, and $100–110 million revenue projections.

- Positive cash flow is expected for FY 2023, and we aim for positive cash.

- Cronos excels in high-margin derivative products, holding a solid market share. Focus on rare cannabinoids and innovation drives growth potential.

- Cronos could benefit from the SAFE Banking Act, and the establishment of Legalize America could benefit Cronos through potential changes in US cannabis laws.

- Cronos faces specific risks related to exploring a potential sale, intensified competition, and an uncertain US regulatory landscape.

- I do much more than just articles at Yiazou Capital Research: Members get access to model portfolios, regular updates, a chat room, and more. Learn More »

janiecbros

Introduction

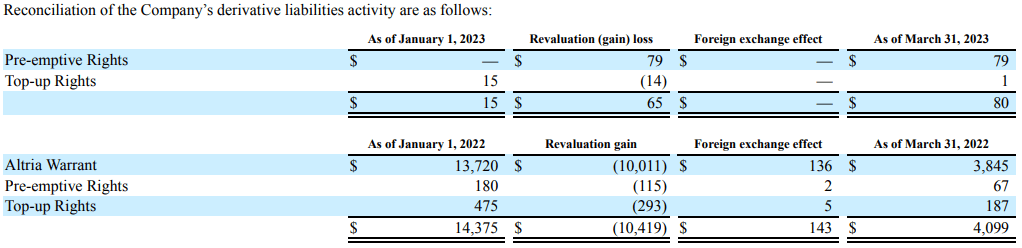

In the cannabis industry, Cronos Group Inc. (NASDAQ:CRON) is charting a path filled with innovation, strategic partnerships, and regulatory uncertainties. With a focus on high-margin derivative products and research into rare cannabinoids, Cronos may seize growth opportunities.

As the cannabis market expands, Cronos faces promising developments and potential pitfalls. Thus, most investors might wonder whether the company's bold strategies pay off or be shaken by intensifying competition and regulatory hurdles. The article explores Cronos's state of operations, liquidity, and products while examining the impact of key legislative changes and lingering risks on its long-term growth and financial stability.

Revenue Growth, Margin Expansion, And Product Success

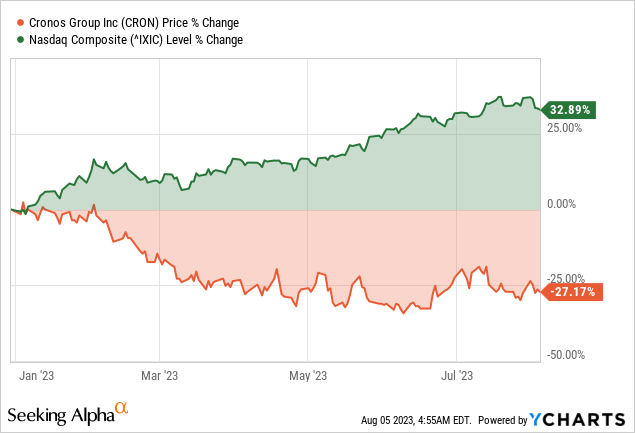

Cronos's Q1 2023 indicates the company's strategic focus on launching innovative, borderless products, improving gross margins, and driving cost efficiencies. The company has successfully achieved operating expense savings in the past and is on track to achieve additional savings in the range of $10 million to $20 million in 2023.

The strategic realignment in 2022 has put Cronos on a better footing for the future. The positive trajectory is expected to be driven by net revenue projections of $100 million to $110 million for 2023. Additionally, the company is on target to save between $10 and $20 million in operating expenses for 2023, with the majority of the savings coming from improvements in sales and marketing, general and administrative, and research and development. As a result, CRON expects continued gross margin improvement, cost reduction efforts, and anticipated interest income of $30 million for the remainder of the fiscal year 2023.

Investor Presentation (Cronos)

Additionally, the gross margin performance has shown volatility quarter-to-quarter, but when looking at the year in totality, the gross margin for 2022 was 13%. In Q1 2023, the consolidated gross margin stood at 12%, and the company aims to improve it further throughout the year, especially with a reorganized supply chain and the decision to stay at the Peace Naturals Campus. The stable gross margin in the rest of the world segment and the expectation of further improvements suggest that Cronos's supply chain optimization and strategic decisions yield positive results.

Further, Cronos's focus on margin-accretive innovation has shown promising results, especially in the higher-margin derivative products. The Spinach brand has achieved a 15.3% market share in the edibles category, growing retail sales by 49% year-over-year, demonstrating consumer enthusiasm for their products. The company's vape category also gained market share, climbing to the seventh position with a 4.4% share in Q1 2023.

Strong Balance Sheet & Positive Cash Flow Outlook

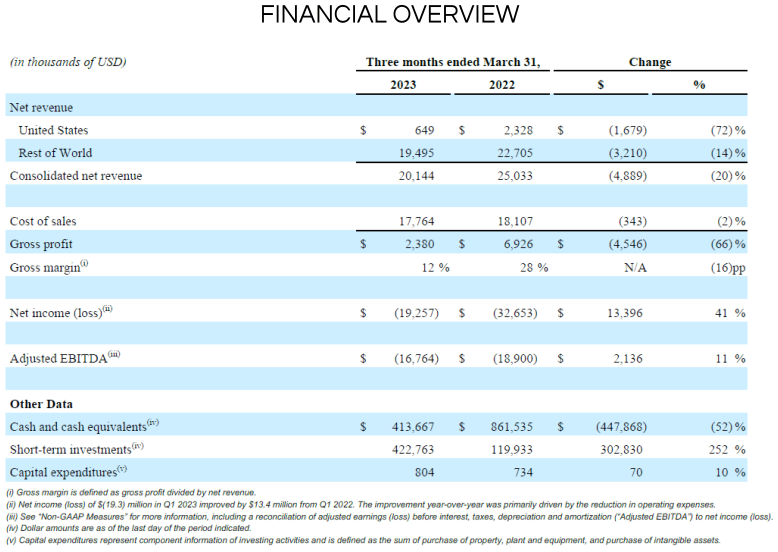

The company's strong balance sheet, with approximately $836 million in cash and short-term investments, enables strategic flexibility and investment in growth opportunities. Cronos's Q1 2023 report indicates the company's progress toward achieving its strategic goals. The company has shown improvement in various financial metrics, including a 55% year-over-year free cash flow (excluding the impact of the cash outflow related to Altria's warrant relinquishment).

Looking ahead, Cronos expects to recoup most of the tax payment associated with the Altria Group, Inc. (MO) warrant relinquishment over the next three years, which will contribute to improving cash flow. The company anticipates positive cash flow for the remainder of fiscal year 2023 and aims to achieve positive cash flow in 2024. Therefore, achieving positive cash flow in 2024 and recouping most of the tax payment associated with the Altria warrant relinquishment will enhance the company's financial position and reduce dependence on external funding sources.

10-Q Q1 2023

Diversified Product Mix & Market Leadership: A Path to Sustainable Growth

Cronos' success in diversifying its product mix and leading in high-margin derivative products, such as edibles and vapes, provides a competitive advantage. The company's strong market share in these categories indicates the potential for sustained growth and revenue generation. The positive developments in the Israeli market, driven by potential regulatory changes, offer significant growth opportunities. The increase in patient counts could lead to a tripling of market size, positioning Cronos as a major regional player.

The company's strategic focus on rare and cultured cannabinoids, such as chewable extracts, offers a differentiation factor that can drive growth in underpenetrated markets. The emphasis on innovation and product differentiation is expected to expand market share and strengthen Cronos's position in the cannabis market. Cronos's focus on launching innovative, borderless products may improve financial performance.

Additionally, Cronos's Spinach brand has demonstrated substantial market share in various cannabis product categories, such as edibles, pre-rolls, and vapes. The success in building a differentiated brand shows the company's ability to cater to consumer preferences and create products with appealing attributes, such as potency and flavor. Lastly, Cronos's cautious approach to investing its cash in stable financial institutions with attractive returns ensures the preservation and maximization of its financial resources.

Investor Presentation

Potential Passage Of SAFE Banking Act: A Game-Changer

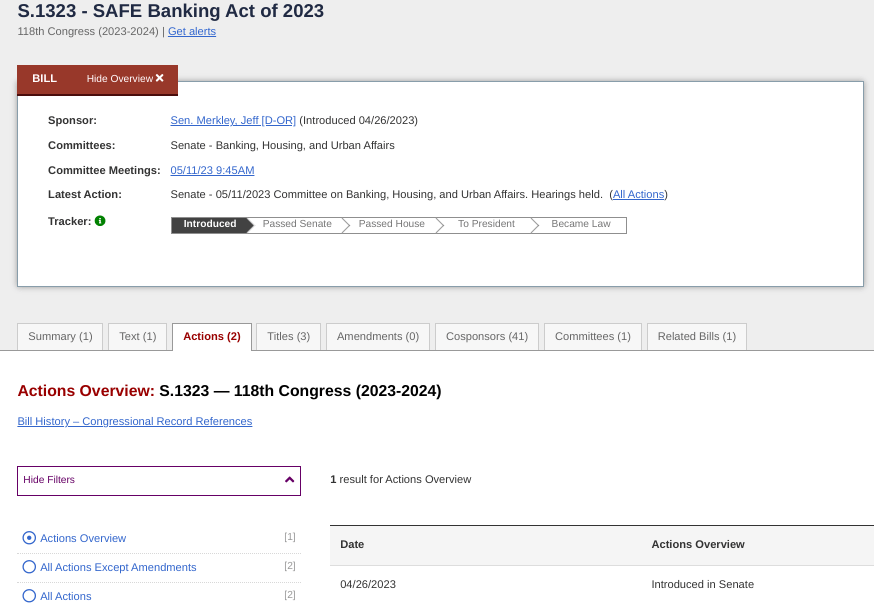

Cronos benefits from the potential passage of the Secure and Fair Enforcement (SAFE) Banking Act. The legislation aims to free up banks and credit unions to work with state-licensed cannabis businesses without fear of federal penalties. Senate Majority Leader Chuck Schumer's confidence in the bill's passage indicates growing bipartisan support, making it increasingly likely to become law.

Cannabis companies face difficulties accessing traditional banking services due to federal restrictions. Passing the SAFE Banking Act would enable Cronos to operate more efficiently by allowing them to open bank accounts, access credit lines, and conduct electronic transactions. It would streamline their financial operations and reduce the risks of handling large amounts of cash.

Likewise, the availability of banking services would enhance investor confidence in Cronos and the overall cannabis industry. With easier access to banking, financial reporting and auditing would become more transparent, attracting a broader range of investors seeking legitimacy and stability in the sector.

Congress.gov

With increased access to capital and financial resources, Cronos would be better positioned to pursue expansion initiatives. It might include increasing cultivation capacity, expanding product lines, or entering new geographic markets. Such growth prospects could lead to higher revenue streams and improved market share.

As a result, the SAFE Banking Act would bring regulatory clarity and oversight to the cannabis industry. For Cronos, this would mean adhering to federal regulations and reporting requirements, reducing the risk of legal and financial challenges associated with non-compliance. With improved financial stability, Cronos could invest more in research and development efforts to develop innovative cannabis products. It could lead to new patentable formulations, driving brand differentiation.

Legalize America & The Cannabis Super PAC

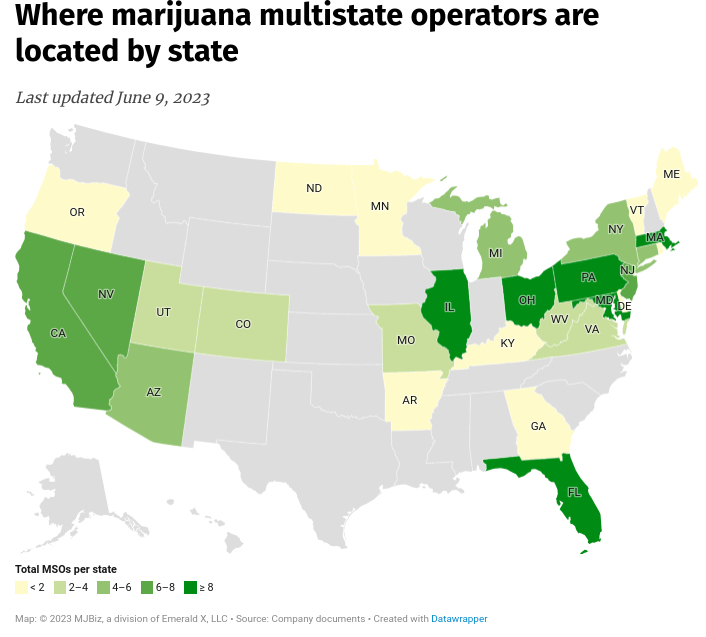

With the establishment of Legalize America, the first cannabis super PAC, there is an opportunity for the Cronos to benefit from potential changes in cannabis laws and regulations in the United States. As Legalize America raises cannabis as a national issue before the 2024 election, it could lead to increased discussions on cannabis reform at the federal level. If cannabis laws become more favorable, Cronos may have access to a larger market and potentially expand operations beyond the states where cannabis is currently legal.

Moreover, the support from major multi-state operators through the U.S. Cannabis Council could enhance Cronos's market position. With a broader network and resource access, the company could explore expansion opportunities in new states or even internationally as more countries consider cannabis legalization. A nationwide push for cannabis reform could increase consumer acceptance and demand for cannabis products. With its diverse product portfolio and established brands, Cronos may experience a surge in sales and revenue as the market expands.

mjbizdaily.com

If cannabis prohibition ends, Cronos can leverage its early entry and established brand presence to dominate a larger, more accessible market. A more favorable regulatory environment could attract more investors to the cannabis industry, giving Cronos access to additional funding for expansion and innovation. Legalization efforts may expand product offerings and market segments, allowing Cronos to diversify its revenue streams and reduce risk.

Implications & Financial Concerns

Cronos is currently exploring the possibility of selling the company. The development has significant implications for the company's future. Exploration of a sale indicates that Cronos may face challenges or seek strategic alternatives. If the sale proceeds, it could lead to management, corporate culture, and business direction changes, which may affect the company's overall performance.

Further, the cannabis industry is highly competitive, and legalizing recreational cannabis in several U.S. states has intensified the rivalry among companies. Cronos could face increasing competition, leading to potential pricing pressures and market share erosion. The uncertain regulatory landscape surrounding cannabis in the United States may challenge Cronos's growth plans. While recreational cannabis is legal in some states, it remains illegal at the federal level. Any adverse changes in cannabis regulations could negatively impact the company's operations and market access.

A potential sale may lead to the loss of Cronos's independence and strategic decision-making power. The company could become subject to the acquiring entity's priorities and business strategies, which may not align with Cronos' long-term vision. If the sale proceeds, Cronos shareholders may face dilution in ownership if the acquisition price is unfavorable. It could result in reduced shareholder value and potential shareholder dissatisfaction.

Altria holds a significant stake in Cronos, so its involvement in the sale process could impact the outcome. Decisions to benefit Altria's interests may not align with what is best for Cronos and its stakeholders. Uncertainty around a potential sale may negatively affect Cronos's reputation and brand perception among consumers, investors, and partners.

Investor Presentation

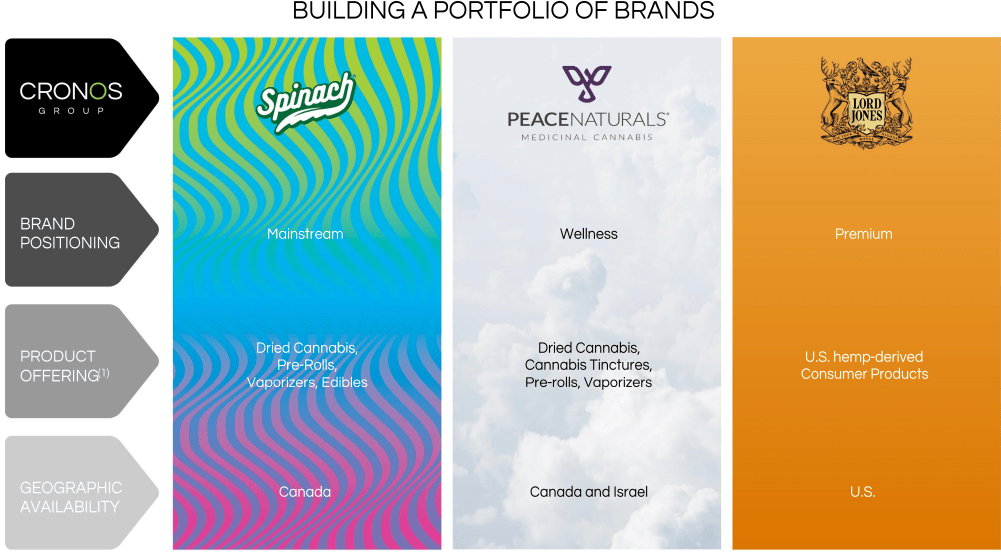

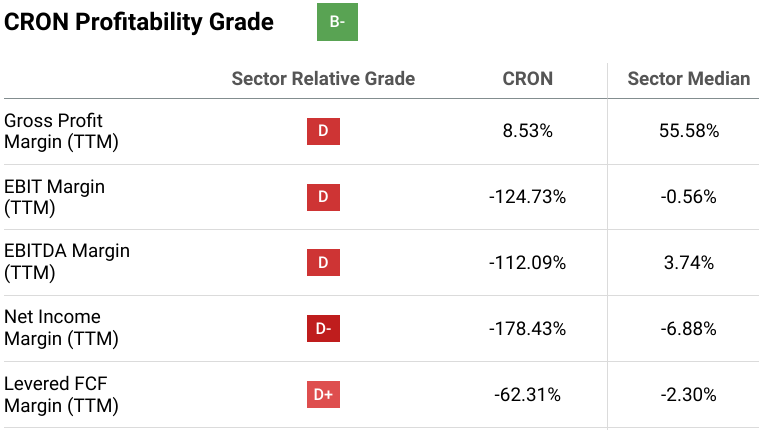

One of the major concerns is its negative profitability and the need for improvement. As of the trailing twelve months, Cronos reported an EBITDA Margin of -112.09% (trailing twelve months basis), significantly lower than the sector median of 3.74%. It indicates that the company's operational earnings are in deep negative territory compared to its peers, signifying weak cost management and operational efficiency.

Moreover, the Net Income Margin for the same period stands at -178.43% (trailing twelve-month basis), far below the sector median of -6.88%. It implies the company incurs substantial losses after accounting for all expenses and taxes. The exceedingly negative net income margin reflects a concerning inability to generate sustainable profits.

Notably, Cronos' leveraged FCF (Free Cash Flow) Margin remains alarmingly negative at -62.31% (trailing twelve-month basis), while the sector median is at -2.30%. It indicates the company is burning through cash at an alarming rate, raising concerns about its ability to fund future operations, repay debts, or invest in growth initiatives.

Seeking Alpha

Another concerning factor is the Asset Turnover Ratio of 0.07x (trailing twelve-month basis), much lower than the sector median of 0.35x. It suggests that Cronos needs to utilize its assets more effectively to generate revenue, indicating potential inefficiencies in its operations and sales processes.

Over the long term, these negative profitability and financial metrics trends could severely harm Cronos. The continuous lack of profitability and negative free cash flow generation could limit the company's ability to reinvest in research and development, marketing, and expansion initiatives, hindering its growth prospects and competitive positioning in the cannabis industry.

The company might need to help to attract investors and raise capital, impacting its ability to fund future projects and repay debts. Additionally, ongoing losses could lead to a weakened balance sheet and increased leverage, further hampering the company's financial flexibility.

Finally, the negative profitability and cash flow situation may also hinder Cronos' ability to weather economic downturns or unexpected market challenges, potentially putting it at a significant disadvantage compared to more financially stable competitors.

Takeaway

In conclusion, despite facing challenges in a highly competitive cannabis industry, Cronos may attain value growth with its strategic focus on innovative products, margin improvement, and cost efficiencies. The company's robust liquidity position and efforts to achieve positive cash flow in 2024 offer optimism for its financial stability and growth prospects.

Leveraging its expertise in high-margin derivative products and rare cannabinoids, Cronos may capitalize on the expanding cannabis market. Moreover, potential legislative changes, such as the passage of the SAFE Banking Act and the influence of Legalize America, could provide significant opportunities for further market access and expansion. Although specific risks remain, Cronos' strategic approach to innovation and differentiation sets the stage for long-term progression.

Author of Yiazou Capital Research

Unlock your investment potential through deep business analysis.

I am the founder of Yiazou Capital Research, a stock-market research platform designed to elevate your due diligence process through in-depth analysis of businesses.

I have previously worked for Deloitte and KPMG in external auditing, internal auditing, and consulting.

I am a Chartered Certified Accountant and an ACCA Global member, and I hold BSc and MSc degrees from leading UK business schools.

In addition to my research platform, I am also the founder of a private business.

This article was written by

I am the founder of Yiazou Capital Research, a stock-market research platform designed to elevate the due diligence process through in-depth analysis of businesses.

I previously worked for Deloitte and KPMG in external & internal auditing and consulting.

I am a Chartered Certified Accountant and a Fellow Member of ACCA Global, and I hold BSc and MSc degrees from leading UK business schools.

In addition to my research platform, I am also the founder of a private business.

My primary strategy focuses on high-quality, free cash flow generative stocks with an above-average growth rate and a strong business moat.

I manage my own highly concentrated portfolio, and I occasionally engage in short-term trades to profit from asset mispricings when Mr. Market does not feel very well.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Recommended For You

Comments (2)