3 Stocks For Long Term Capital Appreciation Potential

Summary

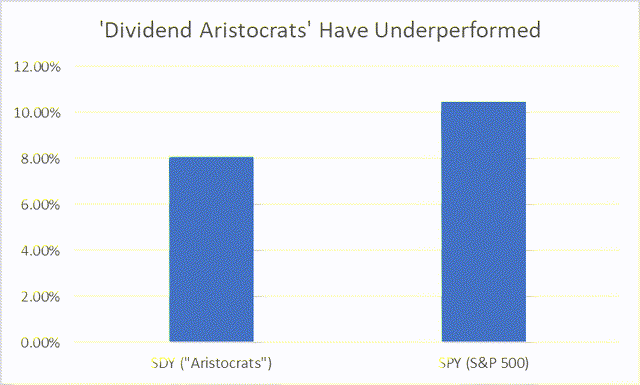

- Stocks that have grown dividends have underperformed the market-cap weighted S&P 500 in the past decade.

- Companies with significant net debt positions and high dividend payouts have limited capital appreciation potential.

- Apple, Alphabet, and Microsoft have strong net cash positions and the potential for upward revisions in future expected free cash flow.

- We continue to point to these three stocks as a few of our favorites for long-term capital appreciation potential.

- Big cap tech and the stylistic area of large cap growth remain the places to be, in our view.

niphon/iStock via Getty Images

By Brian Nelson, CFA

Stock prices and returns of a company are a function of its cash-based sources of intrinsic value: net cash on the balance sheet and future expected enterprise free cash flows (and changes in them). A stock price is reduced by the amount of a dividend payment once the company goes ex-dividend. Dividends therefore become capital appreciation that otherwise would have been achieved had the dividend not been paid. As we look over the past decade, stocks that have grown their dividends have underperformed the market-cap weighted S&P 500 (SPY), and we expect this trend to continue this decade.

Return after Taxes on Distributions and Sale of Fund Shares (10-year) (State Street)

The last 10 years may not represent an entire investment horizon that could span 30-40 years or more, but the drivers behind dividend and income investing could possibly get disrupted in the next few years. It is the future that matters, not the past. Many dividend-paying companies tend to have significant net debt positions while they pay out a large percentage of their free cash flows as dividends, resulting in relatively modest capital appreciation potential. Net cash is an add-back to the present value of future expected enterprise free cash flows, so we view net cash positively (and net debt negatively) when it comes to long-term capital appreciation potential. Retained cash flow is important, so dividend liabilities tend to be headwinds for capital appreciation potential.

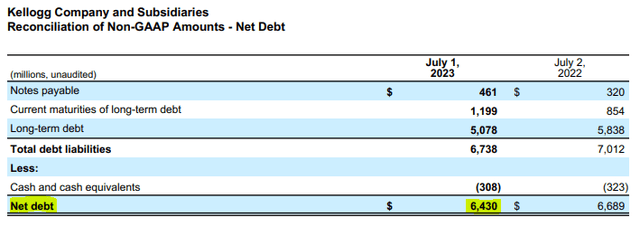

Kellogg is representative of many consumer staples equities that have net debt positions. (Kellogg’s second-quarter press release)

Let's take Kelllogg Company (K) as an example of a company that could face pressure in the coming years. The firm has total debt liabilities of ~$6.74 billion and just $308 million in cash (resulting in a net debt position of $6.43 billion), while its reported diluted earnings per share has fallen to $1.90 in the year-to-date period ending July 1, 2023, from $2.19 in the same period a year ago. On an adjusted basis, Kellogg's earnings per share is expected to decline 1%-2% on a currency-neutral basis for the year while free cash flow so far in 2023 has also fallen due to weakening operating cash flow and higher capital spending.

Yet, despite all of this, shares of Kellogg are trading at 16x current-year’s expected earnings while sporting a forward estimated dividend yield of ~3.6%. If entities like Kellogg can garner a 16x multiple with their comparatively unattractive cash-based characteristics, what type of P/E multiple is then fair for a stock with a huge net cash position, substantial free cash flow generation, and tremendous secular growth prospects? Is it 30, 50, or more? That's what the discounted cash-flow model, also known as enterprise valuation, helps solve. Clearly, we’re not interested at all in Kellogg’s shares at this time, nor will we have any interest in its pending breakup into two separate companies--its snacking business Kellanova and WK Kellogg Co, its North American Cereal business. We want stocks with better cash-based characteristics.

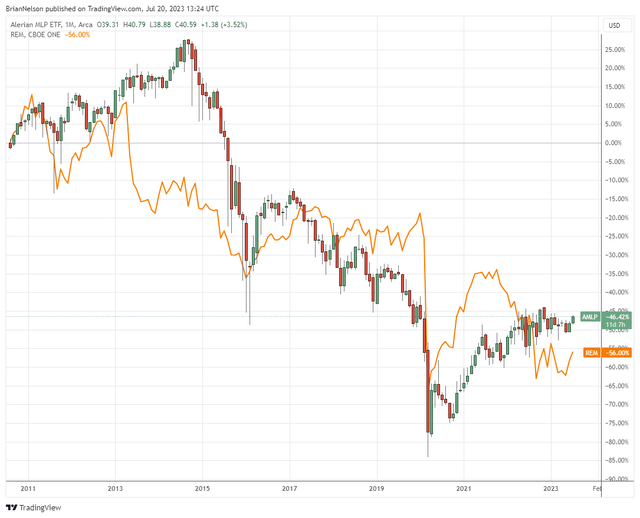

Energy master limited partnerships and mortgage REITs have destroyed the accounts of retirees, necessitating them to chase higher and higher yields as their capital positions have eroded. (Trading View)

Within the context of the cash-based sources of intrinsic value, net cash is vitally important as it helps to create situations with asymmetric upside potential--and that means little tail risk of bankruptcy or capital-market dependence. Capital-market dependence occurs when a company must continuously access the equity or credit markets in order to keep its business going. If capital becomes more expensive, these companies get squeezed. Some of these beleaguered companies often include REITs (VNQ), master limited partnerships (AMLP) and mortgage REITs (REM), among other companies that have capital expenditures and dividend payments that often exceed what they generate in terms of operating cash flow. Having a net cash position, on the other hand, creates asymmetric upside potential, as with bankruptcy or capital-market dependence risk, the range of fair value outcomes for the company is skewed positively to the upside.

That covers the important net-cash dynamic. Now let's talk about the second component of cash-based intrinsic value: future expectations of enterprise free cash flow. For this, we're looking for asset-light (capital-light) entities with strong secular growth prospects such that the potential for future upward revisions in free cash flow are likely, if not probable. What we don't want are capital-intensive entities that are cyclical and have to plow back a lot of their free cash flow into their businesses in order to keep growing, or worse, not shrink. If we can find entities that are growing free cash flow considerably and have products tied to catalysts such as artificial intelligence [AI] where the market can continuously revise future expectations of free cash flow higher, then expectations revisions would suggest a higher intrinsic value and therefore a higher stock price (strong capital appreciation potential) for these companies. Let's now cover three stocks that fit the bill in this article.

Apple Inc. (AAPL)

Apple continues to lead the market higher. (Trading View)

When Apple reported its second-quarter report August 4, the company showcased a balance sheet with ~$166.5 billion in cash and marketable securities against term debt of ~$105.3 billion, good for a net cash position of ~$61.2 billion. Though Apple may be working towards a net-neutral balance sheet in coming years, for now, the firm's net cash position firmly tilts its asymmetric risk-reward scenario to the upside, in our view. For the nine months ended July 1, 2023, net cash from operations came in at ~$88.9 billion while capital spending came in at just ~$8.8 billion, showcasing a company that is not only asset-light, but also one that throws off considerable free cash flow.

One of the concerns often expressed about Apple is the company's price-to-earnings (P/E) ratio. However, it's important to emphasize that P/E ratios are derived in part by the cash-based sources of intrinsic value of the company, and Apple's cash-based sources are nothing short of phenomenal. Earnings, the E in the P/E ratio, only consider a snap-shot of the company's earnings potential and do not factor in the duration of future expected free cash flows. Further, the E in the P/E ratio, ignores the balance sheet, which is a material source of cash-based intrinsic value, as in the case of Apple.

The high end of our fair value estimate range of Apple currently stands at $200 per share, but there is meaningful potential for upwardly-revised free cash flow expectations in the coming periods, especially as future iterations of the iPhone and the 'Vision Pro' are rolled out. The company's ecosystem lends itself to tremendous upselling and cross-selling opportunities, too, and Apple's pricing power across its product suite is fantastic. When it comes to Apple, we think the risk-reward remains in long-term investors' favor. The P/E ratio has significant shortcomings and generally should not be relied upon when assessing the valuation of a company.

Alphabet Inc. (GOOG) (GOOGL)

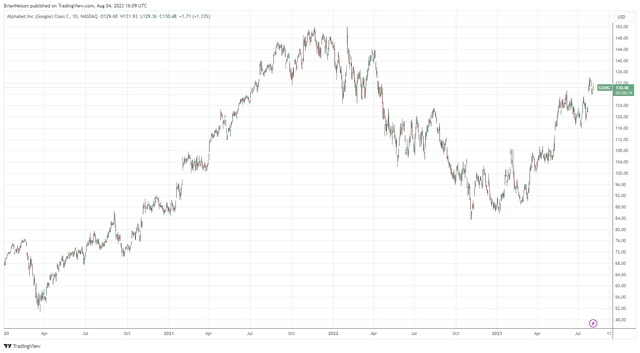

Alphabet has more room to move higher and could once again return to all-time highs. (Trading View)

At the end of June, Alphabet's total cash and cash equivalents stood at $118.3 billion, while long-term debt stood at $13.7 billion--a very solid net cash position. Cash flow from operations at Alphabet jumped to $28.7 billion in its second quarter, while capital spending was $6.9 billion, resulting in free cash flow generation during the period of $21.8 billion. As with Apple, Alphabet has a fantastic net cash position--a better one--while the firm is throwing off free cash flow like few other companies. Though there are risks to its concentration in search-related advertising revenue, its recent results coupled with insights from Meta Platforms' (META) quarterly report suggest a continued recovery in advertising spending following some weakness in 2022.

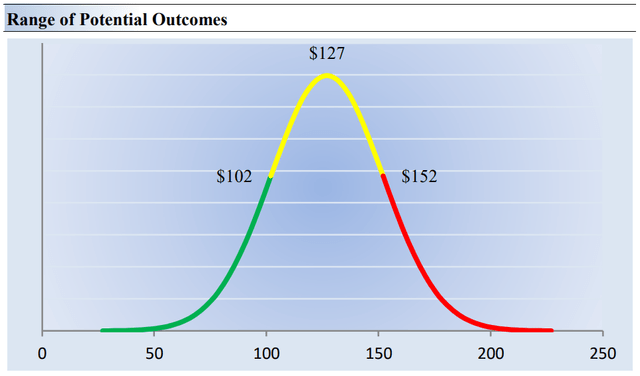

We estimate Alphabet's fair value at about $127 per share at this time, but every company has a range of probable fair values that's created by the uncertainty of key valuation drivers such as future revenue or earnings, for example. After all, if the future were known with certainty, we wouldn't see much volatility in the markets as stocks would trade precisely at their known fair values. There'd be no need for price discovery, as we'd know precisely what the company would be worth. Because we live in an imperfect world, however, this is why a margin of safety or the fair value range we assign to each stock is an important part of our process. In the graph below, we show this probable range of fair values for Alphabet. For optimistic investors, we point to the high end of the fair value estimate range ($152) as a reasonable valuation for shares, implying considerable upside potential.

The high end of our fair value estimate range is $152 for Alphabet. (Valuentum)

Microsoft Corporation (MSFT)

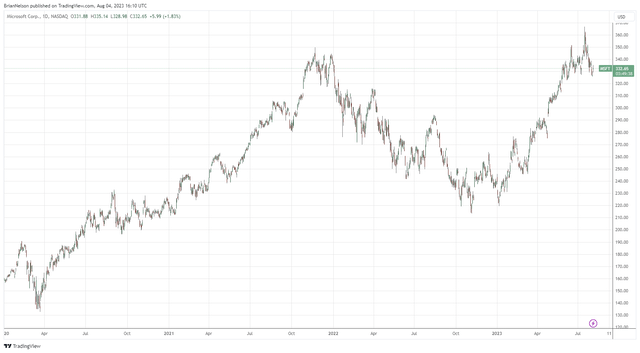

Microsoft recently reached an all-time high and shares have been consolidating. (Trading View)

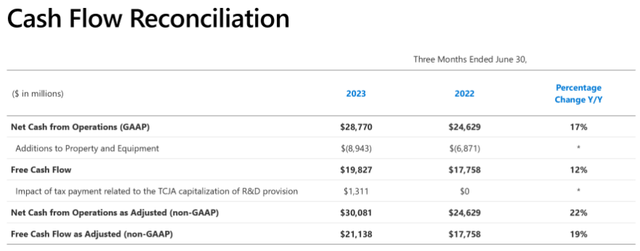

You're probably getting the main theme of this article at this point: we love net cash on the balance sheet and future expected free cash flow! Let's now talk about Microsoft's financials. At the end of June, the company held $111.3 billion in total cash and cash equivalents, exclusive of $9.9 billion in equity investments, and short- and long-term debt of $47.2 billion--good for a very nice net cash position. For the three months ended in June, cash flow from operations at Microsoft surged to $28.8 billion, while capital spending came in at $8.9 billion, good for free cash flow generation in the quarter of $19.8 billion (see image below). Microsoft is yet another great example of a net-cash-rich, free-cash-flow generating, secular-growth powerhouse.

Microsoft's free cash flow has been phenomenal! (Microsoft)

The company continues to work toward wrapping up its deal with Activision Blizzard (ATVI), a combination that we're not too excited about. Though that deal will eat into Microsoft’s net cash position, we’re still huge fans of its future expected free cash flow generation, which remains very impressive. As it relates to potential for upward future free cash flow revisions, we point to AI as a big catalyst. Not only should AI bolster the attractiveness of Microsoft's search engine Bing (without threatening Google too much), but the company has already rolled out 365 Copilot, which puts to use its advancements in AI within its software suite at a much higher price. The high end of our fair value estimate range for Microsoft stands at $368 per share, and it's hard not to like everything that's going right for the company.

Concluding Thoughts

When it comes to long-term capital appreciation potential, we like stocks that have strong net cash positions on the balance sheet, are asset-light with secular growth prospects, are currently generating robust free cash flow, and have the prospect for upward revisions in future expected free cash flow. These dynamics create an asymmetric risk-reward scenario where their fair value estimate distributions are skewed positively with the potential for further upside. All things considered, we continue to be big fans of big cap tech and large cap growth, and point to Apple, Alphabet, and Microsoft as three of our favorites.

This article was written by

Analyst’s Disclosure: I/we have a beneficial long position in the shares of SPY either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

This article and any links within are for informational and educational purposes only and should not be considered a solicitation to buy or sell any security. Valuentum is not responsible for any errors or omissions or for results obtained from the use of this article and accepts no liability for how readers may choose to utilize the content. Assumptions, opinions, and estimates are based on our judgment as of the date of the article and are subject to change without notice. Brian Nelson owns shares in SPY, SCHG, QQQ, DIA, VOT, BITO, RSP, and IWM. Valuentum owns SPY, SCHG, QQQ, VOO, and DIA. Brian Nelson's household owns shares in HON, DIS, HAS, NKE, DIA, and RSP. Some of the other securities written about in this article may be included in Valuentum's simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies. AI in part wrote the summary of this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.