These Are The Reasons Why We Are Bullish On Sysco

Summary

- Sysco's stock has underperformed the market year-to-date, but it could be an attractive holding due to its latest earnings results, commitment to returning value to shareholders, and valuation.

- Despite missing analyst estimates, Sysco's revenue and EPS have grown, indicating strong demand for its products. The company's profitability has also improved.

- The stock appears to be attractively valued compared to its peers in the food distributors industry.

- For these reasons, we assign a "buy" rating to SYY's stock.

hapabapa/iStock Editorial via Getty Images

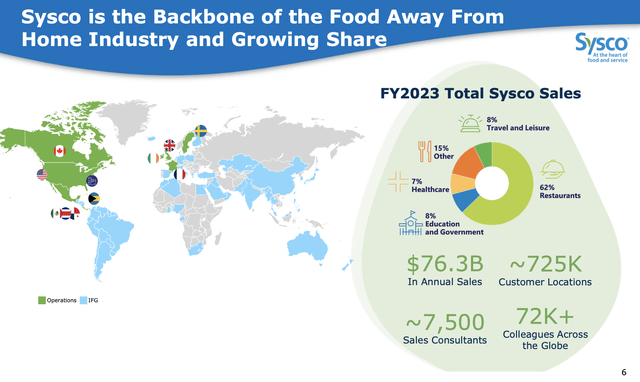

Sysco Corporation (NYSE:SYY), through its subsidiaries, engages in the marketing and distribution of various food and related products primarily to the foodservice or food-away-from-home industry in the United States and internationally.

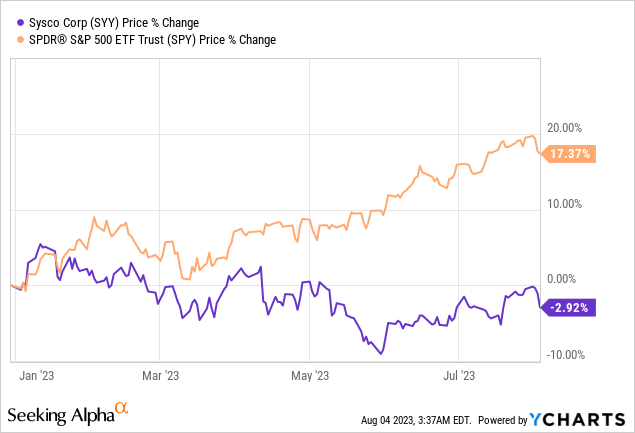

Year-to-date the firm has lost about 3% of its market value, substantially underperforming the broader market, which has gained more than 17% in the same period.

Despite this underperformance, we believe that SYY's stock could be an attractive holding in the portfolio of a wide range of investors. Today, we have decided to summarise and discuss a few reasons why we believe so. Our writing today will be primarily revolving around the firm's latest earnings results, its commitment to returning value to its shareholders and its valuation based on a set of traditional price multiples.

Earnings results

Sysco has reported its latest earnings results a few days ago, after which the stock price has been dropping gradually. The reason for the decline has been the missed revenue estimates. In our view however, the picture is not as bad as the market appears to see it and there are several reasons for this:

1.) Revenue- and EPS growth

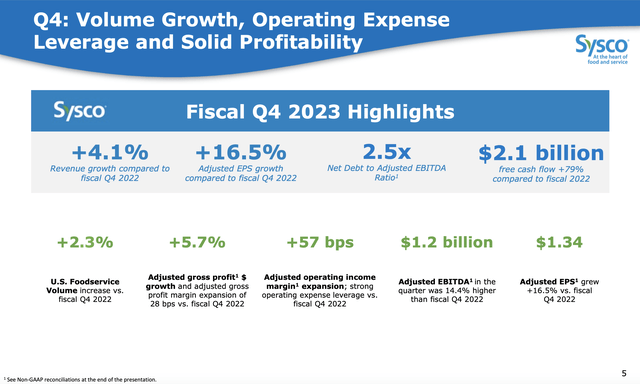

Despite missing analyst estimates, revenue has grown more than 4% year-over-year. It has been partially driven by the volume increase in the U.S. foodservice, which is indicating that the demand for SYY's products remains strong.

Further, as 70% of the company's sales are generated in the restaurants and travel and leisure segments, in our opinion, the improving macroeconomic environment, including moderating inflation and improving consumer confidence, may lead to further demand growth in the coming quarters.

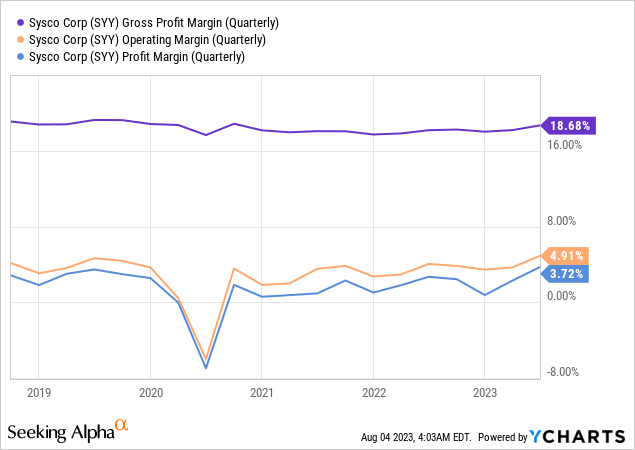

2.) Profitability

Not only revenue and EPS have been growing, the margins have been also expanding substantially, including the gross profit margin, the operating margin, as well as the net profit margin. In the press release, management has explained that the margin expansions can be largely attributed to the firm's productivity and efficiency improvements over the past quarters and are likely to continue in the near future.

Our actions to improve efficiency continued in the fourth quarter with sequential improvements in supply chain productivity and additional cost outs, delivering meaningful operating expense leverage. [...] Our solid financial results included top-line and bottom-line growth, record free cash flow for the year, and achievement of our target net debt ratio, which improved to 2.5 times. Improved productivity drove operating expense leverage, resulting in strong bottom-line margin expansion. Looking ahead, we plan to drive continued productivity gains.

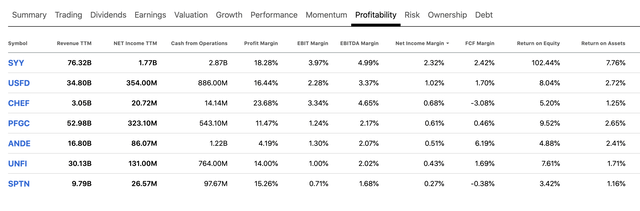

Based on a set of profitability measures, including the net profit margin and the EBITDA margin, SYY's business appears to be the most attractive in the food distributors industry.

For these reasons, we believe that despite missing analyst estimates, SYY's earnings results are definitely positive and show a clear indication of the firm's resilience even in turbulent market environments.

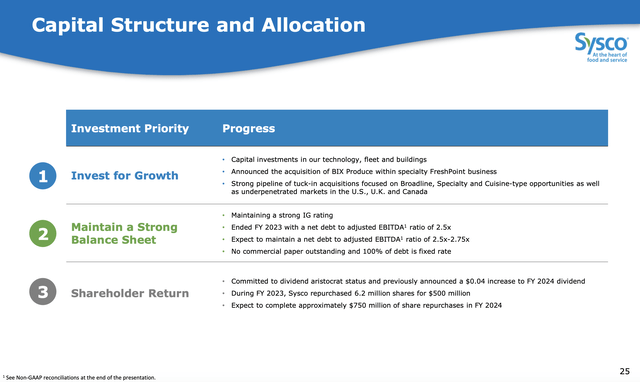

Returns to shareholders

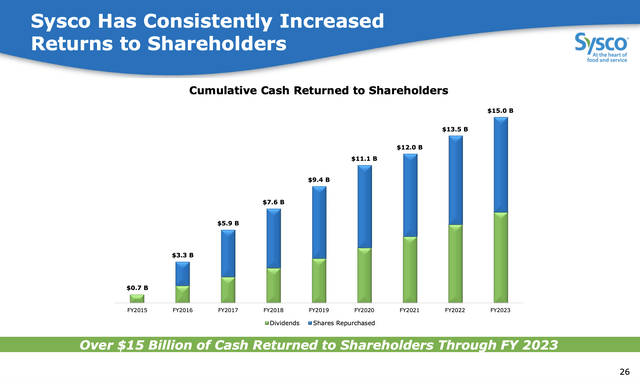

The firm has also remained committed to return value to its shareholders, both in the form of dividends and share buybacks. Over the past 9 years, SYY has returned as much as $15 billion to shareholders. While the slide only shows nine years, in fact the firm has been paying dividends for the past 52 years, consecutively. In the past seven years they have also managed to increase the dividend payments each year. Currently the firm pays a common quarterly dividend of 50 cents per share, which is equivalent to an annual yield of 2.7%.

Looking forward, the firm also seems to put an emphasis on both dividends and share repurchases.

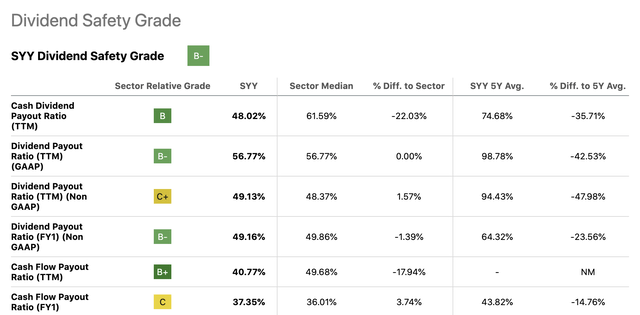

Also important to note that the dividends and share buybacks are not only attractive, but also appear to be safe and sustainable in the near future. The following table shows SYY's payout ratios, which appear to be healthy and about in line with the respective sector medians.

Dividend safety (Seeking Alpha)

For these reasons, we believe that SYY could be an attractive holding in the portfolio of a dividend- /dividend growth investor.

Valuation

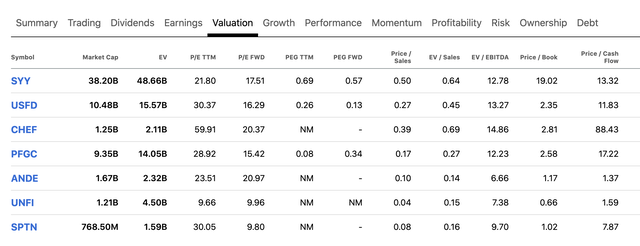

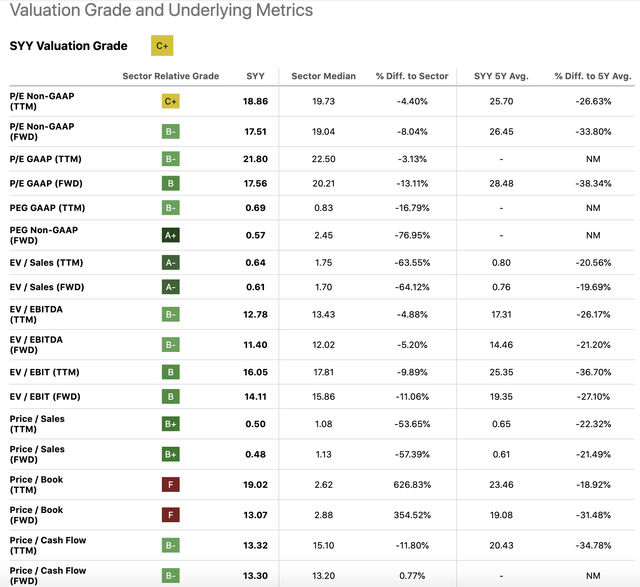

To assess the current valuation of Sysco, we will be using a set of traditional price multiples.

Valuation grade (Seeking Alpha)

The table above illustrates that according to most price multiples, SYY appears to be trading at a slight discount to the consumer staples sector median and also compared to its own 5Y averages.

Let us narrow down the peer group to firms in the food distributors industry only. While SYY is not the cheapest among these firms, SYY's valuation, taking its outstanding profitability and growth into account, is still attractive. Further, having a PEG ratio below one may also be an indication that the potential growth is not fully priced in at the current levels.

To sum up

SYY's stock has substantially underperformed the broader market year-to-date. We believe this performance is not a true reflection of the firm's strong fundamentals, attractive business model and resilience in turbulent markets.

Despite missing revenue estimates in the latest quarter, Sysco has delivered strong results. Both revenue and EPS have grown year-over-year. Profitability and efficiency have also improved.

The firm has remained committed to return value to its shareholders, both in form of dividend payments and in share buybacks. Looking forward, management has also indicated that they are aiming to keep this focus when it comes to capital allocation. Important to highlight that these initiatives appear to be sustainable.

Considering the firm's growth, profitability and its return to shareholders, the stock appears to be attractively valued at the current price levels.

For these reasons, we rate SYY's stock as "buy".

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Past performance is not an indicator of future performance. This post is illustrative and educational and is not a specific offer of products or services or financial advice. Information in this article is not an offer to buy or sell, or a solicitation of any offer to buy or sell the securities mentioned herein. Information presented is believed to be factual and up-to-date, but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. Expressions of opinion reflect the judgment of the authors as of the date of publication and are subject to change. This article has been co-authored by Mark Lakos.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.