UPM-Kymmene: Forestry Remains Clouded, But Packaging/Product Is A 'BUY

Summary

- UPM Kymmene's 2Q23 results showed lower sales and a significant decline in earnings, but the company's long-term growth projects and optimizations are on track.

- The company is facing challenges in key segments due to destocking and inventory rationalization, which is impacting sales and margins.

- Despite the negative quarterly result, UPM Kymmene remains well-positioned with a strong balance sheet, low leverage, and a clear growth path, making it a good long-term investment.

- Looking for a helping hand in the market? Members of iREIT on Alpha get exclusive ideas and guidance to navigate any climate. Learn More »

MinttuFin

Dear readers/followers,

The last time I reviewed UPM Kymmene (OTCPK:UPMKF), I gave the company a rating upgrade and considered it a "BUY" at a cheaper valuation. For now, the company has failed to gain valuation traction and is more or less flat in a market that in the meanwhile has grown about 10%, going by the S&P500. On that level, this investment has not materialized an upside in the past two months.

However, my position is more long-term than that, and the fact that the company hasn't changed much, only means that the company is still a "BUY" here, but that we have a higher conviction with the arrival of 2Q23 results.

In this article, I'm going to review 2Q23 and give you my take on what the company can expect in a forward market characterized by continued headwinds in key segments.

UPM Kymmene - a challenging 2Q23 opens for more "BUY"

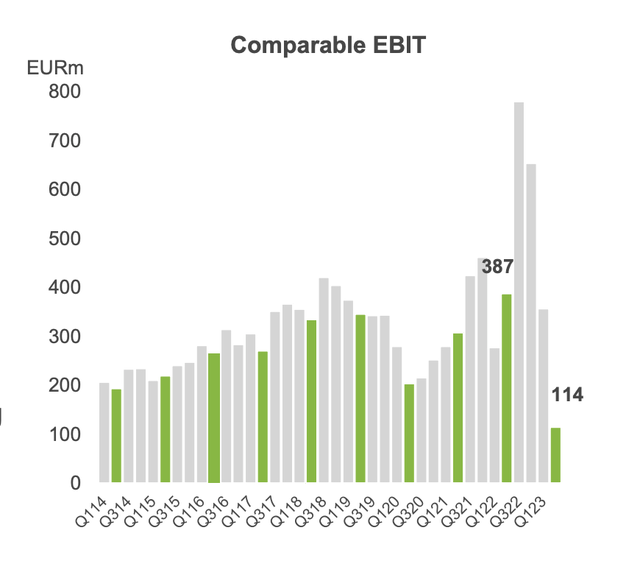

So, moving straight into the 2Q23 results. The company saw slightly lower tip-line sales and a massive comparative EBIT decline - though it was from record highs. The company's earnings before taxes/interest declined by 71% to just below €115M for the quarter, or to around a 4.5% sales margin, compared to a 15%+ YoY sales margin with more than triple the EBIT the year prior.

The reason for this? Destocking and inventory rationalization. Various product value chains are normalizing/adjusting to the current macro, and this is something we see across the entire segment. With pulp and energy prices cycling down to trough levels, the forestry companies - and UPM does own forest - are hurting pretty bad compared to YoY numbers.

Company OCF was actually good - but this was due to energy hedges, not due to any sort of positive operating results. The challenges seen by UPM this quarter are not unique in any way and are seen across the entire industry with peers such as Billerud (OTCPK:BLRDY), Holmen (OTCPK:HLMNY), and Stora Enso (OTCPK:SEOAY) seeing exactly the same sort of trends. I'm long all of these four companies, by the way, and the results do of course not faze me in the least. They mean that in most of the companies, especially those with good visibility, I'm adding more.

Still, it's worth n noting that the downcycling this time around was fairly extreme, even in the context of a 10-year timeframe. It is, in fact, a 10-year low.

UPM IR (UPM IR)

It should be expected, as I see it, for this trend not to normalize in the immediate near term. We should expect slower cycling up to more normalized levels. This means that in terms of positivity, we need to focus on what the company can actually affect - and macro/pulp price trends aren't one of those things.

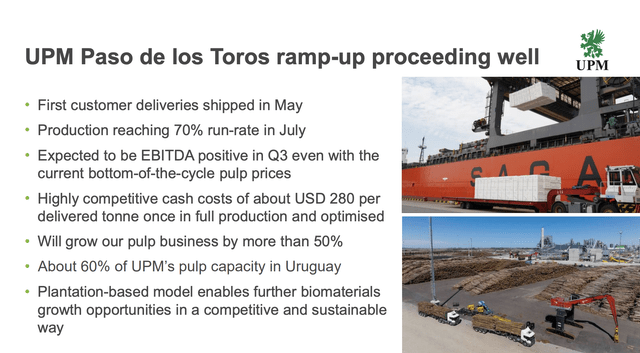

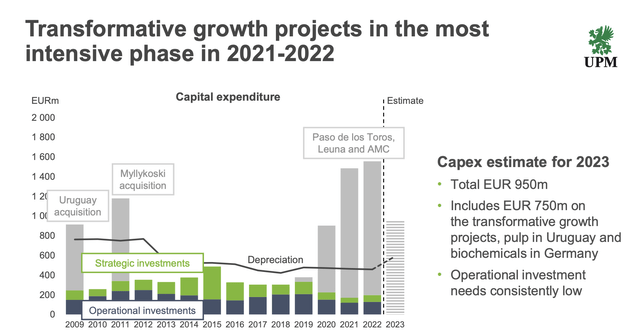

The company's growth projects and optimizations are going according to plan. Paso de los Toros is ramping up production according to plan, albeit of course in a weaker macro.

The company's focus at this juncture is on stabilizing margins - but it can be illustrated fairly easily how difficult this is to do when the market turns against you.

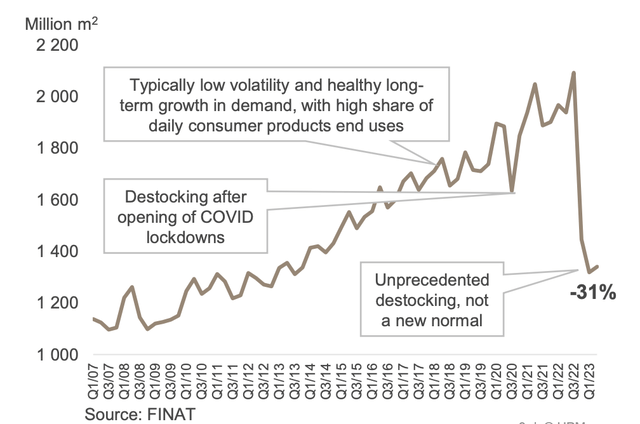

UPM IR (UPM IR)

What you see are the market shipments of self-adhesive label materials in Europe. This is not a trend the company can influence. You can imagine what sort of impact this trend can have on company sales. 1H23 market shipments for most of UPM's products are well below the long-term trends due to this destocking trend. With consumers impacted by inflation, interest rates, and other variables, we're going to see impacted end-use demand, which will further impact company trends.

When is this destocking expected to fade? I've been reading up on various industry reports, following company trends and calls, and I say around 2H23 or 1Q24 seems like a likely time - albeit gradually.

This does not impact the long-term growth thesis of this entire segment, or several segments. It also means that I expect a decrease in company variable costs in 2H23 for most of the companies in these segments.

Out of the company's many segments - because there are 6, the most impacted segment was Fibres and Speciality papers - the areas closest to pulp. The least impacted was Plywood, though communication papers and Rataflac did okay as well.

Overall, this negative quarterly result has done very little to impact the very long-term net leverage position of the company. UPM continues to hold a policy of lower than 2x, and the current net debt/EBITDA is below 1.1x, making it one of the best-leveraged businesses in the entire sector. The company has no financial covenants, and availability of liquidity of upwards of €6.4B at the end of 2Q23, with a net debt of around €2.5B.

The company fully expects the 2023E EBIT to decrease on a YoY basis, with the 2H23 being very similar to the trends we've seen in the first six months of the year. As I said, to find 2023 positives, we need to look more at the long-term trends of projects and strategies.

UPM IR (UPM IR)

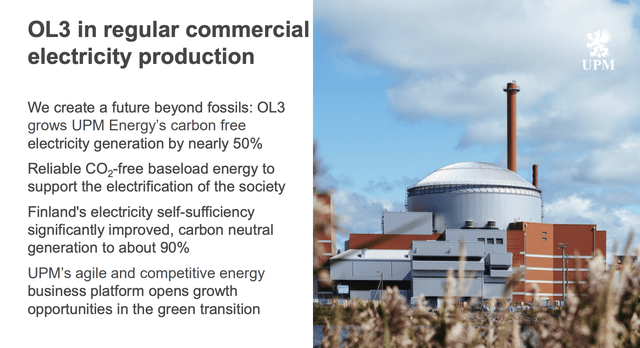

That is where the company is doing very well. Not only in terms of its new production facilities but also in terms of its energy generation...

UPM IR (UPM IR)

...and things like biochemical refining. The company continues to adjust its asset and production to meet global demand. This goes especially for paper, and includes the closure of the UPM Plattling asset in Germany by the end of 2023, a mill with 380kt of publication paper capacity, and a CapEx reduction of 18% run-rate, with annual fixed savings costs of about €100M. Streamlining is ongoing. Another asset already closed is the UPM Schongau, and UPM Steyermühl in Germany and Austria respectively, though these assets retain some of their other production capacity.

UPM has been leading the charge in cost savings and margin improvements and has been very quick, compared to other companies in the same segment, in delivering on this. This now includes cuts in operative costs, temporary layoffs and more flex hours, and significant reductions from its Russia exit. The Plattling closure alone would reduce the workforce by another 400 people, which would bring the total number since fall 2022 to around 1,500 people in less than a year - excluding the Russia exit.

UPM has a very clear-cut growth path ahead of it - and I'm very happy to be a part of it as an investor. While the industry is cyclical and uncertain, I argue that this company is definitely not.

UPM IR (UPM IR)

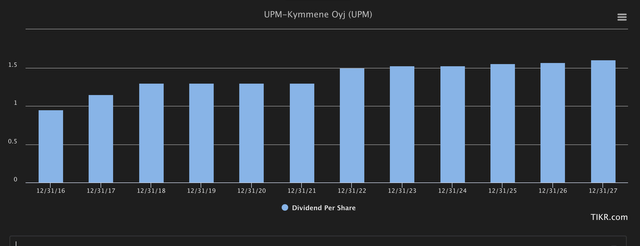

This is also reflected in the company's dividend policy. UPM has increased the dividend by 15% to €1.5/share, which comes to 50% of the comparable EPS. At €30/share, the company is not the cheapest it's ever been - but it's still a vastly above-average player in the sector with a 2022A yield of 5% based on that €1.5/share.

And based on S&P analyst estimates, that yield is actually a safe one, albeit one that won't grow fast on a forward basis.

S&P Global UPM Dividend (TIKR:com)

Let's look at the company valuation and what sort of upside we have going for us for the company here.

UPM Kymmene - the realistic upside is above 15% - I'm buying more

In my investing, a 15% annualized rate of return on a conservative basis is what I want. I want this to be realistic, and what I consider to be safe. How I get it, that's something I'm open to with a variety of possible entries.

Over the past few months, with equity multiples still being at a relatively high level considering the sort of interest rate environment we're in and that I don't personally expect any sort of "soft landing" here, I've been working more and more with hedging strategies, including some buy-writes as opposed to straight buying, to lower my potential cost basis for my investments.

UPM isn't expensive here. Not for what it offers long-term. It's also possible, however, that we may see things going down further in the near term. As I am writing this article, UPM is down below €30/share. For UPM, I consider common share investment a viable entry strategy - it's one I have been using myself.

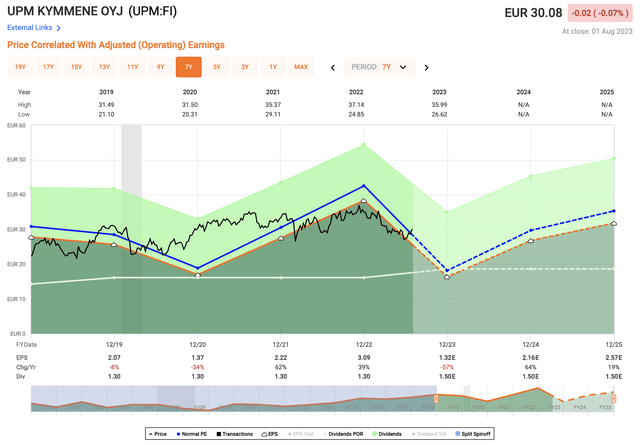

We need to consider the downcycle - but also consider the fact that in the last smaller EPS downcycle, UPM did in fact not drop further, but grew.

UPM Valuation (F.A.S:T graphs)

There's a very specific reason why I remain long here at this somewhat updated estimate. And that is, even ignoring the company's P/E premium of 16-17x, or even a low 15.8x, the company still offers a BBB+ rated safe yield and upside of 15% annually at a 15x 2025E P/E at this time. And that 15%, as I mentioned above, is what I am looking for.

I'm currently unable to find a reliable 15%+ above alternative for the company in the buy-write territory, and I do believe the opportunity for upside is likely here - even if the further short-term downside is not impossible.

This leaves me with two options for entry. Either write cash-secured puts - probably short-term ones, at somewhat aggressive strike prices or just go straight into the common.

Below €30/share, I consider the entry into the common to be a good enough prospect. The company is "too good" to ignore at below €30/share, despite the near-term uncertainties.

That's why as of 2Q23, I'm reiterating my "BUY" rating for UPM. Analysts are giving the company PT averages of €34/share, from ranges of €26 to €42, and out of 15 analysts, 11 are either at "BUY" or outperform". There's a high conviction here that the upside beyond the 2023E trough will be good enough to make up for whatever shortfalls and risk we're currently seeing. This is a sentiment that I agree with.

For that reason, I give you my updated thesis for UPM.

Thesis

- UPM is one of the world's best and most appealing, Finnish-based forestry and pulp/chemical companies with a good energy arm. It also has a great yield. At the right price, this company goes from being lukewarm to a full-fledged must-"BUY" - that's my view, at least. This time has now come.

- At a share price of below or around €30/share, this company will eventually, I believe, reward shareholders with good returns. While there is potential for a downturn further in 2023, I believe the eventual upside will materialize in this investment, causing it to beat the market.

- For that reason, I'm raising my rating on the company to a solid "BUY" here, with a price target of at or around €35/share - though at €35/share, the upside is barely double digits. I'm affirming my longer-term share price here. You could write cash-secured puts, but I believe the entry into the common share marks the better investment in 2Q23.

Remember, I'm all about:

1. Buying undervalued - even if that undervaluation is slight, and not mind-numbingly massive - companies at a discount, allowing them to normalize over time and harvesting capital gains and dividends in the meantime.

2. If the company goes well beyond normalization and goes into overvaluation, I harvest gains and rotate my position into other undervalued stocks, repeating #1.

3. If the company doesn't go into overvaluation, but hovers within a fair value, or goes back down to undervaluation, I buy more as time allows.

4. I reinvest proceeds from dividends, savings from work, or other cash inflows as specified in #1.

Here are my criteria and how the company fulfills them (italicized).

- This company is overall qualitative.

- This company is fundamentally safe/conservative & well-run.

- This company pays a well-covered dividend.

- This company is currently cheap.

- This company has a realistic upside based on earnings growth or multiple expansion/reversion.

The company, because of this, fulfills the key criteria I have, though I won't call it cheap here. It does, however, have an upside, and for that reason, it's worth buying.

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

The company discussed in this article is only one potential investment in the sector. Members of iREIT on Alpha get access to investment ideas with upsides that I view as significantly higher/better than this one. Consider subscribing and learning more here.

This article was written by

Mid-thirties DGI investor/senior analyst in private portfolio management/wealth management for a select number of clients. Invests in USA, Canada, Germany, Scandinavia, France, UK, BeNeLux. My aim is to only buy undervalued/fairly valued stocks and to be an authority on value investments as well as related topics.

I am a contributor for iREIT on Alpha as well as Dividend Kings here on Seeking Alpha and work as a Senior Research Analyst for Wide Moat Research LLC.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of UPMKF, BLRDY, SEOJF, HLMNY either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

While this article may sound like financial advice, please observe that the author is not a CFA or in any way licensed to give financial advice. It may be structured as such, but it is not financial advice. Investors are required and expected to do their own due diligence and research prior to any investment. Short-term trading, options trading/investment and futures trading are potentially extremely risky investment styles. They generally are not appropriate for someone with limited capital, limited investment experience, or a lack of understanding for the necessary risk tolerance involved. I own the European/Scandinavian tickers (not the ADRs) of all European/Scandinavian companies listed in my articles. I own the Canadian tickers of all Canadian stocks i write about. Please note that investing in European/Non-US stocks comes with withholding tax risks specific to the company's domicile as well as your personal situation. Investors should always consult a tax professional as to the overall impact of dividend withholding taxes and ways to mitigate these.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.