Three Reasons Why We Like Costco

Summary

- Costco's profitability has remained steady over the past five years, thanks to its membership model, customer loyalty, value oriented pricing strategy and significant pricing power.

- The company has a strong track record of returning value to shareholders through dividends and share buybacks.

- Costco has shown improved efficiency, with its asset turnover returning to pre-pandemic levels.

- Based on a set of traditional price multiples COST appears to be trading at a premium compared to its sector and peers.

- All in all, we are bullish on COST's financial performance in the coming months and quarters.

BING-JHEN HONG

Costco Wholesale Corporation (NASDAQ:COST), together with its subsidiaries, engages in the operation of membership warehouses in the United States and internationally.

Thanks to the firm's membership model and its value focused pricing strategy the business has managed to fare quite well in the past three years, despite the major macroeconomic challenges, including the pandemic, the political conflict in the Eastern European region and the elevated inflation levels, along with depressed consumer confidence around the globe. In fact, over the past 36 months, COST has significantly outperformed the broader market.

As a result, many investors view COST as a true defensive pick for their portfolios, which does not only offer stability and returns from dividends, but also growth.

For these reasons, we have decided to take a look at COST's business today, and highlight three major factors that make us like the business, and help us explain our bullish thesis.

Profitability

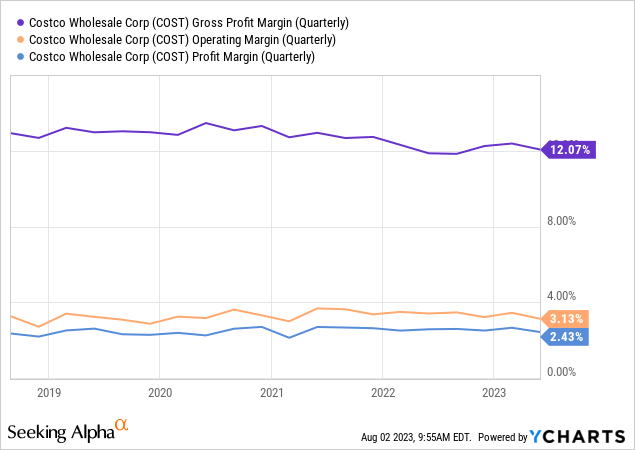

Three ratios that are often used to measure the profitability of a business are: gross profit margin, operating margin and net profit margin. The follow chart depicts these ratios for COST and their developments over the past five years.

On the chart it is clearly visible that Costco has managed to keep its profitability steady during all these years. We believe that this consistency is especially valuable during market turbulence, like the turbulence we have been experiencing in 2020-2021-2022.

Looking forward, we believe that COST is well-positioned and well-equipped to sustain these profitability levels. There are two primary factors that support our thesis:

- The membership model - The membership model provides Costco with a stable and predictable cash flow. Regardless of how much customers are spending, the membership fees are collected by the firm.

- Customer loyalty - On top of the membership model, it is crucial to have a loyal member base. Costco has around 125 MM members. If these members are loyal, and they appear to be, Costco will be able to increase membership fees when necessary, to pass on certain additional costs to their customers, allowing them to maintain the margins at the current levels.

While the sales in June have not been as good as expected by many, the majority of the analysts have remained bullish on the firm's outlook, exactly because of the above-listed two factors. The firm has also reported a slight decline in sales already in May so the decline in June has not been entirely unexpected. In July however, according the the most recent data, sales have jumped nearly 5% and comparable sales have increased by 2.5%. In the coming months, it is important to keep an eye out whether this improvement continues or not. It might as well be a first sign of the improving macroeconomic environment, but it may as well be just an anomaly.

All in all, we believe that the stable profitability figures that Costco has, make it an appealing defensive position in one's portfolio.

Return to shareholders

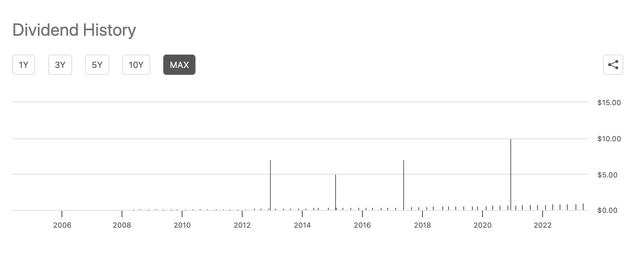

Costco has been committed to return value to its shareholders in the past years. They have been paying regular- and special dividends, and they have also purchased back a significant amount of shares.

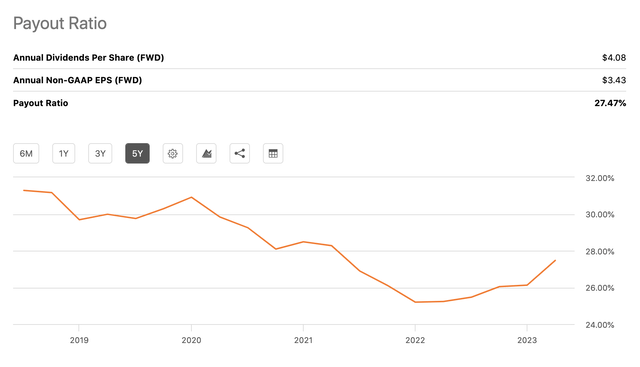

Currently, the company is paying a quarterly common dividend of $1.02, which is equivalent to an annual yield of 0.7%. While this can definitely not be considered a high yielding stock, it is important to understand to consider three things:

- The firm has a strong track record of paying these dividends - 18 years of consecutive dividend payments.

- The dividends are well-covered, both from a net income and a free cash flow perspective.

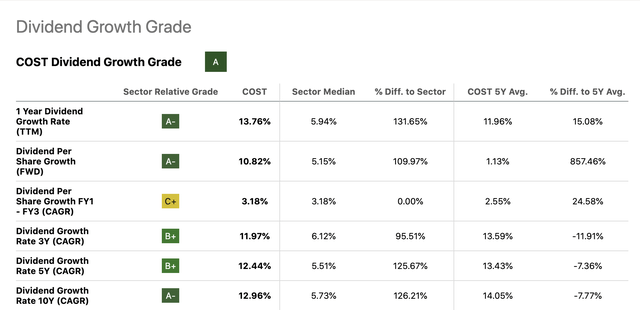

- The company has managed to increase dividends rapidly in the past decade - 18 years of consecutive dividend growth.

Dividend history (Seeking Alpha) Payout ratio (Seeking Alpha) Dividend growth (Seeking Alpha)

On top of the dividends, COST has also returned substantial value to its shareholders by buying back its outstanding common shares. This is important for two reasons:

- the firm may be signalling that it believe its share are undervalued

- share buybacks may be a more tax efficient way of returning value to shareholders - depending on the tax jurisdiction of the investor

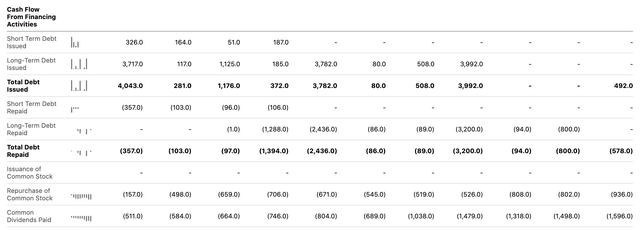

The table below displays, how much each year in the past 10 years the firm has spent on share repurchases and dividends.

Cash flow from financing (Seeking Alpha)

Efficiency

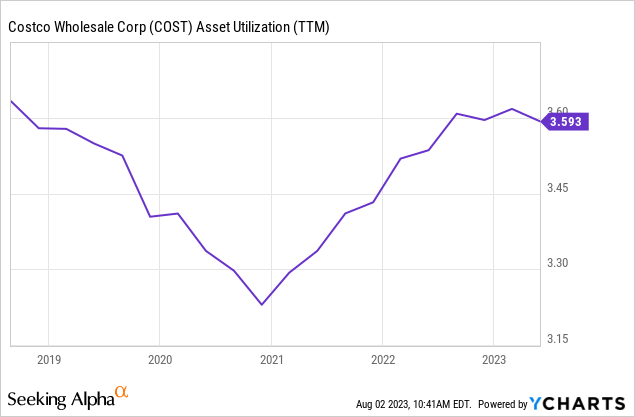

Last, but not least, we would like to write briefly about efficiency. Efficiency is the ability of a firm to generate revenue, using its assets and it can be measured by the so called asset turnover or asset utilisation. In general stable or improving efficiency is preferred. The following chart presents COST's efficiency over the past five years.

While the measure has been trending down in 2019 and 2020, Costco has managed to effectively turn the trend around and bring the ratio back to it pre-pandemic levels. This improvement also plays a key role when assessing the company's return on equity and its development over the years.

Conclusion

In our opinion, Costco has a fundamentally solid business with stable margins, with a loyal customer base and with a membership model that can provide sustainable and predictable cash flows even in turbulent market environments.

The firm's focus on returning value to its shareholders in the form of regular- and special dividends may also be appealing to many. While Costco is usually referred to as a defensive stock, we cannot forget that it may offer both significant dividend growth and capital gains over the years.

Our article however, cannot be complete without pointing out one important thing that we do not like, and that investors/potential investors need to be aware of:

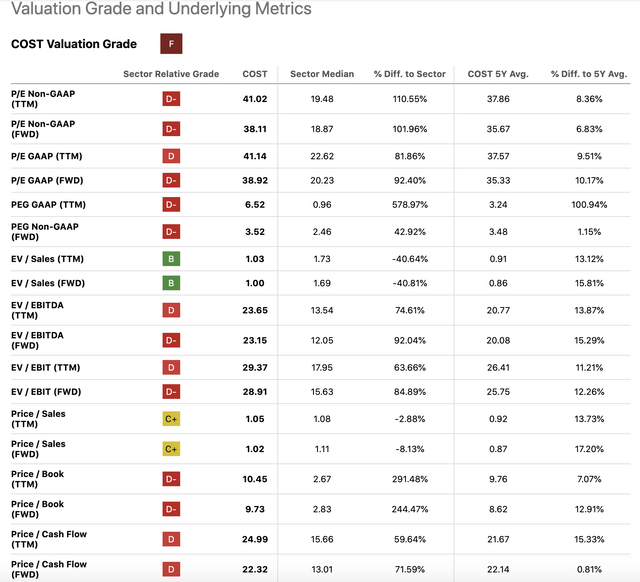

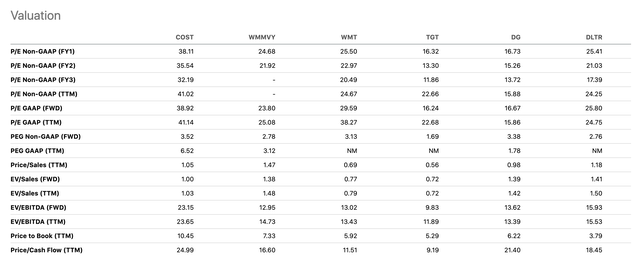

Valuation: According to a set of traditional price multiples, COST appears to be significantly overvalued compared to the consumer staples sector median, as well as to its closest peers and its own 5Y averages. While the business is solid from a fundamental point of view, this overvaluation might have a negative impact on your returns.

Valuation (Seeking Alpha) Peer group comparison (Seeking Alpha)

Despite the overvaluation, we are bullish on the firm going forward. The above mentioned stable margins, the predictable cash flow from memberships, the safe and sustainable returns to shareholders, the improved sales figures in July and the growth potential going forward are all appealing to us. For these reasons, we believe that a premium compared to the sector median and the peers is justified and therefore we rate the stock as a "buy".

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Past performance is not an indicator of future performance. This post is illustrative and educational and is not a specific offer of products or services or financial advice. Information in this article is not an offer to buy or sell, or a solicitation of any offer to buy or sell the securities mentioned herein. Information presented is believed to be factual and up-to-date, but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. Expressions of opinion reflect the judgment of the authors as of the date of publication and are subject to change. This article has been co-authored by Mark Lakos.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Recommended For You

Comments (2)