Seanergy Maritime: Good Execution In A Challenging Market Environment - Buy

Summary

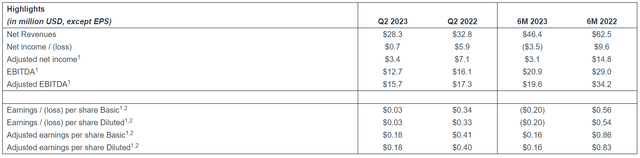

- Seanergy Maritime Holdings reported better-than-expected Q2 results and provided a respectable outlook for Q3 despite very challenging market conditions.

- Cash dividend likely to be eliminated.

- Company agreed to bareboat charter-in a 2011-built Newcastlemax carrier and stated its intent to exercise the associated purchase option next year.

- Given anticipated cash outflows over the remainder of the year, investors should closely monitor the company's liquidity position going forward.

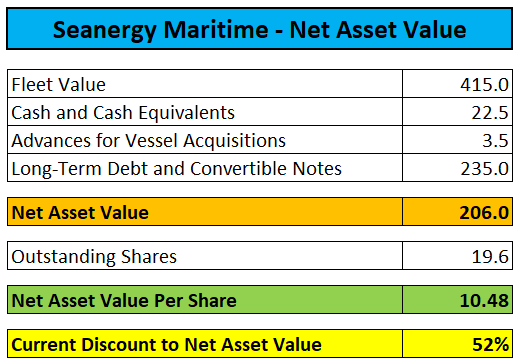

- While discount to net asset value has narrowed as a result of lower second hand vessel prices and the recent involvement of Costamare's CEO and Chairman, I am keeping my "Buy" rating on the shares based on reasonably good execution and the potential for further accumulation by Mr. Konstantakopoulos.

CloudVisual

Note:

I have previously covered Seanergy Maritime Holdings (NASDAQ:SHIP), so investors should view this as an update to my earlier articles on the company.

On Wednesday, Greece-based dry bulk shipper Seanergy Maritime Holdings ("Seanergy" or "Seanergy Maritime") reported second quarter results well ahead of consensus expectations and provided a respectable outlook for Q3 despite very challenging market conditions.

Company Press Release

In addition, the company declared a quarterly cash dividend of $0.025 per common share. On the conference call, management hinted to a potential cancellation of the distribution in favor of share buybacks which at least in my opinion would make a lot of sense given the shares' large discount to net asset value ("NAV").

During the quarter, Seanergy generated $1.9 million in cash from operating activities and utilized approximately $1.6 million to repurchase 362,161 shares at an average price of $4.35. As of July 31, 2023, the company had 19,648,956 common shares issued and outstanding.

Seanergy achieved an average daily time charter equivalent rate of $18,708, very much in line with the preliminary guidance provided in the company's Q1 earnings press release and up a whopping 70% sequentially.

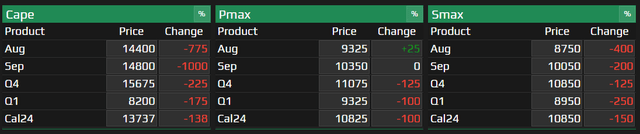

That said, charter rates have experienced renewed pressure in recent weeks. On the conference call, management attributed the weakness to historically low port congestion levels and higher deadweight-adjusted vessel speeds due to many very large ore carriers ("VLOCs") currently steaming from Brazil to China near full speed.

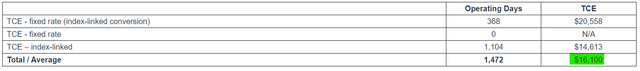

As a result, the company's third quarter TCE rate might be down by a double digit percentage rate:

Company Press Release

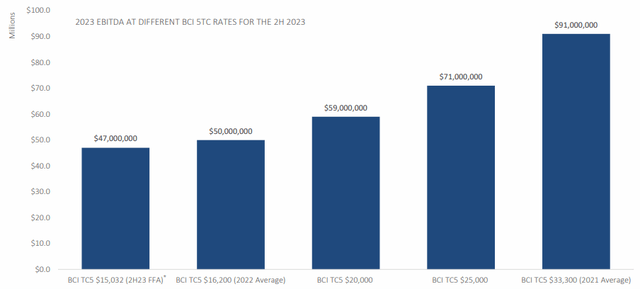

While management remained optimistic for the second half of the year, current forward freight agreement ("FFA") rates don't look encouraging:

Braemar Atlantic Securities

But even at prevailing FFA rates, the company expects full-year Adjusted EBITDA to reach $47 million:

Company Presentation

Seanergy also announced a bareboat charter-in agreement for a 12-year old, Chinese-built Newcastlemax vessel which will be renamed Titanship:

Pursuant to the terms of the bareboat charter, Seanergy has advanced a down payment of $3.5 million upon signing of the agreement and will pay an additional $3.5 million on delivery of the vessel to the Company, as well as a daily bareboat rate of $9,000 over the charter period. Delivery is estimated to take place between August and December 2023, while at the end of the 12-month bareboat period Seanergy has an option to purchase the vessel for $20.2 million.

Upon delivery, the M/V Titanship will commence a time charter agreement with a European charterer for a period of minimum 11 to about 14 months at a daily charter hire based on a significant premium over the BCI. In addition, the time charter provides the Company with the option to convert the variable charter hire to a fixed rate for a period between 2 and 12 months priced at the prevailing Capesize FFA rate for the selected period.

On the conference call, management stated its intent to exercise the purchase option for the vessel next year.

With free cash flow likely to be negative for the remainder of the year due to lower charter rates, elevated vessel operating expenses, higher interest obligations and another $3.5 million down payment coming due upon delivery of the Newcastlemax carrier, I do not expect Seanergy Maritime to engage in further share repurchases in 2023, particularly given the anticipated repayment of the company's remaining $3.2 million in convertible notes until the end of this year.

Assuming no material improvement in charter rates, exercising the purchase option next year would result in further cash drain but it's a bit early to speculate on 2024 dry bulk charter rates at this point.

Despite the challenging charter rate environment, shares have recovered almost 25% from recent all-time lows likely due to recent share accumulation by Costamare Inc.'s (CMRE) Chairman and CEO Konstantinos V. Konstantakopoulos but still trade at a more than 50% discount to NAV:

Company Press Release / MarineTraffic.com

That said, peer Safe Bulkers (SB) is currently changing hands at a similar discount to NAV despite offering a much higher dividend yield.

Bottom Line

Seanergy Maritime Holdings reported better-than-expected second quarter results and provided a respectable preliminary outlook for Q3, particularly when considering the very challenging charter rate environment.

While discount to net asset value has narrowed as a result of lower second hand vessel prices and the recent involvement of Costamare's CEO and Chairman, I am keeping my "Buy" rating on the shares based on reasonably good execution and the potential for further accumulation by Mr. Konstantakopoulos.

That said, given anticipated cash outflows over the remainder of the year, investors should closely monitor the company's liquidity position going forward.

Investors looking for alternative opportunities in the dry bulk space trading at similarly discounted valuations should consider an investment in Safe Bulkers.

This article was written by

Analyst’s Disclosure: I/we have a beneficial long position in the shares of SHIP either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.