Enterprise Products Partners: It's Time For A Downgrade

Summary

- Enterprise Products Partners has been downgraded from a 'strong buy' to a 'buy' due to financial performance and changes in unit pricing.

- The firm posted weaknesses across the board, though this doesn't change the fact that the business is still on solid footing.

- But between these weaknesses and relative pricing, the company deserves to be downgraded, even with future growth prospects in play.

- Looking for a helping hand in the market? Members of Crude Value Insights get exclusive ideas and guidance to navigate any climate. Learn More »

redtea

Historically speaking, I have considered Enterprise Products Partners (NYSE:EPD) to be one of the more attractive companies in the pipeline/midstream space. Robust cash flows and a low trading multiple for units has always been appealing for me. That is why, in every article that I have written about the company dating back to June of 2020, I have gone on to rate it a 'strong buy'. But as an investor, it's imperative that you don't get emotionally attached to the companies that you either own or analyze. You need to remain as objective as possible or else the end result could be a great deal of pain. It is with that in mind that I have re-evaluated the business following the release of results covering the second quarter of its 2023 fiscal year. And based not only on those results, but also on how pricing for units has changed, I have decided to downgrade the business to a 'buy'.

It's time for a change

I have a long history analyzing Enterprise Products Partners. Since my first article on the company in December of 2017, I have gone on to write 12 different articles about the business. In two of them in 2019, I had the company rated a 'strong buy', but I eventually downgraded it in February of 2020 in response to slower growth. That was only short lived, however, because, in June of that year, I ended up raising my rating on the company to a 'strong buy' where it has remained ever since. In general, I have found myself drawn to how cheap shares are and the strong cash flows that management has achieved. And so far, this has proven to be a successful strategy. Since my June of 2020 article when I upgraded the company last, shares have generated upside for investors, inclusive of distributions, of 59.2%. This is comfortably higher than the 42.7% increase seen by the S&P 500 over the same window of time. Though since my most recent article on the company in May of this year, shares are up only 7.7% compared to the 12.7% the S&P 500 experienced.

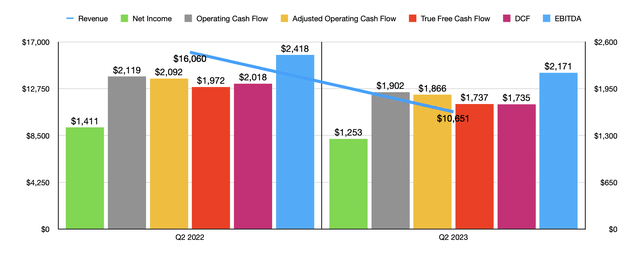

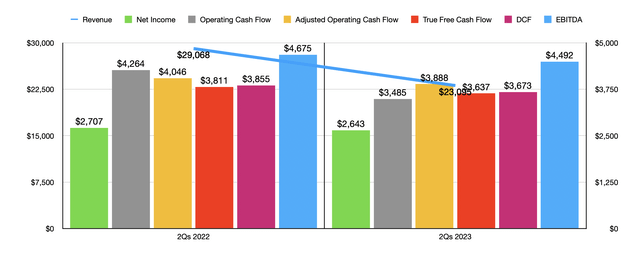

Even though I still consider myself a fan of the company and its business model, I believe now is the appropriate time to downgrade it. Part of the reason for this involves the financial performance the company achieved in the second quarter of the 2023 fiscal year. That data was released on August 1st, before the market opened. In the chart above, you can see certain financial results for the company during that time. I do include revenue for context. But this is only because analysts set revenue guidance for this business like they do any other. But in this industry, revenue is not all that significant. Even so, sales came in at $10.65 billion. In addition to representing a significant decline from the $16.06 billion the company generated the same time last year, sales also were $1.67 billion lower than what analysts forecasted.

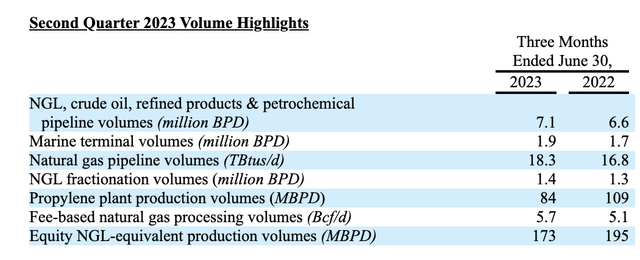

Sales for the business came in lower because of lower commodity pricing. This was actually offset to some degree by higher volume. NGL, crude oil, refined product, and petrochemical pipeline volumes, averaged about 7.1 million barrels per day during the quarter. That was up nicely from the 6.6 million reported one year earlier. The company benefited from marine terminal volumes rising from 1.7 million barrels per day to 1.9 million barrels per day. As you can see in the image above, natural gas pipeline volumes, NGL fractionation volumes, and fee-based natural gas processing volumes, all increased year over year as well. Simply put, a larger physical footprint that has been the result of continued growth-oriented investing has made possible additional volumes through the company's network.

What really matters for the company, however, is the bottom line. And this is where the picture was not as great as I would have liked. During the second quarter, net profits came in at $1.25 billion. That's down from the $1.41 billion reported one year earlier. Earnings per share of $0.57 declined year over year and even missed analysts estimates by $0.01 per share. But this was not the only area where the company struggled. Operating cash flow declined from $2.12 billion to $1.90 billion. If we adjust for changes in working capital, we would get a decline from $2.09 billion to $1.87 billion.

Another metric that I look at is what I refer to as 'true free cash flow'. I get this by making certain adjustments, the most notable of which involves only hitting the company's cash flow for maintenance capital expenditures. These are capital expenditures needed in order to maintain operations as they are today. This doesn't make the company look worse because of growth oriented capital expenditures. During the most recent quarter, this came in at $1.74 billion. This is down from the $1.97 billion reported one year earlier. Another important profitability metric is DCF, or distributable cash flow. It came in during the quarter at $1.74 billion. This is down from the $2.02 billion reported for the second quarter of 2022. And finally, EBITDA for the company dropped from $2.42 billion to $2.17 billion.

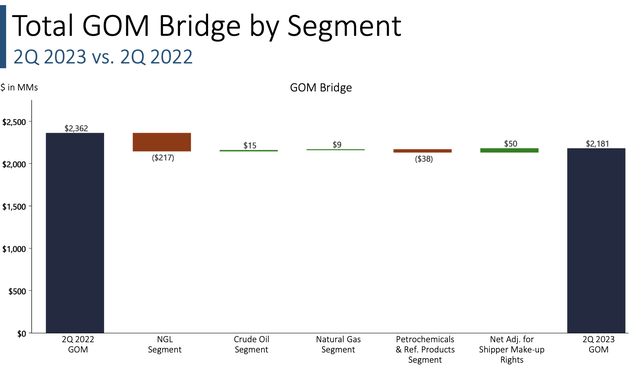

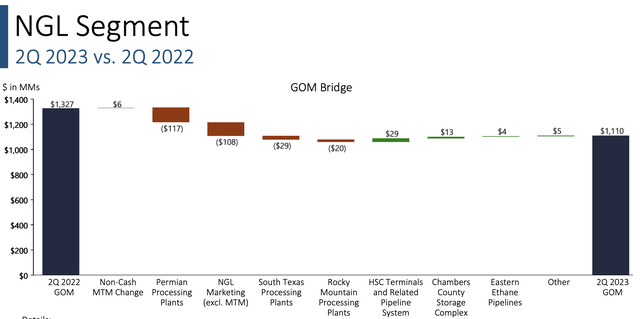

Almost all of the pain for the company on a year over year basis for the quarter came from its NGL segment. When it comes to the firm's gross operating margin, we saw a hit associated with this segment totaling $217 million. The lion's share of this came from a $117 million decline associated with the company's Permian processing plants. This was thanks to an $88 million decrease from its Midland Basin processing plants because of lower average processing margins and a reduction in equity NGL output. A $29 million hit came from its Delaware Basin processing plants for the same reason. Another $108 million decline can be chalked up to the company's NGL marketing activities, primarily due to lower sales volumes and lower average sales margins. Much of this margin decline was the result of a 48% drop in NGL prices year over year.

This is not the only area where the company suffered some pain. Under the Petrochemical & Refined Products segment, gross operating margin fell from $421 million to $383 million. This was largely the result of a $52 million hit associated with octane enhancement and related facilities. Management shocked this up to lower sales volumes and average sales margins, some of which were offset by a reduction in utility and other operating costs. As you can see in the chart below, results experienced for the second quarter of the year had a significant negative impact on the results for the first half of the year as a whole. Revenue, profits, and cash flows are all down during that time, with the second quarter doing the heavy lifting.

Unfortunately, we don't really know what to expect when it comes to 2023 in its entirety. Management has provided guidance on certain metrics, but not enough to help us know with the picture for the year as a whole might be. If we assume that the first half of the year is indicative of the second half, we should expect net profits of about $5.36 billion. Operating cash flow should be $6.57 billion, while the adjusted figure for this should come in at around $7.78 billion. The 'true free cash flow' metric that I use should be somewhere around $7.37 billion, while DCF should be close to that at $7.39 billion. And finally, EBITDA should be a bit higher than any of these, coming in at about $8.95 billion.

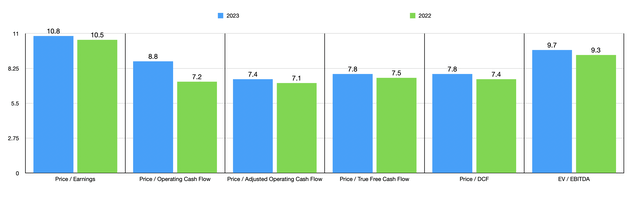

Using these figures, you can see how shares of the business are priced on a forward basis and how they are priced using data from 2022. This can all be seen in the chart above. In the chart table, meanwhile, I took two of these metrics, the price to adjusted operating cash flow multiple and the EV to EBITDA multiple, and compared the company to five similar firms. Being conservative, and using the 2023 estimates, I calculated that three of the five companies ended up being cheaper than our prospect.

| Company | Price / Operating Cash Flow | EV / EBITDA |

| Enterprise Products Partners | 7.4 | 9.7 |

| Energy Transfer (ET) | 3.1 | 7.6 |

| The Williams Companies (WMB) | 7.8 | 10.6 |

| Cheniere Energy (LNG) | 3.6 | 4.5 |

| Kinder Morgan (KMI) | 7.6 | 11.1 |

| MPLX LP (MPLX) | 7.0 | 9.1 |

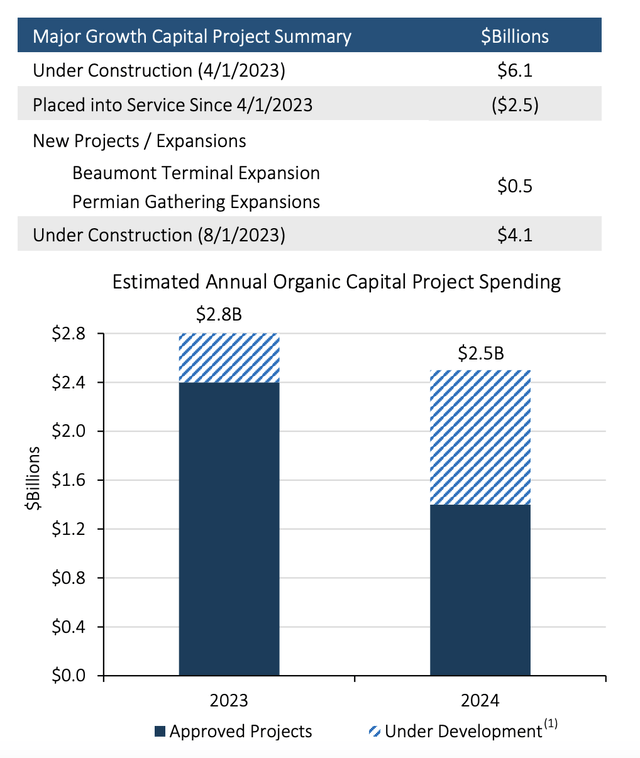

Even though shares do look a bit more expensive compared to what they would look like if we used data from last year, it is important to keep in mind that the long-term outlook for the company is still positive. For starters, management continues to focus on growth initiatives. At present, the company has $4.1 billion worth of growth-oriented projects currently under construction. This is on top of the $2.5 billion of projects that management placed into service since the start of April of this year. Total growth-oriented capital expenditures this year should be between $2.4 billion and $2.8 billion. And next year, management is forecasting between $2 billion and $2.5 billion.

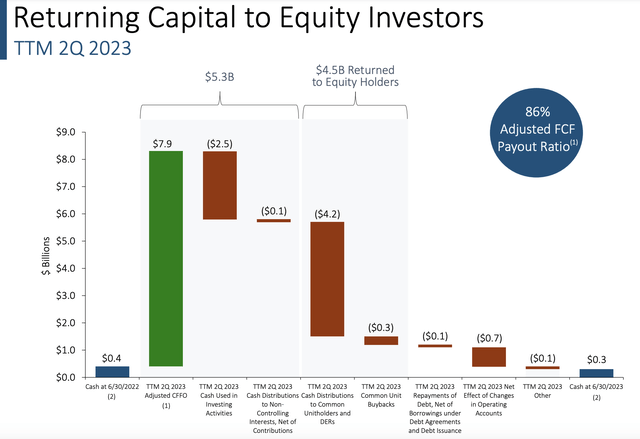

Along the way, management continues to reward shareholders directly. In the trailing 12 months ending in the second quarter, the company generated operating cash flow, on an adjusted basis, of $7.9 billion. $2.5 billion of this was used in investing activities. Common shareholders and other related parties received cash distributions totaling $4.2 billion and management allocated $307 million toward buying back 12.4 million units of stock over this time. While I would personally prefer even more capital allocated toward growth and less toward distributions, this kind of allocation is virtually universal in this space.

Takeaway

From all that I can see, Enterprise Products Partners most certainly had a difficult quarter. It was even more painful than what analysts anticipated. On its own, however, the quarter was far from awful and the long-term picture for the business should be positive. But this doesn't necessarily mean that the company is as compelling an opportunity as it was in the past. Relative to similar firms, the stock has gotten a bit more expensive. This, combined with how much upside we have already seen over the past couple of years, has led me to re-evaluate the firm and has resulted in a downgrade from a 'strong buy' to a 'buy'.

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Crude Value Insights offers you an investing service and community focused on oil and natural gas. We focus on cash flow and the companies that generate it, leading to value and growth prospects with real potential.

Subscribers get to use a 50+ stock model account, in-depth cash flow analyses of E&P firms, and live chat discussion of the sector.

Sign up today for your two-week free trial and get a new lease on oil & gas!

This article was written by

Daniel is an avid and active professional investor. He runs Crude Value Insights, a value-oriented newsletter aimed at analyzing the cash flows and assessing the value of companies in the oil and gas space. His primary focus is on finding businesses that are trading at a significant discount to their intrinsic value by employing a combination of Benjamin Graham's investment philosophy and a contrarian approach to the market and the securities therein.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of ET either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Recommended For You

Comments (10)

undeserved hoopla.as another poster observed one cannot BECOME rich investing here. one might preserve wealth but that is it. with treasury yields as high as they are this is a hold and that is what i am doing. yawwn

We need more like this.

Btw, I’m very overweight in EPD and will remain so, but appreciate another viewpoint!

Respectfully, it's( hard for me) to take investment advice ( seriously)from someone who has 10% of their net worth invested in MPW.That's what I recall you writing in your past article.These two companies are the opposite ends of the spectrum as far as risk goes.Sorry Fish