PayPal Earnings: Journey To $6 EPS In 2024

Summary

- I argue that all the challenges facing PayPal are already reflected in the share price.

- PayPal has reached maturity, allowing it to focus on maximizing profitability and returning capital to shareholders.

- I stand by my belief that PayPal can achieve $6 of non-GAAP EPS in 2024.

- Despite some concerns, PayPal's valuation at around 11x next year's EPS presents a compelling opportunity due to its strong profitability and growth potential.

- Looking for a helping hand in the market? Members of Deep Value Returns get exclusive ideas and guidance to navigate any climate. Learn More »

chameleonseye

Investment Thesis

PayPal (NASDAQ:PYPL) has been a challenging investment over the past several years.

The stock is down significantly from its highs and its CEO is stepping down and leaving a new CEO in place to pick up the reigns and to try to turn around this business. This is the narrative that overwhelms PayPal. And there's little to distract investors away from these dynamics.

However, I argue that these considerations and a lot more are already in the share price. After all, investors only get a value investment, when the outlook is poor. There's no other reason why a stock would sell cheaply, apart from the outlook being grim.

I declare that everyone already knows all these characteristics. And those insights are already in the share price. I stand by bullish contention, that paying 11x next year's EPS for PayPal is a mighty compelling investment opportunity.

The Outlook of a Mature Business

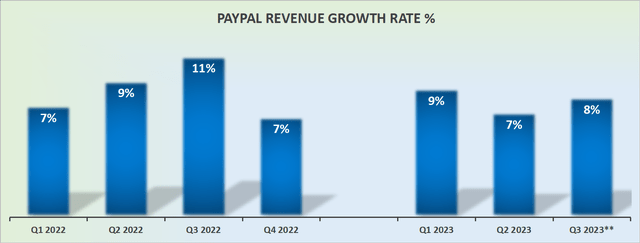

The graphic above is a reminder that PayPal's growth rates have matured. This is no longer a rapidly growing company, that can be counted on to deliver premium growth rates, meaning +20% CAGR.

That being said, there's a lot to be said about a company that has reached maturity. The business will no longer strive to seek to expand its market share aggressively. It can deploy extra resources towards maximizing profitability and, in the not-too-distant future, returning capital to shareholders.

Here's a quote from the earnings call that reflects this argument,

As we look ahead to the rest of 2023 and into 2024, we expect to drive meaningful productivity improvements. Our initial experiences with AI and continuing advances in our processes, infrastructure and product quality, enable us to see a future where we do things better, faster and cheaper. These overall cost savings come even as we significantly invest against our three strategic priorities.

With this context in mind, let's turn our focus toward PayPal's underlying profitability.

Profits Shining Brightly

PayPal reaffirmed that it can deliver $4.95 of non-GAAP this year.

In my previous analysis, I said,

If we assume that PayPal's profitability slows down [in 2024] and its EPS only grows by 18% y/y compared with the 21% y/y EPS growth expected for this year, this would mean that PayPal's 2024 non-GAAP EPS could reach nearly $6 of non-GAAP EPS.

I stand by those assertions. I continue to believe, as I did previously, that PayPal can deliver $6 of non-GAAP EPS in 2024.

What's more, given that PayPal is clearly so profitable with strong cash flow conversion, PayPal is able to support its EPS profile through large share repurchase programs.

Indeed, we know that in 2023, PayPal will have returned the equivalent of an approximate 6% buyback yield to shareholders. And if PayPal were to return a similar $5 billion of free cash flow to shareholders next year, this would perhaps even support PayPal reporting higher than $6 of non-GAAP in 2024.

PYPL Stock Valuation -- 11x Next Year's EPS

PayPal isn't quite as cheap as when I wrote my previous analysis titled, PayPal: 10x EPS, Period. However, for all intents and purposes, it's still in the bargain basement.

Of course, the bull case isn't one without blemishes. After all, as we've already discussed, PayPal is no longer growing at a particularly fast rate. The business now operates ex-growth.

And for a business that has decidedly become ex-growth, that means that its shareholder base must rotate out. The shareholders that become interested in PayPal as a rapidly growing company will come to terms that those fast-growth days are gone. And a new group of investors will come in that will put tremendous focus on PayPal's underlying profitability practically to the exclusion of all other considerations, including its underlying narrative.

Furthermore, PayPal has on numerous occasions in the past 2 years had a proclivity to be too aggressive with its outlook only to later have to downwards revise its original guidance. Investors will be acutely aware of this dynamic, and request a large margin of safety.

But even on the back of all those considerations, I believe that paying 11x for EPS for a business that is clearly growing its bottom line in the very high teens makes sense.

The Bottom Line

In my analysis of PayPal, I acknowledge that the company has faced challenges in recent years, with the stock price declining and a change in CEO.

However, I argue that these factors are already priced into the stock. As a mature business, PayPal is no longer experiencing rapid growth, but it has the opportunity to focus on maximizing profitability and returning capital to shareholders.

Further, I believe PayPal can achieve around $6 of non-GAAP EPS in 2024.

With a valuation of around 11x next year's EPS, I see PayPal as a compelling opportunity for investors, especially considering its strong profitability.

While there are some concerns, such as past aggressive guidance revisions and a shift in the shareholder base, I maintain my bullish stance on the stock due to its attractive valuation and profit growth potential.

Strong Investment Potential

My Marketplace highlights a portfolio of undervalued investment opportunities - stocks with rapid growth potential, driven by top quality management, while these stocks are cheaply valued.

I follow countless companies and select for you the most attractive investments. I do all the work of picking the most attractive stocks.

Investing Made EASY

As an experienced professional, I highlight the best stocks to grow your savings: stocks that deliver strong gains.

- Deep Value Returns' Marketplace continues to rapidly grow.

- Check out members' reviews.

- High-quality, actionable insightful stock picks.

- The place where value is everything.

This article was written by

Our Investment Group is focused on value investing as part of the Great Energy Transition. For example, did you know that AI uses thousands of megawatt hours for even small computing tasks? Join our Investment Group and invest in stocks that participate in this future growth trend.

I provide regular updates to our stock picks. Plus we hold a weekly webinar and a hand-holding service for new and experienced investors. Further, Deep Value Returns has an active, vibrant, and kind community. Join our lively community!

We are focused on the confluence of the Decarbonization of energy, Digitalization with AI, and Deglobalization.

As an experienced professional, I highlight the best stocks to grow your savings: stocks that deliver strong gains.

DEEP VALUE RETURNS: The only Investment Group with real performance. I provide a hand-holding service. Plus regular stock updates.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Recommended For You

Comments (2)