Lumen: Rapidly Deteriorating Situation (Rating Downgrade)

Summary

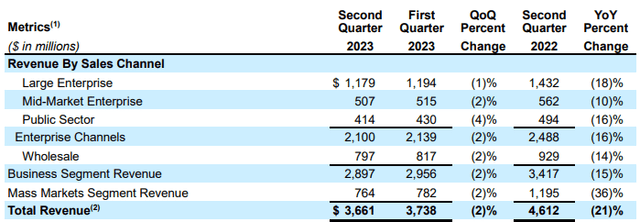

- Lumen's second-quarter revenues declined 21% year over year. They declined 2% sequentially.

- Lumen also reported a near-$9B impairment charge which has driven a sharp increase in the company's leverage ratio.

- The broadband segment is a bright spot for Lumen, with 21% year over year revenue growth in Q2.

- Lumen still has a higher P/E ratio compared to other telecoms which also have better free cash flow prospects.

FilippoBacci

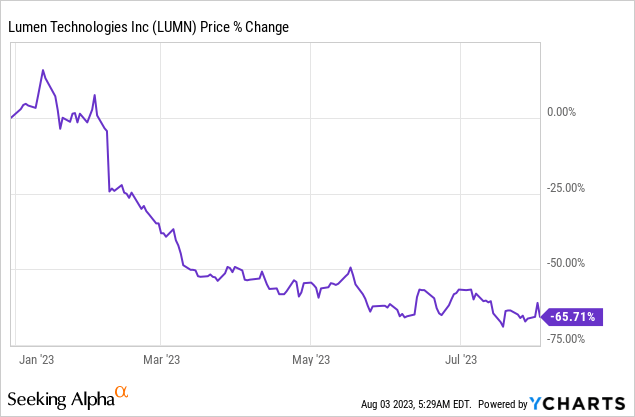

In my last work on Lumen Technologies (NYSE:LUMN) I recommended to buy shares of the telecom due to continual broadband momentum, a confirmed FY 2023 free cash flow forecast as well as a cheap valuation based off of P/E. While I have remained bullish on the telecom for a while, revenue challenges, transaction-driven adjusted EBITDA declines as well as a sharp increase in telecom's leverage ratio following a near-$9B loss in Q2'23 are cause for concern. Given the headwinds in the business and considering Lumen’s debt-burdened balance sheet, I am adjusting my rating on the telecom to hold and no longer recommend shares as a strong buy!

Reasons for rating change

I am changing my rating on Lumen from strong buy to hold because Lumen, despite ongoing broadband momentum is facing serious top line pressure in its core business and transaction-related EBITDA declines. Additionally, Lumen reported a large, unexpected impairment charge which puts the telecom into a difficult leverage position.

Lumen’s revenue challenges persisted in the second-quarter

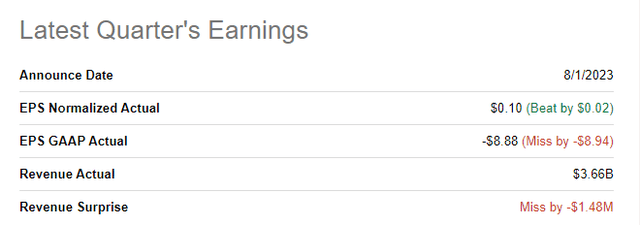

Lumen reported a much larger than expected loss for the second-quarter, resulting in a large GAAP EPS miss. Lumen reported an $8.7B GAAP loss for Q2'23 which was driven by an impairment charge of $8.8B related to a declining value for its North American reporting unit, according to the company's earnings release. Overall, it was a very weak earnings release which resulted in a 12% share price drop on Wednesday.

Although Lumen reported slightly better than expected earnings for the second-quarter on an adjusted EPS basis, the earnings report as a whole was distressing. Lumen continued to see a broad deterioration of its revenue base with Q2'23 revenues declining 21% year over year to $3.66B. Most of the decline was due to asset divestitures last year, but Lumen’s top line still contracted another 2% quarter over quarter as challenges in its core segments persisted.

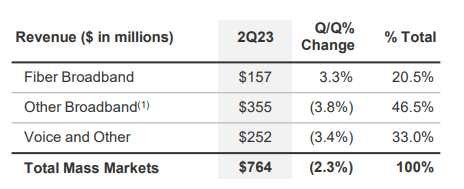

The broadband segment is one of the few bright spots in Lumen's operating portfolio. Although broadband momentum continued in the second-quarter with Lumen reporting 21% year over year revenue growth to $157M, the overall revenue picture is disheartening and investor don't expect this legacy telecom to see a lot of revenue growth going forward either: according to Seeking Alpha-provided estimates, Lumen is expected to see a more than 4% revenue decline in FY 2024 as competition in the market remains fierce.

Source: Lumen

While it is still true that Lumen generates a solid number of net adds in its broadband business, the telecom's consolidated top line should be expected to remain under pressure going forward. Lumen’s broadband segment continued to perform well in Q2'23, however, chiefly because corporate is rolling out a large number of new enabled locations… which is driving Lumen’s subscriber growth: Lumen ended the second-quarter with 877 thousand subscribers in its broadband segment, showing an increase of 21 thousand accounts since the end of the first-quarter.

Source: Lumen

EBITDA should be expected to remain under pressure as well

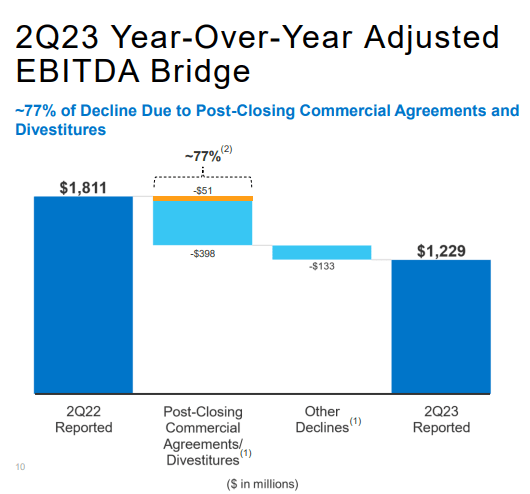

Lumen reported total adjusted EBITDA of $1.2B for Q2'23, showing a decline of 32% year over year, largely due to portfolio optimization strategies (Lumen sold non-core assets in order to focus on its core business, such as broadband in FY 2022). The trend is definitely not a good one and, together, with a sharp increase in the leverage ratio, quite concerning.

Source: Lumen

Deteriorating leverage situation

Lumen had $20.4B in long-term debt on its balance at the end of FY 2022 and $19.9B at the end of Q2'23... so the debt situation only marginally improved in the last six months. Because of the impairment charge of $8.8B which was recorded in the second-quarter, Lumen's equity declined from $10.4B in FY 2022 to $2.3B in Q2'23. As a result, Lumen's long-term-debt-to-equity-ratio increased from 2.0X at the end of FY 2022 to 8.7X at the end of Q2'23. I believe the rise in leverage is concerning and it is a driving factor for my rating down-grade.

Lumen’s valuation vs. other telecoms

Lumen is currently valued at a P/E ratio of 9.7X which is much higher than the P/E ratios of Lumen’s larger rivals AT&T (T) and Verizon (VZ). AT&T and Verizon both are set to achieve strong free cash flow in FY 2023 -- $16B (in the case of AT&T) and $17B (in the case of Verizon) -- which suggests that Lumen has further down-side revaluation potential. Lumen once again confirmed its expectation of $0-200M in free cash flow for FY 2023, but given the weakness in the core business and balance sheet, I believe Lumen is not a buy right now. In my opinion, Verizon offers investors the best value in the telecom sector right now.

Risks with Lumen

There was obviously the risk of continual top line erosion ahead of the telecom's second-quarter earnings report. What changed my rating more than anything was the weakening balance sheet and the increase in Lumen's leverage situation given the massive impairment charge in the second-quarter.

Closing thoughts

Lumen reported a massive 32% decline in adjusted EBITDA for its second-quarter compared to the year-earlier period, but maintained its previous outlook for FY 2023 free cash flow... which I guess was the only good news investors got out of the Q2'23 report.

However, there are continual revenue challenges that are weighing on the company's valuation, despite subscriber growth in broadband. Given the increase in leverage following the $8.8B Q2'23 impairment, I am down-grading Lumen from strong buy to hold and no longer see significant revaluation potential for the telecom’s shares!

This article was written by

Analyst’s Disclosure: I/we have a beneficial long position in the shares of T, VZ, LUMN either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.