Tiptree: Another Quarter Ringing The Register

Summary

- GAAP EPS of $.16 grows to ~.65/share on an adjusted basis when non-cash items such as deferred tax expense related to Warburg investment in Fortegra are backed out.

- Insurance business revenue grew 28% excluding the impact of investment gains and losses.

- Combined ratio of 90.5% helping drive insurance ROAE to over 32% for the quarter.

- Possible revisiting of IPO at some point?

- Looking for a portfolio of ideas like this one? Members of Catalyst Hedge Investing get exclusive access to our subscriber-only portfolios. Learn More »

ibreakstock

Tiptree Q2 Review:

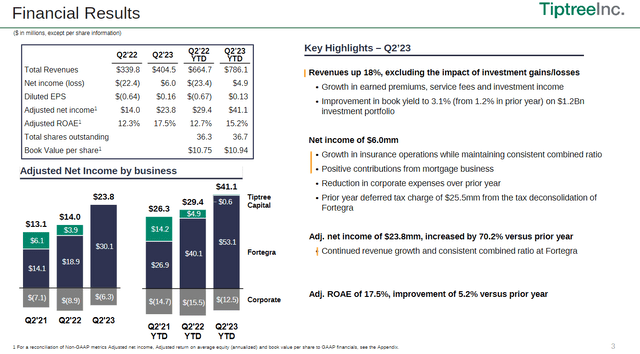

Tiptree (NASDAQ:TIPT) put up another stellar performance in Q2 once again led by Fortegra, which as I mentioned, has essentially become the company's entire operations. GAAP EPS was $.16/share and ~.65/share on an adjusted basis. The company does a good job of breaking down the GAAP vs adjusted earnings calculations with its quarterly presentation. The appendix gives a lot of detail but I also find the below graphic helpful.

Tiptree Performance Highlights (Tiptree Q2 Presentation)

As you can see above. Fortegra is the profit driver. Everything else is sort of meaningless... and that's a good thing. The company also is finally bringing down corporate overhead on an absolute basis and it's really coming down on a relative basis as Fortegra scales overall and its European expansion becomes more meaningful.

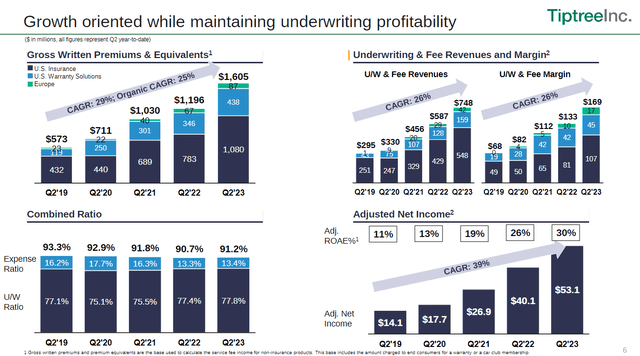

Fortegra is just killing it. Combined ratio came down from 90.9% to 90.5% year over year as revenues and underwriting and fee margin grow at double digit rates. I defy anyone to look at the slide below and find something to criticize.

Fortegra Growth and Performance (Tiptree Q2 Presentation)

One thing even I overlooked was the European expansion. That's starting to look very real however and can be another material growth engine as it scales.

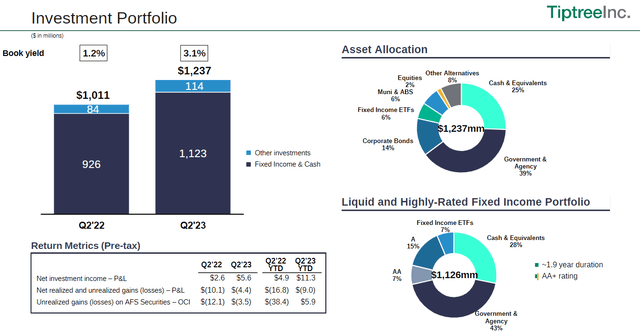

The company continues to manage its float extremely conservatively. The book yield is 3.1%, which is growing nicely but decently below where current yields are. The book yield will expand relatively quickly as stuff bought at lower yield matures and is replaced by higher yielding securities. With 1.9-year duration, that replacement happened at over a 12% rate every quarter. I'm not sure what the company is doing with the investments outside of its high-quality portion. PnL, from that portion, appears de minimus year to date, whether from lack of activity or whatnot.

Tiptree Investment Portfolio (Tiptree Q2 Presentation)

Tiptree Capital Breakdown (Tiptree Q2 Presentation)

Sum of the Parts and Revisit of Fortegra IPO?

I have heard people criticize the sum of the parts argument for this name as there appear to be few moves to realize that value. Remember, however, that company explored an IPO for Fortegra two years ago, that was ultimately shelved due largely to a horrendous job by the underwriter at the time.

In hindsight, the bungling by the underwriter was a blessing. I'm of the opinion that the company should only do an IPO if it could be at least $250 million without giving up a huge percentage of the company in order to ensure a liquid stock that would interest larger investors and be index eligible. Fortegra's growth rate is quickly making that type of offering possible.

The other question is what exactly a Fortegra IPO would accomplish. Everyone already knows it's embedded in the company. Would owning a majority position of a publicly-traded insurer eliminate the holdco discount, or would the company be better off just renaming its Fortegra and IPO'ing Warburg's stake or a piece their stake in the business (provided Warburg goes along with that)? The company could do that and just dividend the cash/assets at the holdco level to current shareholders.

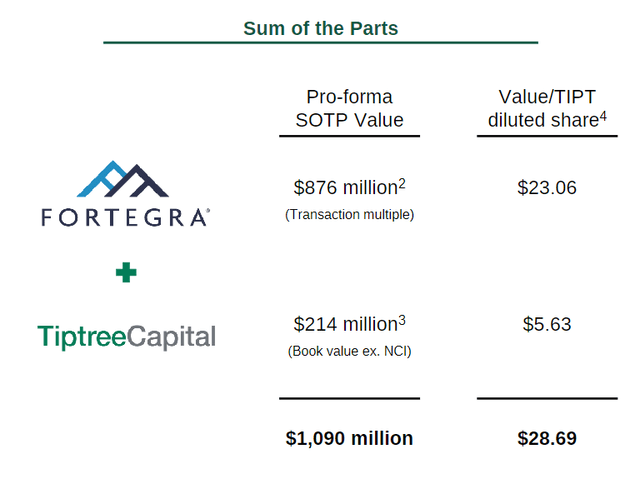

I have advocated for getting rid of the holdco structure and just becoming Fortegra for a while now. I think it's the cleanest way to close the valuation gap. I understand the benefits management sees in the current structure. It's a question of whether they can ever make up for more than $500 million of unrealized value with it (at least in a reasonable timeframe).

With the stock below $15, we're still at over 45% discount to the sum of the parts.

Tiptree Sum of the Parts (Tiptree Q2 Presentation)

Risks:

The biggest here in my opinion is the status quo. The market either doesn't see through the holdco discount or doesn't care because the stock is too illiquid/no one thinks management will do anything to close the gap with the SotP. An operational slowdown at Fortegra always is a risk as well, but that business is just rocking and rolling right now.

Conclusion:

Fortegra is an absolute gem and would be valued as such if the rest of things around it were stripped away. Management is doing that -slowly. I'd like to see that happen sooner. Given Fortegra's scale and growth profile, perhaps that comes about. Until then, value should continue to accrete.

My new investment group, Catalyst Hedge Investing, is live. The launch has been terrific. The chat board is live and active as is the best ideas portfolio. There are still generous introductory prices for early subscribers that will continue for the life of your subscription. Come join the fun!

This article was written by

Analyst’s Disclosure: I/we have a beneficial long position in the shares of TIPT either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Recommended For You

Comments (1)