SSR Mining: A Much Stronger H2 On Deck

Summary

- SSR Mining had a rough H1 financially, with ~303,500 GEOs produced at costs well above the industry average.

- However, this was largely due to having the unfortunate combination of front-end loaded sustaining capital and back-end weighted production, leading to ugly H1 and Q2 results.

- The good news is that SSRM has easy comps on deck in Q3, a stronger Q4 and significantly lower costs due to heavy investment in H1 out of the way.

- So, with the stock trading at one of the lower P/NAV multiples sector-wide and being of the few producers growing per share metrics, I would view pullbacks below US$13.25 as buying opportunities.

surachetsh

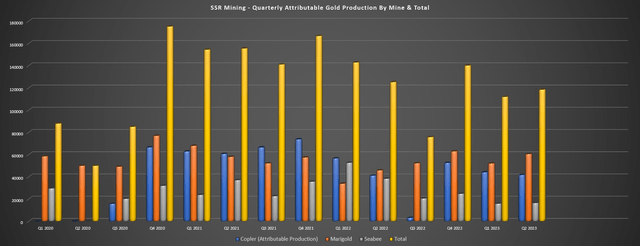

It's been a mixed first half of the Q2 Earnings Season for the Gold Miners Index (GDX) and while SSR Mining (NASDAQ:SSRM) was a serial outperformer in 2021 and the first half of 2022 with consistently solid performance, its results have been less pleasing since Q3 2022, starting with the temporary disruption at its Copler Mine in Turkiye. And while Q4 was a very solid quarter with ~140,000 attributable ounces of gold produced, SSR Mining reported some of the weakest results sector-wide in Q2 and H1 2023, with Q2 production coming in at ~156,600 gold-equivalent ounces at costs over 21% above the industry average. Let's inspect the Q2 results below and dig into why this isn't an issue, and it could actually provide an opportunity if the stock remains under pressure.

Copler Sulfide Plant (Company Presentation)

All figures are in United States Dollars unless otherwise noted.

Q2 Production & Sales

SSR Mining released its Q3 results this week, reporting quarterly production of ~156,600 gold-equivalent ounces [GEOs], a 2% decline from the year-ago period. Unfortunately, its headline results from a cost standpoint weren't anything to write home about either, with all-in sustaining costs [AISC] of $1,633/oz, a 29% increase year-over-year with higher costs across all of its operations. This operating performance has left SSR Mining sitting at ~303,500 GEOs produced (down 9% year-over-year) with AISC sitting at $1,663/oz, making it one of the highest cost gold producers heading into H2 and miles away from its FY2023 guidance midpoint of ~740,000 GEOs at $1,395/oz. However, this was an abnormally bad H1 for several reasons, and investors can expect the H2 results to be night and day relative to H1.

SSR Mining - Quarterly Attributable Production by Mine & Total Gold Production (Company Filings, Author's Chart)

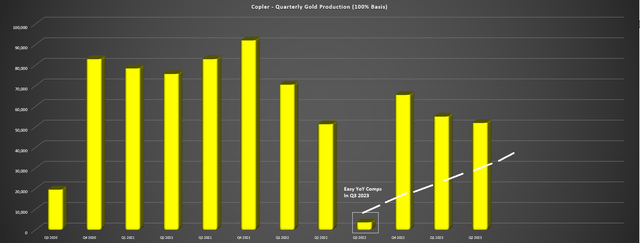

Starting with SSR Mining's quarterly production by mine, Copler had a solid quarter, producing ~52,000 ounces of gold, benefiting from increased tonnes stacked at higher grades (~154,000 tonnes at 1.46 grams per tonne of gold), and higher tonnes milled and improved recoveries (190 basis points), partially offset by lower grades. This allowed the mine to report a 3% increase in production year-over-year, and the mine benefited from an average realized gold price of $1,979/oz, one of the highest figures sector-wide. Unfortunately, all-in sustaining costs were up year-over-year to $1,384/oz (+10% year-over-year), affected by fewer ounces sold than produced and 25% higher sustaining capital spend in the period. That said, management expects a better H2 for Copler, with an initial contribution from the Cakmaktepe Extension (pre-stripping underway), with Q4 expected to be the strongest. And while Q3 will be impacted by autoclave maintenance, the company is up against very easy comps in the coming quarter (temporary shutdown in Q3 2022).

Copler - Quarterly Gold Production & Easy Comps In Q3 2023 (Company Filings, Author's Chart)

Moving over to the company's Marigold Mine in Nevada, production improved materially year-over-year to ~60,400 ounces, up from relatively easy comps of ~45,800 ounces in the year-ago period. The increased production in Q2 2023 was related to higher tonnes stacked (~5.04 million tonnes) and the timing of leach recoveries, offset by lower grades stacked in the period (0.52 grams per tonne of gold vs. 0.67 grams per tonne of gold). However, while the production results were solid, many investors might have been alarmed by the cost performance, with all-in sustaining costs soaring to $1,656/oz, a 14% increase from an already high $1,458/oz in Q2 2022. Meanwhile, H1 2023 all-in sustaining costs came in at $1,659/oz. However, it's important to note that sustaining capital was heavy in Q2 2023 and H1 2023 due to haul truck purchases, with sustaining capital more than doubling to ~$35.2 million (Q2 2022: $15.9 million).

Marigold Operations (Company Presentation)

If we adjust for this elevated sustaining capital in the period, all-in sustaining costs were closer to $1,400/oz. And importantly, with Marigold's H1 sustaining capital coming in at ~79% of its annual guidance, the mine is set up for a much better second half from a cost standpoint, especially with even higher production and sales in H2. Hence, I don't see any reason to be worried about the higher costs in H1 2023, and this is one reason SSR Mining's costs were so high in H1 2023, with its largest contributor having costs significantly above the industry average ($1,656/oz vs. ~$1,350/oz). However, with these being a tailwind in H2 2023, we should see a material drop in SSR Mining's consolidated all-in sustaining costs. Finally, it's worth noting that more typical ore being stacked, leach cycles have returned to normal vs. the noisy and less predictable quarterly results last year.

Finally, at the company's Seabee Mine in Saskatchewan, production came in at ~16,400 ounces, a massive decline from ~38,300 ounces in Q2 2022. However, the mine was up against very difficult year-over-year comps in the period, with it being difficult to lap an average feed grade of 12.1 grams per tonne of gold, well above the average reserve grade and it lapped this with lower grades than planned (equipment downtime resulting in a shift in mine sequencing in Q1). Given the lower production and sales, all-in sustaining costs surged to $1,690/oz, also well above industry average levels, and the mine is on track to deliver into the low end of guidance, unfortunately. The good news is that Seabee has seen grades rebound, with nearly ~8,000 ounces produced in July and high-grade stopes on deck to deliver a better second half of the year.

Seabee Operations (Company Website)

Overall, SSR Mining put together satisfactory production results in what's expected to be the softer half of the year, and from a big picture standpoint, the addition of Hod Maden will certainly be a welcome addition to this portfolio later this decade with its co-product AISC being over 45% below the industry average even adjusting for inflationary pressures (~$700/oz vs. ~$1,350/oz). So, with a better H2 ahead, significant exploration upside across its assets from a regional standpoint and a bright future with a world-class asset now in its portfolio and barely four years from first production, there's a lot to like about SSR Mining. And while revenue was down year-over-year at ~$301 million despite a higher gold price ($1,963/oz vs. $1,861/oz), this was because of the back-end weighted production guidance and the hiccup at Seabee that led to lower ounces sold than planned.

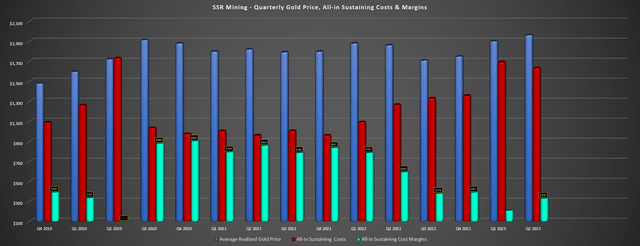

Costs & Margins

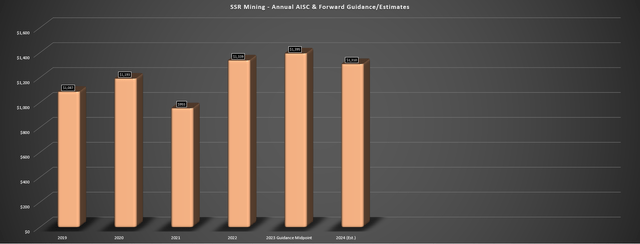

Digging into costs and margins, SSR Mining reported all-in sustaining costs of $1,633/oz in Q2 and H1 AISC of $1,663/oz, making it among the highest cost miners thus far this year, which is certainly out of character relative to its industry-leading costs of $955/oz in FY2021. The result, despite a higher average realized gold price, was significant margin compression, with AISC margins sinking to $330/oz vs. $594/oz in the year-ago period. However, as highlighted earlier, this was largely due to front-end weighted sustaining capital in 2023 with back-end weighted production, a combination that can lead to very ugly headline results. That said, with ~61% of sustaining capital for the year already spent and a much stronger second half ahead, we should see a material improvement in costs, with the potential for SSR Mining to deliver into its AISC guidance range of $1,365/oz to $1,425/oz despite this looking near impossible from the H1 results.

SSR Mining - Quarterly Gold Price, AISC & AISC Margins (Company Filings, Author's Chart)

Meanwhile, if we look out to FY2024, 2023 is a higher-cost year for the company due to the purchase of new haul trucks at Marigold, but we should see an easing of sustaining capital spend in FY2024 at the same time as we're seeing positive commentary when it relates to an easing of inflationary pressures sector-wide in many areas. The result is that SSR Mining should see costs improve materially in H2 2023 but also in FY2024, with the potential for AISC to return to more normal levels at $1,320/oz or lower. And with the addition of a 40% interest in Hod Maden later this decade, there's room for margins to improve even further. So, while some investors might be re-thinking their investment in SSR Mining after the rough H1 results, it's important to be aware of the unfavorable position the company was in with front-end loaded sustaining capital spend and a very expensive year at Marigold.

SSR Mining - Annual AISC & Forward Guidance/Estimates (Company Filings, Author's Chart)

Given the elevated capital expenditures and lower production, free cash flow came in at ~$22.4 million, the company ended the quarter with one of the strongest balance sheets sector-wide, and it accomplished all of this while spending $120 million at Hod Maden for its upfront cash payment and an additional ~$40 million on buybacks with ~2.68 million shares repurchased at US$14.97. So, with a strong liquidity position, SSR Mining should be able to continue taking advantage of weakness in its share price to reduce it share count, easily fund aggressive exploration across its portfolio to grow resources and reserves, and most importantly continue its per share growth, which is a rarity in the sector.

Valuation

Based on ~216 million fully diluted shares and a share price of US$14.50, SSR Mining trades at a market cap of ~$3.13 billion and an enterprise value of ~$2.82 billion. This leaves SSR Mining trading at just 0.71x P/NAV vs. an estimated net asset value of ~$4.40 billion, a very reasonable valuation for a company with one exceptional asset (Copler), three solid assets in Marigold, Puna, and Seabee, and a future 40% ownership of a world-class asset (Hod Maden). Using what I believe to be a fair multiple of 1.0x P/NAV for its diversified portfolio of solid assets (offset by less than 45% of future production from Tier-1 jurisdictions), I see a fair value for SSR Mining of US$20.35. This fair value estimate points to a 40% upside from current levels, making SSR Mining one of the more undervalued names in the mid-cap gold space on a P/NAV basis.

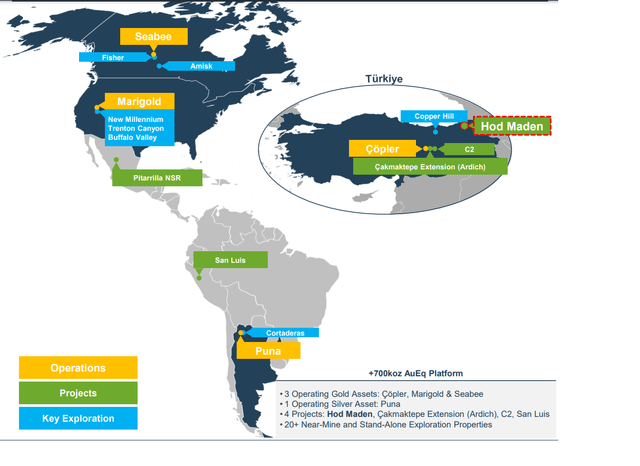

SSR Mining Portfolio (Company Presentation)

That said, I am looking for a minimum 35% discount to fair value to justify starting new positions in mid-cap producers, and while SSR Mining is getting closer to this buy zone after its recent correction, the ideal buy zone for the stock comes in at US$13.25 or lower. Hence, while the stock remains higher on my watchlist given that it has a strong H2 on deck with easy comps ahead (limited production from Copler) and is one of the few gold producers with consistent and attractive shareholder returns and growing reserves per share, I don't see a low-risk buying opportunity just yet. Therefore, I remain focused on other names currently, but would get much more interested in SSR Mining if we saw a pullback to US$13.30.

Summary

SSR Mining may have had ugly headline Q2 results with its second highest all-in sustaining costs on record (ex COVID-19 related headwinds in Q2 2020), but it's important to note that costs were abnormally high because of elevated sustaining capital spend in H1 coupled with lower production. However, with a combination of front-end weighted sustaining capital (62%/38%) and back-end weighted production, SSR Mining will finish the year strongly with easy comps to lap in Q3 (weak quarters from Marigold and Copler) and an even better Q4 with Copler firing on all cylinders and contribution from the Cakmaktepe Extension Project. So, for investors looking for one of the few names in the mid-cap producer space with per share growth, attractive returns to shareholders and a very solid H2 on deck, SSR Mining is a name worth watching if it pulls back below US$13.25.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Disclaimer: Taylor Dart is not a Registered Investment Advisor or Financial Planner. This writing is for informational purposes only. It does not constitute an offer to sell, a solicitation to buy, or a recommendation regarding any securities transaction. The information contained in this writing should not be construed as financial or investment advice on any subject matter. Taylor Dart expressly disclaims all liability in respect to actions taken based on any or all of the information on this writing. Given the volatility in the precious metals sector, position sizing is critical, so when buying small-cap precious metals stocks, position sizes should be limited to 5% or less of one's portfolio.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Recommended For You

Comments (1)

https://imgur.com/a/Td28u0zSubscription Link:

buy.stripe.com/...