MeridianLink's Q2 Earnings: The Price Of Optimism

Summary

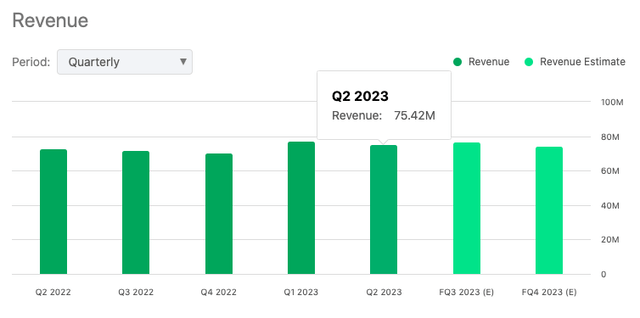

- MeridianLink's Q2 revenue reached $75.4 million, a 3% increase YoY, slightly below their growth forecast.

- The company received a $30 million refund from fulfilling an escrow obligation, fueling future growth.

- Data verification software revenue decreased by 8% YoY, primarily due to a drop in mortgage-related revenue.

VioletaStoimenova

Thesis

This analysis of MeridianLink's (NYSE:NYSE:MLNK) Q2 earnings that showcased GAAP EPS of -$0.06 that missed by $0.05, and revenue of $75.4M that missed by $1.89M, dissects the firm's financial performance, highlighting revenue growth and key strategic moves, alongside an evaluation of the company's valuation and prospective challenges. While the firm exhibits growth potential and healthier cash flows, high P/E ratios point towards an overvalued stock, and uncertainty in the non-mortgage loan market raises concerns about future revenues suggesting that investors adopt a cautious stance and consider MeridianLink as a "hold".

Company Profile

MeridianLink, Inc., a software and services firm based in Costa Mesa, California, offers a vast array of solutions catering to financial institutions across the U.S., including consumer reporting agencies, credit unions, banks, mortgage lenders, and specialty lending providers.

Its product suite ranges from its multi-product platform 'MeridianLink One', tailored to the dynamic needs of digitally transforming organizations, to loan solutions like 'MeridianLink Consumer' and 'MeridianLink DecisionLender'.

The company also provides end-to-end consumer lending and marketing automation solutions, cloud-based software for mortgage loan origination and business lending, and a web-based system for debt collection and order fulfillment. Founded in 1998, MeridianLink has established itself as a comprehensive solution provider in the financial software space.

MeridianLink's Q2 Earnings Highlights

MeridianLink's Q2 revenue reached $75.4 million, reflecting a 3% increase YoY, albeit falling slightly short of their forecasted growth range of 4% to 8% YoY.

The shortfall can be attributed to a $2.3 million reduction in revenue, a consequence of a dispute with a reseller associated with a recent acquisition. However, with the adjustment to account for this situation, the company's performance aligns with their revenue guidance, recording a growth of 6% YoY and achieving an adjusted EBITDA margin of 38%.

Despite this blip, MeridianLink successfully fulfilled its escrow obligation for the StreetShares acquisition, leading to a refund of $30 million to the company. This influx of capital is slated to fuel the company's growth and add value to their customers. According to management, emphasizing their strategic focus on both organic and inorganic growth, MeridianLink envisions becoming a billion-dollar entity and the preferred partner for digital transformation for financial institutions within their domain.

The company's software solutions revenue predominantly hinges on non-mortgage lending, which constitutes 87% and exhibited a YoY growth of 1%. After accounting for the revenue reduction, it indicates a YoY growth of 5%. The combined mortgage and non-mortgage lending software revenue accounts for nearly three-fourths of the total revenue, posting a growth of 8% YoY. Upon adjustment, the growth rate stands at 12% YoY.

MeridianLink's successful strategy of cross-selling various loan types to customers and enhancing their experience via the MeridianLink One platform has helped bolster its business growth. With a GAAP gross margin of 62% and adjusted gross margin of 70% in Q2, the company has noted an uptick in operating expenses, largely owing to added headcount and increased compensation expenses.

Despite recording a net loss, MeridianLink exhibited healthier cash flows, with unrestricted cash and cash equivalents totaling $108.9 million at the close of Q2.

Lastly, the company anticipates a delayed revival in mortgage volumes, which they foresee will enhance revenue in the latter half of 2023.

Valuation

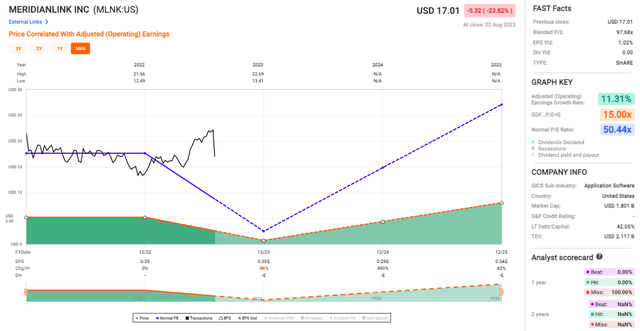

MeridianLink's colossal blended P/E of 97.68x far outstrips the norm P/E of 50.44x, which is already high. It suggests that investors have been willing to pay nearly 100 times earnings for this stock, an eyebrow-raising valuation that suggests extreme optimism about the company's future prospects.

Now let's add the EPS yield of 1.02% into the mix - a ridiculously low yield by any stretch.

In terms of the Adjusted (Operating) Earnings Growth Rate, we're looking at 11.31%. Not too shabby by any means, but when we take the high P/E ratio into account, it seems investors are pricing in some serious growth expectations that this number alone doesn't quite justify.

Sector Valuation

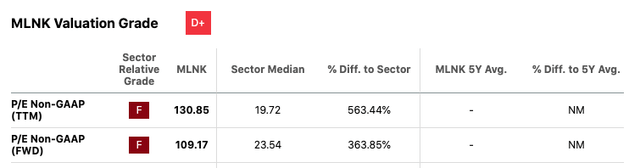

Unfortunately, given Seeking Alpha's Valuation Grade and Underlying Metrics presented here, the data also suggests an overvaluation on multiple fronts, raising more red flags.

MLNK's Price-to-Earnings (P/E) ratio, both trailing twelve months (TTM) and forward, is alarmingly high at 130.85 and 109.17 respectively compared to the sector median of around 20. With percentages as high as 563.44% and 363.85% difference to the sector, this points towards unsustainable valuations and potential risks for the stock.

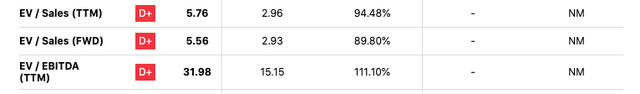

The Enterprise Value to Sales (EV/Sales) ratio for MLNK also demonstrates an overvaluation problem. Both TTM and forward ratios are about twice as high as the sector median.

Similarly, MLNK's Enterprise Value to EBITDA (EV/EBITDA) ratio is more than double the sector median, which could be indicative of an overpriced stock.

Risks & Headwinds

The company's data verification software solutions segment has been navigating through a downturn, with revenue witnessing an 8% YoY dip. This slump has been fueled by a 12% shrinkage in mortgage-related revenue. Adding to this, the resurgence in mortgage volumes has been slower than anticipated, provoking a reduction in their Q3 guidance range and overall projections for the fiscal year 2023.

Analyst note: Even though we're talking about risks here, to the company's credit, total mortgage-related revenue has been witnessing a sequential uplift, marking a 13% increase from the previous year and contributing 26% to overall MeridianLink revenue.

Looking at the year 2023, the company anticipates a modest YoY growth of total revenue by 5% to 6%, a cautious projection compared to their previous forecasts. Even with sporadic signs of recovery, the deferred bounce-back of the mortgage market, along with the single-time revenue reduction associated with the StreetShares acquisition, have induced the company to moderate its growth prospects.

Lastly, MeridianLink has also observed that the non-mortgage loan market, particularly within the used car industry, appears to be decelerating. This slowdown could potentially impinge on its revenue growth derived from this segment. Moreover, the adjusted EBITDA margin for the entire fiscal year of 2023 is projected to be approximately 35%, a mild decrement when compared to the current quarter.

Final Takeaway

Based on the information provided, I would rate MeridianLink as a "hold". While the company shows some positive signs, such as healthier cash flows and strategic investments fueling growth, it also grapples with several concerns. Its high P/E ratios and overall valuations suggest a potentially overpriced stock, its projections for 2023 are cautious, and challenges in the non-mortgage loan market could impact future revenues. Furthermore, the company's recent revenue shortfall and lower growth rate in its major revenue-contributing segment indicate potential volatility. These factors create a scenario of increased uncertainty that warrants a hold until clearer trends emerge.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.