Largest Weekly U.S. Crude Storage Draw On Record And More To Come

Summary

- EIA reported the largest U.S. weekly crude draw in history and the trend is expected to continue.

- Next week's preliminary US crude storage figure shows a small build, but this quickly reverses the following week.

- If we are right, U.S. commercial crude storage could fall to 2022 level by the end of August.

- The incoming crude draws combined with flat U.S. oil production and low product storage should keep pushing oil prices higher.

- However, readers should note the weakness in U.S. oil demand figures, and we will want to see that rebound.

- I do much more than just articles at HFI Research: Members get access to model portfolios, regular updates, a chat room, and more. Learn More »

esemelwe/E+ via Getty Images

You may not know this from the price action in oil today, but EIA reported the largest weekly crude draw in history (-17 million bbls).

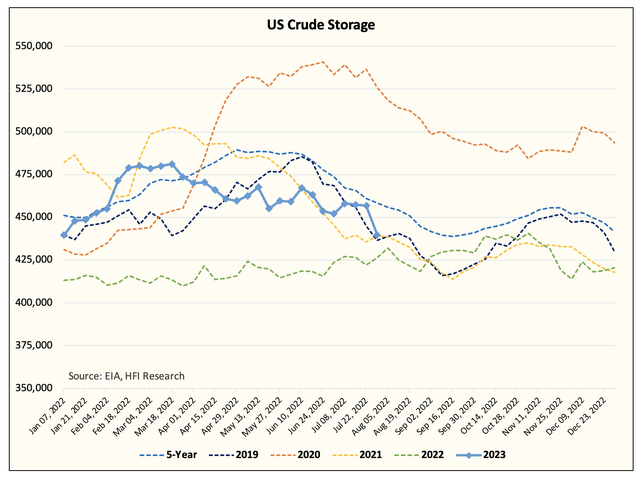

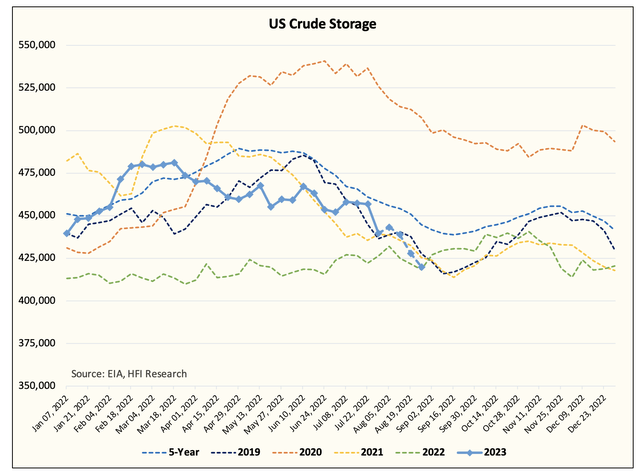

The drop also puts us in-line with 2019 and 2021 storage levels. For readers that follow us closely for the weekly crude storage forecasts, we want to give you a heads-up for next week.

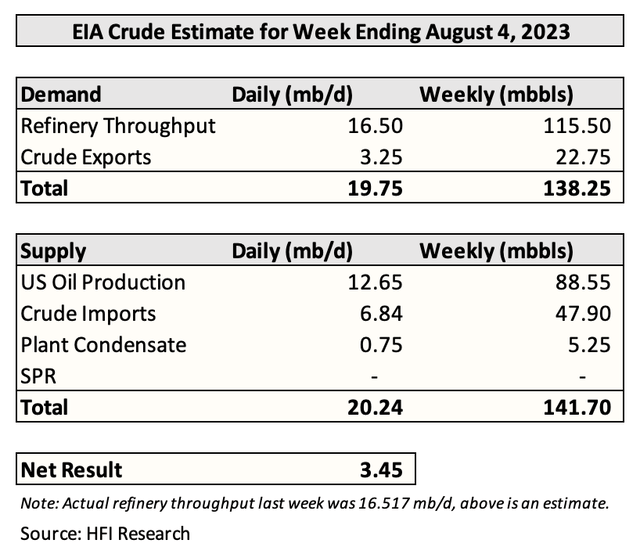

Preliminary figures show a build as U.S. crude exports drop and imports rebound.

This is not expected to be a trend. Looking at Kpler tanker traffic over the coming weeks, U.S. crude exports are expected to remain elevated, while U.S. crude imports remain low. This combined with flat U.S. oil production is a recipe for much lower crude storage.

Our very early estimate shows U.S. crude storage falling in line with 2022 by the end of August.

For readers, the conclusion to reach is that the crude draw is only beginning. Seasonally speaking, U.S. crude storage draws into mid-September, so this is not a surprise to the market. But the magnitude of the draw will be a tailwind for the bulls.

For the Saudis, this is much needed in order to sustainably keep prices higher. We think the Saudis will keep the voluntary cut of ~1 million b/d into November to ensure that any demand downside surprise will be covered.

Now that we've covered the incoming US crude storage changes, let's move on to the positives and negatives in the report.

Negatives

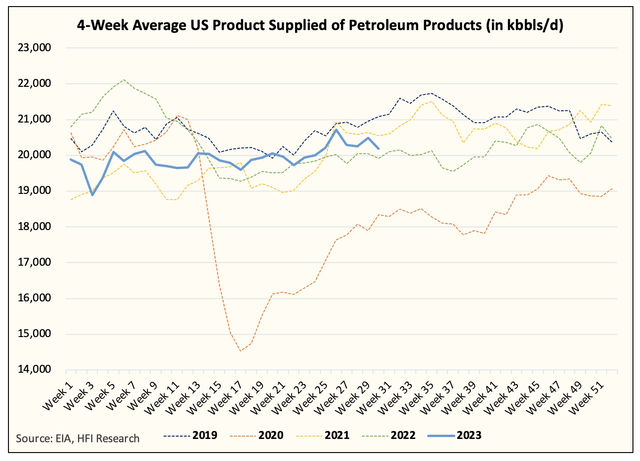

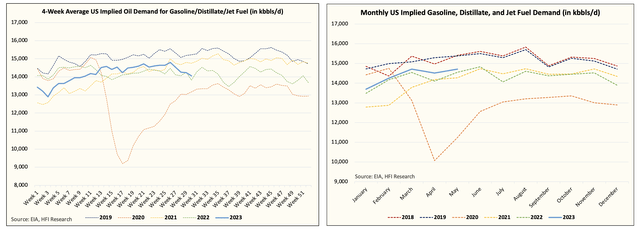

U.S. oil demand is not recovering as we expected. In fact, it is now moving in the opposite direction of what we expected. While the weekly demand figures are by no means accurate of the bigger picture, the directionality has been a good indicator. As a result, it is unlikely that we see U.S. oil demand reach an all-time high this summer.

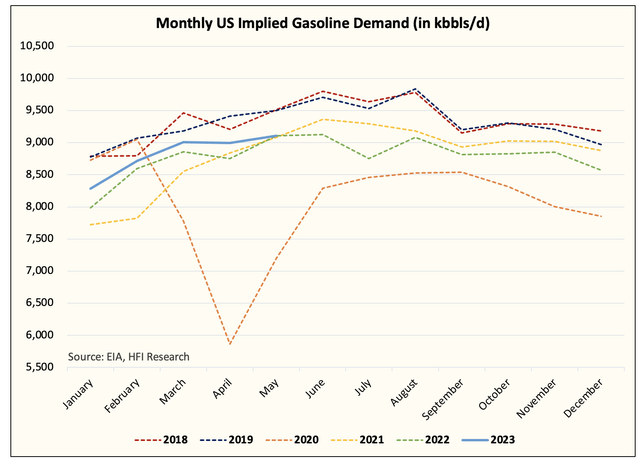

Interestingly, gasoline demand, which was a key tailwind going into the summer, is now becoming a drag.

And if we overlap this with the monthly oil demand data, we can see that gasoline demand has not been as strong as we had hoped for.

Now for those of you that say that weekly oil demand is garbage, you have to realize that the monthly big 3 demand (gasoline, distillate, and jet fuel) have tracked closely with the directionality of the weekly figures.

The latest weakness in the big 3 is the result of weakness in gasoline and distillate. Labor Day usually marks the peak for U.S. gasoline demand, so without an uptick in the following weeks, it is very likely we do not see further improvements in those demand figures.

As for total U.S. oil demand, other oil has kept total demand elevated. For those wondering what other oil entails, EIA describes it as:

Natural gas plant liquids (NGPLs) and liquid refinery gases (LRGs) excluding propane/propylene which is reported separately, unfinished oils, kerosene, and asphalt/road oil. These products typically account for the majority of other oils stocks. Stocks of the remaining minor products included in other oils inventories not collected on weekly survey forms are estimated. Minor products include aviation gasoline, other hydrocarbons and oxygenates, aviation gasoline blending components, naphtha and other oils for petrochemical feedstock use, special naphtha, lube oils, waxes, coke, and miscellaneous oils.

In the coming weeks, we will need to see U.S. oil demand trend higher or else our assumption that WTI reaches $85 to $90 will have to be lowered. Elevated refining margins and low product inventories suggest a tighter market condition than implied by EIA's demand figures, so let's see what the data shows us.

Positives

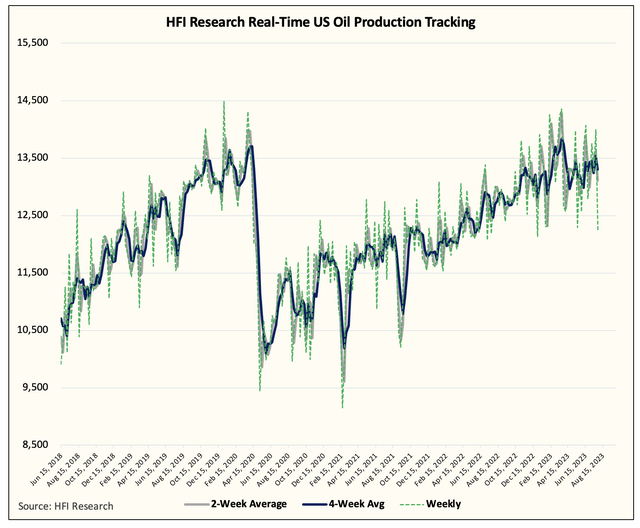

- U.S. oil production remains flat.

Our latest high-frequency data puts U.S. oil production around ~12.6 million b/d or slightly lower than the May production average of ~12.65 million b/d.

Typically, U.S. oil production starts to meaningfully grow by the end of Q3 and into Q4. If we don't see similar momentum this time, it implies that US oil production has already peaked for the year. Given the rig count drop, we think this is a very high possibility.

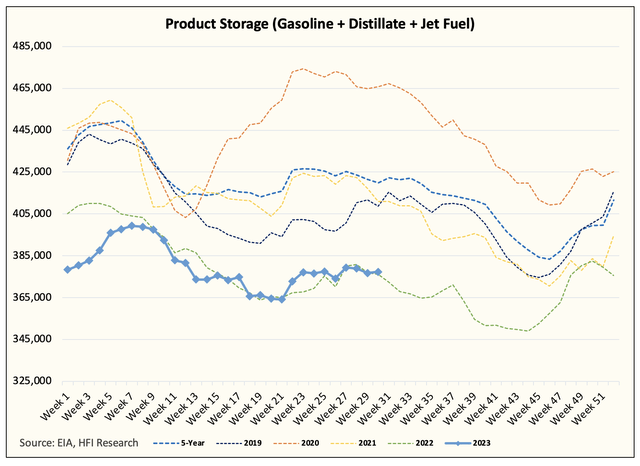

- U.S. product storage remains low.

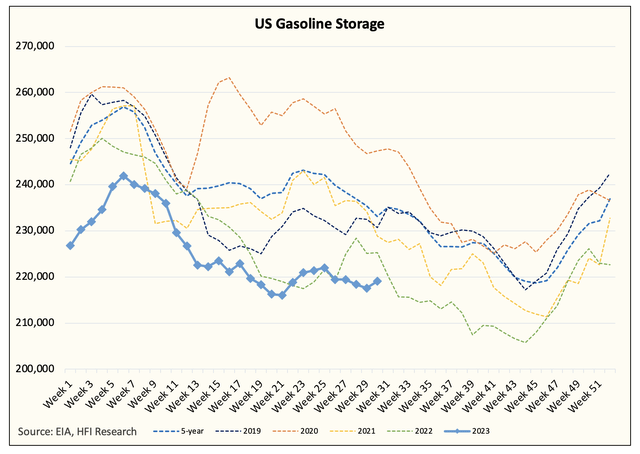

Despite the weak demand we alluded to previously, product storage remains low. Gasoline storage is still at the lowest level over the last 5-years.

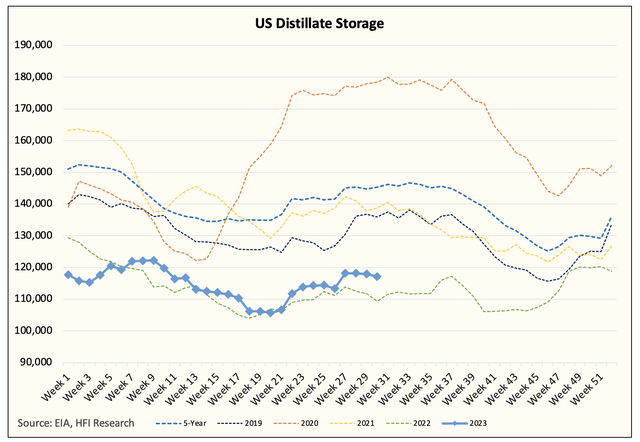

Distillate storage remains low.

All things considered, elevated refining margins continue and suggest to us that low storage levels are incentivizing refineries to increase throughput. But with US refinery throughput stuck around ~16.5 million b/d and maintenance just a few weeks away, refining margins are likely to remain elevated going forward.

Conclusion

Q3 inventory draws are underway. Next week's EIA report will show a crude build, but the following weeks will show material draws. The trend has not changed. This combined with flat U.S. oil production and low product storage should continue to push oil prices higher.

However, readers should note the weakness in U.S. oil demand figures, and we will want to see that rebound in order to keep pushing prices higher.

HFI Research, #1 Energy Service

For energy investors, the 2014-2020 bear market has been incredibly brutal. But as the old adage goes, "Low commodity prices cure low commodity prices." Our deep understanding of US shale and other oil market fundamentals leads us to believe that we are finally entering a multi-year bull market. Investors should take advantage of the incoming trend and be positioned in real assets like precious metals and energy stocks. If you are interested, we can help! Come and see for yourself!

This article was written by

#1 Energy Research Service on Seeking Alpha

----------

HFI Research specializes in contrarian investment analysis. We help you to find clarity in a world of uncertainty. We take contrarian thinking very seriously and believe that the only way to obtain a real edge in the market is to possess a contrarian investment thesis. We share our investment analysis with premium subscribers through daily and weekly reports.

----------

HFI Research Premium currently includes:

Oil Market Fundamentals - Our daily oil market report that discusses the current oil market fundamentals and the incoming price trend.

Natural Gas Fundamentals - Our daily natural gas market report that details current trader positioning, fundamentals, weather, and the incoming trade set-up.

Real-Time Trade Notifications - We actively trade oil and natural gas ETNs. In addition, we also issue real-time trade notifications on individual stocks.

Weekly EIA Crude Storage Forecasts - Every Saturday, we give the EIA crude storage estimate for the incoming week's report.

Weekly US Oil Production Forecasts - A weekly tracker for real-time US oil production so subscribers can understand what's happening to US shale growth.

What Research Reports We Read - A weekly report that covers all the research reports we read for the week, so subscribers can understand the market consensus and contrarian viewpoints better.

What Changed This Week - Our flagship weekly report.

For more info, please message us.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Recommended For You

Comments (1)