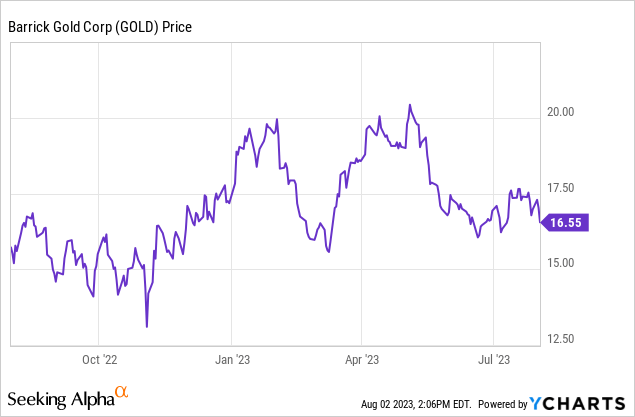

Barrick Gold: What's Next?

Summary

- Barrick Gold Corporation recently reported strong Q2 production figures, despite what the numbers may appear to show.

- Production is expected to rise throughout H2 2023 while margins improve.

- Barrick could grow its annual gold output by 25% by the decade's end.

- The government of Mali may implement a new mining law that increases its stakes in gold projects.

- I discuss the latest developments below.

- This idea was discussed in more depth with members of my private investing community, The Gold Bull Portfolio. Learn More »

JohnnyGreig

Barrick Gold: Strong Quarter, But What’s Next?

This article serves as an update on Barrick Gold Corporation (NYSE:GOLD), the largest gold miner by market cap. Barrick recently disclosed its preliminary Q2 sales as it nears its Q2 2023 financial results, scheduled to be released pre-market on August 8.

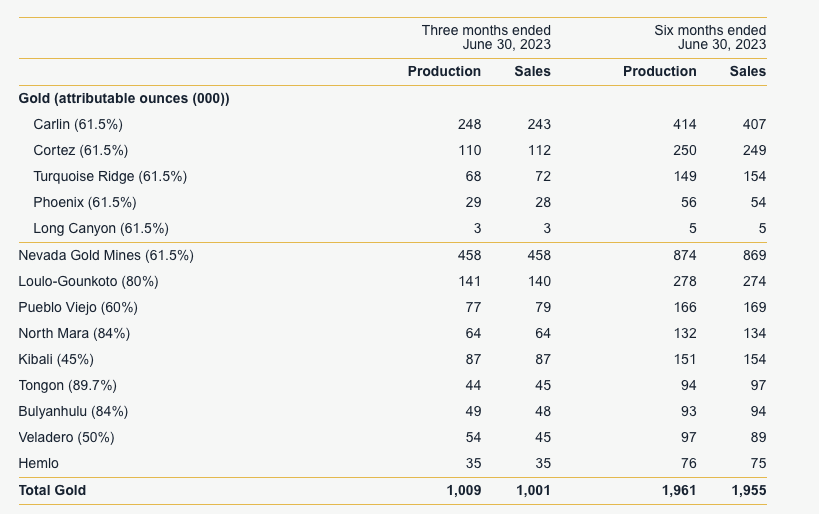

Overall, it was a strong quarter: Barrick achieved sales of 1 million ounces of gold and 101 million pounds of copper, coming off of Q2 production of 1.01 million ounces of gold and 107 million pounds of copper.

Given these figures, the company claims it is confidently on track to meet its full-year gold and copper production targets, and thankfully, production is even expected to rise progressively over the year.

Barrick Gold

However, there are both positive and negative insights to derive from Barrick’s latest data release, and recent news for investors to consider.

The positives from Q2 sales

Barrick reported increased production at the Carlin mine, as it returned to normal throughput levels following maintenance in the first four months of the year.

High-grade discoveries were announced at both the Kibali and Veladero sites.

Barrick anticipates a decrease in Q2 gold cost of sales per ounce by 3% to 5% when compared to Q1; expected decline in total cash costs per ounce by 1% to 3%; and a drop in all-in sustaining costs by up to 2% lower.

Notably, Barrick also anticipates a 7% to 9% expected decrease in copper's all-in sustaining costs per pound.

The company's average realized metal prices for Q2 will be higher than in prior quarters, with the average gold price at $1,976 per ounce, and the average copper price at $3.84 per pound.

The negatives

Barrick's gold production will fall by 3% (although, readers should also be aware that production is expected to rise throughout the year).

-

A decline in copper production by 11%, which is attributed to:

Sequencing at the Cortez mine.

Scheduled maintenance at the Turquoise Ridge.

The initiation and commissioning of the plant expansion project at Pueblo Viejo, which impacted copper production.

What’s Next for Barrick? Growth is Coming

Investors in Barrick Gold have many promising developments to anticipate this year. Noteworthy events to look forward to include:

Increased production at the Pueblo Viejo mine.

The initiation of commercial production at Goldrush.

The recommencement of operations at the Porgera Mine in Papua New Guinea.

I expect further improvements as the year progresses, with higher production, reduced costs, and, assuming gold prices remain stable, expanded margins that should lead to higher free cash flow.

Barrick is also nicely positioned for long-term growth beyond this year. While many gold miners are expecting flat or negative production growth over the next 3-5 years, Barrick should be able to grow substantially.

The company projects that it can boost output from 5 million gold equivalent ounces in 2022 to as high as 6+ million by the close of this decade (2029).

This implies an approximate growth of 25% by the decade's end, driven by its organic project pipeline from projects like Reko Diq and Lumwana Super Pit, and, assuming it can successfully replace its reserves.

As for Reko Diq: Recently, Barrick confirmed that it aims to start production at its 50%-owned project by 2028. This is one the largest undeveloped copper-gold projects in the world with an expected average annual production rate of 280,000ozAu and 430 millions pounds of copper for the first five years. A feasibility study is due for release in 2024 and will give investors more detailed guidance on the project's estimated capex.

New Mali Changes: Will They Impact Barrick?

Unfortunately, it was recently reported that Mali's government could be making substantial changes to its mining law, effectively increasing its interest in new projects to 35% from the current 20% rate.

The government currently holds a 20% stake in Barrick's Loulo-Gounkoto mine, which is estimated to produce up to 560,000ozAu this year at industry-leading AISC of between $1,070-$1,150/oz. The mine is considered a tier-1 asset and contains close to 7 million ounces of gold reserves. Therefore, it's a pretty critical asset for Barrick.

Thankfully, this law appears to impact only new projects. According to Reuters, it gives the state the option to buy a bigger stake in each project within the first two years of commercial production, possibly through a newly created state mining entity. However, Loulo-Gounkoto has been in operation for more than two years already.

Barrick has yet to comment on the proposed new mining laws.

Barrick Gold: Key Takeaways

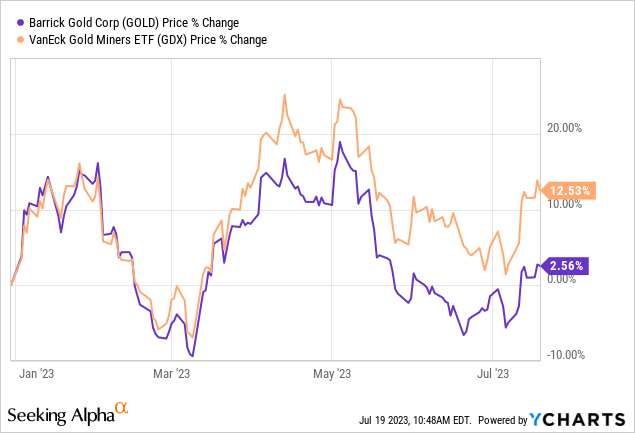

YCharts

Despite trailing behind the performance of the gold miners index (GDX) year-to-date, there is a strong rationale to believe that Barrick Gold's stock has reached its lowest point and will see an upswing throughout the year.

Mainly, I think the increased production and lower cash costs expected this year should manifest in upcoming earnings results, potentially leading to more impressive cash flow figures, and potentially higher dividends and share buybacks.

In the long-term (1-2+ years out), there are plenty of reasons to consider an investment in Barrick:

Barrick is working on expanding existing operations, including Nevada Gold Mines, Pueblo Viejo, and Lumwana.

The company has world-class growth projects underway, such as Goldrush, Fourmile, and Reko Diq.

Barrick also holds longer-dated options on large gold projects, which could boost production much more than the expected 6 million ounces per year figure.

Barrick has generally been successful at avoiding overpriced acquisitions in the past few years. I’ve noticed a pretty good at preserving its capital. This saved money has been wisely used to improve the company's existing assets vs. buying new overpriced mines.

Barrick is scheduled to disclose its Q2 2023 financial results before the market opens on August 8, 2023. A strong quarter is expected for Barrick Gold Corporation given the strong production figures, predicted lower cash costs, and high metal prices.

What gold miners are a better buy than Barrick? Find out by joining our community of smart investors who trust The Gold Bull Portfolio for expert analysis on all commodity stocks!

Subscribe today to gain immediate access to my top picks, personal portfolio insights, and in-depth analysis of over 140 stocks. And, as a special welcome offer, new subscribers can try out our service risk-free with a free 2-week trial and receive a 10% discount on annual subscriptions. Don't miss this opportunity to take control of your investment strategy and grow your wealth – subscribe now!

This article was written by

With over a decade of experience in the investment industry, I am a highly skilled private investor with a proven track record of success in the commodities and hard assets sector. My areas of expertise include investing in gold and silver miners, royalty and streaming companies, pure exploration companies, as well as oil and gas producers and MLPs. My comprehensive understanding of these markets and my ability to identify and capitalize on profitable opportunities have enabled me to consistently deliver strong returns for my subscribers.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of GOLD either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Recommended For You

Comments (3)