Choice Properties: A 5.5% Yield From A Grocery-Anchored REIT

Summary

- Choice Properties Real Estate Investment Trust is a retail-focused REIT with related company Loblaw as main tenant.

- This ensures an excellent earnings visibility.

- Even if I would apply a 5.5-5.7% cost of debt across the debt portfolio, the AFFO/share would decrease by just C$0.14.

- As there is a 10-year refinancing cycle, I am optimistic Choice will be able to increase its NOI at a faster pace than its interest expenses.

- I do much more than just articles at European Small-Cap Ideas: Members get access to model portfolios, regular updates, a chat room, and more. Learn More »

Marvin Samuel Tolentino Pineda/iStock Editorial via Getty Images

Introduction

Choice Properties Real Estate Investment Trust (TSX:CHP.UN:CA, OTC:PPRQF) remains one of my favorite real estate investment trusts, or REITs, in Canada. The Weston family calls the shots at both Choice Properties and Loblaw Companies (OTCPK:LBLCF, L:CA), where Choice was spun out of. This means the ties between both entities are very strong, and as the Loblaw group of companies is the largest tenant of Choice's empire, I think having these strong ties makes the future somewhat more predictable as Loblaw will obviously extend leases with its sister company. The main risk would be corporate governance risk, but I don’t see any "special discounts" for Loblaw when looking at Choice’s rental income.

The Q2 results were good

Before getting started, keep in mind that this article is meant as an update to previous coverage on Choice Properties. I would like to refer you to my two most recent articles here and here to get a better background overview of this Canadian REIT.

I’m obviously very interested in the NOI (to determine if the real estate assets are fairly valued on the balance sheet) and the funds from operations ("FFO") and adjusted FFO ("AFFO") to determine the safety of the distribution and the ability of the REIT to retain cash flow to reinvest in its development pipeline.

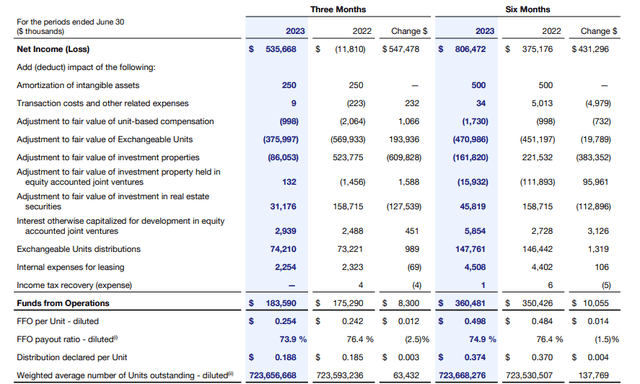

Looking at Choice’s NOI result, the starting point is obviously the C$536M in net income, and this also immediately explains why you should never look at a REIT and determine whether or not it is a good investment based on the reported net income. As you can see below, a very substantial part of the net income was generated by the C$376M value adjustment of the exchangeable units, while the fair value of the real estate assets also increased by about C$86M (partly offset by a $31.2M reduction in the fair value of real estate securities).

Choice Properties Investor Relations

This means the accounting NOI was C$238M while the cash NOI was C$231M. Including the adjustments for JVs and equity accounted investees, the net attributable NOI was C$243M.

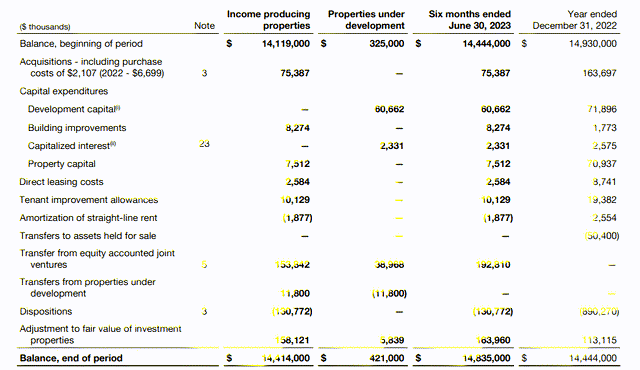

I will use the normalized NOI of C$238M, which is approximately C$950M per year. As you can see below, the total book value of the income producing properties is C$14.4B, which indicates the properties are currently valued using a NOI yield of 6.6%.

Choice Properties Investor Relations

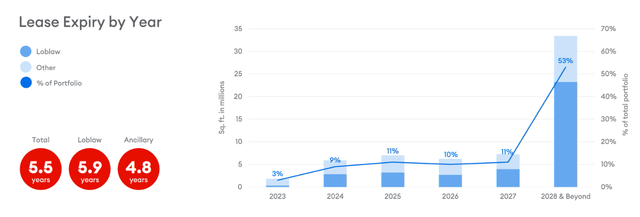

Given the very strong relationship with the main tenant and the long-term leases, I think that’s fair.

Choice Properties Investor Relations

As you can see below, the FFO in the second quarter of 2023 came in at C$183.6M. That is a C$8.3M increase compared to the second quarter of 2022 and represents an FFO of C$0.254 per unit. On an annualized basis, this means the FFO per share is now clearly exceeding C$1, which means Choice Properties is currently trading at about 13.5 times its FFO.

Choice Properties Investor Relations

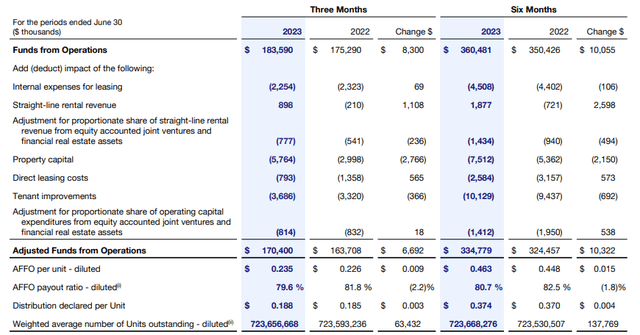

While the FFO is an interesting metric, I also like to use the AFFO, as it includes some capex elements. As properties always need some small improvements and investments, the AFFO is likely the best metric to use to determine the earnings power of a REIT.

Choice Properties Investor Relations

As you can see above, the net AFFO was C$170.4M, for a result of C$0.235. And although the H1 AFFO per share was "just" C$0.463, it now looks like Choice has a good shot at reporting an AFFO of around C$0.95 per share and could reach the C$1 run rate by the end of next year. In that case, the P/AFFO would be less than 14.

What about the cost of debt?

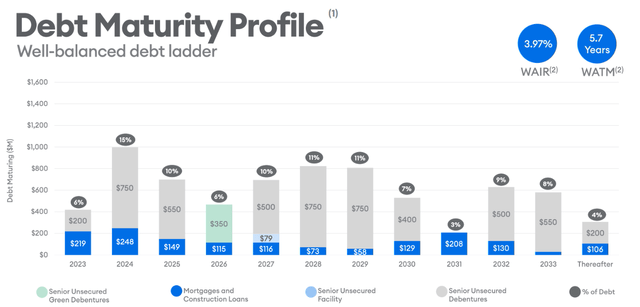

The strong result in the second quarter is even more impressive when you realize the REIT had to deal with an increasing cost of debt. While Choice was pretty shielded (its interest income increased as well), it will become a major issue in the REIT landscape. During the second quarter, Choice paid just over C$67M in interest expenses which represents a weighted average interest rate of just over 4% per year. Refinancings are nicely staggered and it looks like 2024 will be an important year for Choice as it will have to refinance about C$1B in debt.

Choice Properties Investor Relations

This won’t be an issue and there will barely be an impact on the cost of debt as the two bonds maturing in 2024 have interest rates of 4.3% and 3.556% respectively. And even the 2025 refinancings won’t have a major impact on the interest expenses in absolute terms as the two bonds maturing in 2025 have a coupon of 3.55% and 4.06%.

Meanwhile, the 6-year debt of the REIT has a yield to maturity of approximately 5% while the 10 year bond maturing in March 2033 has a yield to maturity of 5.6%. This is where a good CFO can earn his keep by making the right refinancing decisions (which will likely be a mix of longer term debt and mid-term debt) but even if I would apply a 150 bp cost of debt increase throughout the debt portfolio (a recent 11 year debt offering was completed at a 5.7% yield), the net impact on the AFFO would only be C$100M (or just C$0.14 per share per year) and would only materialize over a 10 year refinancing cycle.

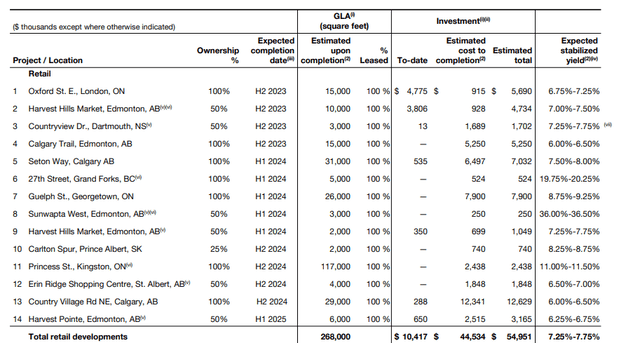

This also means that if Choice is able to increase its annual NOI by just 1% per year, the impact of the refinancings will be barely noticeable as an annual 1% increase would zero out the impact of a cost of debt increase to 5.5% throughout a 10 year refinancing cycle. As such, I don’t think Choice Properties will face dire times when it needs to refinance existing debt. The main "problem" for Choice Properties in the current interest rate cycle could be that it will have to be more selective in its development pipeline as capital is now more expensive. Looking at the anticipated retail development pipeline, the anticipated yield of 7.25-7.75% definitely exceeds the cost of capital so I don’t expect any major issues there (not in the least because the C$55M can be entirely covered by retained earnings if that’s what would be required).

Choice Properties Investor Relations

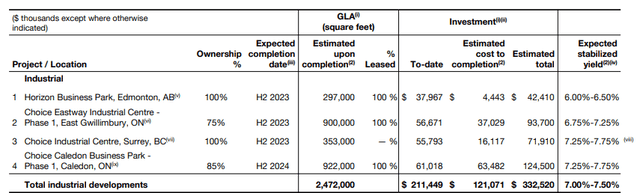

The active industrial development portfolio is more active (with an anticipated C$121M cost to completion) but the REIT also expects a stabilized yield of 7-7.5% on completion.

Choice Properties Investor Relations

As the REIT is already incurring interest expenses and even assuming it will borrow the entire remaining C$121M at a 5.7% cost of debt (using the recently issued debenture as reference), the interest increases will jump by just C$7M while this C$332M development portfolio will contribute in excess of C$21M in net rental income. The biggest issue would be in the residential portfolio where the anticipated returns are sub-5% but the cost to completion is just C$55M.

Taking the active development portfolios into account, the REIT needs about C$222M to complete its entire "active" development portfolio which will add about C$32M in net rental income and likely in excess of C$0.03 per share in AFFO. With most projects slated for completion before the end of next year, I feel comfortable expecting a run rate AFFO of in excess of C$1 per share by the end of 2024.

Investment thesis

It is clear Choice Properties is not cheap. It’s not cheap right now, it hasn’t gotten cheap during COVID and it likely will never get cheap as the very strong relationship with the main tenant (which basically is a related company) justifies a premium valuation. Based on the current share price, the yield has increased to 5.5% (thanks to a small distribution hike) while the payout ratio will be just around 80% on a full-year basis.

And as the REIT is currently trading at its book value of around C$13.65, I think the stock is still attractive. There is plenty of room for further distribution hikes (even if those increases would be just one symbolic cent per year) as I expect the AFFO will increase in 2024 despite a higher cost of debt.

I have a long position in Choice Properties and will be looking to add to this position, but I am in no rush.

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Consider joining European Small-Cap Ideas to gain exclusive access to actionable research on appealing Europe-focused investment opportunities, and to the real-time chat function to discuss ideas with similar-minded investors!

This article was written by

Analyst’s Disclosure: I/we have a beneficial long position in the shares of CHP.UN:CA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

I may add to my position and/or write out of the money put options.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.