Walgreens: I'm Starting To Become Skeptical

Summary

- Walgreens Boots Alliance current dividend yield is over 60% higher than its 5 year average indicating it's extremely undervalued.

- Investors who believe in WBA's turnaround story may be catching a falling knife due to its cash flow issues and continued controversy.

- These next few quarters will be crucial for management as more investors may consider abandoning the stock pushing the stock price to new lows in the near future.

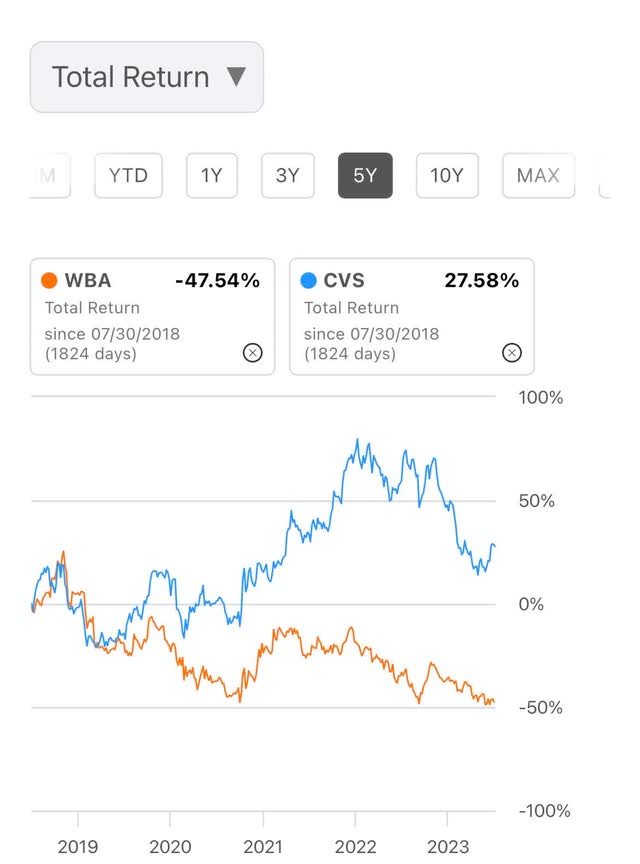

- CVS Health Corporation has beaten WBA in price return and total return over the last several years and continues to beat the retailer to the punch at every turn.

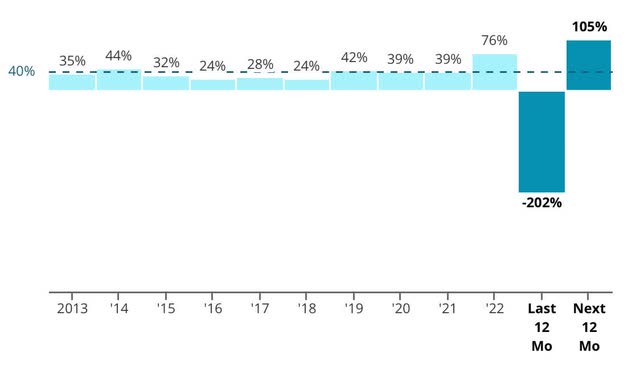

- Although Walgreens is a dividend aristocrat, it could be at risk of cutting its dividend due to the payout ratio well above 100%.

alexsl

Introduction

It's obvious there's been a lot of controversy surrounding Walgreens (NASDAQ:WBA) recently. I bought into the retail giant because even though they've had their fair share of controversy, I liked the fact that they made a conscious effort to transform from a standard brick-and-mortar business into a healthcare one-stop shop. Walgreens had a lot of success during COVID-19 with the vaccine but the effects from that quickly began to dissipate and management realized they need to do something fast if they wanted to keep them afloat. And while I commend them for the transition, I'm beginning to become skeptical of their outlook. When I invested I liked the move into the healthcare space (still do) and bought in at an average price of $36. Since then the stock has dropped roughly 22%, and with their latest earnings, I'm considering selling my shares.

Agree Realty's (ADC) CEO Joey Agree recently commented in regards to WBA: ADC had outsized exposure for many years and we have made a concerted effort to reduce our exposure to Walgreens and I have been very outspoken about the challenges that WBA is facing. To be blunt, CVS has beaten them to the punch: Acquisition of a PBM, installation of clinics in stores and now becoming a fully integrated vertical healthcare provider. I do not expect them to have an IG rating in the next 18 months as front end sales continue to deteriorate and generic pressures price on RX. I'm willing to hold WBA while they continue their transformation but for how long? That remains to be seen.

Turnaround Story

One thing that drew me to WBA besides the leap into the healthcare space was the dividend and their investment grade credit rating. These are two things I look for when investing in a company. When I decided to pull the trigger on WBA they were starting their transition with acquisitions in Village MD and Shields Health Solutions. They also had acquired CareCentrix and Summit Health.

The company introduced four new strategic priorities: 1. Transform and align the core business; 2. Build the next growth engine, which was healthcare; 3. Focus on portfolio and optimize capital allocation; 4. Build a high-performance culture and a winning team. Any experienced management knows that in order to stay profitable, you have to make changes and spend CAPEX to grow your business. I believe WBA has done a good job at doing so but the questions remains, is it too late?

Walgreens investor presentation

Total Return

My followers know by now I invest for total return as I typically have a long-term outlook for my holdings. Investors who've been holding WBA longer than I have probably can tell you the retail giant has not been a great investment over the long-term. In December of 2018, WBA was trading at a price near $86 and has since then seen its share price decline by more than 67%. Below CVS Health Corporation (CVS) blows WBA out of the water in virtually every category. Whether it's price return or total return. WBA has had a negative return over the last 3, 5, and 10 years in price and total return, while CVS has had positive returns during the same period. I started investing in Walgreens a few years ago when they decided to pivot from the retail space. I'm a firm believer that everyone deserves a second chance and I decided to give WBA the same treatment.

Pressure On The Dividend

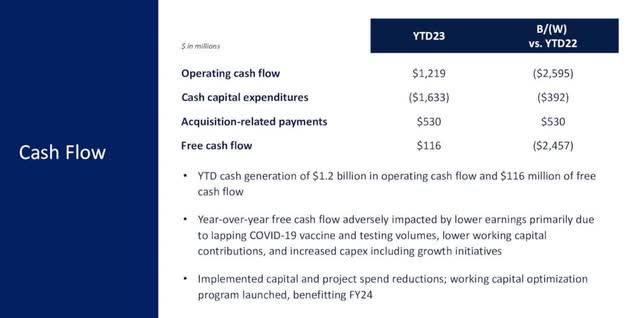

As an avid dividend investor I decided to make the leap because of the low P/E ratio and their aristocrat status. The stock currently pays a dividend of $0.48 and is currently trading at a price near $30 at the time of writing. When I look into dividend stocks one of the metrics I look at is "Will a 100 shares in the stock pay me enough dividends to purchase at least one or more shares at the current price". The reason I look at this metric is because it allows me to start a quick position and DRIP (dividend re-investment plan) the dividends; essentially set-and-forget the stock while I focus on building other positions in my portfolio. In Q3 WBA reported YTD FCF of $116 million compared to $2.6 billion YTD FCF in 22'.

The company's FCF will remain under pressure causing coverage to be tight in the near-term. They are expecting to generate positive FCF in the next few years but until then, investors should watch closely to see if management executes their plan in the near term. WBA's expected FCF payout ratio for the next 12 months is 105%, well above the average for consumer retailers.

I'm watching closely and am willing to give management more time but these next couple of quarters will be crucial.

Lackluster Earnings

During Q3 2023 earnings they reported EPS of $1.00 missing analysts' estimates by $0.07 and revenue of $35.42 billion beating estimates by $1.29 billion. Management acknowledged that their performance in the third quarter did not meet their overall expectations, and updated their 2023 guidance. Lowering guidance can be one of the biggest contributors to share price movement. WBA reported earnings on June 27th and as seen below the retail giant saw its share price dip below $29. It has since rebounded over a $1 above $29. Rightfully so, investors are skeptical about WBA and I have to agree, especially after their lackluster performance in Q3.

Furthermore, they lowered fiscal 23' guidance and now expect it to come in between $4.00 to $4.05. The CEO, Roz Brewer, stated in their recent earnings call, "this updated outlook reflects consumer and category trends, a lower contribution from COVID and an overall more cautious forward view given the continued macroeconomic uncertainty." This was one thing from management that caught my attention. The reason being because the height of the pandemic has passed and WHO actually declared an end to COVID on May 5th of this year. WHO's director-general reported that the pandemic had been on a downward trend for the past 12 months and most countries had returned to life as we knew it before COVID. Walgreens' CEO mentioned the steeper drop-off in COVID vaccines and testing due to this, which should have been expected and factored in going into 2023. To be fair comp sales did grow 8.8% and gross margin grew 100 basis points over the year. Adjusted EPS also grew 4% and third quarter sales were solid growing almost 9% so management did report some positive news for the company.

Year-to-date Highlights

Although adjusted EPS and sales grew during the third quarter, adjusted EPS declined for the year more than 20%. GAAP earnings were a loss of $2.9 billion, compared to net earnings of $4.8 billion a year ago.

WBA QTR3 investor presentation

Valuation

Seeking Alpha gives WBA a valuation grade of A+, and that's because their current dividend yield is over 50% higher than its 5-year average which is near 4%, indicating it's extremely undervalued. If you believe in the company's turnaround story then Walgreens may turn out to be a great investment for its shareholders in the long-term. But investors may also be catching a falling knife. But with each day and with all the controversy surrounding the stock, and the recent downgrade by Deutsche Bank in June citing their disappointing fiscal 2024 outlook, it's getting difficult to not consider selling the aristocrat. I believe management will do their best to make it to dividend king status these next couple of years, but they may have no choice but to cut the dividend.

Risks

Last week the FED raised interest rates another .25 bps and even though most consider them done, they left the door open for more hikes in the future. In my opinion, with inflation at 3% I think they will hold to see how it stabilizes over these next few quarters, then possibly start to cut at the end of the year. Management also reported that customers were feeling the strain of higher inflation and interest rates, lower SNAP benefits and tax refunds. As a result, consumers are pulling back on seasonal and discretionary spending. With a promised higher for longer environment from the FED, WBA will feel even more pressure which is starting to become a concern, and could potentially affect the dividend going forward.

Bottom Line

Investors in WBA for the long-term have continued to be in the red over the last several years and watched its share price decline more than 60%. Over the last few years the company has made acquisitions to transform the retail giant into a healthcare behemoth going forward. As stated by ADC's CEO, Joey Agree, WBA has been behind the curve and is trying to play catch up to its biggest competitor CVS, but the question remains. Is it too little too late? I rate WBA a hold for now while management continues to make the full transition into the healthcare space. Investors looking to start a position in Walgreens due to the high-yield could potentially be falling into a value-trap. I suggest investors looking to start a position hold off and see what management does over these next few quarters. My plan is to hold for now but will be potentially looking for an exit strategy (price) soon.

This article was written by

Analyst’s Disclosure: I/we have a beneficial long position in the shares of WBA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Recommended For You

Comments (3)